Posted on 10/10/2010 4:21:31 PM PDT by blam

Detailing The Bullishness Everywhere

by: Seeking Delta

October 10, 2010

The NAAIM (active money managers) and AAII (individual investors) sentiment surveys were released Wednesday and Thursday respectively. Both showed a sizable increase in bullish sentiment.

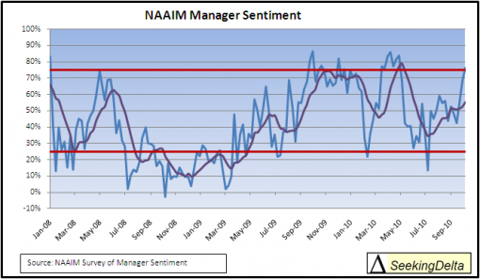

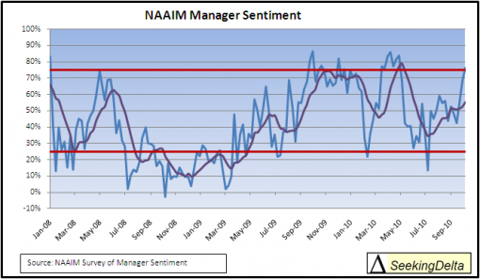

Active managers continue to pile into equities as the NAAIM survey saw a jump in its weekly number from 68% last week to 78% this week. The eight week moving average has been trending up since last July. At 78%, the current equity exposure is now in the “extremely” bullish category (identified as one standard deviation above average).

The NAAIM number measures current equity exposure (0% would be all cash, 100% fully invested). Additional detail can be found here.

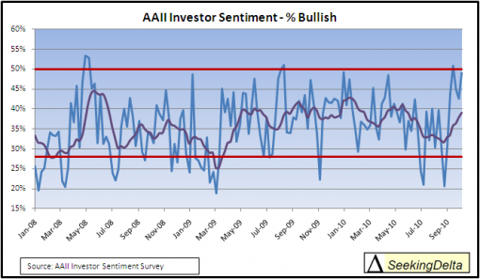

Individual investors also are increasing their outlook for the next six months. Sentiment, as measured by the AAII survey, rose from 43% last week to 49% this week, just shy of the “extremely” bullish category (identified as one standard deviation above average). The eight week moving average is at 39%. More from Charles Rotblut, editor of the AAII Journal, can be found here.

With the AAII survey commonly viewed as a contrary indicator and both sentiment surveys at, or approaching “extremely” bullish territory caution should be in order. Subsequent equity returns from these levels have not historically, on average, been favorable (see AAII research here for and NAAIM research here).

Hedge funders trading with themselves in a desperate attempt to meet their bonus targets for this year. Be very careful.

Is gold an option?

“Hedge funders trading with themselves in a desperate attempt to meet their bonus targets for this year. Be very careful.”

Whats that old axiom...A fool and his money?

As I have stated many times, this is not your fathers market.

It is now run by, government, and super fat cats

like Soros and Buffet, and we know their objective is to destroy America and the capitalist system.

Watching it is meaningless, until it crashes.

Why would anyone, other then the mega rich try to play it, when the government is buying shares, just to hold it up.

I think the current ratio of corporate insiders selling shares in their company, to corporate insiders buying shares in their own company, was, last I heard, about 2300 to 1.

While *some* insider selling is common this time of year, at best it peaks at a lot lower than this.

Personally, if somebody *gave* me equities right now, for free, I would still immediately sell them.

Any ‘bullishness’ is not backed up by any economic data. The economy continues to deteriorate. Perhaps investors are encouraged by shrinking payrolls and downsizing. This may be good news for their dividends, but it’s bad news for the rest of us.

Yup. This was last week...the week before was 1400 to 1.

Telling, IMO.

Yup. This was last week...the week before was 1400 to 1.

Telling, IMO.

Yup. This was last week...the week before was 1400 to 1.

Telling, IMO.

It goes up and down and up and down and up and down and up and down and up and down and... yeah, definitely bullshi...oops my fingers are tired.

“...shrinking payrolls and downsizing.”

Which leads to fewer customers, smaller orders, more time between orders, more layoffs, less production, decreased revenue and higher per unit prices, leading to even fewer sales. Then the government steps in with confiscatory taxes on a sizable percentage of arbitrarily defined “excess capital”.

Just how can this be good for dividends, in the long term? Eventually, won’t the corporation have to lower dividend payouts? At what point will these businesses cease to exist?

The drool is leaking out of the sides of their mouth in anticipation of QE II and how they are going to gamble with more 0% FED provided taxpayer dollars. The stock market is completely broken. Economic melt down is a good thing for the market as they know more money will be stuffed into their pockets to play with.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.