Posted on 09/16/2021 5:01:34 PM PDT by blam

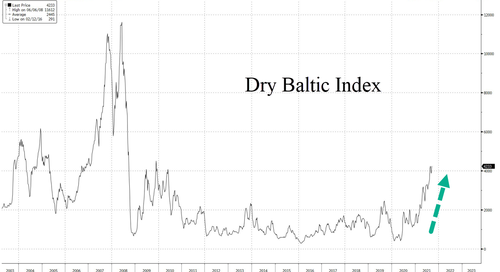

Similar to container rates, dry bulk shipping rates are poised to move higher on limited vessel capacity and robust demand, according to Genco Shipping President and CEO John Wobensmith, who spoke with Bloomberg.

“I think rates can go higher from here,” Wobensmith said. “You do get to a point, and you’ve seen this in containers, where you hit a certain utilization rate, and you start to go parabolic on rates. I think we’re getting close to that period.”

He said, “fundamentally, you’ve got demand outstripping supply growth,” adding that freight agreements are above $20,000 for 1Q, a level not seen seasonally in a decade.

More than 5 billion tons of commodities, such as coal, steel, and grain, are shipped worldwide in bulk carriers in a given year. A move higher in the Baltic Dry Index (BDI) indicates increasing commodity demand on top shipping lanes.

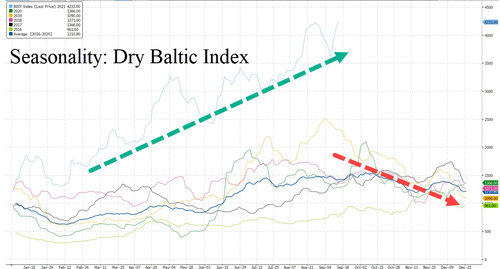

Lending credit to Wobensmith’s argument is BDI on a seasonal basis that shows demand is currently outpacing vessel supply and pressuring rates higher.

He doesn’t expect bulk carrier rates to experience a significant reversal until early next year as demand troughs seasonally. “You need very little demand growth to just continue to build off what we’ve seen this year,” he said. “It’s more about higher highs and higher lows than anything else.”

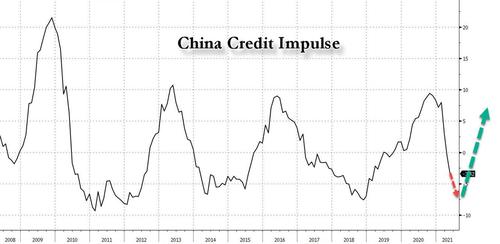

China’s credit impulse needs to turn higher for the commodity boom and bulk carrier rates to stay elevated.

Besides China, passage of a US infrastructure bill could be the fiscal injection that could also spark higher commodity prices, thus continue driving bulk carrier rates higher.

All of this is feeding into inflation that the Federal Reserve convinces everyone it’s only “transitory.”

Which means that domestically production will be more advantageous. Might be an upside, depending on how it’s handled.

Your dry-bulk price chart tells the story - in spite of massive demand growth around the world, the price has gone nowhere for 13+ years. Probably at first a lot of over-investment which increased supply of bulk-vessels, but over the last 5 years, I would suppose, much less investment and a lot of consolidation.

Covid hits and owners start scrapping vessels, only to find that demand roars back greater than ever.

bkmk

Parabolic? Thank goodness it isn’t exponential. Then we’d really be in trouble.

Biden is taxing everything in sight.

First FAMINE....and then FINANCIAL COLLAPSE. PRAY.

meanwhile, this story is gathering pace:

16 Sept: Zero Hedge: Evergrande Suspends Trading In All Bonds

by Tyler Durden

Earlier today we pointed out that in what can (obviously) only be a remarkable coincidence, China’s largest, and most systematically important real estate developer, China Evergrande (and its $300+ billion in debt), collapsed on the 13th anniversary of Lehman’s bankruptcy filing, when Beijing told Evergrande’s creditor banks that the insolvent company, which recently hired Houlihan Lokey as bankruptcy advisor, would not pay interest on its debt next week, nor would it repay principal, in effect blessing the coming default...

https://www.zerohedge.com/markets/evergrande-suspends-trading-all-bonds

16 Sept: Aljazeera: Protesters hauled away from Evergrande HQ as meltdown fears mount

Security personnel in Shenzhen hauled away protesters who had gathered at the HQ of troubled real estate developer China Evergrande Group, which is teetering on the edge of a potentially messy debt default that could send shockwaves through China’s economy.

Earlier on Thursday, Evergrande’s main unit, Hengda Real Estate Group Co Ltd, applied to suspend trading of its onshore corporate bonds following a downgrade...

https://www.aljazeera.com/economy/2021/9/16/protestors-hauled-away-from-evergrande-hq-as-meltdown-fears-mount

following behind paywall:

17 Sept: Sydney Morning Herald: China’s nightmare Evergrande scenario is an uncontrolled crash

By Shen Hong, Enda Curran and Sofia Horta e Costa

https://www.smh.com.au/business/companies/china-s-nightmare-evergrande-scenario-is-an-uncontrolled-crash-20210917-p58sgc.html

I was scanning an auto-related subreddit on Reddit, and I was shocked to find that there are significant shortages of maintenance/repair products for certain cars, oddly enough, NEWER cars. People “in the trenches” were reporting that some dealers have had to give out their loaners and even some used cars for warranty car owners where the parts might not be available until significantly into next year. They park those cars “out back”, no room in the shop. For older cars, the aftermarket or reman parts can fill in (some dealers have had their policies modified by manufacturers) to allow reman or non-OE parts to be used in service work. Of course, you have to HAVE reman or non-OE parts available - and many newer cars don’t have those yet. You might be able to get a 10 year old car repaired more easily than a six month old car for this reason.

On the trucking side, some fleet owners are parking or even cannibalizing trucks to keep other trucks running. If you are an owner operator and can’t get your truck fixed, you are now effectively unemployed, just when you could be cleaning up, and I don’t know if you can get unemployment benefits. Maybe independent owner operators have business insurance.

I do a lot of business in China, and my company moves 1000’s of containers around the globe. I can tell you two things, for sure:

1) China has a MASSIVE credit bubble. So big, it could wreck the GLOBAL economy. and

2) Global shipping is FUBAR right now. We recently had to pay $1.3 Million, just to ship 500 tons of product from Japan to the US West coast. If you’re not shipping HIGH VALUE products, right now... you ain’t shipping.

Who controls railroads?

Pipelines cost less and are safer BUT Dems favor railroads.

Who stands to make big bucks favoring rail?

I thought money grew on trees, wth...

The Asian bomb has exploded, Tesla Giga Shanghai is shipping cars abroad.

Tesla’s cars are fast, but they’re snails compared to the team that built the electric carmaker’s factory in SHANGHAI, CHINA—the company’s first Gigafactory outside of the United States.

The project signals ambition at Tesla that goes beyond China. CEO Elon Musk has described the Shanghai factory as the automaker’s “TEMPLATE FOR FUTURE GROWTH.” Tesla Gigafactory Shanghai could very well be Tesla’s ace-in-the-hole this year, thanks to the rapid ramp of its Model 3 and Model Y production.

So HOW STRATEGICALLY IMPORTANT IS GIGA SHANGHAI FOR TESLA?

Tesla recently said that it has shifted its “ ” from Fremont Factory to Gigafactory Shanghai, and Tesla’s July results in China are confirming that.

“Due to strong U.S. demand and global average cost optimization, we have completed the transition of Gigafactory Shanghai as the primary vehicle export hub.”

While Gigafactory Shanghai was originally only supposed to produce vehicles for LOCAL DEMAND, Tesla surprised itself with how fast it was able to ramp up production at the plant.

The automaker achieved an annualized production capacity of 450,000 electric vehicles at Gigafactory Shanghai within two years of starting production at the new factory.

It enabled Tesla to start exporting vehicles from the factory to other markets – reducing the exportation load out of the FREMONT FACTORY, which can now focus more on local demand.

This shift is becoming clear with the release of TESLA’S JULY RESULTS in China.The Asian bomb has Exploded, Tesla INSANE EXPORTS carrying 4,410 Tesla Model 3 | September 18, 2021 | Tesla Fans

YouTuber iJustine is doing some kind of rollout presentation for Cadillac's new all-electric model, 6 PM.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.