Posted on 08/18/2012 2:43:49 PM PDT by radioone

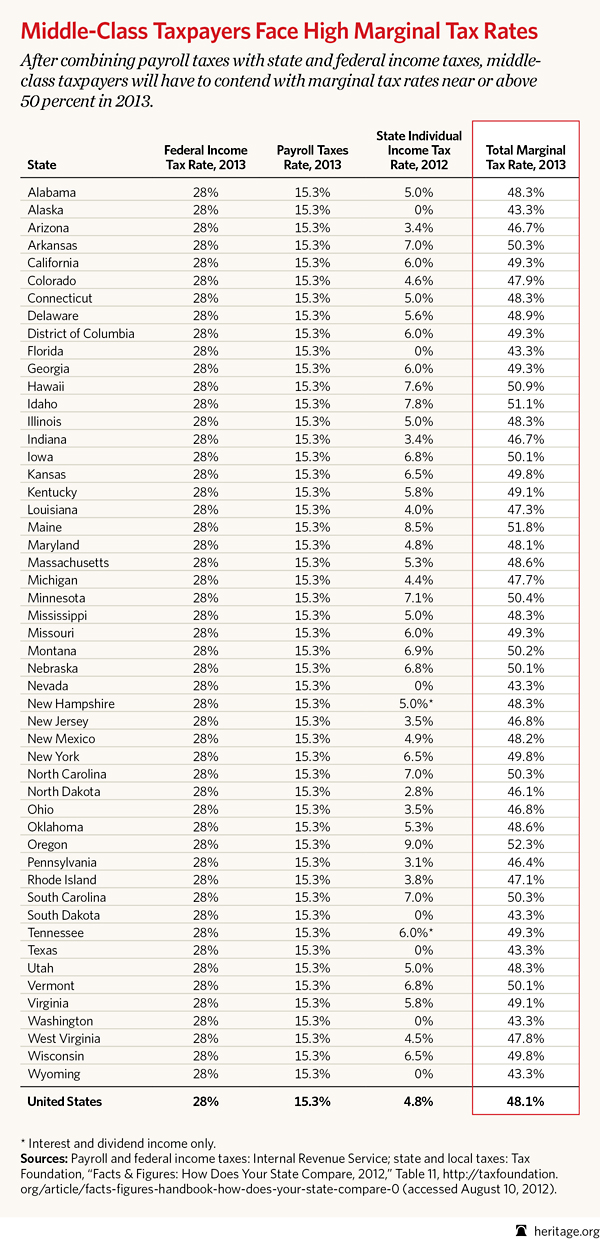

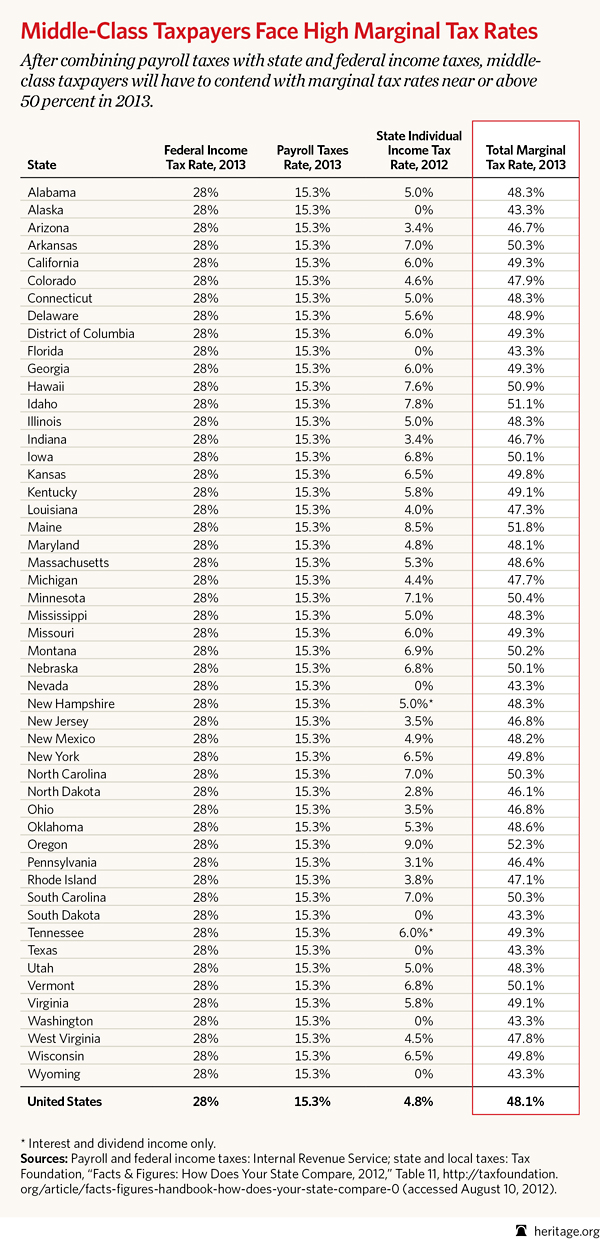

How high is the marginal tax rate on each additional dollar the average American earns? In other words, if you got a raise of one dollar, how much of that dollar would be taxed away? These rates are already high, and they’re getting higher next year.

A middle-class taxpayer’s income is subject to a 25 percent federal income tax. Then there is the federal Social Security and Medicare payroll tax of 13.3 percent in 2012—5.65 percent of that is removed from the employee’s paycheck, and the remaining 7.65 percent is paid by the employer. (In reality, the employee pays the entire 13.3 percent, because the employer’s portion of the tax does not affect the cost of labor: The employer would pay the employee 7.65 percent more if there were no employer’s portion of the payroll tax.)

So the 25 percent federal income tax plus 13.3 Social Security and Medicare payroll taxes equals 38.3 percent going to federal taxes in 2012.

And then there are state taxes. According to the Tax Foundation, the average state’s income tax rate for the middle-class taxpayer is 4.82 percent, which brings the total to 43.12 percent in federal and state taxes. And it’s going higher, thanks to the nearly $500 billion in tax increases for 2013 that some have called Taxmageddon. In January of next year, the federal income tax rate for middle-class taxpayers is scheduled to rise from 25 percent to 28 percent, and the payroll tax is scheduled to rise from 13.3 percent to 15.3 percent. This drives the marginal tax rate based on the aforementioned three taxes to 48.12 percent. Add in state and local property, corporate, excise, and other state and local taxes, and the percentage of each additional dollar that is taxed hovers around 50 percent.

When half of each additional dollar earned is taxed away, taxpayers experience a disincentive to start businesses or expand existing ones. This leads to fewer jobs being created.

It is outrageous that any dollar earned by a middle-class taxpayer would go as much to taxes as to supporting the taxpayer’s family. The government didn’t earn the taxpayer’s paycheck and shouldn’t be entitled to it.

See the table below to see how your state compares to the national marginal tax rate of 43.1 percent in 2012 and 48.1 percent in 2013.

Joke’s on them...no job.

The State income tax here in California is 9.3% right now that chart shows it at 6%- So I guess it will even be higher

than 50% in 2013

Any job or contract priced to reality, has room for only two parties. Not the government-or anybody else.

Remember that the snake offered to “mediate” Eve’s relationship to her God.

“No one making under $250K will see their taxes go up. ”

///

not only that, but our incomes are effectively going down.

because of Q.E., our remaining income is worth less.

worse, Obama’s policies make gas and food more expensive,

especially from turning 37% of our corn into gas,

to fight non-existent global warming...

This doesn’t include use taxes, registration fees ,sales taxes,and in Maryland where I live they charge me every time I flush my own friggin toilet, that I paid for and built the septic system for.

Lot of taxes left out of this chart.

Any tax on a middle income earner’s employer, landlord, grocer, etc. is a tax he pays.

Thank God a tax break.

It’s amazing that Texas has no state income tax and somehow we survive.

They forgot property taxes, local and state sales taxes, and excise taxes. In Illinois when you add it all up it’s well over 50%.

THE GOVERNMENT GETS MORE OF OUR MONEY THAN WE DO!!!

FEDERAL TAXES

Federal Income Tax

Social Security Tax

Medicare Tax

Inheritance Tax

Capital gains tax

OTHER TAXES

State Income Tax

Real Estate Tax

Personal Property Tax

Utility Taxes

Up to 6 different telephone taxes

Gasoline Tax (Federal and State)

Cigarette Tax (Federal and State)

Liquor Tax (Federal and state)

Highway tolls

Service Charge Tax

(air fare, hotels, taxi cabs, etc)

LICENSES AND PERMITS

(fees paid to the government)

Business license

Building Permit

Vehicle License Registration

Driver’s license

Marriage License

Building permit

Electrical license

Occupancy permit

Food License

Fishing License

Hunting License

YOUR EMPLOYER PAYS TAXES ON YOUR BEHALF:

Social Security (7 ½ %)

Federal Unemployment Tax (FUTA)

State Unemployment Tax (SUTA)

Plus Workers Compensation

Plus Medical insurance

AND DON’T FORGET,

WE PAY 7 TO 10% SALES TAX ON ALMOST EVERYTHING WE BUY!

47% of wage earners don’t pay Federal income tax and Obamatax will tax US even more????

Don’t forget the expiring tax cuts and “fiscal cliff” in a very few months. Then, eventually, bond collapse, repudiation (”haircuts” for bond investors), then cuts and/or cutoffs in pensions, etc.

Don’t fret, soon you and every one else will make > 250K. Of course gas will be $25/gallon also.....

“It is outrageous that any dollar earned by a middle-class taxpayer would go as much to taxes as to supporting the taxpayer’s family”

Great point. Which is why I can’t understand why the politicians seem to only care about reducing the taxes on the richest Americans. They are already paying at a lower level than middle-class Americans:

“The 400 highest-earning taxpayers in the U.S. reported a record $105 billion in total adjusted gross income in 2006, but they paid just $18 billion in tax, new Internal Revenue Service figures show. That works out to an average federal income tax bite of 17%—the lowest rate paid by the richest 400 during the 15-year period covered by the IRS statistics. The average federal tax bite on the top 400 was 30% in 1995 and 23% in 2002.”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.