Posted on 03/22/2013 4:35:06 AM PDT by blam

U.S. House Prices About To Soar... Don't Wait A Moment Longer!

Housing-Market / US Housing

March 21, 2013 - 09:56 AM GMT

By: DailyWealth

Steve Sjuggerud writes: "We're only one year into this recovery..." Doug Yearley said on Bloomberg TV yesterday morning.

"Remember, we had seven of the worst years in housing that this country has ever seen. This recovery, we believe, should be a lot longer than just one or two years."

Yearley is the CEO of Toll Brothers, a nationwide homebuilder. When asked if he thought the strength in housing could continue, he didn't mince words...

"We feel really good this spring," he said. "Our orders are up 49%."

He explained that there's simply "no inventory." And "no inventory" is one of the key ingredients in seeing higher home prices ahead.

You always have to take a CEO's comments with a grain of salt. It's his job to be optimistic. But I fully agree with his assessment. As you probably know, I have been extremely optimistic on U.S. housing for years now – expecting big gains.

Our True Wealth Systems numbers back me up...

In short, U.S. housing is the greatest value it's ever been in our lifetimes – and probably the greatest value it will ever be.

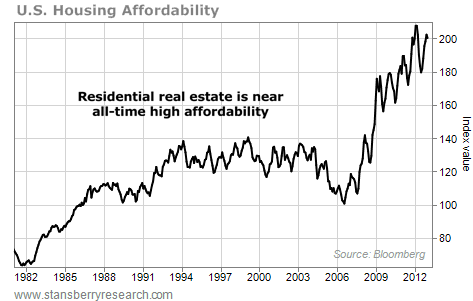

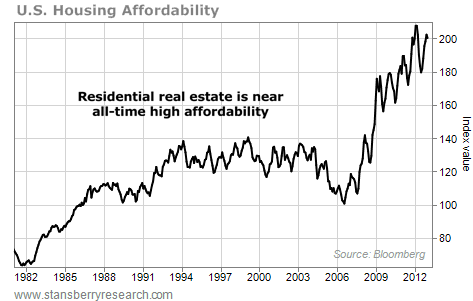

I objectively define value as "affordability." Affordability is a function of 1) house prices, 2) mortgage rates, and 3) income. The first two crashed to an epic degree, making U.S. housing more affordable than ever.

Even better, house prices are finally going up. We have our uptrend.

So housing is incredibly affordable, and your risk is now reduced because the uptrend has returned.

This is it.

This is as good as it gets. Housing is about to soar. And this moment is your lowest-risk moment to buy. So don't wait a moment longer...

Want to know what to do with your money?

It's simple... Go buy a house.

But wait!

Buy now and we’ll throw in a 2 Sham-Wows for free! sham-WOW!

Pay only shipping and handling

This BS sounds like Obamma propaganda.

Yep! The DJ is going to 20,000!

Maybe this is a North Dakota headline?

Just envision how this regime could choreograph a massive shoot up of home prices... somehow wealth transfer, say, $1 M to each any every undocumented worker to purchase a home. Offer this to all current residents of Mexico.

.... to be paid for via some newly minted platinum $1 T coins.

It sounds like they’re trying to fatten us up for the final kill.

I have learned that a builder will lie to your face with a smile.

They define their 'recovery' with variables that are a function of government (mortgage rates driven by Fed rates), nebulous 'feelings' about "prices will go up" and income. Reports I've seen in the last two years don't show income 'going up' - the reverse, actually. Couple that with ObamaCare's impact for premiums fines, etc. Wishful thinking and push opinions trying to breath life into a market of uncertainty. ..

It is like the car tire business. There can only be a down market so long, then the tires have to be replaced.

Or West Texas, we have a huge housing shortage since the oil boom.

I see nothing but pessimism with each post on FR. Truth is, in many pockets of America, home building is booming, as it is here where we live and it is not North Dakota.

Its getting so that when you factor in real estate taxes, its like having a second mortgage. I remember my first house, the RE taxes were $50/month. Now its $600/month and climbing about 5% per year. I wonder if that is getting factored in?

I see nothing but pessimism with each post on FR. Truth is, in many pockets of America, home building is booming, as it is here where we live and it is not North Dakota.

There are a few new homes being built in our area - which is good to see, BUT there are still tons of homes that have not sold and/or homes that are rented because they could not be sold.

New foreclosures every day. New signs every day “For Sale New Price”. Around here at any rate, people are still struggling to sell and still not getting what they want when they sell.

A lot of the sales around here are investors. They are buying up apartments and other rental properties. My friends in Florida tell me the same thing is happening there.

LOL...we’re coming up on a DECADE of promises of how the housing recovery is just around the corner. We were promised a “soft landing” in 2005 and got anything but.

But we still haven’t gotten the full landing. The market is still juiced by insane interest rates and money printing. Eventually that will stop - and it will be a fall, a very long fall, when that happens.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.