Posted on 02/14/2022 10:14:25 AM PST by blam

Another day, another contradictory economic data point.

Just one business day after the latest UMichigan report showed consumer sentiment in January tumbled to the lowest level since 2011, driven in large part by the continued surge in inflation expectations which hit a whopping 5.0% for the 1-year window, the highest since 2008 and a remarkable 3.1% for the 5-10 year period, the highest since 2011 and following a relentless increase over the past two years…

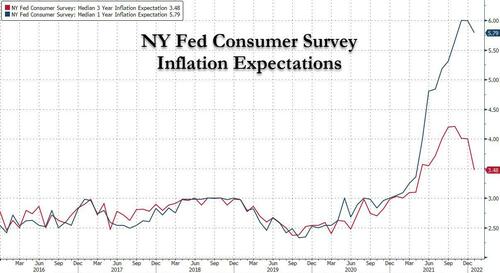

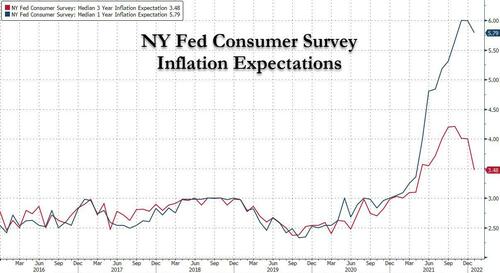

… moments ago the NY Fed published its own contradicting view on the critical issue of consumer inflation expectations – critical because the higher it rises, the closer the Fed is to losing control over monetary policy anchor, inflation expectations – when it unveiled earlier today that inflation expectations unexpectedly declined for both the 1 Year and 3 Year look-ahead periods.

Specifically, the NY Fed’s Survey of Consumer Expectations found that inflation expectations at the one-year horizon decreased to 5.79% in Jan. from the previous month’s 5.99%, the lowest since October and the first decline since October 2020, while median three-year ahead inflation expectations fell by a striking 0.52 percentage points to just 3.48%, the lowest since April…

… thanks to a broad-based drop across age, education, and income groups, and marked the largest monthly decline since survey inception in 2013!

Yet while it was unclear what prompted this sharp drop in inflation expectations – whether it was pessimism on continued wage growth and cyclical recovery (both good drivers of inflation) or because of asset inflation and supply chain congestion (both bad), the latest survey showed that median year-ahead home price change expectations continued to grow and in January rose to 6.0% from 5.53%, an increase that was most pronounced among respondents with no more than a high school education and those who live in the West and Northeast census regions.

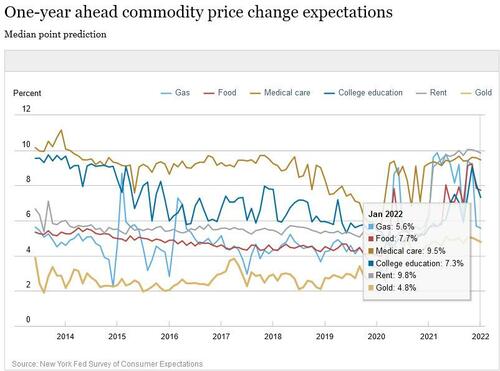

All products and services surveyed by the New York Fed unexpectedly declined in January, including the year-ahead price changes for food, rent, gas, medical care, college education and gold. Specifically, over the next year consumers expect gasoline prices to rise 5.57%; food prices to rise 7.73%; medical costs to rise 9.45%; the price of a college education to rise 7.32%; rent prices to rise 9.84%.

The survey also showed that the median households is expecting one-year-ahead earnings growth to rise by 3%, the same as last month. Last year, an average gain of 2.6% was expected. Meanwhile, a smaller percentage of consumers, 10.04% vs 10.35% in prior month, expect to not be able to make minimum debt payment over the next three months.

What is bizarre is that just last week, the latest CPI print showed inflation soared 7.5% in January, the biggest annual increase since 1982. Persisting high inflation has led has led the central bank to pivot toward a tighter monetary stance to help cool off prices.

Which again begs the question: are consumers giving the Fed the benefit of the doubt and expecting that its rate hikes will contain inflation, or – more importantly – are the falling inflation expectations the result of consumers seeing the coming recession which will be the direct result of the Fed’s policy mistake.

In a separate analysis of data from the survey and from the University of Michigan’s sentiment index, New York Fed economists concluded that consumers seem to recognize the unusual nature of the current bout of high inflation.

“This result suggests that while consumers are highly attuned to current inflation news in updating their short-term inflation expectations, they are taking less signal than before the pandemic from the recent sharp movements in realized inflation when revising their three-year-ahead expectations,” the economists said in a blog post.

Naturally, that’s what the NY Fed would say, especially if like the BLS, it is putting its finger on the data analysis in hopes of making expectations appear lower than they are, which would explain the growing divergence between the growing inflation expectations in the UMich survey and the sudden, unexpected decline in the NY Fed, which has a clear and present reason to represent these as low as possible: continued growth would prompt a very political debate on whether the Fed has finally lost control over inflation expectations, in which case many would ask just what is the point of having a central bank any more.

The Fed’s lost all credibility. Who truly believes they are an independent institution. They’ve become just as political as the Supreme Court.

Better known as “we can’t raise interest rates ‘cause it would tank the Federal Deficit”.

“Expectations unexpectedly...?”

Is that like a double negative effect?

“Inflation expectations tumble?” Can these imbeciles write a straightforward headline?

Depraved liars!

Liars. My daughter is a realtor. People are offering up to $100,000 ABOVE the already inflated asking prices for homes, in order to have their bids accepted. Just about everything at the grocery store has gone up 25 - 100%. The problem is, they not only think we’re too stupid to notice, they don’t care, because the media will lie, lie, lie for them, and our constitutional right to seek relief from their behaviors, is prosecuted as insurrection. Fascists.

Hey they’ve been talking to the Guru Krugman and you know he has a perfect track record:-)

The nice folks from the Biden administration, or your own lying eyes?

Speaking of Real Estate:

Last fall there was a HUGE land sale in our neck of the woods. Hundreds and hundreds of acres; all good farm land and pasture land. If you want to build a home around here, you need 40 acres, minimum.

Some parcels were going for $8K an acre, which has been unheard of up until now.

Our property has pretty much doubled in value over the past few years, though few would be able to afford it. Amazingly, taxes haven’t gone up. Yet. Ugh!

A lot of people aren’t old enough to remember Jimmy Carter and are too dimwitted or ill-informed to realize that many countries have walked the path we’re on. Inflation is at a 40 year high? This is the worse these people have experienced, so they expect it to normalize. With even a modest rise in interest rates, back up to six or eight percent, the feds won’t be able to service the debt. That’s when things will start to get fun. Italy, Greece and Argentina will be sending in jump teams to consult with Team Biden.

2021 “transitory inflation”

2022 “drop in Inflation expectations”

The greater the word salad, the more clueless the Fed

Boy O Boy. I remember Harry Truman.

Figures never Lie, But LIARS FIGURE!

” With even a modest rise in interest rates, back up to six or eight percent, the feds won’t be able to service the debt.”

A rise in interest rates won’t affect currently issued federal debt. It would affect new debt or rolled over debt, and whether that spending happens is up to Congress.

Needs repeating for the un-informed.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.