Posted on 06/18/2022 4:41:46 AM PDT by blam

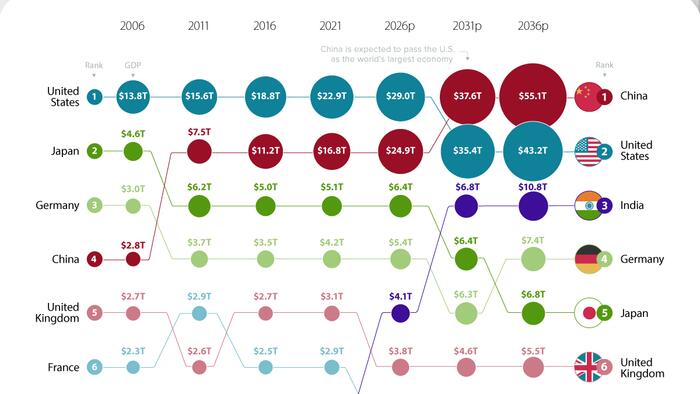

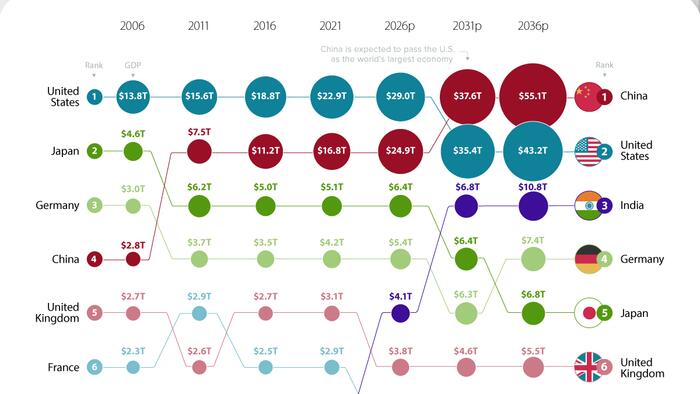

As the post-pandemic recovery chugs along, the global economy is set to see major changes in the coming decades. Most significantly, China is forecast to pass the United States to become the largest economy globally.

The world’s economic center has long been drifting from Europe and North America over to Asia. This global shift was kickstarted by lowered trade barriers and greater economic freedom, which attracted foreign direct investment (FDI). Another major driving factor was the improvements in infrastructure and communications, and a general increase in economic complexity in the region.

Visual Capitlaist’s visualization uses data from the 13th edition of World Economic League Table 2022, a forecast published by the Center for Economics and Business Research (CEBR).

When Will China Become the Largest Economic Power?

China is expected to surpass the U.S. by the year 2030. A faster than expected recovery in the U.S. in 2021, and China’s struggles under the “Zero-COVID” policies have delayed the country taking the top spot by about two years.

China has maintained its positive GDP growth due to the stability provided by domestic demand. This has proven crucial in sustaining the country’s economic growth. China’s fiscal and economic policy had focused on this prior to the pandemic over fears of growing Western trade restrictions.

India is Primed for the #3 Spot

India is expected to become the third largest country in terms of GDP with $10.8 trillion projected in 2031.

Looking back, India had a GDP of just $949 billion in 2006. Fast forward to today and India’s GDP has more than tripled, reaching $3.1 trillion in 2022. Over the next 15 years, it’s expected to triple yet again. What is behind this impressive growth?

For starters, the country’s economy had a lot more room to improve than other nations. Demographics are also working in the country’s favor. While the median age in many mature economies is shooting up, India has a youthful workforce. In fact, India’s median age is a full 20 years lower than Japan, which is currently the third largest economy.

Over the last 60 years, the service industry has boomed to around 55% of India’s GDP. Telecommunications, software, and IT generate most of the revenue in this sector. IT alone produces 10% of the country’s GDP. India’s large tech-savvy, English-speaking workforce has proved attractive for international companies like Intel, Google, Meta, Microsoft, IBM, and many others, while the domestic startup scene continues to boom.

The Indian government is also pursuing “production-linked incentives” (i.e. subsidies) for multinational companies looking to diversify their production away from China. If these incentives prove successful, more of the world’s solar panels and smartphones will be produced within India’s borders.

How Will the Global Economy Look in 2031?

By the year 2031, there will be major changes in the global economic power rankings.

As we said before: China will have become the world’s largest economy in terms of GDP and India will be the world’s third largest economy. Let’s also take a look at the top 10 economies by 2031.

Out of the top five economies, three are located in Asia: China, India, and Japan—a clear demonstration of how economic power is shifting towards large population centers in Asia.

Europe will have four countries in the top 10: Germany, the United Kingdom, France, and Italy. From South America, only Brazil appears in the top 10.

Under these projections, Russia sits outside the top 10 in 2031. Of course, it remains to be seen how crushing sanctions and global isolation will affect the economic trajectory of the country.

Now, the big question. Is it inevitable that China takes the top spot in the global economy as predicted by this forecast? The truth is that nothing is guaranteed. Other projections have modeled reasonable alternative scenarios for China’s economy. A debt crisis, international isolation, or a shrinking population could keep China’s economy in second place for longer than expected.

China collapses without western money. If America goes down, who will buy China’s cheap goods?

Does GDP really matter, when we’re untold TRILLIONS in debt? So much so that we’ll NEVER climb out of it? Never. Ever.

Does China carry a lot of debt? I never looked...

On my most recent visit to Guangzhou (2018) the streets were lined with glass and steel skyscrapers and during rush hour one saw bumper to bumper traffic of Toyotas.Hyundais and Buicks (yes,Buicks).

Every time we buy some cheap piece of Chinese cr@p China's military gets stronger...much stronger.

I don’t see how China could lead the world. China steals all its innovative technologies and intellectual property from the United States.

Further, China cannot feed its own people.

Buicks are the most popular and sought after car in China. If you don't have a Buick, you ain't squat.

We need a high tariff to protect US industry, raise revenue, lower tax rates and promote ON shoring of industry. So many wins with a tariff.

I think real per capita GDP is a much better indicator of economic power. Subtract the impact of inflation on GDP and look at output per person is a much more reliable measure of productivity and standards of living. India has a population of about 1.25 billion people and Japan has a population of 125 million. Their projected GDPs are about the same which suggests that the standard of living on average will still be ten times higher for the average Japanese citizen compared to the average Indian citizen.

Yes China and India have seen annual economic growth rates that are almost unprecendented in world economic history-but only because they started out so low. It is what economists

call the catch-up effect. The article does mention population growth, age distribution and so forth which are also important.

I think that the EU will be in second place after China if it survives the sanctions trap set for it by the US.

Funny. I don’t see Russia anywhere on that list.

As of 2022, the USA produces 3.6X times more GDP per capita than China.

Since the USA has deliberately imported millions of low skill workers and their dependents, that is a pretty amazing statistic.

“China has maintained its positive GDP growth due to the stability provided by domestic demand.”

What a load of ignorant BS. After 2008, China printed an enormous amount of yuan, pumping that money into building ghost cities, plants they didn’t need capacity, etc. All those non productive assets only temporarily boost GDP but those chickens are coming home to roost. 39% of China’s GDP is real estate. China biggest real estate developer just went bankrupt. There are an enormous amount of bad loans tied to junk real estate. Reminds me of 1980’s Japan, where value of all land had a paper vale of 4 times all the land in the US, a country 25X larger. That bubble popped hard and it took Japan more than a decade recover.

The official CHICOM GDP numbers are phonier than a 3 dollar bill.

Part of the picture is missing because of the populations. Shown another way, the money per person will be greater in the US. Thus the actual valuation of an economy can be seen in different ways. The Chinese will still be poorer than Americans, by (buy) and large.

Coming in to the city from HK on the train, you disembark right in front of a huge park. Prices were higher there than in HK back in 2007.

After the 2008 financial crisis, the CHICOMs printed 20 TRILLION, and dumped it their economy. They made the US and Bernanke look like hard core gold bugs by comparison, with our puny 4 trillion.

One employment number may be useful...

China has consistently had about 5X times as many industrial workers as the USA.

Before Covid, the number was approximately China - 100 million - and USA - 18 million.

In spite of that massive manpower difference, USA industrial output value was only about 10% behind China in 2019.

Even when Japanese industry was allegedly taking over the world in the 1980s, USA industrial workers produced more value per capita than Japan did.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.