Posted on 04/12/2022 9:52:25 AM PDT by blam

In the latest inflationary shock – one which Biden will dutifully read from the teleprompter was entirely the fault of "PutInflation" – even if a chart of CPI in context shows otherwise…

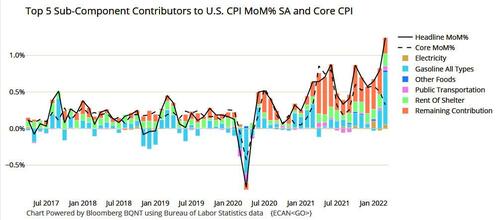

… this morning the BLS reported that headline CPI skyrocketed 1.2% (1.24% unrounded) M/M in March as energy surged 11.0% and food prices jumped 1.0% mom for a second consecutive month. The energy price moves reflect the shock from the Russia-Ukraine conflict, while food has yet to feel the impact given lagged pass-through and is likely to remain hot throughout the year. In other words, while much of the covid-linked supply chain inflationary spike is fading, we are about to face an even bigger, Ukraine-war food inflation spike!

Core CPI came in slightly softer than expected at a still elevated 0.3% (0.32 unrounded) mom. As noted earlier, the miss owed to a 3.8% plunge in used auto prices, which sliced 20bps from the monthly core drop.

Meanwhile, new cars continued to head higher, with a 0.2% mom increase, as did medical commodities. HH furnishings/supplies stayed hot, with a 1.0% mom gain, as did apparel, with a 0.6% rise in March—these two components have shown greater sensitivity to ongoing supply-chain tightness. Here is a snapshot

◾ Grocery inflation jumps 10.0% in March vs. the February rate of +8.6%.

◾ Cereals and Bakery Products +9.4%, Meats, Poultry, Fish, and Eggs were +13.7%

◾ Dairy and Related Products were +7.0% Fruits and Vegetables were +8.5%

◾ Airfares in March skyrocketed 10.7% and are now at their highest point since the pandemic began.

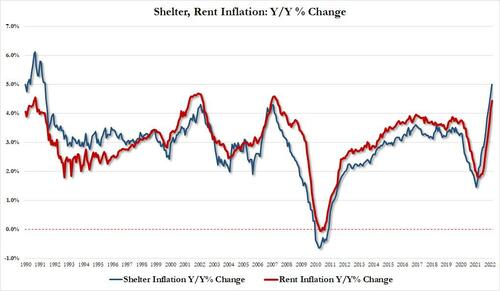

◾ Shelter inflation 5.0% Y/Y in March vs 4.7% in Feb, and the highest since May 1991

◾ Rent inflation 4.44% Y/Y in March vs 4.17% in Feb, and the highest since May 2007

◾ The household furnishings and operations index rose 1.0%, the eighth consecutive increase

◾ The index for new vehicles increased 0.2 percent in March after rising 0.3 percent the previous month.

◾ The index for communication was also among those few indexes which declined over the month, falling 0.5 percent

The only materially lower category, as noted above, was the index for used cars and trucks which fell 3.8 percent in March, its second consecutive monthly decline after a series of large increases.

Away from good, within services, OER and rents of primary residence both came in at 0.43% mom, cooling slightly from February.

This is consistent with the signal from high-frequency rent data that we have probably hit the peak for the sequential rate, although even so we expect fairly elevated readings going forward.

Meanwhile, Medical care services rebounded strongly to 0.6% mom, shaking off the Covid soft patch. These two key components alone point to still strong stickier inflation. Transportation services skyrocketed 2.03% mom as airline fares spiked 10.7% mom and car/truck rental soared 11.7% mom, reflecting reopening pressures, and motor vehicle insurance climbed 0.7%. Lodging also jumped 3.3% along the same reopening theme, while recreation services grew 0.4% mom.

If we consider lodging, car/truck rental, and airline fares as more near-term reopening pressures, these components accounted for 13bps – overall, broad-based services inflation with additional lift from reopening,

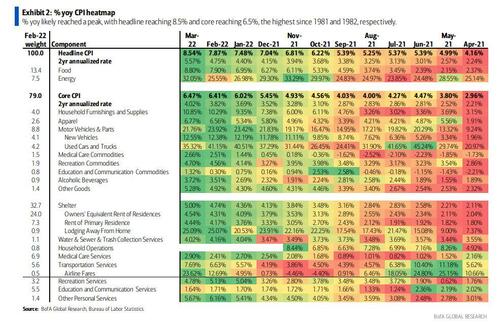

On a Y/Y basis, rates for headline inflation both headed higher this month, with headline jumping to 8.5% (8.54% unrounded) from 7.9% and core increasing to 6.5% (6.47% unrounded) from 6.4%. As a handful of investment banks have stated, both reflect the peak for yoy rates but expect inflation to cool to hot levels by year-end (largely due to base effect), with headline at 6% 4Q/4Q and core at 5% 4Q/4Q.

In terms of the all-important Fed reaction, it will likely look through some of the noisier components of the report — keep an eye out for trimmed-mean later this morning- and conclude that price pressures remain elevated, underpinning the need to hike by 50bps (but not 75bps or proceed with an intermeeting hike)

In terms of the market response, 10Y nominal yields dropped by 10bps and the curve steepened, with the decline in rates roughly split between inflation breakevens and real rates, as the market pried both a fading in inflationary pressures and less aggressive Fed response.

According to BofA economist Alexander Lin, today’s print is an inflection point, with core MoM inflation cooling to the lowest level since September ’21. This shift may challenge TIPS demand, especially with the Fed set to begin balance sheet reduction in May. Market pricing for the Fed’s terminal rate declined about 10bps to 3.1% following the report, but fed funds futures through September declined less than 4bps.

In general, the print still reflects very strong cyclical inflation components and should not deter the Fed from delivering on three 50bps rate hikes in coming meetings.

Finally, here are the heatmaps for today's CPI report, first M/M…

… and also Y/Y.

That sure sounds like wishful thinking.

Getting past the gobbledygook, prices of individual commodities and services and groups of commodities and services will rise and fall with supply and demand. But inflation is caused by one thing - the government, or its central bank, creating money to fund a deficit.

p

Wishful thinking?! I want whatever the author is smoking! Clearly they have no clue as to what the reality is.

By the way, it was $6.19 in October. Can't blame in Putin. Blame lies on Pooter Brandon.

The local grocery store has a big sign starting pay at $18 an hour. I was looking at used Toyota pickups. The Tacoma I would like... Asking $42,000 for a 2017. Let’s go Biden

Stocks are way down since early Dec 2021 when the Fed Chairman said he wanted 4 rate hikes and others wanted 11 in 2022. The mortgage rates are 5.87% and higher now.

Everything the democrats have done is deliberate.

Nothing has been done to improve people’s lives.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.