Posted on 01/24/2016 11:17:44 PM PST by Cincinatus' Wife

"...Daniel Yergin, founder of IHS Cambridge Energy Research Associates, said it is impossible for OPEC to knock out the US shale industry though a war of attrition even if large numbers of frackers fall by the wayside over coming months.

Mr Yergin said groups with deep pockets such as Blackstone and Carlyle will take over the infrastructure when the distressed assets are cheap enough, and bide their time until the oil cycle turns.

"The management may change and the companies may change but the resources will still be there," he told the Daily Telegraph.

"It takes $10bn and five to ten years to launch a deep-water project. It takes $10m and just 20 days to drill for shale," he said, speaking at the World Economic Forum in Davos.

In the meantime, the oil slump is pushing a string of exporting countries into deep social and economic crises. "Venezuela is beyond the precipice. It is completely broke," said Mr Yergin.

Iraq's prime minister, Haider al-Abadi, said in Davos that his country is selling its crude for $22 a barrel, and half of this covers production costs. "It's impossible to run the country, to be honest, to sustain the military, to sustain jobs, to sustain the economy," he said.

This is greatly complicating the battle against ISIS, now at a critical juncture after the recapture of Ramadi by government forces. Mr al-Albadi warned that ISIS remains "extremely dangerous", yet he has run out of money to pay the wages of crucial militia forces........

(Excerpt) Read more at telegraph.co.uk ...

Well, things are tough all over. I hear Iran can afford to loan them a little.

And Obola is laughing all the way to his bankers (Soros, etc.) ... His Saudi lords are getting some money (not a lot through) and the rest of the country has cheap gas so they will elect another denocrat, the enviro’s are mad - but dare not complain, and the red states are getting screwed ....

“Saudis ‘will not destroy the US shale industry’”

Because.... Obama beat them to it ?

http://news.yahoo.com/china-seeks-chapter-iran-sanctions-lifted-112235566—finance.html

Jan 23, 2016

TEHRAN, Iran (AP) - Chinese President Xi Jinping said Saturday he hopes to open a “new chapter” in relations with Iran after the lifting of international sanctions under a historic nuclear deal, as he paid the first visit by a Chinese leader to the Islamic Republic in 14 years.

“In cooperation with the Iranian side and by benefiting from the current favorable conditions, China is ready to upgrade the level of bilateral relations and cooperation so that a new chapter will start in bilateral relations,” Xi said after meeting with Iranian President Hassan Rouhani, according to Iranian state TV.

Trade between the two countries stood at some $52 billion in 2014, but that figure dropped last year due to plunging oil prices. China is Iran’s biggest trade partner, and continued purchasing oil from Iran after nuclear-related sanctions were tightened in 2012, despite U.S. pressure.

“China has always stood by the side of the Iranian nation during hard days,” Rouhani said, in comments posted on his official website.

Iran’s Supreme Leader Ayatollah Ali Khamenei, who has the final say on all state matters, told Jinping later Saturday that Iran will continue its policy of bolstering ties with the “East.” He praised China’s “independent” stance in global issues, saying it helps deepen strategic ties with Tehran....................................”

yep.

The Great Muslim, doing bis best, using the Greatest Office on the Planet to empower his brothers in the destruction of America.

How presidential!

B.S. title to a nonsense article that contradicts itself from paragraph to paragraph. Still, there are a few useful grains of information included.

First, while unsavory in other ways, the Saudis are NOT flooding the market with oil. Saudi production has been fairly stable, in their attempt to maintain market share. If anything, it has been the US flooding the market with oil, at least until prices fell so low that some US producers began to fall out.

The present dynamic is production increases from Iran and Iraq, in particular, creating or “pushing” the US slump. Assuming that the article is correct (a useful grain of information?) in pegging Iraq’s cost of production at $11 / barrel (and I would assume other area producers are in that neighborhood), this is clearly problematic for US producers. Iraq, for example, is desperate for cash, and with the Saudis and Iran at each other’s throat (no cooperation there), Iraq’s only option is to pump as fast as they can at $10-$20 per barrel profit. Other countries are in the same situation. Venezuela, comes to mind.

As a side note, one would think that “greenies” would hate Obama to no end, for enabling Iran’s contribution to cheap oil.

One other “useful grain” is the article’s statement that “It takes $10m and just 20 days to drill for shale.” I’d assume the cost and time to reopen most shuttered wells, outside of offshore platforms that have been moved, is no more, at worst. This all rather renders the idea that both domestic and overseas production capacity will crash due to “lack of investment”, causing shortages and high prices, quite unlikely, at least for any prolonged period of time. Barring a major Saudi - Iranian war, as output begins to fall in a few years, prices will begin to rise, and new wells (and shuttered old ones) will be reopened. Shale oil technology will be even cheaper, and more available, worldwide. Put another way, as long as there are “enough” recoverable deposits at $50-$60 per barrel, and no major wars come along, the price will not head north of there for long.

Either you produce it or you lose the lease. If you shut a well in (close the valves), there is no guarantee it will produce like it did when you open the valve back up--in fact, most don't.

So most producers will continue to produce the well or plug and abandon it. The latter is done with cement pumped into the wellbore. It can be drilled out, but that costs almost as much as a new well, and the plugging process damages the porosity in the rock along the original wellbore. You can't just turn them on and off. It is a popular misconception with horizontal oil wells, but it just doesn't work that way.

Oil prices will saw back and forth till equilibrium is reached which in my opinion is somewhere around $40 ~ $50 per barrel. But, prices will always be volatile and subject to politics of the time, always have been always will be.

Agreed.

Government should subsidize the shale industry now. That’ll bankrupt OPEC and make SA a rotting cesspool once again.

Then once oil is so cheap nobody can compete nor care to compete, unsubsidize it and let the market correct itself. After all, the sheiks are doing this now. Why not do the same?

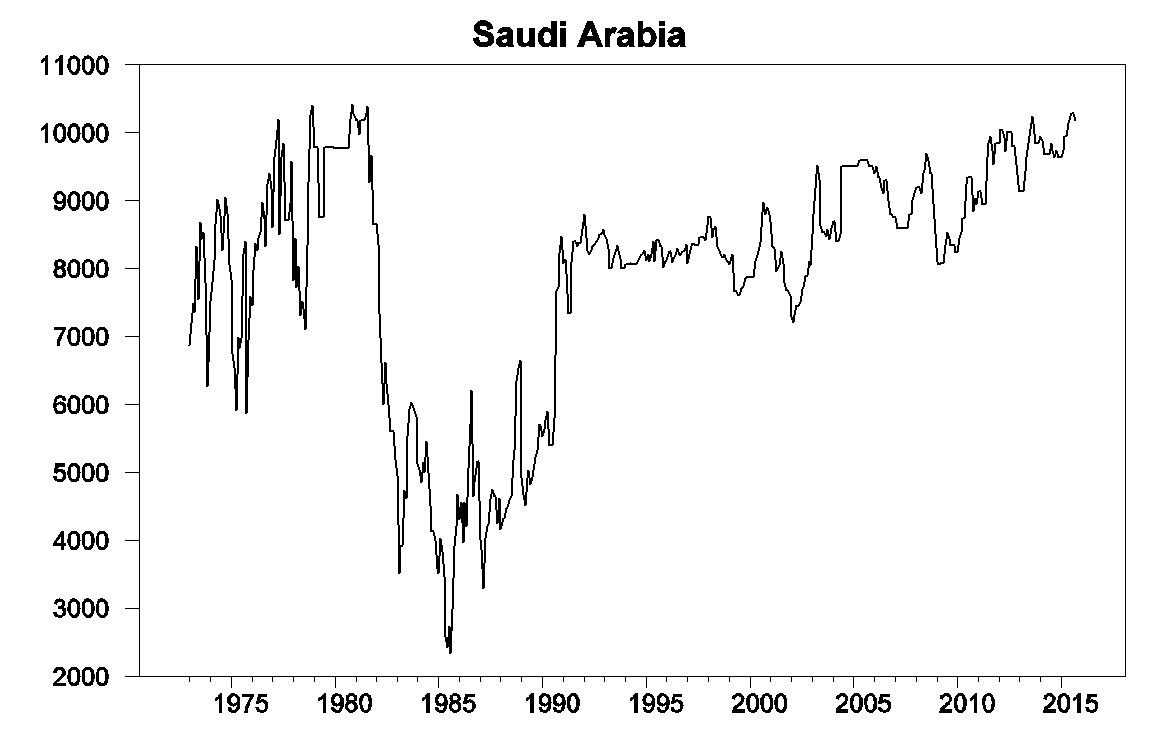

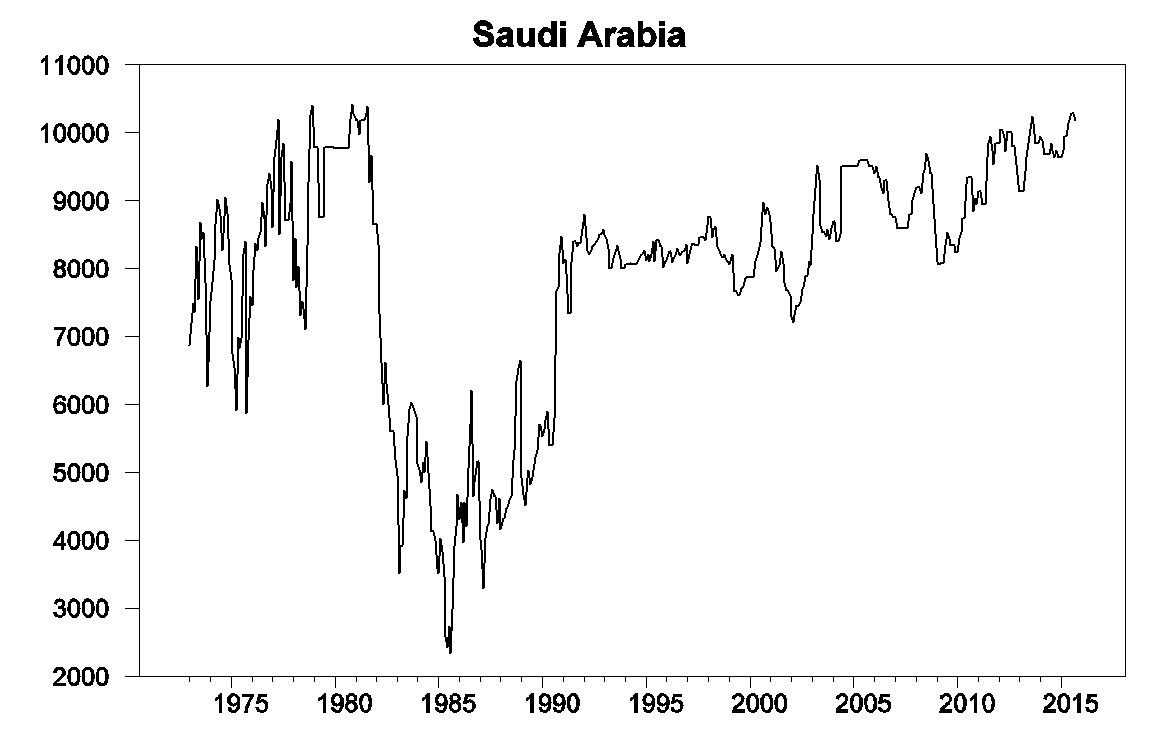

And the vertical scale on that is . . . ?

The Saudi’s are not subsidizing their oil production. In order to do that they would have to have another source of revenue and they really don’t. They just have a greater supply and a cheaper cost of production than most of their competitors.

No. Absolutely not.

“Government should subsidize the shale industry now. “

I propose a different tack rather than warping the free market; create a ban on oil derived from areas that have terrorist control Every transport ship that wants to sell oil to the US should first have the chemical composition of the crude analyzed prior to pumping out the oil. If it is shown to come from an area where terrorists can get the money the oil would be confiscated.

The Saudis with their huge reserves of cash, are probably trying to be hidden partners in the purchasing of these operations.

“Other countries are in the same situation. Venezuela, comes to mind.”

Venezuela’s situation is even worse. Venezuela’s oil is “heavy” and only brings about $23/bbl in today’s market. I read that their production cost is $17-18/bbl.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.