Posted on 12/06/2022 6:05:27 AM PST by Diana in Wisconsin

The US Federal Reserve continues to grapple with inflation, which at 7.7% (October CPI) is more than triple the Fed’s 2% target, without causing a recession by lifting interest rates too high.

The Fed has two options when it comes to interest rate increases designed to tackle the highest US inflation since the early 1980s. The first is it continues to hike rates, beyond what the economy can handle, causing a recession, usually defined as two consecutive quarters of negative economic growth. This is the “Volcker Fed” playbook.

In 1979, then US Federal Reserve Chair Paul Volcker faced a serious challenge: how to quell inflation which had been wracking the economy for most of the decade. The prices of goods and services had averaged 3.2% annually since World War II, but after the 1973 oil shock, they more than doubled, to an annual 7.7%. Inflation reached 9.1% in 1975, the highest since 1947. Although prices declined the following year, by 1979 inflation had reached a startling 11.3% (led by the 1979 energy crisis) and in 1980 it soared to 13.5%.

Not only was inflation going through the roof, but economic growth had stalled and unemployment was high, rising from 5.1% in January 1974 to 9% in May 1975. In this low-growth, hyperinflationary environment we had “stagflation”.

(Excerpt) Read more at aheadoftheherd.com ...

Conclusion:

"By now it should be apparent that we can’t keep going like we have been, with the Fed continuing to raise interest rates as the economy stumbles towards recession. The signs of a faltering economy are everywhere, as we have described — continued high inflation, especially food and energy, that is not reflected in the Fed’s preferred inflation index, the core PCE; rising inflation expectations; dissipating consumer confidence; an imminent collapse in consumer spending, notwithstanding the “Black Friday” bounce; a plunging PMI and an inverted yield curve, both reliable recession indicators.

Regarding what the Fed does or doesn’t do, the problem is the central bank is using the wrong numbers. If the Fed is under-estimating inflation, as we believe it is, then everything it does to control inflation will likely be wrong as well. This includes raising interest rates.

The Fed can only push interest rates so high, without blowing up the Treasury and being forced into an aggressive bond-buying program (QE), thus accelerating inflation. The irony is that in trying to bring down inflation through interest rate hikes, the Fed, because of the high debt levels, will fail, and will be forced into a loose monetary policy involving interest rate cuts and QE.

Between de-dollarization and investors fleeing Treasuries, it appears likely that the US Federal Reserve will eventually have to take over buying the debt, issued to finance the federal government’s expenditures.

With over $31T of debt, the US government budget is at great risk of running unsupportable deficits if interest rates continue to increase."

Also:

5 Reasons Why Food Will Get More Expensive (From May, 2022)

https://aheadoftheherd.com/5-reasons-why-food-will-get-more-expensive/

Just got my CC bill. I had our grocery budget down to $400/month for the two of us. While buying the same stuff (even with modifications) our grocery bill (which includes household items and house pet supplies; hunting dogs are in another category) has DOUBLED, and some house pet supplies have been cut back (you get 1/2 a Milk Bone, now!) or I’ve switched to some cheaper brands on items.

I know many of you are seeing the same.

All I know is that Paul Krugman says the Fed Reserve is doing everything perfectly right...which means we are about to explode in an undesirable, probably debilitating, financial crisis!

But what do I know? I have never won a Nobel prize in economics, so...

YEP! I told my wife yesterday, after stepping down to the mid-grade brand of dog food, “If he gets much more expensive to feed, I’m going to double up on the expensive stuff for two months and then shoot, field dress, and butcher my 95# black mouth cur German Sheppard!”

It is getting RIDICULOUS!! And I’m not sure what is more ridiculous: the actual prices we are seeing or the White House and our enemedia telling me everything is perfectly okay and going great!!

Transitory...

But how can this be happening? Democrats passed the Inflation Reduction Act. They had a party at the White House to celebrate, with James Taylor singing some of his songs. Considering all of that how can inflation still be a problem???

Sarcasm......

Maybe Karine Jean-Pierre has some answers.....

When obozo was in office, gas got up to $4/gallon and food prices doubled. Then the prices started to lower a bit.

My son was going through peanut butter like crazy, so we were buying a 2 pack of large peanut butter for $7. In a few short months, that same package was $14.

Dims in power, people suffer.

The Feds are a criminal enterprise and this is their sucker punch to make you use that crap digital control system.

Well, yeah we are, but apparently all those RAT voters aren't. I think I'm changing parties so I can take advantage of their lower prices.

“Inflation” refers to the money supply. Price hikes are a result of the devaluation of the currency supply that is inflated. This blogger - and most everyone else - wrongly conflates the two.

All I know is that Paul Krugman says the Fed Reserve is doing everything perfectly right...which means we are about to explode in an undesirable, probably debilitating, financial crisis!

—

Hard to know who is a better reverse bellwether on the economy Krugman or Cramer. At least Cramer has a more entertaining delivery.

They’re not wrong. They’re just lying.

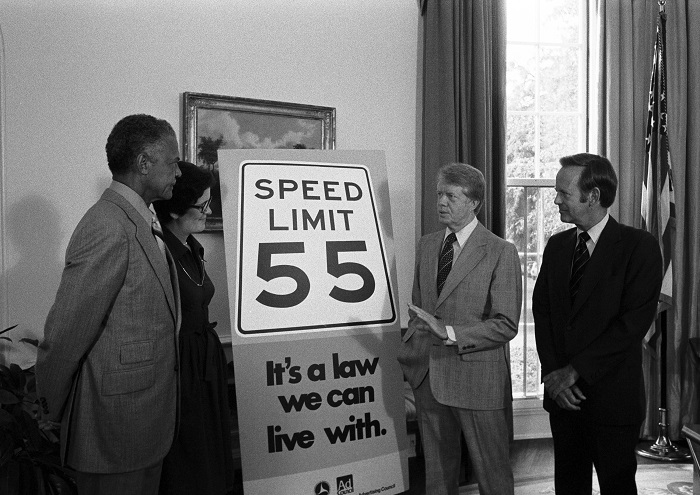

If they lower the interstate speed limit to 55 mph then the cirlce wil be complete.

It is actually pretty simple: Inflation is caused by too many dollars chasing too few goods.

You can either create more goods—something the government cannot do. I guess the government could ease import restrictions and incentivize companies to be more productive. But these were not the reasons for supply shortages.

Second, the government can suck dollars out of the system. This is done through taxes and interest rates.

The Fed will have to keep raising rates until they are at or higher than the PPI which is the wholesale inflation rate. At this stage it looks like the two lines are going to cross at around 5-5.5%.

There are a lot of causes for this stuff. But the solutions are much, much simpler. And none of them are “pleasant.”

Moppet head should explain things better, me thinks.

In Peru, staples such as rice, potatoes and corn could tumble as much as 40% unless more fertilizer becomes available. The International Rice Research Institute predicted crop yields could drop 10% in the next season, meaning there’ll be 36 million fewer tons of rice — enough to feed 500 million people. That 36 million tons of rice works out to about 0.4 lb/person per day for a year.

Since that is 10% of the original value, that means there was 4 lb/person/day of rice.

Something doesn't sound right about the numbers.

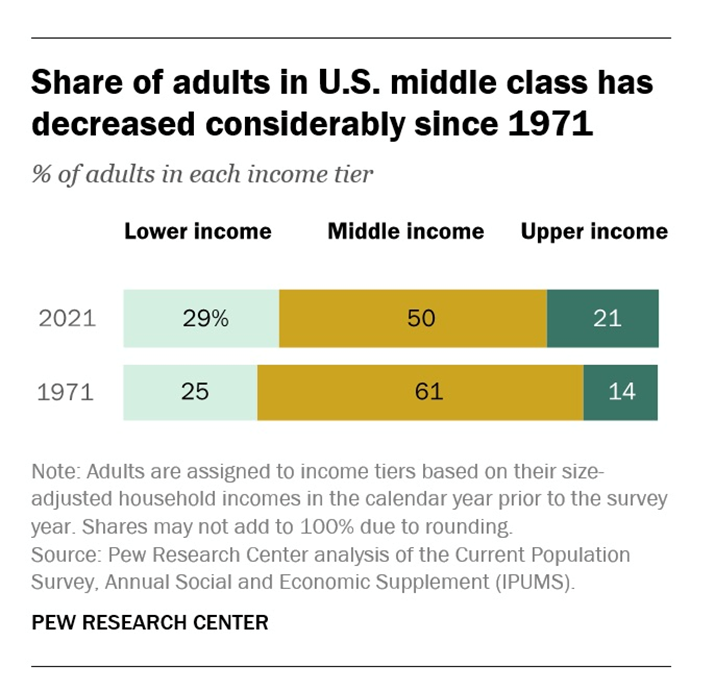

Also from your table this chart:

7% of the that 61% got rich; 4% became poor.

So it's tricky -- it's more towards a very divided society; but it's not like all the middle class are just falling off the ladder either.

Or increase tariffs an promote domestic production.

“you get 1/2 a Milk Bone, now!”

Tell your dog he’s lucky, if things keep going this way it’ll be 1/4th of a water bone!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.