Skip to comments.

A Darkening Market Sky [Maybe; Investment & Finance Thread Feb. 1]

Weekly investment & finance thread ^

| January 30, 2015

| Freeper Investors

Posted on 02/01/2015 10:49:28 AM PST by expat_panama

On the left is the excerpt --from the expert linked in Real Clear Markets: A Darkening Market Sky - Anthony Mirhaydari, The Fiscal Times

|

With the first month of the new year coming to a close, it's clear that 2015 is shaping up to be quite different from the smooth, easy climb investors enjoyed in 2013 and 2014. As recently as late December, the market optimism seemed indefatigable as stocks powered to new record highs on hopes for new stimulus from the European Central Bank, solid U.S. economic data and a strengthening tailwind to consumer spending from the collapse of energy prices. Now, four weeks later, the sky has darkened. Stocks have returned to their mid-December lows, with a retest of the October lows — which represented the most severe selloff since 2011 — looking likely. Why? First, investors are losing faith with the lynchpin of this bull market: The belief in the omnipotence of the world's central bankers. Plus, Greece is riling up the global financial establishment once again. Corporate profits and outlooks have included some serious disappointments as oil keeps falling to fresh lows and currency market volatility depresses the value of repatriated foreign earnings. [snip] On top of all that, a weaker-than-expected U.S. durable goods report suggested that the slowdowns in Europe and Asia might be having an effect here at home. Orders dropped 3.4 percent in December, marking the fourth consecutive contraction and the worst reading since August. |

|

In 2012 and 2013, the market uptrend rose out of the ashes of the fiscal cliff scare and relief over the results of the last Greek election, with plenty of help from global central bankers who locked arms and unleashed a wave of stimulus. ECB chief Mario Draghi made his "whatever it takes" promise in July 2012. The Federal Reserve unveiled its "QE3" bond-buying program that September. And "Abenomics" kicked in after Japan’s December 2012 election, with the Bank of Japan unleashing the most aggressive use of cheap money stimulus so far, including the purchases of both stocks and bonds. [snip] Drags include the impact of the stronger dollar on foreign profits, overseas weakness and the drop in energy prices. Although these factors were known heading into the reporting season, the actual impact on results has been more severe than expected, shattering expectations — formed by years of seemingly unstoppable corporate profitability — that results would always and forever surprise to the upside. According to FactSet, S&P 500 earnings per share growth expectations for 2015 stand at 4.9 percent, down from 8.6 percent earlier this month. Moreover, expected revenue growth has been cut in half to 1.5 percent. [snip] In response, I've recommended clients embrace a more defensive posture including long bets on volatility. For the more conservative, consider simply raising the cash allocation in your portfolios. |

|

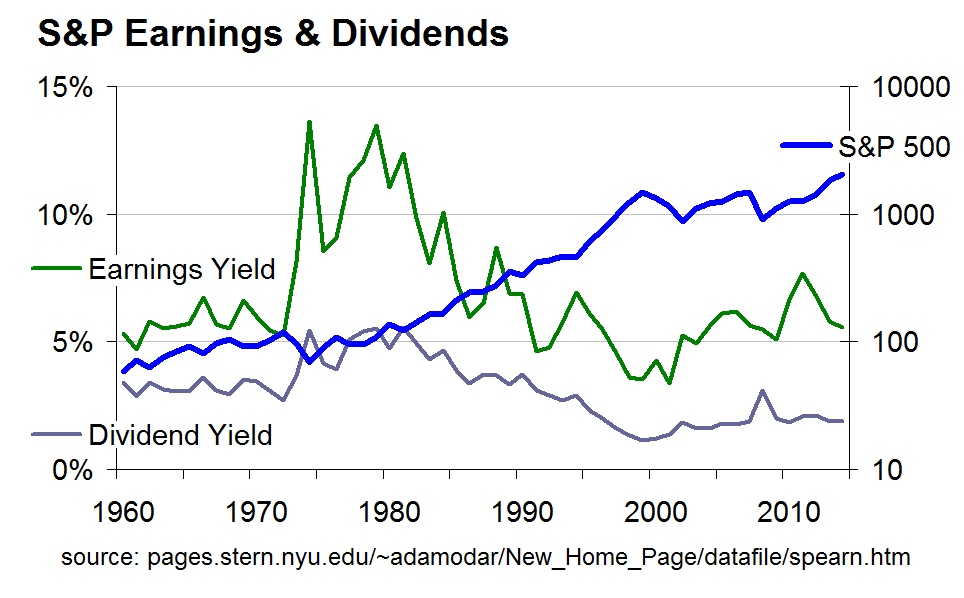

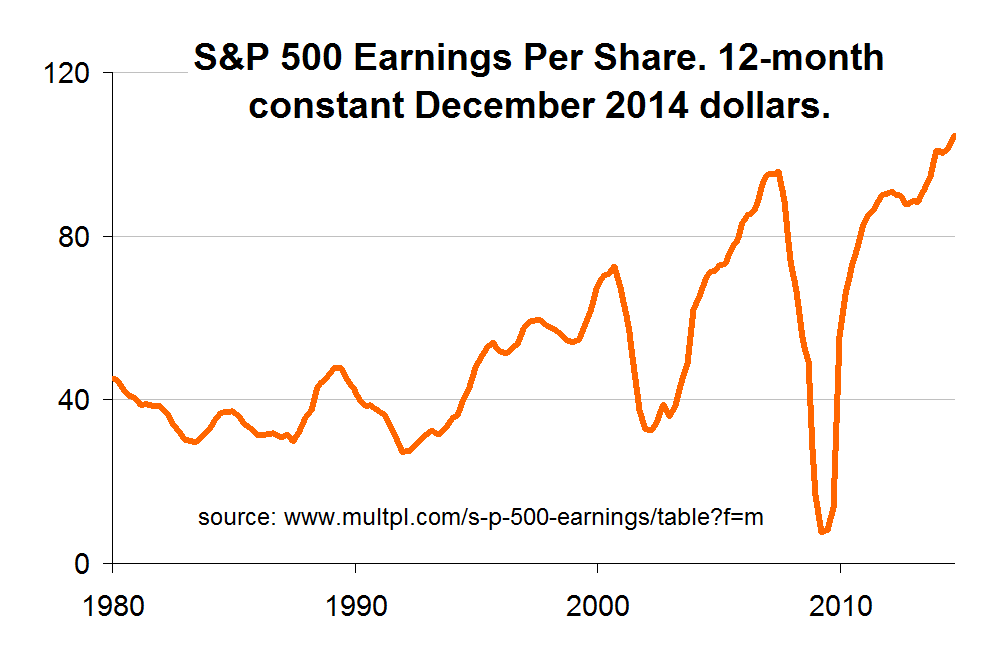

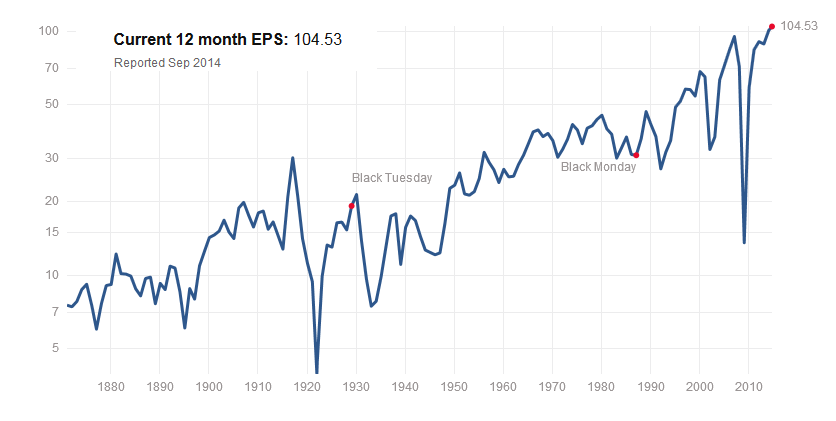

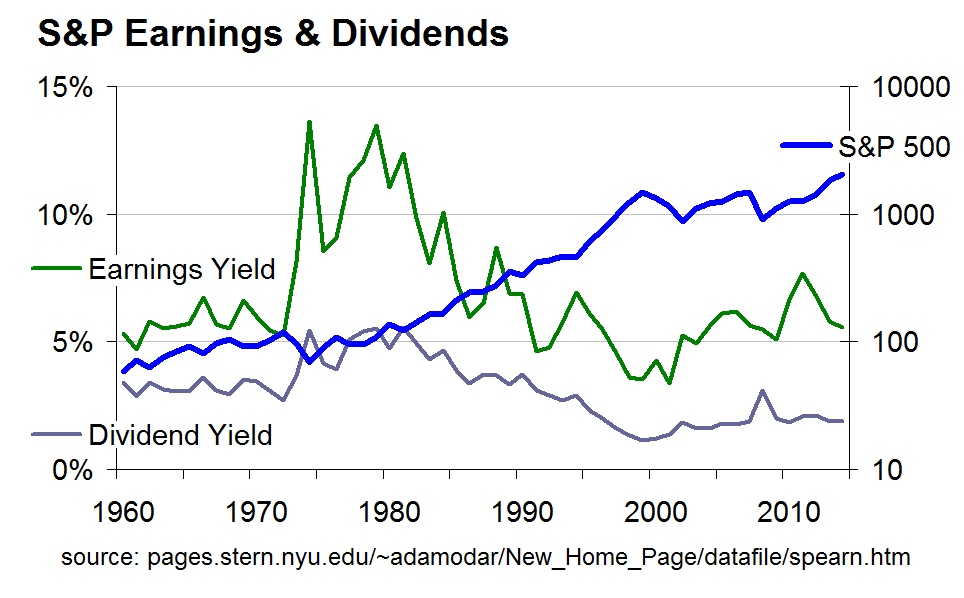

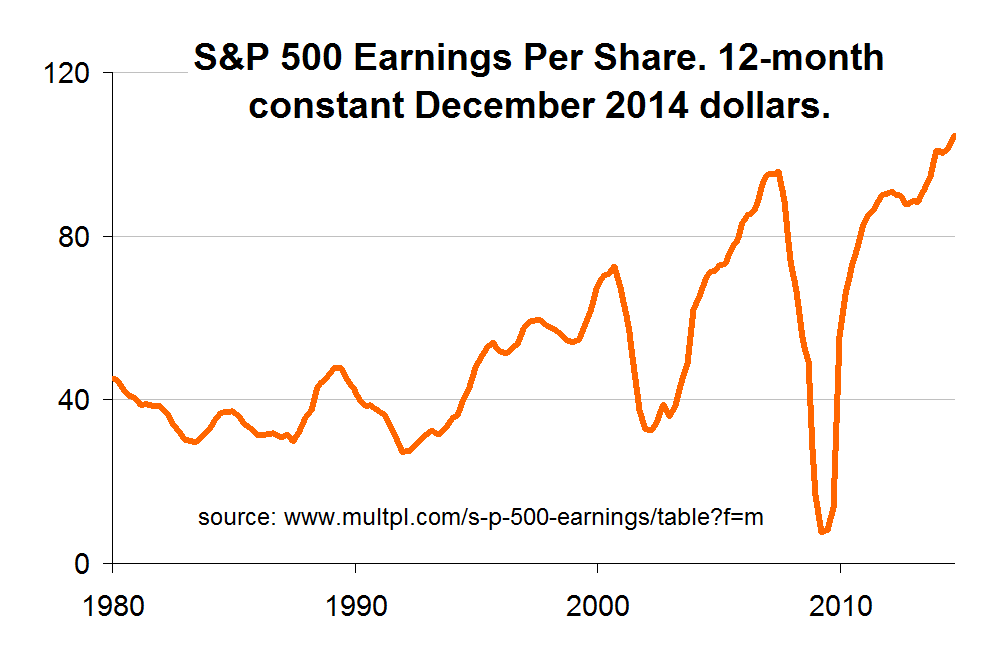

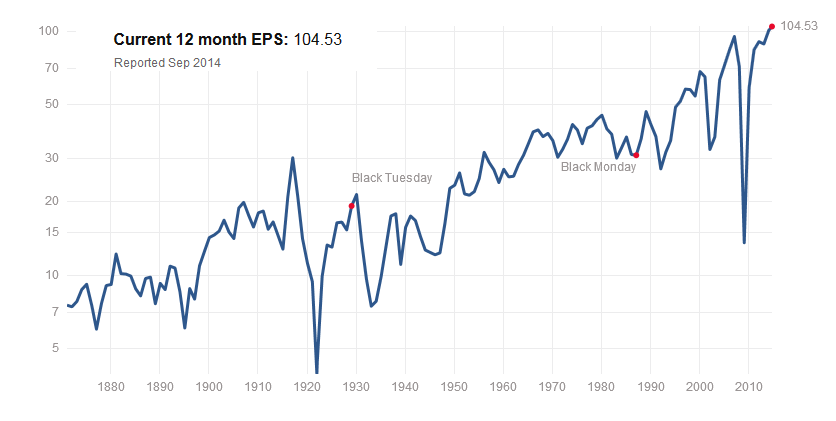

* * * * * * * * * * * * * * * * * * This piece originally caught my eye because it made some sense: seems to me like the investment markets are not going anywhere. While metals are failing to climb from their bases the major stock indexes sank below their 50-day moving averages and IBD keeps calling it 'market under pressure' as the distribution days pile up. So Mirhaydari's take satisfied my need for a daily dose of doom'n'gloom. OK, lets think about this. Maybe someone can help me but what I'm getting here is that that the world's in turmoil, the economy's underachieving, and stock valuations are bearish. At first glance it's convincing and then I try and think of when was the last time the world was not in turmoil or when was the economy ever overachieving? We're down to stock valuations. underachieving, and stock valuations are bearish. At first glance it's convincing and then I try and think of when was the last time the world was not in turmoil or when was the economy ever overachieving? We're down to stock valuations. The writer hangs his hat on "S&P 500 earnings per share growth expectations" and in this wonderful info-age we can check it out for ourselves. This site has the historical numbers and a look at the past and yeah, EPS's are in fact stalling like they did back in the dot.com days and in mid '08. Looking harder I'm also seeing that failing 'growth expectations' really don't help much as a predictor of worse investment returns in the future.  I'm looking all the way back to 1870 and instead of seeing a harbinger of destruction, I'm seeing business as usual. I'm looking all the way back to 1870 and instead of seeing a harbinger of destruction, I'm seeing business as usual. Got to love how we got all the facts here and the facts on stock valuations usually go to both earnings and dividends, and the way they relate to over all market stock prices. Our friends at NYU got a site where we can download S&P500 earnings'n'dividend stats back to 1960 and imho there's food for thought. Then again, I would have proffered some magic indicator proving with all certainty that the market's going up or the market's going down.  It don't work that way. Maybe we're back to seeing Mirhaydari as being right after all. Maybe not w/ the doom'n'gloom shtick, but with the idea that it's good advice to "embrace a more defensive posture including long bets on volatility". Or as IBD calls it, we got a yellow light that means 'proceed with caution'. Then again, I can't remember ever wanting to invest in any other manner... * * * * * * * * * * * * * * * * * *

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; mirhaydari; sandp; stockcharts; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-55 next last

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

One thing after another ping.

To: expat_panama

Finance thread: Is anyone worried about the “SuperBowl Indicator”, which predict a down (deflated) market for the year if the Pats win? As a Pats fan, I’m putting on my shorts.

To: expat_panama

To: Pearls Before Swine

“As a Pats fan, I’m putting on my shorts.”

I’m glad for that. We don’t need to see you with out your shorts on. ;^)

5

posted on

02/01/2015 11:07:59 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

6

posted on

02/01/2015 11:09:09 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Lurkina.n.Learnin

We don’t need to see you with out your shorts on. ;^)Indeed you don't, ahem. It's a market term...

To: Pearls Before Swine

I didn’t know that, but I’m already rooting for the Seahawks.

8

posted on

02/01/2015 12:29:29 PM PST

by

Rusty0604

To: expat_panama

This s/b good for stocks:

President Barack Obama’s budget will propose an ambitious six-year, $478 billion public works program of highway, bridge and transit upgrades, half of it financed with a one-time mandatory tax on profits that U.S. companies have amassed overseas, White House officials said.

http://www.freerepublic.com/focus/f-news/3252993/posts

9

posted on

02/01/2015 12:42:57 PM PST

by

Rusty0604

To: Pearls Before Swine

I thought maybe someone was short sheeted!

10

posted on

02/01/2015 1:46:40 PM PST

by

Jack Hydrazine

(Pubbies = national collectivists; Dems = international collectivists; We need a second party!)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

HAPPY GROUNDHOG'S DAY!!! It either means that today's gloomy futures (stocks -0.04% and metals -0.50%) will foretell the trading for weeks ahead, or it means that we're stuck in a never ending repeat of reversals to previous levels like we had in January. What is different today however is that this morning's reports are beginning on the first day of the week/month:

Personal Income

Personal Spending

PCE Prices - Core

ISM Index

Construction Spending

--and there's also this:

- Reuters European markets subdued as Chinese data weighs European shares stalled and core bond yields held near lows on Monday following disappointing data from China, while Greek markets were volatile as the government pursued efforts to reach a compromise with its creditors. Some Greek bank stocks rebounded as much 22 percent as Greece's leftist government began its drive to persuade a skeptical Europe to accept a new debt agreement. Finance Minister Yanis

- Deflation the danger as China's factories struggle

- Oil prices fall on weak Chinese data, U.S. refinery strikes By Claire Milhench LONDON (Reuters) - Crude oil prices fell on Monday after U.S. unions called a refinery strike and activity in China's factory sector shrank for the second month in a row, quashing Friday's bullish mood. At 0938 GMT (4.38 a.m. ET) Brent crude oil futures were down $1.05 at $51.94… Reuters 56 mins ago

- Gloom-and-Doom Over as $1 Billion Swedish Fund Bets Big on U.S. “The U.S. has shown again that they’re the best in the world at everything -- they can be out for the count, but when they get momentum, they’re like an old steam engine and just go,” Christian Voboril, a fund manager at Coeli in Stockholm, said in an interview. Voboril, whose Coeli Select Sverige… Bloomberg

- Typical net worth by age: Where do you stand? Knowing your net worth can -- in fact -- be important, but in a limited scope. USA TODAY

- What could rock markets this week Central banks, along with corporate earnings, will be in play in the week ahead. CNBC's Pauline Chiou has more. CNBC Videos

To: expat_panama

12

posted on

02/02/2015 7:08:21 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

I didn’t know he is planning on capping the retirement savings again. Labor unions, especially gov’t ones, push this because most of them have defined benefit plans in which their distributions can add up to that much, and it certainly isn’t “fair” that taxpayers can have better retirement than they do.

To: abb

Good grief! He’s raising taxes on savers on top raising taxes on folks that build businesses.

To: Pearls Before Swine

Hadn’t watched professional football in years but watched the game last night mainly for the commercials. Was pulling for the Seahawks the first half then switched to backing the Patriots in the third quarter after watching their performance, think Edelman won me over. Turned out to be a good game.

To: Aquamarine

Just found this Edelman jpg. lol

To: expat_panama

RBA cuts rates. AUD plummets.

Why is the Fed going to raise again?

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Hiya & a great morning to you! So we ended up yesterday (as usual) w/ our last minute reversals in spite of the pre-market futures gloom. None of that goom today as futures traders are seeing metals again up +1.48% and stock indexes up +0.34%. Reports coming later today are just Factory Orders, Auto Sales and Truck Sales.

Sooo much happening in the news but at least the latest econ thread list can still fit here:

To: Wyatt's Torch

Why is the Fed going to raise again?Please help me out here on just where the Fed as announced raising rates. All I'm getting from the FOMC is that

"...if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner..."

--and don't forget that the sun will nova in a few billion years too. Back on planet earth, inflation yesterday (PCE Prices - Core) was zero. As expected. Like the previous month.

To: expat_panama

Plenty of them (Fed governors) talking about when they are going to raise this year. Bullard yesterday as an example.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-55 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

underachieving, and stock valuations are bearish. At first glance it's convincing and then I try and think of when was the last time the world was not in turmoil or when was the economy ever overachieving? We're down to stock valuations.

underachieving, and stock valuations are bearish. At first glance it's convincing and then I try and think of when was the last time the world was not in turmoil or when was the economy ever overachieving? We're down to stock valuations. I'm looking all the way back to 1870 and instead of seeing a harbinger of destruction, I'm seeing business as usual.

I'm looking all the way back to 1870 and instead of seeing a harbinger of destruction, I'm seeing business as usual.