Skip to comments.

The Student Debt You Willingly Took On Is Not My Problem To Solve

The Federalist ^

| 02/17/2020

| Margot Cleveland

Posted on 02/17/2020 7:41:53 AM PST by SeekAndFind

Of all the pandering showcased during Democrats’ attempts to win back the presidency, wiping out student debt ranked at or near the top.

“I believe that education is the future for this country,” socialist Sen. Bernie Sanders barked during the first round of Democratic primary debates, explaining that’s why we must “eliminate student debt and we do that by placing a tax on Wall Street.” Sen. Amy Klobuchar spoke similarly. “I can tell you this,” the Minnesota senator demagogued, “if billionaires can pay off their yachts, students should be able to pay off their student loans.”

There can be no serious discussion of this issue, however, in 60-second sound bites. So, beyond the soak-the-rich shtick that shades every Democratic economic debate point, the candidates resorted to two tactics: shock and sob stories.

The Shock Strategy

The size of student debt provides the jolt necessary to peddle their plans to the American populace. “I got $100,000 in student loan debt myself,” California Rep. Eric Swalwell bemoaned. “College affordability is personal for us,” South Bend, Indiana, Mayor Pete Buttigieg shared, noting that his household has “six-figure student debt.” So, sure, “I believe in reducing student debt,” Buttigieg announced.

Next came the sob stories. Those student loans are suffocating a generation, the candidates suggested. After all, “40 million of us who can’t start a family,” the diaper-changing daddy Swalwell contradictorily proclaimed, adding that they “Can’t take a good idea and start a business and can’t buy our first home.”

“We can’t put people in a position where they aren’t able to go on and move on,” frontrunner Joe Biden agreed.

Tellingly, when not constrained by the debate format, these same politicians push the same narrative to garner support for bailing out student loans, all while the media provides the Democrats a free assist.

“With loans totaling more than $130,000,” Buttigieg’s household is “among the 43 million people in the United States who owe federal student loan debt,” the Associated Press reported last month, before highlighting the myriad plans to bail out student debt pushed by a cadre of presidential candidates. The AP then furthered the narrative by using statistics to shock the public into socialism:

The debtors are so numerous and the total debt so high—more than $1.447 trillion, according to federal statistics—that several of the Democratic candidates have made major policy proposals to address the crisis. Their ideas include wiping away debt, lowering interest rates, expanding programs that tie repayment terms to income and making college free or debt-free. Student loan debt is often discussed as an issue that mostly affects millennials, but it cuts across age groups. Federal statistics show that about 7.8 million people age 50 and older owe a combined $291.9 billion in student loans. People age 35 to 49, a group that covers older millennials such as Buttigieg as well as Generation X, owe $548.4 billion. That group includes more than 14 million people.

Sob Stories Reign Supreme

Then the sad tales continue the sales pitch for a government solution to student debt—a ploy that began well before the 2016 elections. Here’s one of myriad media examples.

“Shayna Pilnick, 28, would like to buy an apartment but can’t afford a mortgage. Jacqueline Mannino, 23, and her boyfriend, Benjamin Prowse, 26, want to get married. Jacob Childerson, 24, and his wife, Jennifer, 25, wish they could start a family, but they live with Jennifer’s parents,” is how USA Today opened its 2013 profile of millennials unable to obtain their dream life because they are “tethered” to “tens of thousands of dollars in student loan debt.”

There are many ways to counter these arguments, based on both economics and equity. But it’s hard to counter soundbites with sense, so instead, here are my inquiries for these politicians, the press, and all the students demanding relief from the burdens of their debt: Tell me your sob stories from age 12 on, not what you can’t do now, but what you couldn’t do then. Tell what you had to do then and through college to avoid what is now, to you, crushing student debt.

What time did you get up to deliver papers in junior high? How many hours a week did you work since 14 to save for college? How many toilets did you scrub? How many high school football games did you miss because you were working? What dream college did you forgo to avoid taking out student loans?

Which 8 a.m. class did you take so you could complete your major’s requirements and still work in the afternoon? Which bus line did you take to get to your job because you didn’t borrow to buy a car? What job did you work full-time while completing your MBA at night?

What did you do to afford college? What didn’t you do because of the cost of college? Were you getting tattoos and traveling your way through college? Were you pledging and partying? Did you go to your top-choice university? Maybe an out-of-state public university with higher tuition rates? Which spring break and study abroad destinations did you visit along the way?

Did you splurge on your fairytale wedding instead of paying down your student loans? What cars did you buy or lease? Where did you live? What electronics did you own? What clothing and other personal expenditures did you have? In short, show me the money and how you spent it!

None of my business? You’re right. Nor is your student debt my business or my problem.

Margot Cleveland is a senior contributor to The Federalist. Cleveland served nearly 25 years as a permanent law clerk to a federal appellate judge and is a former full-time faculty member and current adjunct instructor at the college of business at the University of Notre Dame. The views expressed here are those of Cleveland in her private capacity.

TOPICS: Business/Economy; Education; Society

KEYWORDS: college; studentdebt

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-132 next last

To: polymuser

21

posted on

02/17/2020 7:57:05 AM PST

by

SeekAndFind

(look at Michigan, it will)

To: SeekAndFind

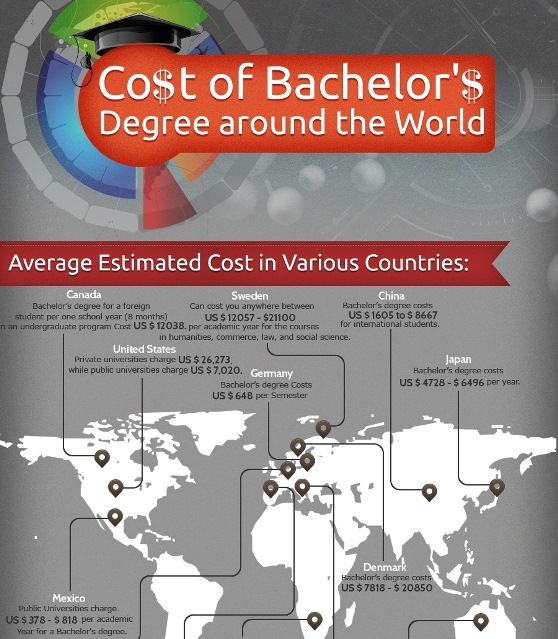

Is that per semester/year?

22

posted on

02/17/2020 7:57:38 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: SeekAndFind

Make student loan debt dis-chargeable via bankruptcy.

23

posted on

02/17/2020 7:59:15 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: SeekAndFind

1) “You have to go to college and get a degree if you want a good job.”

2) College/universities have a practically endless population of HS grads who are “required” to purchase their product, thus the cost skyrockets b/c people must pay it.

3) HS grads pay the ever-increasing costs to get a degree b/c they “have to.” Obviously most can’t actually afford this tremendous cost, so they’re forced to take on loans—yes, even the smart ones who got some scholarships, took AP classes, and did some time in community college. College is now that expensive.

4) In many cases, these 22-23 year olds are graduating with six-figure debts. They haven’t bought a house or a car yet, and are up to their eyeballs with a loan guarantor. The average time to pay off student loans these days is about 20 years. So now they’re in their 40s before they can “start a life.”

5) Nobody on the outside of this travesty seems to give a shit and keeps pressing HS grads to “go to college and get a degree so you can get a good job.” College costs keep going up, debt continues to accumulate.

Parents/authority figures continue to press this “go to college or else” mentality and students/graduates are required to “just figure it out b/c I did it when I was your age.” Never mind that “when I was your age” was 30-40 years ago.

Two entities are not required to rethink or change anything: employers requiring college degrees for even the most basic jobs and colleges that keep jacking up their prices despite gigantic endowments.

Why is that?

24

posted on

02/17/2020 8:01:01 AM PST

by

Future Snake Eater

(Plans are worthless, but planning is everything. - Dwight Eisenhower, 1957)

To: gcparent

College is too expensive to work and pay as you go. The stakes are so high now that it isn’t worth lowering your GPA because of work.

25

posted on

02/17/2020 8:01:33 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: SeekAndFind

OK. Would like to see $ change over time...like 2000 to recent. Like those first charts/graphs.

26

posted on

02/17/2020 8:03:27 AM PST

by

polymuser

(It's discouraging to think how many people are shocked by honesty and so few by deceit. Noel Coward)

To: Future Snake Eater

From what I’ve personally witnessed in my travels, MANY high school graduates aren’t proficient in the basics of readin’ and writin’, much less prepared to take on college courses (unless, of course, they’re given “points” for affirmative action). There’s such a large percentage of the populace who shouldn’t be wasting their time, and our money, near the halls of higher learning.

To: Future Snake Eater

28

posted on

02/17/2020 8:06:48 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Mr. Jeeves

Exactly, let the colleges that ripped off these people for worthless degrees and useless indoctrination pay off that debt.

29

posted on

02/17/2020 8:09:05 AM PST

by

Lurkinanloomin

(Natural Born Citizens Are Born Here of Citizen Parents_Know Islam, No Peace-No Islam, Know Peace)

To: central_va

That is ridiculous. 15 credits a semester is how many hours? A part time job of 20 hrs a week is nothing. My kids best gpa were when they had on campus jobs. You are more focused and not at the bars. I worked 20 hrs week all thru college, good gpa with a business degree. Got a great job.

30

posted on

02/17/2020 8:10:48 AM PST

by

gcparent

(Justice Brett Kavanaugh)

To: SeekAndFind

it is our problem. since the midnight passage of the affordable care act (where we had to pass it to see what’s in it), student loans are 100% government run, government funded operation.

To: SeekAndFind

I have an advanced degree from a top-10 program.

I worked for the degree while married with little children. I graduated debt-free and no, I didn’t have a scholarship. It took 5 years to earn that Master’s degree rather than two.

No sympathy. I tried, it just isn’t there.

32

posted on

02/17/2020 8:13:33 AM PST

by

Fai Mao

(There is no rule of law in the US until The PIAPS is executed.)

To: 2banana

I have seven kids, three have bachelors degrees without loans, one is a year away and will graduate without loans, 5,6, and 7 TBD.

So, up until now, I have no skin in the game, except as a taxpayer.

But I’m not sure you all realize what a slimy racket this is.

College administrations and boards are critically dependent on the loan industry to maintain their lifestyles (which include their preferred inefficient and costly methods of information transfer AND include “keeping the kids happy”).

An acceptance letter nowadays always says “Because you are wonderful, you have been granted an aid package of $XX,XXX”. It never discloses that 80% of this “aid package” consists of loans.

My oldest daughter managed to enroll as a freshman and we did not know she had acquired a loan of $5000 (as opposed to a scholarship) until the first tuition bill came. It took months to remove the loan from her account, once the Feds disburse the money to a college it is almost impossible to give it back.

My wife, my daughter, and I are all good readers, and we always read the fine print. Take it from me, this “loan” was somehow applied for by the college and paid by the government without our knowledge.

The whole college system is rotten to the core. Nothing bad would happen if student places (”seats”) were reduced by 90%.

It is the only business that has 10 000 unsold units every year AND has cultivated a sense of scarcity verging on panic among its target consumers.

33

posted on

02/17/2020 8:15:20 AM PST

by

Jim Noble

(There is nothing racist in stating plainly what most people already know)

To: 2banana

If you just had one single state which appointed some financial expert to take apart the entire budget apparatus of their public university system, and latch onto terminating one-quarter of all employees (those without value), and then halt all sports costs....you’d see a typical year of cost drop a significant amount.

To: yefragetuwrabrumuy

Better yet, honor the 10th Amendment and end federal funding as well as involvement in student loans entirely.

35

posted on

02/17/2020 8:16:56 AM PST

by

Rurudyne

(Standup Philosopher)

To: SeekAndFind

Probably already addressed. If you borrow 10's of thousands of dollars while studying Feminist/Racial/Gender majors, or any of the Social majors, you're only jobs are in Human Resources which are the lowest paying in any company.

My recently retired wife spent 20 years in one of the largest privately owned financial institutions. We had this conversation the other day and she agrees with my above assessment. Like others, I've come to the conclusion that not all need to attend college if they don't study STEM. Let those who are floating through college with their Social majors spend their life in mom's basement and working at McD's to pay off their loans. It's not my tax-payer problem.

IT'S THE FAULT OF THE STUPID PARENTS WHO GO ALONG WITH UNPREDUCTIVE MAJORS THEIR LAZY CHILDREN WANT.

36

posted on

02/17/2020 8:17:25 AM PST

by

A Navy Vet

(I'm not Islamophobic - I'm Islamonauseous. Also LGBTQxyz nauseous.)

To: gcparent

That is ridiculous. 15 credits a semester is how many hours? A part time job of 20 hrs a week is nothing. My kids best gpa were when they had on campus jobs. You are more focused and not at the bars. I worked 20 hrs week all thru college, good gpa with a business degree. Got a great job.A semester at a public university in VA is $5-$7K, AGAIN THAT IS PER SEMESTER. 20 hours of work per week will only net maybe $150/wk or $600/mo. A semester is around 4 months to you earn maybe 1/3 of the money you need to pay as you go. It is not possible. It is better to borrow and study your ass off especially if you major in STEM. I get it even though I graduated many decades ago. It is all sham a crock now. I feel bad for these kids.

37

posted on

02/17/2020 8:18:48 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Lurkinanloomin

Exactly, let the colleges that ripped off these people for worthless degrees and useless indoctrination pay off that debt. I don't agree. Did the colleges FORCE them to get degrees in gender studies, black studies, social justice as related to transvestites, etc. NO they did not; the idiot students signed up for that excreta of their own free will. Let them labor as ditch diggers, baristas, etc, until the debt is paid. If they don't have to pay it off then one of life's most important lessons - there are bad consequences for bad decisions - will never be learned.

38

posted on

02/17/2020 8:19:03 AM PST

by

from occupied ga

(Your government is your most dangerous enemy)

To: SeekAndFind

I don't understand this whole student debt "crisis."

When I was still in my 20s, I purchased a home and had well over $100K in mortgage debt. This was in the 1980s.

Somehow, without any drama and certainly without any "crisis", I just went ahead and paid the whole damn thing off over the next 20-30 years.

39

posted on

02/17/2020 8:19:58 AM PST

by

SamAdams76

(Trump (61); Butt (23); Commie (21); Fake Indian (8), Crazy Amy (7); Slow Joe (6); Drunken Weld (1))

To: SeekAndFind

Arguments based in logic, statistics or what’s fair are useless here.

The only thing that matters is that when 50.001% of the voting population decides to vote themselves loan forgiveness it WILL HAPPEN.

40

posted on

02/17/2020 8:23:02 AM PST

by

Buckeye McFrog

(Patrick Henry would have been an anti-vaxxer)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-132 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson