TARP $$ backsheesh:

Member Bank Amount of Donation Tarp Funds

DCCC Bank of America $5,000.00 $15,000,000,000.00

DCCC Capital One $25,000.00 $3,555,199,000.00

DCCC Citigroup $22,500.00 $25,000,000,000.00

DCCC Comerica Inc PAC $1,000.00 $2,250,000,000.00

DCCC Goldman Sachs $30,000.00 $10,000,000,000.00

DCCC JP Morgan $30,000.00 $25,000,000,000.00

DCCC Morgan Stanley $15,000.00 $10,000,000,000.00

DCCC PNC $2,500.00 $7,579,200,000.00

DCCC Wells Fargo $30,000.00 $25,000,000,000.00

Nancy Pelosi Bank of America $5,000.00 $15,000,000,000.00

Nancy Pelosi Citigroup $10,000.00 $25,000,000,000.00

Nancy Pelosi Goldman Sachs $20,000.00 $10,000,000,000.00

Nancy Pelosi JP Morgan $22,500.00 $25,000,000,000.00

Nancy Pelosi Morgan Stanley $10,000.00 $10,000,000,000.00

Nancy Pelosi Wells Fargo $10,000.00 $25,000,000,000.00

Steny Hoyer Bank of America $17,500.00 $15,000,000,000.00

Steny Hoyer Capital One $7,500.00 $3,555,199,000.00

Steny Hoyer Citigroup $10,000.00 $25,000,000,000.00

Steny Hoyer First Horizon $250.00 $866,540,000.00

Steny Hoyer Goldman Sachs $10,000.00 $10,000,000,000.00

Steny Hoyer JP Morgan $20,000.00 $25,000,000,000.00

Steny Hoyer KeyCorp $2,000.00 $2,500,000,000.00

Steny Hoyer Merril Lynch $5,000.00 $10,000,000,000.00

Steny Hoyer Morgan Stanley $13,500.00 $10,000,000,000.00

Steny Hoyer SunTrust $500.00 $4,850,000,000.00

Steny Hoyer Wells Fargo $10,000.00 $25,000,000,000.00

Its time to light the torches and sharpen the pitchforks!

Gee, why would a charitable organization who is supposedly saving lives be tracking this kind of political malfeasance?

25 BILLION DOLLARS?...and they had to create FAKE ACCOUNTS??????................

What the ??!!?!? Bring that whole house down. Biblical style!!

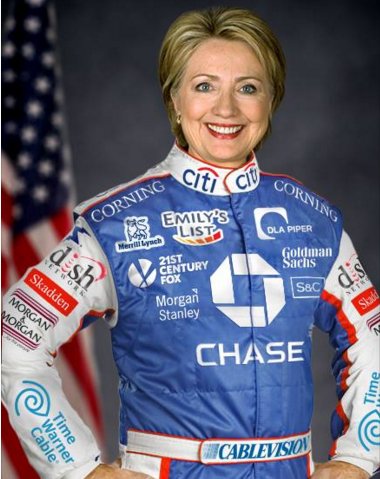

How can any Bern supporter JUSTIFY voting for Hillary after this?

Might you do the un-initiated/un-informed here a bit of a solid and take a moment to explain what this table means?

Member

Bank

Amount of Donation

TARP funds

Thanks! Interesting stuff and thanks for posting it.

Man! At that rate, had I only donated 5 Benjamins I could have raked in 1.5Million.

TARP $$ backsheesh:

Member Bank Amount of Donation Tarp Funds DCCC Bank of America $5,000.00 $15,000,000,000.00 DCCC Capital One $25,000.00 $3,555,199,000.00 DCCC Citigroup $22,500.00 $25,000,000,000.00 DCCC Comerica Inc PAC $1,000.00 $2,250,000,000.00 DCCC Goldman Sachs $30,000.00 $10,000,000,000.00 DCCC JP Morgan $30,000.00 $25,000,000,000.00 DCCC Morgan Stanley $15,000.00 $10,000,000,000.00 DCCC PNC $2,500.00 $7,579,200,000.00 DCCC Wells Fargo $30,000.00 $25,000,000,000.00 Nancy Pelosi Bank of America $5,000.00 $15,000,000,000.00 Nancy Pelosi Citigroup $10,000.00 $25,000,000,000.00 Nancy Pelosi Goldman Sachs $20,000.00 $10,000,000,000.00 Nancy Pelosi JP Morgan $22,500.00 $25,000,000,000.00 Nancy Pelosi Morgan Stanley $10,000.00 $10,000,000,000.00 Nancy Pelosi Wells Fargo $10,000.00 $25,000,000,000.00 Steny Hoyer Bank of America $17,500.00 $15,000,000,000.00 Steny Hoyer Capital One $7,500.00 $3,555,199,000.00 Steny Hoyer Citigroup $10,000.00 $25,000,000,000.00 Steny Hoyer First Horizon $250.00 $866,540,000.00 Steny Hoyer Goldman Sachs $10,000.00 $10,000,000,000.00 Steny Hoyer JP Morgan $20,000.00 $25,000,000,000.00 Steny Hoyer KeyCorp $2,000.00 $2,500,000,000.00 Steny Hoyer Merril Lynch $5,000.00 $10,000,000,000.00 Steny Hoyer Morgan Stanley $13,500.00 $10,000,000,000.00 Steny Hoyer SunTrust $500.00 $4,850,000,000.00 Steny Hoyer Wells Fargo $10,000.00 $25,000,000,000.00

- How the investment banks (Merrill, Lehman, Bear Stearns) had leveraged themselves into near-death experiences before

- How US government policies virtually forced banks to make low-down payment mortgages to buyers with sub-standard credit, forcing up prices

- How securitization meant these sub-standard loans could be bundled up and sold far and wide (w/ great losses to the buyers)

- How the ratings agencies gave this crap AAA ratings

- How the sales incentives to create mortgage-backed securities led to incredible short term behavior on the part of investment bankers

- How AIG (insurance) screwed up by guaranteeing many of these in Credit Default Swaps....etc, etc, etc.

It took an unholy confluence of events—government policy, investment banker greed, and last, but not least, securitization to create the perfect storm.....and swamped taxpayers w/ billion dollar bailouts.

====================================

POLS MAKE ZILLIONS IN PERPETUITY---by making insider deals w/ these bankers to issue education, transportation, and other municipal bonding deals.

Bonding is eternal taxation---taxpayers get stuck w/ huge tax bills.

The price tag for the Wall Street bailout is popularly put at $700 billion—---the actual size of TARP--the Troubled Assets Relief Program. But TARP is just the best known program in an array of more than 30 overseen by Treasury Department and Federal Reserve that have paid out or put aside untraceable money to bail out financial firms and inject money into the markets.

To get a sense of the size of the real $14 trillion bailout, see MJ chart at web site. A guide to the pieces of the puzzle includes massive untraceable Treasury Department bailout programs.

Money Market Mutual Fund: In September 2008, the Treasury controlled by Obama/Emanuel announced that it would insure the holdings of publicly offered money market mutual funds. According to the Special Inspector General for the Troubled Asset Relief Program (SIGTARP), these guarantees could have potentially cost the federal government more than $3 trillion [PDF].

Public-Private Investment Fund: This joint Treasury-Federal Reserve program bought toxic assets from banks and brokerages—as much as $5 billion of assets per firm. According to SIGTARP, the government's potential exposure from the PPIF is between $500 million and $1 trillion [PDF].

TARP: As part of the Troubled Asset Relief Program, the Treasury controlled by Obama/Emanuel made loans to or investments more than 750 banks and financial institutions. $650 billion has been paid out (not including HAMP; see below). As of December 21, 2009, $117.5 billion of that has been repaid.

Government-sponsored enterprise (GSE) stock purchase: The Treasury controlled by Obama/Emanuel bought $200 million in preferred stock from Fannie Mae and another $200 million from Freddie Mac [PDF] to show that they "will remain viable entities critical to the functioning of the housing and mortgage markets."

GSE mortgage-backed securities purchase: Under the Housing and Economic Recovery Act of 2008, the Treasury controlled by Obama/Emanuel may buy mortgage-backed securities from Fannie Mae and Freddie Mac. According to SIGTARP, these purchases could cost as much as $314 billion ---SNIP---.

LONG READ---go to web site to read more and checkout the shocking financial charts.

SOURCE http://motherjones.com/politics/2009/12/behind-real-size-bailout

Thousands to the dems for billions? That’s enlightening - maybe we should just buy the dems to save America. ;-)