Skip to comments.

Here’s why (and how) the government will ‘borrow’ your retirement savings

Sovereignman.com copied onto ZeroHedge ^

| February 15, 201616 copied by ZeroHedge on Feb 16

| Simon Black copied by Tyler Durden

Posted on 02/27/2016 1:15:20 PM PST by SkyPilot

According to financial research firm ICI, total retirement assets in the Land of the Free now exceed $23 trillion.

$7.3 trillion of that is held in Individual Retirement Accounts (IRAs).

That’s an appetizing figure, especially for a government that just passed $19 trillion in debt and is in pressing need of new funding sources.

Even when you account for all federal assets (like national parks and aircraft carriers), the government’s "net financial position" according to its own accounting is negative $17.7 trillion.

And that number doesn’t include unfunded Social Security entitlements, which the government estimates is another $42 trillion.

The US national debt has increased by roughly $1 trillion annually over the past several years.

The Federal Reserve has conjured an astonishing amount of money out of thin air in order to buy a big chunk of that debt.

But even the Fed has limitations. According to its own weekly financial statement, the Fed’s solvency is at precariously low levels (with a capital base of just 0.8% of assets).

And on a mark-to-market basis, the Fed is already insolvent. So it’s foolish to think they can continue to print money forever and bail out the government without consequence.

The Chinese (and other foreigners) own a big slice of US debt as well.

But it’s just as foolish to expect them to continue bailing out America, especially when they have such large economic problems at home.

US taxpayers own the largest share of the debt, mostly through various trust funds of Social Security and Medicare.

But again, given the $42 trillion funding gap in these programs, it’s mathematically impossible for Social Security to continue funding the national debt.

(Excerpt) Read more at sovereignman.com ...

TOPICS: Business/Economy

KEYWORDS: debt; elderly; ira; retirement; seniors; socialsecurity

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-56 next last

This is coming folks.

Bet on it.

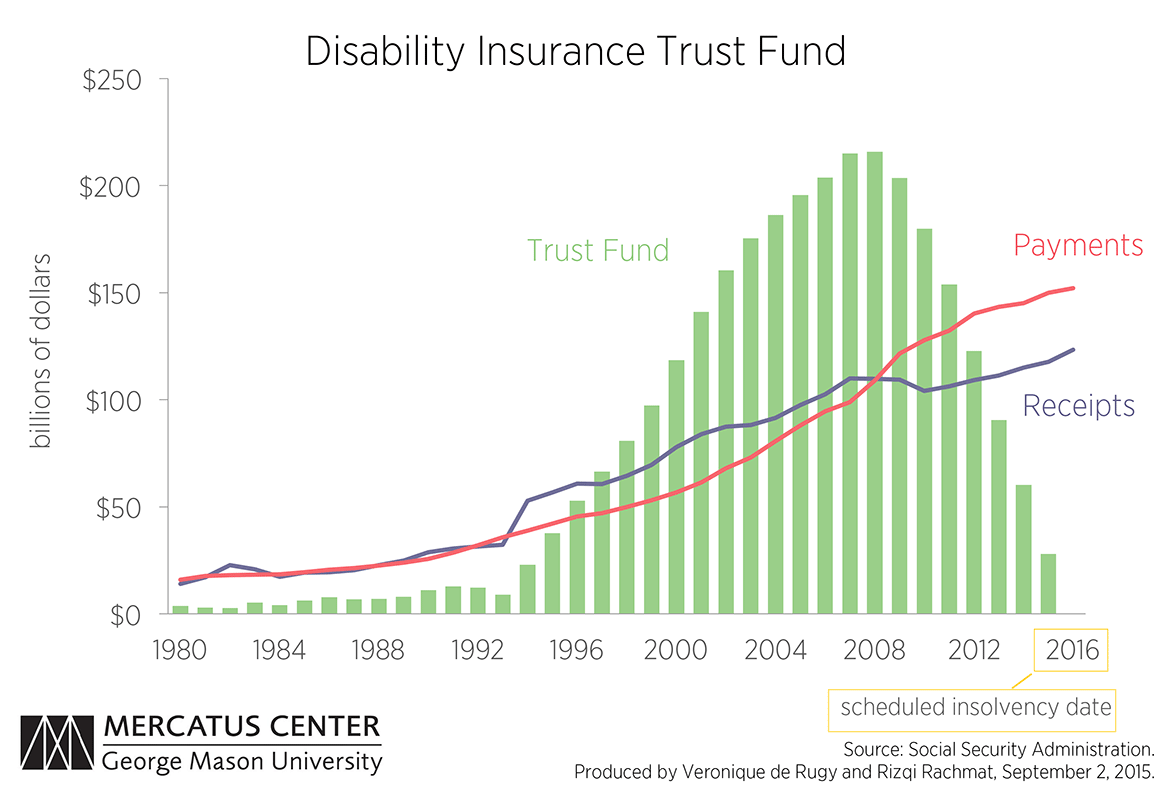

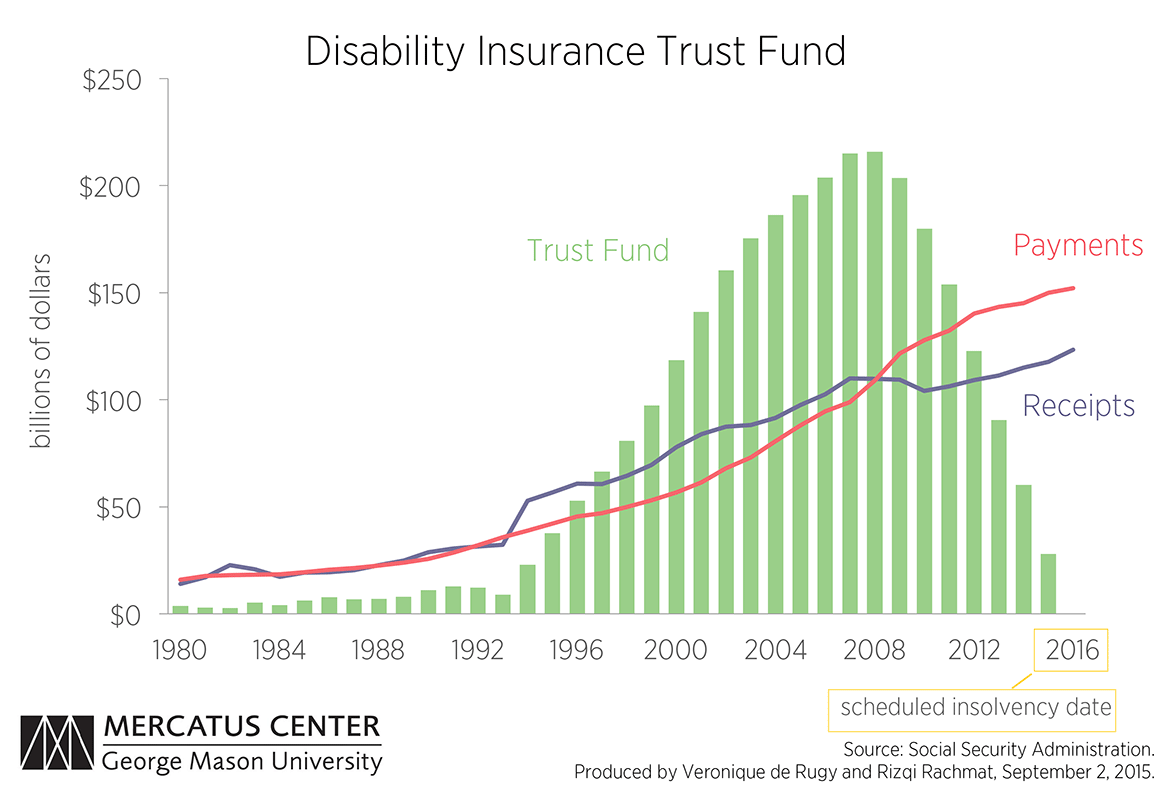

As he points out, SSDI (because of massive increases under Obama in beneficiaries who were able to con their way onto SSDI when their unemployment expired) is now broke.

And as he also points out:

1) Borrowing retirement funds is becoming a popular tactic.

1) Borrowing retirement funds is becoming a popular tactic. (Forced loans have been a common tactic of bankrupt governments throughout history).

2) The US government has already done this with federal pension funds. During the multiple debt ceiling fiascos since 2011, the Treasury Department resorted to "extraordinary measures" at least twice in order to continue funding the government. They dipped into federal retirement funds (TSP accounts) and borrowed what they needed to tide them over. In fact, the debt ceiling debacles were only resolved because the Treasury Department had fully depleted available retirement funds.

3) They’ve been paving the way to borrow your retirement savings for a long time. (Obama's "MyIRA program; this month Congress introduced the "Making Your Retirement Accessible", or MyRA Act, which would charge a penalty to employers whose workers don’t have a retirement account.

This reality puts the US government in rough spot. It’s not like government spending is going down anytime soon; it already takes nearly 100% of tax revenue just to pay mandatory entitlements like Social Security, and interest on the debt. Plus the government itself estimates that the national debt will hit $30 trillion within ten years. Bottom line, they need more money. Lots of it. And there is perhaps no easier pool of cash to ‘borrow’ than Americans’ retirement savings.

$7.3 trillion in US IRA accounts is too large for them to ignore.

1

posted on

02/27/2016 1:15:20 PM PST

by

SkyPilot

To: SkyPilot

To paraphrase relating to the gun control debate, they can take it from my cold dead hands.

I would be tempted to cash out of 401K and IRA, and pay the penalty, just to keep my savings out of the hands of the bureaucrats.

Anyone else agree?? Hate to pay the penalty to cash out, but once they take our funds, what’s to keep them from reneging on the promise that we get it back in retirement???

To: SkyPilot

It will happen. The only question is when...

3

posted on

02/27/2016 1:21:56 PM PST

by

2banana

(My common ground with terrorists - they want to die for islam and we want to kill them)

To: SkyPilot

4

posted on

02/27/2016 1:22:10 PM PST

by

laplata

( Liberals/Progressives have diseased minds.)

To: Dilbert San Diego

Don’t worry—you will love it when they do it.

You see, they will be war bonds after some nasty false flags have hit the homeland, and you don’t want to be unpatriotic now do you?

:-(

5

posted on

02/27/2016 1:22:16 PM PST

by

cgbg

(Epistemology is not a spectator sport.)

To: SkyPilot

I've read speculation that the way the gov would do it is to take a person's government sponsored retirement savings when they retire and shift them to an annuity. That way, the person would get a monthly payment based on age, but when they died, the gov got to keep the money. Thing is most people are dumb enough to buy into guaranteed income for life, so their retirement won't run out.

It would go along way down that slippery slope we're on of eliminating inheritance for middle-class people, thus further destroying the middle class.

6

posted on

02/27/2016 1:23:34 PM PST

by

grania

The EU is making moves to eliminate the 500 Euro bill soon, and they won't stop there. The Central Banks, the UN, and governments all want to outlaw cash. It will give governments complete control over every transaction. They will know what you buy, and when you buy it. The power to tax everything will increase greatly.

http://teapartyupdate.com/u-s-government-to-outlaw-cash/

ObamaCare was never about "health care." It was about control. Those who don't play ball can and will be denied coverage and access to health care.

We are rapidly approaching the End Times system of total economic control over all human beings.

They will make their next move when the next economic crisis arises (derivatives, markets, currency, commodities).

Watch for a global "re-set" with a new currency.

They may come for our retirement savings before or after this - but they already have plans in place to seize them, or give you quite a haircut. Expect to be issued worthless "bonds" for what you now have.

7

posted on

02/27/2016 1:25:16 PM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: Dilbert San Diego

You might be paying a bigger penalty leaving it in.

Hard to say.

It’s a crapshoot.

It is a worry though.

8

posted on

02/27/2016 1:25:51 PM PST

by

Lorianne

To: grania

person's government sponsored retirement savings not sure what that term means?

9

posted on

02/27/2016 1:28:51 PM PST

by

nascarnation

(RIP Scalia. Godspeed)

To: Lorianne

Yes it is a worry.

Our retirement savings should not be subject to being coopted by the government. But who can know for sure what will happen? Would any of you put it past Obama, or Hillary, or any other politico for that matter, to take actions against our retirement investments????

I’m tempted to hedge my bets.

Everybody has to decide for themselves how to proceed.

To: Dilbert San Diego; 2banana

11

posted on

02/27/2016 1:33:36 PM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: Dilbert San Diego

“I would be tempted to cash out of 401K and IRA, and pay the penalty, just to keep my savings out of the hands of the bureaucrats.”

Me, too, and this is how I'd do it. I wouldn't cash out of my 401K while I'm working at my current job because cashing-out means you'd take the penalty hit up front. When you leave a job, your 401K money can go to you directly and you have 100 days to roll it over into a new 401K account. What I would do is NOT roll it over; I'd put it into real estate or stocks or bank accounts of under 10k. I wouldn't report it on my tax return, reasoning that my former employer would report my having cashed it out, so I wouldn't need to report it. If the IRS eventually came after me for the penalty or income tax on it, I'd go to a lawyer and then make a payment plan with the IRS. However, I have heard the IRS often doesn't track the cashed-out 401Ks.

In any case, I no longer trust that the government won't tax/seize 401ks, which, after people turn 70, are not supposed to be taxed. Also, I predict eventually people who are merely middle class won't get social security. So, no social security, and your 401k is taxed — perhaps heavily.

Yes, I'd consider not rolling over my 401k the next time I switch jobs.

12

posted on

02/27/2016 1:34:26 PM PST

by

utahagen

To: SkyPilot

As far as I understand, this has already started. Apparently the Obama administration has passed new regulations (on what authority I do not know) that mutual fund brokerage operations, in order to “protect” investors, must put proceeds of stock sales in federal funds. This in effect forces investors to lend to the federal government. I understand these new rules are to take effect in the next few months.

13

posted on

02/27/2016 1:37:22 PM PST

by

T Ruth

(Mohammedanism shall be defeated.)

To: grania

14

posted on

02/27/2016 1:49:04 PM PST

by

Rusty0604

(oh the stories I could tell. but I really don't think scalia's death is suspiciou.)

To: SkyPilot

That buys a lot of Democrat votes.

What really bothers me with this and SNAP (food stamps) and the other programs is how so many people who don’t need the money cheat the system so they can have fancier cars and vacations.

15

posted on

02/27/2016 1:49:56 PM PST

by

blueunicorn6

("A crack shot and a good dancer")

To: SkyPilot

We have about 22% of our able bodied U. S. Citizens out of work.

If we put them back to work, government receipts would increase by about one third.

Any of that 22% that were receiving government help, would cease to do so. Government spending would go down.

That’s how you get healthy in a hurry.

That’s what Trump has proposed.

When Trump becomes president and does this, all the above ceases to be a problem. Dire predictions fade away. Nobody mentions them again.

Erik, Trump’s son talked up a private sector replacement for Social Security.

IMO we should work toward a time when SSDI & Medicare will be something our seniors pay for themselves, through insurance premiums from savings they have accumulated over a lifetime.

Trump is the one guy who could actually have the vision and the energy to see this happen.

16

posted on

02/27/2016 1:50:55 PM PST

by

DoughtyOne

(Facing Trump nomination inevitability, folks are now openly trying to help Hillary destroy him.)

To: nascarnation

I mean IRAs and 401Ks that have earned federal tax exemptions until retirement.

17

posted on

02/27/2016 1:52:30 PM PST

by

grania

To: grania

OK, I was confusing it with govt employees’ plan.

18

posted on

02/27/2016 1:58:45 PM PST

by

nascarnation

(RIP Scalia. Godspeed)

To: utahagen

When I quit my job, I rolled it over into an IRA where I make my own in testament decisions. Then you are free to invest in those things you mentioned.

19

posted on

02/27/2016 1:59:53 PM PST

by

Rusty0604

(oh the stories I could tell. but I really don't think scalia's death is suspiciou.)

To: SkyPilot

$7.3 trillion in US IRA accounts is too large for them to ignore. In January, 2009, the national debt was $10.6 trillion.

Last month, January, 2016, it flew past $19 trillion without slowing down.

By the end of Obama's term in office this coming January the debt is projected to be over $20 trillion.

So, even if the government 'borrowed' (confiscated) the entire $7.3 trillion in IRA accounts next January it still wouldn't be enough to cover just the $9.7 trillion in new debt rung up by Obama and the US Congress since Obama was elected.

.

20

posted on

02/27/2016 2:03:21 PM PST

by

Iron Munro

(Everyone has a plan till they get punched in the mouth -- Mike Tyson)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-56 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson