Posted on 04/20/2013 9:48:43 AM PDT by IbJensen

Americans are waking up today to the worst “case of the Mondays” they’ll have all year: It’s Tax Day.

Most Americans dread Tax Day, and for good reasons. Beyond the huge tab Americans pay to the government, the tax code is so complex that it’s difficult to figure out what we owe to the IRS. This is a pain for taxpayers and a huge drain on the economy.

According to the federal Taxpayer Advocate in its 2012 report, Americans’ cost of complying with today’s complex tax code totaled $168 billion in 2010. That’s almost as large as the impact of the Obama tax hikes in fiscal year 2013, and twice the size of sequestration this year [see chart].

It takes taxpayers 6.1 billion hours—or 51 hours per household—to complete all the required filings. That’s more than six full eight-hour working days per household!

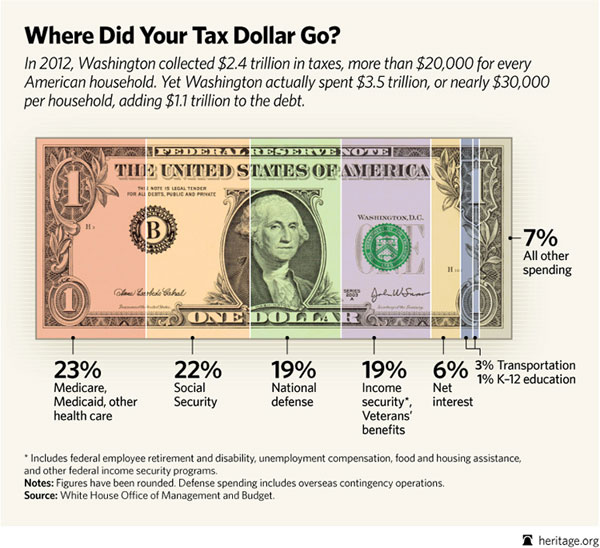

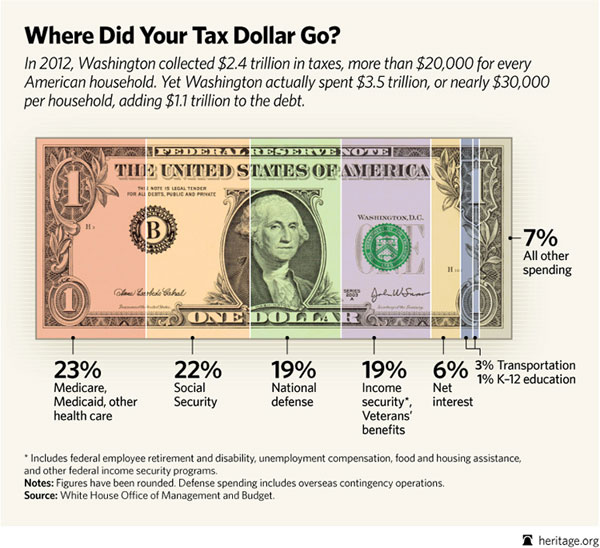

The compliance burden comes on top of the direct financial cost of $3.5 trillion in federal spending. In 2012, Washington collected $20,000 in taxes for every household in America. But Washington spent nearly $30,000 per household.

Americans pay high taxes as it is, and with the 13 tax increases that hit this year, tax revenue is growing beyond its historical average as a share of the economy. But Washington’s deficits continue, because spending keeps going up.

Future Tax Days promise to be even worse because of the tax increases from the fiscal cliff deal and from Obamacare. Taxpayers will start seeing these costs when they do their tax returns next April and in future years.

Too much taxing and spending is bad for the nation. Americans are right to be concerned about how the President and Congress allocate their hard-earned money. As the above infographic shows, 45 percent or almost half of all spending went toward paying for Social Security and health care entitlements. Without reforming these massive and growing programs, Washington will have to borrow increasing amounts of money, piling debt onto younger generations and putting the nation on a dangerous economic course.

Growing government spending threatens current and future taxpayers with higher taxes. Congress should reduce spending and prevent any more tax increases. Congress also needs to reform the tax code so it is less of a burden on the American people.

Of course if the compulsory forms are incomplete, we end up being made criminals, and spending all the more time and money fighting off the government.

What's wrong with this picture???

Americans need to get rid of IRS, institute term limites without pay and benefits for life, restructure SS and Medicare, significantly restructure and slash welfare, and, in general, re-direct how revenue is to be spent. These changes are needed - now. Americans can do better without government involvement. The key is to clean the Congressional house and bring in Americans who care about their and our families and are not just influenced by their party, their perks and the little badge they wear on their lapels.

“It takes taxpayers 6.1 billion hours—or 51 hours per household—to complete all the required filings. That’s more than six full eight-hour working days per household!”

It takes me about 2 hours to do my taxes, on-line, by myself and I have a lot of stuff to write off due to two businesses and paid employment. People are unorganized slackers who wait until the last minute to do their taxes, then scramble, when they should keep stuff organized all year long.

However, that doesn’t mean for one MINUTE I agree with where my tax dollars are spent/wasted! :)

Otherwise Justice Justice Marshall had officially clarified that Congress is prohibited from laying taxes in the name of state power issues, essentially any issue which Congress cannot justify under Section 8.

"Congress is not empowered to tax for those purposes which are within the exclusive province of the States." --Justice John Marshall, Gibbons v. Ogden, 1824.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.