Posted on 03/14/2023 9:24:43 PM PDT by SeekAndFind

This year, Uncle Sam will take his cut of the past year’s earnings on April 18. Many taxpayers are undoubtedly wondering how this year’s Tax Day will affect their finances, as a lot of people are still struggling financially as a result of the pandemic. Since the tax code is so complicated and has rules based on individual household characteristics, it’s hard for the average person to tell how they will be impacted.

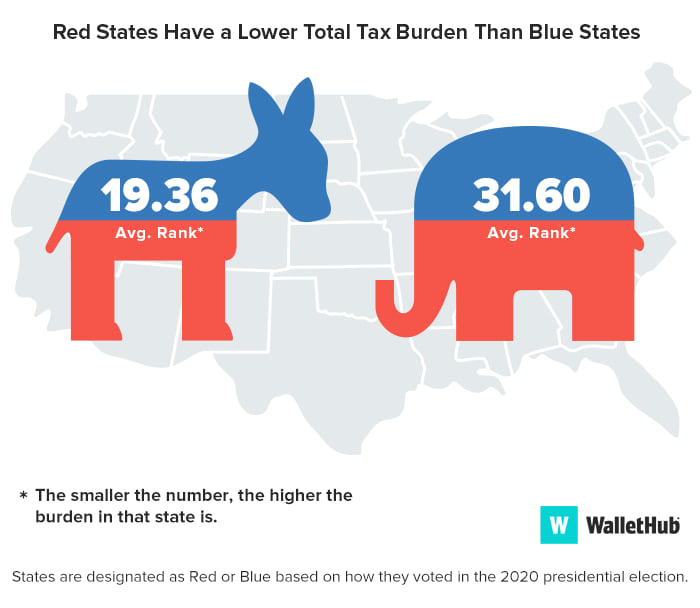

One simple ratio known as the “tax burden” helps cut through the confusion. Unlike tax rates, which vary widely based on an individual’s circumstances, tax burden measures the proportion of total personal income that residents pay toward state and local taxes. And it isn’t uniform across the U.S., either.

To determine the residents with the biggest tax burdens, WalletHub compared the 50 states across the three tax types of state tax burdens — property taxes, individual income taxes and sales and excise taxes — as a share of total personal income in the state.

| Overall Rank* | State | Total Tax Burden (%) | Property Tax Burden (%) | Individual Income Tax Burden (%) | Total Sales & Excise Tax Burden (%) |

|---|---|---|---|---|---|

| 1 | New York | 12.75% | 4.43% (6) | 4.90% (1) | 3.42% (25) |

| 2 | Hawaii | 12.70% | 2.55% (34) | 3.18% (8) | 6.97% (1) |

| 3 | Maine | 11.42% | 5.48% (1) | 2.51% (21) | 3.43% (24) |

| 4 | Vermont | 11.13% | 5.31% (2) | 2.49% (22) | 3.33% (27) |

| 5 | Minnesota | 10.20% | 2.93% (22) | 3.74% (5) | 3.53% (22) |

| 6 | New Jersey | 10.11% | 4.98% (4) | 2.54% (20) | 2.59% (43) |

| 7 | Connecticut | 10.06% | 4.16% (7) | 3.07% (11) | 2.83% (41) |

| 8 | Rhode Island | 9.91% | 4.48% (5) | 2.31% (28) | 3.12% (34) |

| 9 | California | 9.72% | 2.76% (30) | 3.80% (4) | 3.16% (32) |

| 10 | Illinois | 9.70% | 3.98% (8) | 2.22% (30) | 3.50% (23) |

| 11 | Maryland | 9.47% | 2.61% (33) | 4.07% (3) | 2.79% (42) |

| 12 | New Mexico | 9.37% | 2.04% (42) | 1.75% (37) | 5.58% (4) |

| 13 | Iowa | 9.34% | 3.42% (14) | 2.57% (18) | 3.35% (26) |

| 14 | Kansas | 9.34% | 3.11% (18) | 2.43% (23) | 3.80% (18) |

| 15 | Utah | 9.19% | 2.36% (37) | 3.17% (9) | 3.66% (19) |

| 16 | Mississippi | 9.16% | 2.84% (23) | 1.70% (39) | 4.62% (7) |

| 17 | West Virginia | 9.08% | 2.28% (40) | 2.76% (14) | 4.04% (12) |

| 18 | Nebraska | 9.01% | 3.69% (10) | 2.41% (24) | 2.91% (39) |

| 19 | Ohio | 8.99% | 2.78% (27) | 2.60% (17) | 3.61% (21) |

| 20 | Wisconsin | 8.92% | 3.17% (16) | 2.83% (13) | 2.92% (38) |

| 21 | Massachusetts | 8.80% | 3.49% (12) | 3.35% (6) | 1.96% (45) |

| 22 | Arkansas | 8.77% | 1.77% (46) | 2.24% (29) | 4.76% (6) |

| 22 | Kentucky | 8.77% | 1.99% (44) | 3.16% (10) | 3.62% (20) |

| 24 | Louisiana | 8.75% | 1.95% (45) | 1.74% (38) | 5.06% (5) |

| 25 | Oregon | 8.65% | 3.14% (17) | 4.39% (2) | 1.12% (50) |

| 26 | Pennsylvania | 8.57% | 2.81% (25) | 2.57% (18) | 3.19% (30) |

| 27 | Colorado | 8.52% | 2.97% (20) | 2.32% (27) | 3.23% (29) |

| 28 | Indiana | 8.42% | 2.34% (38) | 2.17% (32) | 3.91% (15) |

| 29 | Arizona | 8.39% | 2.50% (35) | 1.60% (40) | 4.29% (8) |

| 30 | Washington | 8.37% | 2.63% (32) | 0.00% (44) | 5.74% (3) |

| 31 | Michigan | 8.25% | 3.09% (19) | 2.19% (31) | 2.97% (36) |

| 32 | Texas | 8.22% | 3.97% (9) | 0.00% (44) | 4.25% (11) |

| 33 | Nevada | 8.19% | 2.03% (43) | 0.00% (44) | 6.16% (2) |

| 34 | Virginia | 8.18% | 2.97% (20) | 2.92% (12) | 2.29% (44) |

| 35 | North Carolina | 8.16% | 2.19% (41) | 2.65% (16) | 3.32% (28) |

| 36 | Georgia | 8.01% | 2.68% (31) | 2.38% (25) | 2.95% (37) |

| 37 | North Dakota | 8.00% | 2.77% (28) | 0.95% (41) | 4.28% (9) |

| 38 | Missouri | 7.80% | 2.30% (39) | 2.36% (26) | 3.14% (33) |

| 39 | South Carolina | 7.67% | 2.80% (26) | 2.03% (33) | 2.84% (40) |

| 40 | Idaho | 7.59% | 2.39% (36) | 2.03% (33) | 3.17% (31) |

| 41 | Oklahoma | 7.47% | 1.74% (48) | 1.90% (36) | 3.83% (17) |

| 42 | Alabama | 7.41% | 1.41% (50) | 2.00% (35) | 4.00% (13) |

| 43 | Montana | 7.39% | 3.45% (13) | 2.66% (15) | 1.28% (47) |

| 44 | South Dakota | 7.12% | 2.84% (23) | 0.00% (44) | 4.28% (9) |

| 45 | Florida | 6.64% | 2.77% (28) | 0.00% (44) | 3.87% (16) |

| 46 | New Hampshire | 6.41% | 5.11% (3) | 0.14% (42) | 1.16% (49) |

| 47 | Wyoming | 6.32% | 3.32% (15) | 0.00% (44) | 3.00% (35) |

| 48 | Delaware | 6.22% | 1.77% (46) | 3.28% (7) | 1.17% (48) |

| 49 | Tennessee | 5.75% | 1.71% (49) | 0.06% (43) | 3.98% (14) |

| 50 | Alaska | 5.06% | 3.54% (11) | 0.00% (44) | 1.52% (46) |

Note: *No. 1 = Highest

I live in Oregon.

I hate it here.

Crap wages. Insanely expensive rent and home prices. Liberal/progressive inspired plague of crime and drug use.

Dear GOD, please let me live long enough to “go Galt” and expatriate myself and my wife to her home in the Philippines

I can’t say I believe some parts of that chart. The states I’m most familiar with, MS, TN, and AL, show that among the three MS has a higher sales tax than the other two. From personal experience that’s wildly incorrect, sales tax in parts of TN and AL will top 10% in certain areas since they both allow local taxes to be added on. MS has a 7% sales tax with a local option for an extra 2% but most areas don’t have that. That chart doesn’t look like it includes the local part of the sales tax, but I don’t care who I’m paying it to, just that I have to pay it. TN and AL as a rule have much higher sales taxes than MS.

Lots of nice places to move to at the bottom of the list.

I live in Hawaii.

Ridiculous tax on everything. Everything has to be shipped here.

Weather is great, I hate the political regime.

California Sales & Excise tax is 3.16%??? Does not make any sense.

The statewide rate is 7.25% and Towns and Counties levy their own taxes on top of that. Alameda County is 10.25%. Los Angeles County is 9.25%. Santa Clara County is 9.125%. I’d guess 80% of the California population is paying 9% or more.

When I moved to California in 1973, it was 3%. There was an extra “BART Tax” added in Santa Clara County that brought it up to 3.5%. We never got BART.

The thing that hacks me off about Sales Tax is that it is automatically indexed to inflation because it is on things you purchase. So the increases from 3% to nearly 10% are very real and take a HUGE chunk out of your take-home pay. This hits young families the hardest when they are raising kids, buying furniture, cars, etc. We don’t spend much in retirement, so the hit isn’t that big, but the principal of the thing really galls me.

I live in Hawaii.

Ridiculous tax on everything. Everything has to be shipped here.

Weather is great, I hate the political regime.

Bought a cheap house in Arizona in case I have to make a fast escape from the liberal goons here.

Wife does not want to sell our ocean view house here. I am screwed, take multiple short vacations to Arizona.

I think I’ll move.

Looks like I live in the state with the lowest tax burden. And as a senior citizen I get $218,000 knocked off the assessed value of my house, so my tax burden is even lower than that of the average Alaskan. Now if only I could do something about my federal taxes.

The % shown isn’t the actual sales tax rate. It’s the % of the average person’s income that goes to pay sales taxes. MS shows a higher % than the other two because the average income in that state is so low.

I keep seeing the movement to have a good portion of western and central Oregon to join Idaho state. If that happens the remaining Oregon people will really get hit with taxes. We in Idaho would be happy to join the rural areas of Oregon.

Minnesota has the 5th highest tax burden for its citizens, yet has a $12 billion surplus. Our Democrat controlled legislature now seeks to raise vehicle license fees. Minnesota has moved from being the land of 10,000 taxes to tax hell.

Alaska is the real standout

Surprised how low Delaware is.

Yes, in that case it’s pretty misleading even though it might technically be true. One would look at that and assume that Alabama’s taxes were lower than MS but I know from experience that’s not the case. Alabama’s sales taxes are so high that I avoid purchasing things when I pass through the state. In addition to the state sales they also add county and city, and if you’re in a tourist area they add another tourism sales tax. I stopped at Bass Pro Shops in Spanish Fort AL once and if I remember right the sales tax was around 13%, I made a quip to the store manager asking if Barack Obama was their store manager and he didn’t smile.

Last I I added all of the taxes I could find on the bottom of the yearly bills, it came to some 46% of my income.

So, I earn 2.00 to pay the government 1.00 dollar to spend that on stuff and save it. Then they tax what I earn on the savings as interest or gains, and then tax me 7% on what I spend buying stuff!

Now, if you could up your skin melatonin and move to San Francisco, your payoff would be many times what you have already paid...

This table is WAY off. The liberals are not including the “fees” the States are legally able to not call “taxes”.

For instance, Colorado has an “ownership tax” on a new car of about $900 but additional “fees” in excess of $400.

Fees are killing Colorado.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.