Posted on 06/10/2022 9:14:29 AM PDT by blam

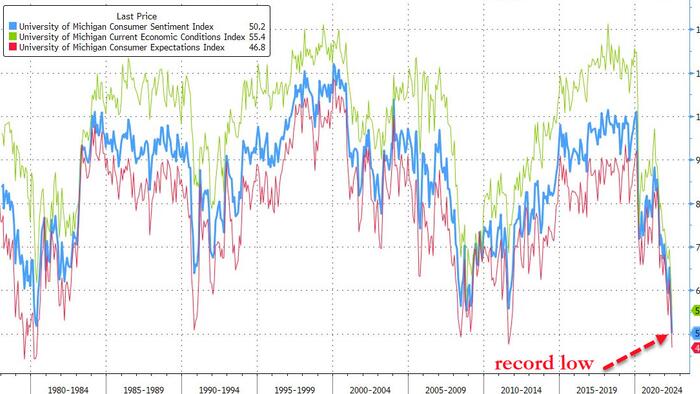

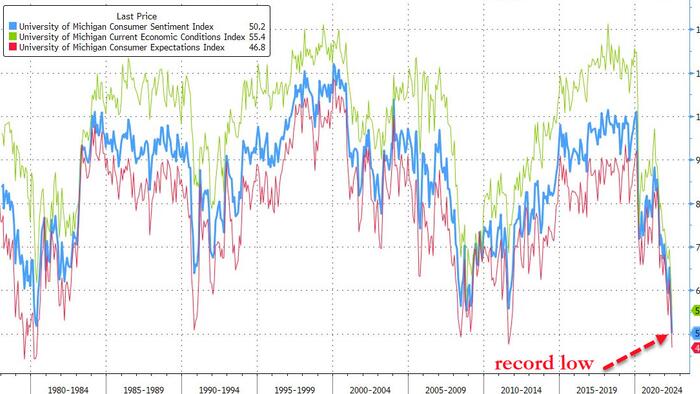

In a stunning miss, University of Michigan Sentiment collapsed in preliminary June data, crashing from 58.4 to 50.2 (massively below the 58.1 expectations).

Source: Bloomberg

That is the lowest reading ever for UMich.

Worst consumer confidence IN HISTORY pic.twitter.com/EW5UtBc1AY

— zerohedge (@zerohedge) June 10, 2022

Don’t worry though, ‘they’ are on it…

*YELLEN: AMAZING HOW PESSIMISTIC HOUSEHOLDS ARE GIVEN JOB GAINS

Maybe you should give them more stimmies to cheer them up?

— zerohedge (@zerohedge) June 9, 2022

Developing…

And they will STILL vote for Gov. Shiny ShoeBox Face!

It is pointless to keep posting all of these negative stories because almost no one has any real interest in doing anything about any of it. Few have been harmed enough to do anything. By the time they are sufficiently harmed, the leftists will have almost all of the weapons. No more tea parties for you!

And maybe it’s not American citizens filling those jobs!

Context please? What is a University of Michigan Sentiment? I would like to see a picture of the stunning miss.

A vote of No Confidence in the Biden cast of Clowns

People feel pain from inflation, they don’t need numbers to know they’re screwed.

History of P/E ratios in the stock markets, for over the past 200 years, have been a good gauge of when bubbles are being created, and by historical measures the current bubble has been builidng for a decade (or two) and ignored all along the way.

The current P/E average for the S&P 500 is 31.3. The modern era average is about 19, while the longer term historic average is about 15-16.

Yes. it is pure math but based on long held principles of finance - what is sustainable levels of earnings against GDP growth, population growth and other factors, and deals with the sustainability of interest rates as well. Then it observes that when in the historic average p/e of 15-16, growth and interest rates are usually stable, reflecting neither bubbles nor big declines. When the average is stretched too far above 15-16, expectations are greater than can be sustained long term. Yes, there will be particular issues earning above the 15/16 average due to some immediate (not long term) company or sector advantage, and issues with lower p/e below 15=16, also due to individual compnay or sector conditions.

But looking at the historic average p/e is looking at the whole market and its cycles overall, not individual stock issues.

And unfortunately today, about 40% of the market is held by funds doing nothing other than an index fund, where, like lemmings, they are not choosing a path but just following whatever path the market (a market index) is taking. I think they have proven to be fine in volatile but expanding market conditions - they keep up with the market without having to pick the stocks in the market driving its expansion.

But on the downside a dominance of assets in an index fund provides no relief.

I agree, What does this have to do with anything? Is this some kind of hokey reference to sports, what?

University of Michigan consumer sentiment index.

Imagine how low it might be if the MSM were slanting economic stories to make Brandon look bad rather than their current practice of slanting economic stories to make Brandon look good.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.