Skip to comments.

A "One Percent" Tax Increase Will Not Fix Social Security's Problems

The Concord Coalition's Series On Social Security Reform ^

| March 18, 2005

| The Concord Coalition

Posted on 03/25/2005 7:22:30 AM PST by FreeKeys

The Social Security payroll tax, better known to workers as FICA (or SECA for the self employed), is now levied at a rate of 12.4 percent on workers earnings up to $90,000 a year. Employees and employers split the tax, meaning that they nominally pay 6.2 percent each. The Social Security trustees now project that the program has a deficit over the next 75 years equal to 1.89 percent of the payrolls on which the tax is levied (taxable payroll). Various commentators have thus pointed out that, in theory, the entire shortfall could be eliminated by levying a tax increase of a little less than 1 percentage point on employees and employers each (bringing the combined tax rate up from 12.4 percent to 14. 29 percent).[1]

What then is all the fuss about? If employees and employers each simply paid one percent more, the problem goes away...Right?

Wrong. The 1.89 percent deficit figure is a highly misleading measure of Social Security's funding shortfall. Ultimately, a tax hike at least three times as large would be required to pay scheduled benefits.

(Excerpt) Read more at concordcoalition.org ...

TOPICS: Business/Economy; Culture/Society; Editorial; Government; News/Current Events

KEYWORDS: payrolltaxes; ponzischemes; socialsecurity; taxes; taxhikes

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

Trust fund solvency doesn't solve much

The proposition that Social Security solvency could be achieved with a 1.89 percent hike in the payroll tax is based on a technical estimating concept called "actuarial balance," which averages past and projected trust-fund surpluses against trust-fund deficits emerging over the next 75 years. Under that concept, Social Security appears to be solvent until 2042 -- meaning that, until then, its trust funds would possess sufficient "assets" to cover current law benefit promises. And if Congress raised payroll taxes or cut benefits by 1.89 percent of taxable payroll, starting immediately, Social Security's trust funds would be deemed "solvent" for 75 years

The problem with the actuarial balance measure is that it equates trust fund solvency, which simply summarizes 75-years' worth of governmental bookkeeping entries, with genuine funding. It assumes that projected surpluses recorded to the trust funds in the early years will offset deficits later, i.e., that they will be saved. The government, however, is not in the business of saving surplus Social Security taxes. It invests them in federal securities, which means it lends the money to itself. Then, like all other federal receipts, the money is used to pay whatever expenses the government has on hand at any given time… and sometimes even to offset cuts in other taxes. In other words, Congress is free to spend the money it is supposedly saving.

For the 1.89 percent solution to ease Social Security's burden on future workers and taxpayers, the new money would have to be saved. That is, politicians would have to allow the program's extra interest-earning assets to accumulate unspent for decades -- a proposition that seems highly unlikely and in any event cannot be guaranteed.

Because in practice the surplus Social Security dollars are not saved, there is no real reserve to cover future deficits, and there is no real interest earned on that reserve. The Social Security trust funds are credited with interest from the government's general fund, but this is simply a matter of bookkeeping between the government's own accounts. Both the reserve -- now recorded to the trust funds at $1.7 trillion -- and the interest, however, are included in the calculation of the program's 75-year actuarial balance. Thus, by assuming that those large sums are real assets available to meet future benefits, the actuarial balance measure greatly understates the resources that will have to be taken out of the future earnings of employees and employers or levied in the form of some other tax.

What matters to the economy and the budget is not some summary measure of "trust fund solvency" but the annual difference between Social Security's outlays and its earmarked tax revenues. Under current law, this difference is due to turn negative in 2018 and widen to an annual deficit of $370 billion, or 4.5 percent of payroll, by 2041, the last year the trust funds are technically "solvent." Even if the 1.89 percent solution were enacted, Social Security would still face large and steadily growing cash deficits starting in 2023.

Still, let's suppose for a moment that future Congresses will save the extra trust-fund surpluses generated by the 1.89 percent solution even though past Congresses haven't saved the surpluses of earlier years. There is a further problem--namely, that the solution isn't permanent. As the Government Accountability Office has explained:

|

While a 75-year actuarial balance has generally been used in evaluating the long-term financial outlook of the Social Security program and reform proposals, it is not sufficient in gauging the program's solvency after the 75th year. For example, under the Trustees' intermediate assumptions, each year the 75-year actuarial period changes, and a year with a surplus is replaced by a new 75th year thathas a significant deficit. As a result, changes made to restore trust fund solvency only for the 75-year period can result in future actuarial imbalances almost immediately.[2]

|

In other words, the "actuarial balance" concept assumes that while we would require the trust funds to be in balance over a full 75 years, our children will be satisfied with balance for 40 years and our grandchildren will be satisfied with an empty cupboard. To keep Social Security in balance permanently, an extra tax hike above and beyond the 1.89 percent solution would be required in each and every future year.

Not a minimal tax increase

Although proponents describe it as a relatively minimal "tweak," a 1.89 percent of payroll tax hike is a significant tax increase. Less than 2 percent of anything sounds rather minimal, but if enacted this year, a 1.89 percent hike in the payroll tax would amount to a $1.2 trillion tax increase over the next decade.

At the individual level, a one-percentage point rise in the payroll tax means a tax rate on employees and employers each of 7.2 percent instead of 6.2 percent. That translates into an increase in actual taxes to be paid of 16 percent. The average earning two-worker household will make about $73,000 this year. A one-percentage point rise in the tax rate means they would have to pay $730 in additional Social Security taxes--on top of the $4,526 they already must pay. That increase is equivalent to seven weeks worth of groceries, thirty fill-ups at the gas pumps, one weekly vacation rental, and so on. If both workers in the household are self-employed, the tax increase would be in the range of $1,200. That one-percentage point extra tax would be required year after year, and would subtract from each household's ability to save. Moreover, none of this reflects what employers might do in reaction to their higher taxes: will they take it out of future wage hikes? Will they raise prices on their goods and services?

And keep in mind, the actual tax increases would ultimately have to be much larger than the 75-year actuarial imbalance figure suggests. Since the trust fund reserves are only IOUs between government accounts, other funds would have to be obtained to cover the shortfall--either by raising taxes, cutting other spending, or borrowing.

As noted earlier, if the combined 12.4 percent tax rate were raised by 1.89 percent, it would only keep the program's cash flow positive through 2023, or for five additional years. If the payroll tax were hiked to cover the subsequent shortfalls, by 2025, it would have to be 14.8 percent; by 2040, it would have to be 16.9 percent; and by 2075, 18.2 percent. Those rates reflect increases that are a long way from what the 75-year actuarial balance measure implies.

- a 14.8 percent tax rate translates into a 20 percent increase in taxes;

- a 16.9 percent rate translates into a 36 percent increase, and;

- an 18.2 percent rate translates into a 47 percent increase.

Alternatively, if benefits were to be cut to close Social Security's long-term deficits, the promised levels would have to fall by 16 percent in 2025, 25 percent in 2040, and 30 percent in 2075.

A growing tax burden

Those figures are only for Social Security, which is just one part of the looming cost burden future taxpayers will face. If Medicare's projected deficits are taken into account, the implied tax rate would be much higher still. The Hospital Insurance (HI) portion of Medicare is also financed with a payroll tax and its shortfalls alone are higher than Social Security's.

[3] Moreover, 75 percent of the cost of Medicare's Supplementary Medical Insurance (SMI) program is paid for out of the general fund, with enrollee premiums covering only 25 percent.

The total resources needed to close the projected funding gap in the two parts of Medicare greatly exceed those projected for Social Security. This can be illustrated by showing the total cost of both programs as a percentage of taxable payroll. The SMI program is not currently funded with a payroll tax, and while Congress could choose other means to finance the portion to be derived from the general fund, if both the HI shortfall and the general fund portion of SMI were to be financed by a payroll tax hike, the tax rate for Medicare would have to rise from 2.9 percent today (1.45 percent on employee and employer each) to 15 percent in 2040 and 25 percent in 2075.

If added to the rates needed for Social Security, the implied payroll tax rate necessary to cover the future costs of both Social Security and Medicare would be 32 percent in 2040 and 44 percent in 2075.

Implied Tax Rates That Would Cover Future Costs

of Social Security and Medicare

|

|

|

|

|

|

Rates now scheduled in law

|

|

Rates implied by future costs

|

|

|

|

2025

|

|

2040

|

|

2075

|

|

|

|

|

|

(as percent of worker earnings)

|

|

|

|

Social Security

|

|

12.4

|

|

15

|

|

17

|

|

18

|

|

|

|

Medicare

|

|

2.9

|

|

10

|

|

15

|

|

25

|

|

|

|

Combined

|

|

15.3

|

|

25

|

|

32

|

|

44

|

|

|

|

Source: Figures calculated based on the 2004 trustees' report intermediate projections. Columns may not add due to rounding

|

The magnitude of the future fiscal challenge is minimized by the trust-fund accounting framework underlying the official Social Security (and Medicare) solvency measures. Actuarial balance greatly understates Social Security's true burden on our future. This indicator not only misleads the public about the magnitude of the future fiscal burden posed by Social Security, it says nothing about the program's impact on national savings and generational equity. The trustees could do a great service to the debate over reform by abandoning it altogether and instead focusing on what really matters--the system's deficits as they are projected to emerge and grow

here 3-25-2005

1

posted on

03/25/2005 7:22:32 AM PST

by

FreeKeys

To: ancient_geezer

2

posted on

03/25/2005 7:31:37 AM PST

by

Calpernia

(Breederville.com)

To: FreeKeys

We could increase the SS tax and remove the cap on the income subject to the SS tax and it would not improve the SS situation one bit.

Reason. Congress has spent EVERY penny ever collected in SS taxes and will continue to spend every penny collected as general revenue. The only thing that will happen is the SS IOU Fund will grow and grow and grow with obligations to be paid for with future tax increases.

3

posted on

03/25/2005 8:13:44 AM PST

by

Phantom Lord

(Advantages are taken, not handed out)

To: Phantom Lord

And that's what it is all about...the future. Action needs to be taken one way or the other SOON by our leaders in Washington if the future generations want any chance of receiving SS. I was just reading about Majority Whip Roy Blunt and how he's getting pretty involved with the SS reforms. Its nice that some legislators are still considering this an URGENT issue. Good grief!

To: Phantom Lord

The tax has already been raised 10.4 percent over the decades! The system is a turkey and need radical restructuring using the magic of compounding interest from sound investments. I'll be building guilotines in my garage if they allow the dems to raise the FICA tax again!

5

posted on

03/25/2005 9:50:36 AM PST

by

Wristpin

( Varitek says to A-Rod: "We don't throw at .260 hitters.....")

To: Phantom Lord; Taxman; Principled; EternalVigilance; rwrcpa1; phil_will1; kevkrom; n-tres-ted; ...

Congress has spent EVERY penny ever collected in SS taxes and will continue to spend every penny collected as general revenue. The only thing that will happen is the SS IOU Fund will grow and grow and grow with obligations to be paid for with future tax increases.

Quickest and most certain way to solve the problem with retirement and Social Security shortfalls is quit taxing income going into savings and investment altogether, and tax only expenditures for consumption.

Fund the current generation of retirees at current promised benefit out of appropriations from general revenues, as is actually happening under the Social Security Act, 42 USC 401, while phasing out Social Security benefit system totally in favor of personal retirement which individuals own rather than relying on a government ponzai scheme that serves only to fuel additional government spending.

A Taxreform bump for you all.

If you would like to be added to this ping list let me know.

John Linder in the House(HR25) & Saxby Chambliss Senate(S25), offer a comprehensive bill to kill all income and SS/Medicare payroll taxes outright, and provide a IRS free replacement in the form of a retail sales tax:

H.R.25,S.25

A bill to promote freedom, fairness, and economic opportunity by repealing the income tax and other taxes, abolishing the Internal Revenue Service, and enacting a national retail sales tax to be administered primarily by the States.

Refer for additional information:

6

posted on

03/25/2005 10:26:54 AM PST

by

ancient_geezer

(Don't reform it, Replace it!!)

To: FreeKeys

Hey Libs...Want to "pull the plug" on something..pull it on Social Security.!!

7

posted on

03/25/2005 11:09:55 AM PST

by

Don Corleone

(Leave the gun..take the cannoli)

To: Phantom Lord

SS cannot be saved, the ponzi scheme can only be prolonged. As you say, the "surplus" is spent as soon as it is collected. That means that someday we will have to pay again what we have already paid, plus interest. That is economically impossible as the already astronomical amount grows daily.

The first step toward a solution, meaning an exit strategy, is to admit the problem. Tell the people:

"We have been lying to you since 1935 and the situation is only getting worse - for you. For us it has been great. We get all that money you pay in to spend as we please to stay in office and have all these wonderful perks and we don't care if it is a good idea for retirement or not, we have our own separate retirement system that is invested in the stock market. We would never be stupid enough to depend upon that SS scam."

Then tell them the solution.

"Ok, there, we said it. Now here is what we are going to do. That Trust Fund we have been lying about, the one that is full of IOUs that even a government with hundreds of printing presses could never pay, the ones we called a surplus? Well, since they are worthless anyway we are going to trash them. Just throw them away. Bye, bye. Syanara. Adios.

'But, but', you say, 'how are we going to pay what is owed to the retirees, now and in the future?'

Just like we always have, through taxing you. But this time we are going to balance the input and outgo as best we can. We are going to project what we owe next year and we are going to adjust your FICA to pay that.

That means your taxes will go down because we are not adding a nonexistent surplus to them. At the end of next year if we still have a surplus we will lower your taxes again. If we came up short, we will raise them accordingly.

We will balance income to output each year as closely as we can until all retirees who were born before 1960 are fully paid. The rest of you will have a choice. First, we will give you your money back. Then, we will deduct for you, just as we always have, if you would like. In addition we will suggest and regulate certain groups of investments in which you may participate. We will even do the paperwork for you.

If you don't want to do that we will deduct nothing, but we strongly suggest that you put that money aside for retirement rather than for a new car payment. There you have it. The game's over. It has been fun, at least for us. Now go get a life and build prosperity for yourself."

Failing that unlikely scenario, I suggest you follow ancient geezer's suggestion.

8

posted on

03/25/2005 11:22:31 AM PST

by

Mind-numbed Robot

(Not all things that need to be done need to be done by the government.)

To: ancient_geezer

Thanks for the ping, Geezer.

The National Retail Sales Tax is the ONLY! solution to the Social Security mess.

It is up to us to force Congress and the Bush Administration to enact H.R. 25.

Question is, are we up to the task?

BTW, there is a new website promoting the Fair Tax:

http://www.MyFairTax.org.

Click here to have a look at it.

“I have sworn upon the altar of God eternal hostility against every form of tyranny over the mind of man.” [Thomas Jefferson, letter to Benjamin Rush, 1800.]

Click here, here and, now here to help us scrap the Code, scrap the IRS and abolish the VLWC!

You can also click here to sign a petition in support of Fundamental Tax Replacement.

We will never be a truly FRee people so long as we have the income tax and the IRS.

9

posted on

03/25/2005 12:01:46 PM PST

by

Taxman

(So that the beautiful pressure does not diminish!)

To: Taxman

Thanks for the links.

Those who think we can't have a fair tax are wrong. Per John Linder there are 600,000 fair tax volunteers now and there will soon be 1,000,000 to overwhelm Washington. VOLUNTEER!

10

posted on

03/25/2005 2:15:37 PM PST

by

groanup

(http://fairtax.org)

To: groanup; ancient_geezer

Thanks, groanup.

We can do this, but we do need a lot of help!

11

posted on

03/27/2005 3:39:43 AM PST

by

Taxman

(So that the beautiful pressure does not diminish!)

To: ancient_geezer; Principled; Bigun; EternalVigilance; kevkrom; n-tres-ted; Poohbah; CliffC; ...

Yo! Tax Reformers!

Need some help on this thread -- SS is a great issue for us!

Jump in with your comments and bump this thread to the top.

12

posted on

03/27/2005 3:44:14 AM PST

by

Taxman

(So that the beautiful pressure does not diminish!)

To: FreeKeys

Ya its going to be painful.. These dont' even add in all of the state employees, who have lavish pensions with full health benefits. Then the federal and county government workers who will all be retiring.

Inside old school corparte America, also is full of people in their 50's getting ready to retire. All promised great pensions and health. But what is more frightening is the pension funds that do exist, are invested in corporate America. So those could all be wiped out as well, if the company goes down.

Then of course there is the medicaid disaster, already 50% of medical funding in America is through the government. As people age they use more drugs, more operations etc..

Social security I believe is just the tip of the iceberg.

13

posted on

03/27/2005 3:55:34 AM PST

by

ran15

To: ran15

Then of course there is the medicaid disaster, already 50% of medical funding in America is through the government

|

Medicare's Long Term Impact The Federal Government, through its Medicare regulations, is beginning the rationing of medical care, partly on the pretext that "medical care is just too costly these days." Well, whose fault do you think all that is in the first place????

|

"Scratch the surface of an endemic problem ... and you invariably find a politician at the source." -- Simon Carr

"To err is human, but it takes a politician to really screw things up." -- Old American Adage

|

"If a government were put in charge of the Sahara Desert, within five years they’d have a shortage of sand." -- Dr. Milton Friedman

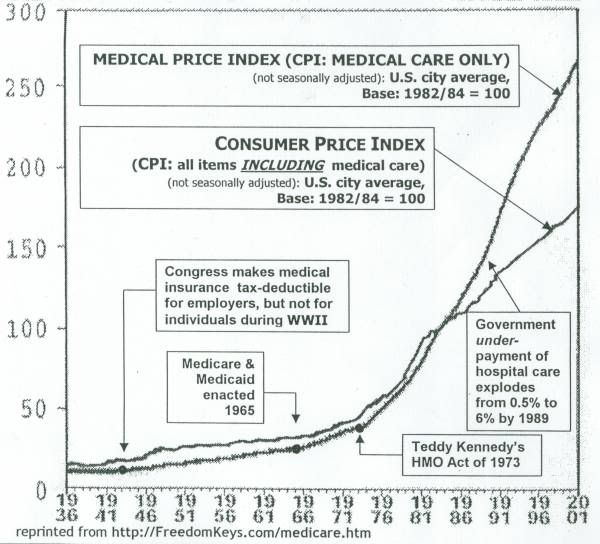

Medicare went into effect in 1965, and the HMO-subsidizing act in 1973, together triggering a non-stop explosion in health care costs which dwarf price increases in virtually all other products and services for consumers.

|

"It was the unfair tax-deductibility imbalance which Congress instituted during World War II which started the long-term spread of the fundamentally irrational (basically idiotic) 'someone else is supposed to pay for my health care' attitude which Americans blindly accept as normal today." -- Rick Gaber "After over half a century of employer-provided health care coverage, the American people have developed a phobia of paying for health insurance themselves." -- Arnold Kling "In reality, because government actions have been a major factor in forcing up the price of health care in America, we now have the perverse situation in which someone who either does not have access to private insurance or qualifies for government payments must face the system out of pocket. While politicians and their allies are fond of decrying the fact that at any given time, millions of Americans lack health insurance, they [conveniently] forget that they themselves have played a major role in creating the conditions that have made going without health insurance a recipe for individual financial calamity." – William L. Anderson "The wealthiest government employees or corporate executives who receive health care insurance as a part of their compensation package receive this benefit on a tax-free basis. Any one who pays their own health insurance premiums or medical bills must struggle to wring these payments from income that is fully taxed. This practice transcends unfairness and lack of equity. It also inflates the cost of health care for everyone." -- Richard E. Ralston, HERE. "For many years the government has subsidized the demand and restricted the supply of medical care. One consequence has been a rapid increase in both the relative price and real expenditures for medical care. The relative price of [all] medical care has increased at an increasing rate; ... Total expenditures for medical care have increased from 5 percent to 13 percent of GDP over the past thirty years and are now the most rapidly growing component of both private payrolls and government budgets." "When the government pays, health care's lack of affordability becomes a self-fulfilling prophecy. In health care, as in other things, government is the high-cost producer." -- Arnold Kling

| "We propose a simple change to tax law that would cut unproductive health spending, reduce the number of uninsured and promote greater tax fairness. For anyone with at least catastrophic insurance coverage, all health-care expenses -- employee contributions to employer-provided insurance, individually purchased insurance and out-of-pocket spending -- would be tax-deductible. The deduction would be available to those who claim the standard deduction and to those who itemize. "The most important effect of tax deductibility would be to reduce unproductive health spending. Under current law, medical care purchased through an employer's insurance plan is tax-free, while direct medical care purchased by patients must be made with after-tax income. As we and many others have observed, this tax preference has given patients the incentive to purchase care through low-deductible, low-copayment insurance instead of out-of-pocket, which in turn leads to cost-unconsciousness and wasteful medical practices. In addition, the tax preference for insurance creates incentives for the health-care system to rely on gatekeepers rather than deductibles and copayments when it does try to control costs. The cost of gatekeepers are financed out of insurance premiums that are paid with before-tax dollars; deductibles and copayments are paid with after-tax dollars."

-- Glenn Hubbard |

|

|

-- from http://FreedomKeys.com/medicare.htm

14

posted on

03/27/2005 5:24:45 AM PST

by

FreeKeys

("Social Security is a disaster. Keeping it going doesn't even begin to fix the problem."-Neal Boortz)

To: Taxman

This Scott Stantis cartoon appeared in the March, 1996 issue of Reason magazine.

15

posted on

03/27/2005 5:28:23 AM PST

by

FreeKeys

("Social Security is a disaster. Keeping it going doesn't even begin to fix the problem."-Neal Boortz)

To: FreeKeys

Your graph shows pretty blatantly that getting the government and corporate health payments out of taxation started the problem.

Instead of individual consumers choosing plans best for them.. mega corporations and governments went with 'socialism-lite'.. so workers have to get their healthcare through mega bureaucracies.

16

posted on

03/27/2005 5:42:47 AM PST

by

ran15

To: FreeKeys

Re: SS and Medicare: Exactly where in the U.S. Constitution do the Founding Fathers suggest/imply/allow the Federal government to operate retirement and healthcare programs (scams, really)?

17

posted on

03/27/2005 5:54:35 AM PST

by

Taxman

(So that the beautiful pressure does not diminish!)

To: FreeKeys

Captures the essence of the problem, does it not.

Except 58% of the geezers (and I am one) support privatization.

Those geezers should have "AARP" buttons on their chests.

18

posted on

03/27/2005 5:56:38 AM PST

by

Taxman

(So that the beautiful pressure does not diminish!)

To: Taxman

Those geezers should have "AARP" buttons on their chests.

The rest should have "AARP" branded into their butts!!!

19

posted on

03/27/2005 9:51:07 AM PST

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Phantom Lord

Is the question ever asked:

What would happen if Congress stopped spending the SS revenues on all their other vote buying programs? Am thinking that because the proportion of workers to retirees is way out of whack that reserving revenues for their originally intended purpose would only be part of the fix.

Not holding my breath that they would do this but just curious about how close SS would be to being self-supporting. Also notice that, reserving for purpose is never brought up as a solution. It obviously needs to be at least part of it.

Actually the best answer is to phase out SS entirely - it would be very painful while that was happening but long term the best answer. No pol brave enough to bring that up though.

20

posted on

03/27/2005 9:57:39 AM PST

by

Let's Roll

( "Congressmen who ... undermine the military ... should be arrested, exiled or hanged" - A. Lincoln)

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson