The banks are soaking up money because they know the worst is yet to come

Sustained Record Unemployment Durations

And fewer are even trying

Anyone who thinks this is getting better is just...

Posted on 07/29/2012 10:12:43 AM PDT by whitedog57

The Federal Reserve’s Open Market Committee will meet on July 31 and August 1. What will they do?

The broader economic indicators for the U.S. are either slowing down or not improving. Real GDP growth was revealed to be a paltry 1.50% for Q2 2012 following 2.0% for Q1 2012 and 4.0% for Q4 2011.

U6 unemployment (Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons) remains at near 15%.

Since June 2010, more Americans have gone on disability than have dropped off of unemployment rolls by 237,000. And an additional 4.9 million Americans have gone on the SNAP (Food Stamp) programs.

One factor is the regulatory binge that the Obama Administration has embraced (healthcare, EPA, banking, etc). The Obama Administration approved 10,215 regulations in its first three years costing $46 billion annually, with nearly $11 billion more in one-time implementation costs. Dodd-Frank Wall Street reform legislation is only 30% complete, but is already jam packed with over 8,800 pages of rules and regulations.

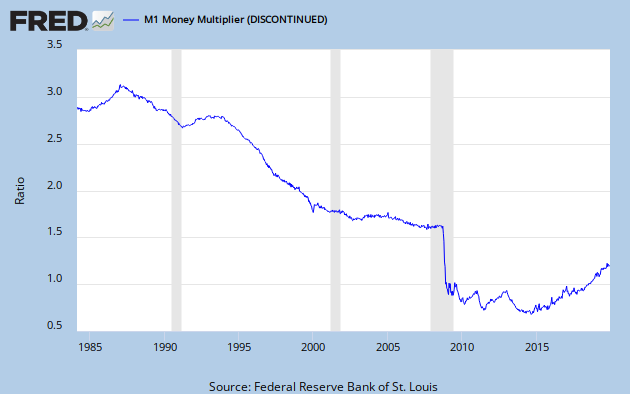

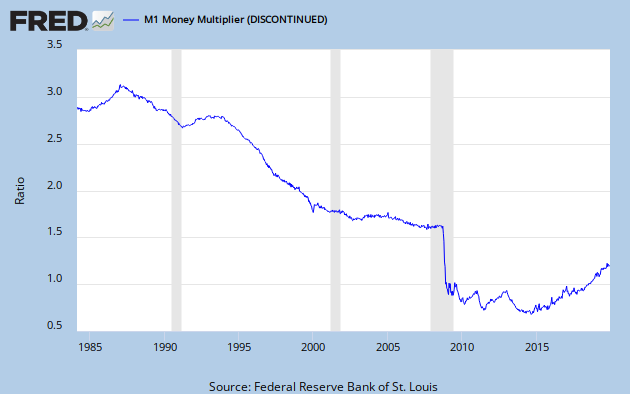

The third factor of concern to The Fed is doggedly low money velocity. M2 Money Stock has grown from 1,591.4 billion on November 3, 1980 to 10,035.1 billion on July 16.

Despite this 6.30x increase in M2 Money Stock since 1980, the M2 Money Velocity (GDP/M2 Money Stock) has slowed to 1.575, the lowest since 1959. So, “printing” more money has become less effective in stimulating economic growth over time. Its peak was 2.135 for Q3 1997.

Adding to The Fed’s woes is that additional debt issuance by the Federal government is not effective in stimulating economic growth either. As of June 12, 2012, there was a 2.33 increase in Federal debt for every $1 of GDP growth.

(Excerpt) Read more at confoundedinterest.wordpress.com ...

The banks are soaking up money because they know the worst is yet to come

Sustained Record Unemployment Durations

And fewer are even trying

Anyone who thinks this is getting better is just...

Gulp! I'll bet that doesn't include all of the executive orders - like amnesty for illegals, EPA directives, scuttling pipelines, etc.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.