Skip to comments.

COVID Stimulus Spending May Eventually Lead to Inflation. Are Cryptocurrencies and Gold Viable Hedges?

PJ Media ^

| 03/01/2021

| Bryan Preston

Posted on 03/01/2021 7:23:31 AM PST by SeekAndFind

The Democrats are set to pass yet another big-spending bill they claim is COVID-19 relief. As with previous bills during the pandemic, there’s less COVID relief in it and a whole lot of other things that have nothing to do with helping Americans struggling through the pandemic. It’s packed with reckless spending that will typify the Democrats’ control of Washington over the next couple of years.

The very first congressional COVID “relief” bill struck me as big spenders treating it as a genie jumping out of a Christmas tree. That was the $2.2 trillion CARES Act, passed in late March 2020. It was less targeted relief for the pandemic and its lockdowns and unemployment than Congress seeing the opportunity to have all its spending wishes fulfilled at the expense of future generations.

The House has passed its $1.9 trillion bill this past week. It faces an uncertain future in the evenly divided Senate. Supposing it passes, that will be more than $4 trillion spent in the past year just on so-called relief, which is less relief than Congress using the true crisis to go on a series of spending binges.

Congress acts as if this massive, unimaginable federal spending will not have any negative consequences, but it almost certainly will. Something that cannot go on forever will not go on forever. Massive, unchecked, and irresponsible federal spending cannot go on forever without an almost Newtonian reaction. For every physical action, Sir Isaac Newton discovered, there’s an equal and opposite reaction. While that applies to physics, we see it work out in politics, too. For every policy proposal there’s always pushback. Every time Congress intervenes in the economy, there are consequences.

(Excerpt) Read more at pjmedia.com ...

TOPICS: Business/Economy; Society

KEYWORDS: crypto; cryptocurrencies; gold; inflation; stimulus

Navigation: use the links below to view more comments.

first 1-20, 21-29 next last

To: SeekAndFind

COVID Stimulus Spending May Eventually Lead to Inflation.

May? MAY?!

Is this some sort of joke?!

2

posted on

03/01/2021 7:24:55 AM PST

by

cuban leaf

(We killed our economy and damaged our culture. In 2021 we will pine for the salad days of 2020.)

To: SeekAndFind

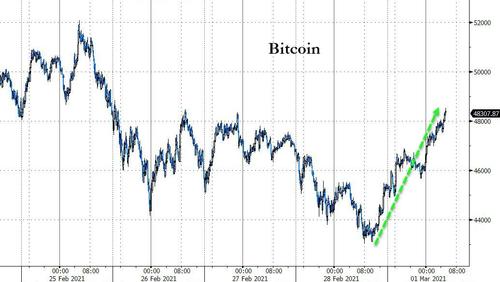

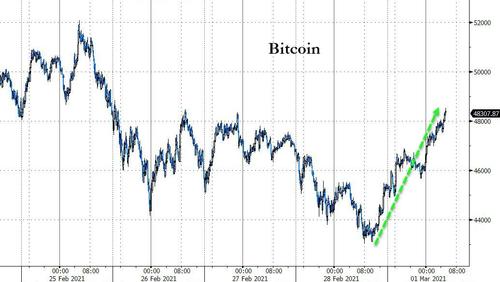

The dollar’s value is based on scarcity and faith. The federal government essentially printing money and artificially distorting real estate and labor markets while hiding bailouts for overspending blue states in so-called relief erodes Americans’ faith in our central government. Printing dollars by the trillion removes scarcity. The Biden administration’s and Congress’ dubious behavior and political priorities further erode faith. One reaction we’re already seeing is the move to Bitcoin. As federal spending has ramped up and up, so has the value of the digital cryptocurrency. One year ago, a single Bitcoin was worth about $8,500. Now it’s over $43,000 and has reached a stratospheric $50,000. This explosive increase of well over 400% in a single year reflects both a growing faith in digital crypto as it goes mainstream and a fear that the dollar may be subject to inflation or even hyperinflation thanks to the continued weakness in the U.S. economy and the feds’ mad spending spree.

Crypto may be a viable safe harbor against

overspending and inflation now thanks to its designed scarcity. Crypto is also subject to volatility. A given cryptocurrency can be launched into orbit on a couple of Elon Musk tweets, such as Dogecoin (DOGE-USD) has been in recent weeks. Gold may be another beneficiary of the weakening faith in the dollar. One year ago an ounce of gold was worth $1,619. Today an ounce of gold is worth just under $1,800, but it topped $2,050 in 2020. Is there room for gold to go higher?

To: SeekAndFind

A single tulip bulb used to cost as much as an entire farm.

4

posted on

03/01/2021 7:25:56 AM PST

by

cuban leaf

(We killed our economy and damaged our culture. In 2021 we will pine for the salad days of 2020.)

To: SeekAndFind

They might be. But both are volatile.

And really, does anyone want to live in a world of $5000 gold or $600 silver? There won’t be anything to buy with it.

To: SeekAndFind

What most of the discussion about “inflation hedges” tend to ignore is the way that inflation disrupts the market (and then government action) in weird and unexpected ways.

True breakaway inflation would be followed by government price controls which in turn will cause shortages, perhaps even rationing.

Prep for shortages by stocking up on non durable stuff you can see—win win.

6

posted on

03/01/2021 7:27:43 AM PST

by

cgbg

(A kleptocracy--if they can keep it. Think of it as the Cantillon Effect in action.)

To: cuban leaf

That’s not entirely correct. There was a tulip bubble, but not for the individual bulb. The Madness of Crowds has been debunked over the past 20 years, but no one here seems to realize that.

The inflation came in entire crops of specific tulips. In terms folks can relate to, they were buying “breeds”, not generic dogs. Show poodles, not generic reduce mutts.

The entire bubble cycle is well defined. When government spends the way they do, all of that free money gets slapped down on the table and out on a single number.

Inflation hedges are well known. The only thing I would say is that if you buy a hedge, make sure you own it. In your hand. Otherwise it’s paper and it will blow away.

To: cgbg

Think back a year ago when transportation was halted. What did people need? What was in short supply? What did people talk about needing to get? A well stocked pantry, some source of heat, and a method of transportation are good things to secure.

To: Vermont Lt

The question isn’t whether you want to live in that world or not, because it’s almost certainly coming irrespective of your wishes. The question is: what assets do you want to arrive in that world with, that you already bought well before arrival?

9

posted on

03/01/2021 7:34:58 AM PST

by

coloradan

(They're not the mainstream media, they're the gaslight media. It's what they do. )

To: SeekAndFind

Gold, silver and land. If you don’t have it get some.

10

posted on

03/01/2021 7:37:53 AM PST

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: SeekAndFind

There already is inflation. The question is, will it increase to a point where the media finally start talking about it?

When the government creates money, it dilutes the value of the currency, stealing from those people who worked hard to save a little money and who are now very angry that it is being reduced to nothing.

11

posted on

03/01/2021 7:38:52 AM PST

by

I want the USA back

(The nation is in the grips of incurable hysterical insanity, as usual.)

To: Georgia Girl 2

Bitcoin has soared back above $48,000 this morning, after crashing near a $42,000 handle over the weekend, following Congress' passing of Biden's stimulus package.

“In the US a $1.9 trillion stimulus package is on the way. That's more than all the cash currently sitting on the US Treasury account at the Federal Reserve,” on-chain analytics service Ecoinometrics summarized to Twitter followers.

To: Vermont Lt

Tulips are just the “low hanging fruit” analogy. Pick your pyramid...

Bitcoins have no value beyond faith. They are even weaker than fiat currency of nations, because at least they back up their currency with armies. For their currency to fail, the country itself has to fail. What has to fail for bitcoins to fail? I just see them as a real world example of the “greater fool”. Sure, if you’re not the final “greater fool”, you can do pretty well.

13

posted on

03/01/2021 8:02:05 AM PST

by

cuban leaf

(We killed our economy and damaged our culture. In 2021 we will pine for the salad days of 2020.)

To: SeekAndFind

Cryptocurrency is fiat currency as is the dollar and all

government issued currencies. Is it based on faith and trust.

Faith is for religion and trust is not for government.

14

posted on

03/01/2021 8:03:03 AM PST

by

ChildOfThe60s

(If you can remember the 60s.....you weren't really there..)

To: SeekAndFind

One year ago an ounce of gold was worth $1,619. Today an ounce of gold is worth just under $1,800, but it topped $2,050 in 2020.One year ago silver was in the $12 range, today around $27 and acting like it will go higher. In everyday terms, "one thin dime" now brings at least $2.50.

15

posted on

03/01/2021 8:19:19 AM PST

by

Oatka

To: SeekAndFind

16

posted on

03/01/2021 8:19:46 AM PST

by

goodnesswins

(The issue is never the issue. The issue is always the revolution." -- Saul Alinksy)

To: Georgia Girl 2

Gold, silver and land. If you don’t have it get some.I'd recommend a fourth asset: Lead. Preferably in a ratio of 92% Lead, 6% Antimony and 2% Tin, for a Brinell Hardness Number (BHN), of 18.

17

posted on

03/01/2021 9:08:14 AM PST

by

Towed_Jumper

(When you’re standing on the edge of a cliff, a "giant step forward" is NOT progress.)

To: SeekAndFind

18

posted on

03/01/2021 10:55:23 AM PST

by

FLT-bird

To: Oatka

Short term negative on gold because there is no more COVID effect since COVID is coming to an end, despite all the fear mongering. But long term we have Democrats in total control of the public purse. I thought the Bush administration was irresponsible when it came to wasting money, but this new one will be like no other.

To: SeekAndFind

Inflation is already starting to happen.

20

posted on

03/01/2021 11:20:00 AM PST

by

BiteYourSelf

( Earth first we'll strip mine the other planets later.)

Navigation: use the links below to view more comments.

first 1-20, 21-29 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson