Well, putting your faith in fedzilla be good enough for you, but for many others, not so much.

Posted on 02/14/2018 7:44:46 AM PST by SeekAndFind

By Jon Danielsson, Director of the ESRC funded Systemic Risk Centre, London School of Economics. Originally published at VoxEU

Cryptocurrencies are supposedly a new and superior form of money and investments – the way of the future. The author of this column, however, does not see the point of cryptocurrencies, finding them no better than existing fiat money or good investments.

I have been trying to understand what the point of cryptocurrencies is, without success. They may not be an immediate financial stability concern (den Haan et al. 2017), but I just don’t get them.

As far as I can tell, they are supposed to be some combination of:

Are Cryptocurrencies Money?

What do we need money for? Three things:

Any form of money should be evaluated according to those criteria.

We have used many things throughout history as money, like seashells, cigarettes, silver and gold. These are all scarce real assets with value to their users, available in small units and easy to transact.

No country has such money anymore. Instead, what we use is fiat money, a currency without any intrinsic value. Paper printed by the government, whose quantity is amplified by the financial system. It is only valuable because the government guarantees it is.

Fiat money issued by a credible modern central bank is vastly superior to money based on real assets like gold, not least because the supply of fiat money can be adjusted to best serve the economy, rather than be dominated by the production of some natural resource. The volume of cryptocurrency cannot be adjusted in the same way.

Of course, governments are tempted to abuse fiat money and print too much, as the first creator of fiat money did, the Chinese government in the 13th century. More recently, the stagflation of the 1970s is due to the central banks being bad stewards of money.

Because the governments of the time could not be trusted, several thinkers proposed free monetary systems, such as Hayek in 1977, discussion which presages current cryptocurrency debates. Still, advances in monetary policy eventually gave us more stable money by the 1980s.

So how do cryptocurrencies stack up on the criteria for money mentioned above: as a store of value, ease of transactions and for lending of last resort?

They are vastly inferior for transactions. Transactions with cash are costless, anonymous, and immediate. Electronic transactions are very cheap and also immediate, and can be done in any amount.

Bitcoin transactions take an hour or more, with a cost of at least $25, and they are not all that anonymous. Yes, there are cryptocurrencies that promise more efficiency or privacy. But even then, while it can take a long time to find someone who accepts Bitcoin, it is much longer with the competitors. Meanwhile, the largest amounts that can be transacted by cryptocurrencies are dwarfed by those one can transact with fiat money.

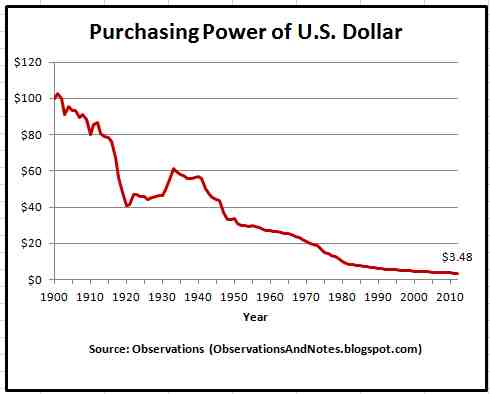

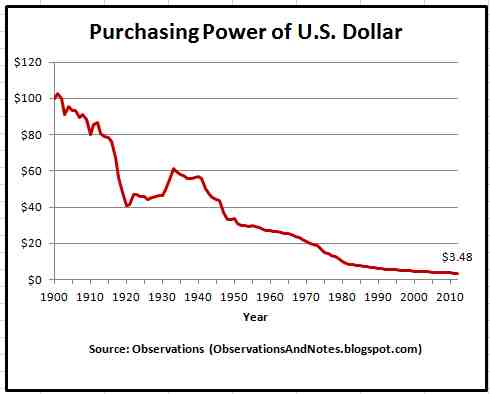

And what about store of value? Neither cryptocurrencies nor fiat money have any intrinsic value. What matters is credibility – our expectation that the money will retain its value over time.

For fiat money, the central banks are committed to keeping its value stable at a decreasing rate of 2% per year. The major central banks have been quite successful at keeping their tracking error small for a long time.

Bitcoin and other cryptocurrencies are much inferior in this regard. Their value doubles or halves in a span of few days. One cannot say with any degree of certainty that one’s holdings of cryptocurrencies will hold their value over the next week, not to mention a month or year. If one holds cryptocurrencies, it is for speculative reasons, not as a store of value.

That leaves lending of last resort (LOLR), providing liquidity to financial institutions in times of crises. This has been an essential function of central banks ever since Walter Bagehot’s 1873 analysis of the 1866 crisis. LOLR was last used in 2008, and will certainly be needed again at some point in the future. There is no such facility in any of the cryptocurrencies.

If cryptocurrencies are money, they are a much inferior to existing fiat money.

Are Cryptocurrencies Investment?

Cryptocurrencies, along with fiat money, have been called Ponzi schemes. Not quite. The definition of a Ponzi scheme is an investment where existing investors are paid for by new investments. Neither cryptocurrencies nor fiat money fit the definition.

But are the cryptocurrencies an investment? It depends on what one means by investment.

The value of a stock or a bond reflects future income appropriately discounted to the present. Not so with cryptocurrencies or fiat money. They have no intrinsic value. Their value is caused by scarcity, as well as the cost of mining or government promises. However, mining is sunk cost, not a promise of future income.

The only reason cryptocurrencies retain value is because we expect other people in the future to value them the same, or more than we do now. Just like collecting stamps. The value of stamps is created by scarcity and expectations of future investors pricing them more highly than we do now.

Cryptocurrencies are not an investment in the same way as a stock or a bond. They are an investment in the same sense as stamp collections are.

However, even then, most people don’t use fiat money directly as a store of value except in small amounts. At the very least, one can keep fiat money in a bank account or government bonds that earn interest. An investment that is as safe as the government. The possibility of such near riskless lending at stable rates is absent for cryptocurrencies.

So if cryptocurrencies are an investment, they are more like stamps or lottery tickets than fiat money, stocks, or bonds.

Credibility

The intrinsic value of fiat money is underpinned by the credibility of the government and the central banks tasked with controlling money.

Central banks are independent and with considerable political cover, essential to ensure the credibility of fiat money. Countries that disregard the latest developments in monetary policy, like Venezuela, do that to their cost.

Central bank independence, political cover, and reputation for competence are key. Jerome Powell, the current chair of the Federal Reserve system, is the most powerful bureaucrat in the world. General Joseph Dunford, Chairman of the Joint Chiefs of Staff, might have nuclear weapons in his arsenal, but he reports to President Trump. Jerome Powell does not.

While our faith in central banks has increased considerably since Friedrich Hayek wrote his article cited above, it could still be higher. However, I can download detailed performance statistics on fiat money dating back decades. I know the supply of money and I know the policy tools used and I can make up my own mind. Information about cryptocurrencies and other activity statistics is much harder to come by and have a much smaller history.

The value of the euro and of the dollar is underpinned by the credibility of the ECB or the Fed. With cryptocurrencies, it is the credibility of some unknown entities and processes.

I trust the central banks in developed economies much more than I trust any of the cryptocurrencies.

Privacy and Security

That leaves privacy and security.

Cash is 100% anonymous, but one is at some risk of theft. Electronic transactions are not anonymous, but are safer.

While some cryptocurrencies promise anonymity, the most popular, Bitcoin does not, unless one is really careful in hiding one’s tracks using skills that are only available to a small group of users. The reason is that transaction records on the blockchain cannot be changed or deleted and are therefore searchable.

Meanwhile, not a day passes without reports of theft from cryptocurrency investors. The best advice is to keep one’s private key on an air-gapped burner laptop.

Cash and electronic money are also subject to theft. Still, there is no need for a private key with cash transactions and keys are much less important for electronic cash transactions. There are multiple layers of security that protect us. The fiat money of non-expert users, provided they take basic precautions, is very safe.

I feel quite confident in doing online banking without resorting to an air-gapped burner laptop.

Cryptocurrencies are only safe from theft if one is expert and takes elaborate precautions. We are much more likely to be a victim of a crime with cryptocurrencies than cash or electronic money.

So…

Cryptocurrencies are inferior to most fiat money and investments, while they do not provide privacy or security.

When I say this to advocates of cryptocurrencies they usually respond in two ways – that I don’t understand cryptocurrencies, and that they have new and wonderful qualities that I miss.

There are many things I don’t get, but I have put some effort into understanding the mechanics of cryptocurrencies. However, one can know all the mechanics, all the geeky technical details, and still not have a clue about what they mean.

Take as an example human beings. I can know all the physics and chemistry and physiology, understand how molecules and organs operate, yet still don’t know the first thing about an individual.

Its the same with cryptocurrencies. Knowing the mechanical details does not translate to understanding their economic function.

Cryptocurrencies are more like a religion or a cult, not a rational economic phenomena. They even have their own foundation myth, the elusive Satoshi Nakamoto.

I await my enlightenment.

www.openbazaar.org

www.overstock.com

These sites let you buy anything with bitcoin.

Your story sounds like somebody that won the lottery bragging about how good an investment lottery tickets are.

I hope that Lightning ends up working, but I have serious doubts. In any case, it's still very alpha software (even the Lightning developers are saying its premature to put it on the main network) and its gonna be years before the crypto economy integrates it, assuming it works.

That's not correct.

If one holds cryptocurrencies, it is for speculative reasons, not as a store of value.

That's not correct either.

There are many things I don't get, but I have put some effort into understanding the mechanics of cryptocurrencies.

It's not evident from the article. He doesn't understand the aesthetics of various CCs. He thinks it's a Chinese plot to take over. He doesn't understand how CCs store value: it is temporary since the underlying ciphers will be cracked in decades. A CC store of value has to be monitored and managed, can't just throw it in a mattress and forget about it like gold. There will always be better and longer-lasting CCs and it is up to hodlers to figure that out or pay someone else to manage their CCs.

Other points in the article are more correct although exaggerated. The fees about $3-4 although they peaked above $50. I realize bitcoin has not been successful for day-to-day transactions, but real world transactions requiring dollar conversions will fade as virtual world transactions denominated in CC take over.

This was exactly my first thought.

Not correct. CCs are backed by the algorithms. There's now a multibillion dollar bug bounty on those algorithms that has yet to be claimed.

Crypto refers to PKI, or signing with a private key. When you own a CC you own a private key with value alloted to the corresponding public key (converted to an address). Nothing is hidden, and you say, they are not hidden from the government.

No, that's nonsensical. Exchanges are compeltely antithetical to mining. Miners are CC purists. Sure they like the money and some will cash out through an exchange.

In contrast, exchanges are for the weak and stupid. People who want to speculate go to an exchange and let the exhange keep their value in their own private keys. All those people get is an entry in a centralized database at that exchange. That's completely opposite of how CC's work.

Well, putting your faith in fedzilla be good enough for you, but for many others, not so much.

The author makes some very good points. But this....

“Fiat money issued by a credible modern central bank is vastly superior to money based on real assets like gold, not least because the supply of fiat money can be adjusted to best serve the economy, rather than be dominated by the production of some natural resource.”

This is where he lost credibility.

Who wrote this? some apparatchik at the Federal Reserve?

It wasn't the bulbs. It was the new varieties. The boom came about from new imported varieties. The bulbs in quantity killed the boom.

CC's are in the beginning stages of the variety phase. Think of bitcoin as a plain red tulip that is incredibly overpriced. If you have some there are continually new opportunities to trade those in for new varieties. Many of those will fail to gain traction, but speculation is always risky.

Bitcoins etc are just made up money like er... our dollar or the yen or the EU funny looking money. The Feds want to control the dollar. I just wish they would do a better job of it. If they did there would be no bitcoin.

They’re to provide some stability and protect us against the ravages of “official” currencies.

The love of money

Is the root of all evil

Money is NOT real

Only love is real

Ammo will be the currency of the new economic order....

I am never suggesting anyone “invest”, “speculate” or buy any crypto currency.

I am suggesting that instead of sitting around talking down other people’s decisions or inventions that the same amount of time could be spent on learning something new. Something that may provide value—and developing the critical analysis skills that can allow you to see potential.

Most of the people I see shitting all over bitcoin have no idea—and want to learn nothing—about how any of this works.

I hope you don’t buy any. I use the dollar amounts to show how a minimal investment early gets you leverage that a late adopter will never manage.

Its comments like that which indicate you are speaking about things (crypto currencies AND tulips) that you’ve read about in headlines, but you know nothing about.

But that’s OK.

I could not care less if anyone ever bought another BTC or tulip.

Respectfully, folks love comparing 'cryptocoins' to tulip bulbs. Other than both can be "bought and sold", they are completely different in usefulness, how they are reproduced, transported, divided up, hidden, stored, maintained, longevity, ...

'Cryptocoins' are the most useful means of exchange yet invented. When distilled down, 'means of exchange' are simply means of accounting for human transactions (whatever they may be). In this, distributed ledger technology (DLT, i.e., 'cryptocoins') can't be beat when occurring beyond a local/face to face level.

Actually, a year ago you would have been absolutely correct. Curiosity got the best of me last fall and I started reading up.

I understand that a lot of folks really get into this and buy these things, and think the rest of us don’t know what we are talking about.

I compare it to a person who sells Amway and thinks that if only people really understood it, they would jump in with both feet.

And you are right that tulip bulbs and Cryptocurrency are not the same thing. Tulip bulbs have actual intrinsic value. Once cryptocurrency runs out of “greater fools”, it has even less value than an antique ferry token, because it doesn’t really exist.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.