Today's stocks are not built on reality, and have not been for years.

Many people cannot see.

Posted on 08/21/2015 3:05:07 PM PDT by Signalman

It’s finally happening. The crash season is upon us.

We’ve seen the early signs this week with leading stocks getting the carpet swept out right from underneath them.

China’s stocks are right where they were when its bubble burst 35% into July. UK stocks are in a correction. The DAX is in a correction. And the S&P 500 hasn’t busted quite as much – yet – but it’s dipped below that important level of 2,000 at the bottom of the S&P 500 Channel going back to late 2011.

That strongly suggests the market has topped and the great crash is in motion. It must be grating on the psyche of any investor who’s dared to stay in stocks this long.

So where do we go from here?

I can promise you, it’s only going to get worse!

Like our economy, there is clear seasonality when it comes to stocks. Trends flesh out overtime. It’s not random. From that data, I want to give you a picture of what the next few months might look like.

It’s a well-known fact that September tends to be the worst month of the year. This goes all the way back to

(Excerpt) Read more at economyandmarkets.com ...

Yes and higher at year end.

I’m 22% cash.

I need a bear market.

Today's stocks are not built on reality, and have not been for years.

Many people cannot see.

Under King hussein, that's a guarantee. With his cronies of Soros and Buffett, the plan to fundamentally transform the Republic is well underway. It paves the way for the caliphate they always intended. The clear election fraud of 2008 that kept Governor Sarah Palin from the White House continues to have disastrous aftershocks. She would have restored the American oil industry.

And it’s not even october...

So are you selling short? How much?

I think we can forget the fed raising the interest rate in september.

True. And for active traders one of the old rules was: If stocks get too frothy, move to bonds, where money can be made, only more slowly.

But today there is no money to be made in bonds, slowly or otherwise. How that fits into things, I'm not exactly sure. But I'm guessing that low bond yields would tend to put a brake on stock declines.

Completely correct. With the equities markets around the world essentially in free fall, the last thing the Fed will do is raise the interest rate even 25 basis points. In fact, this may postpone raising the rate until the middle of 2016 at minimum.

Well, socialists, no revenues for you. And may the vicious circle swallow the recirculating debt completely up, until it’s all gone.

The Fed isn't going to raise rates until a GOP President gets elected, so he can take office in a recession.

In the last year of the Clinton administration, the stock market went into free fall. Clinton did nothing to stop it.

In the last year of George Bush’s administration the stock market went into free fall. He tried to stop it.

Now, the market has gone into free fall in Obama’s admin several times, and he has done nothing to stop it.

Must be market giddyness over the change in future policies.

Bond yields are so low because the Fed has set interest rates ultra low, in the logic that these low rates will "stimulate economic growth."

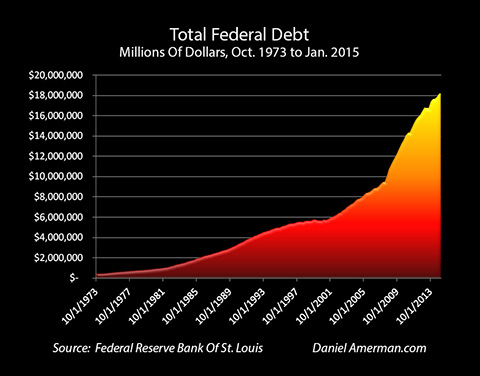

That scheme has failed, but now the Fed is in a quandry. It cannot lower rates any more, but if it raises them, the Federal government could not afford to pay its own debt payments.

The low rates and very low bond and savings rate returns "forced" people to put most of their eggs into the stock market basket. Now, that bluff has been called and its time to pay the piper.

bmp

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.