The Bush 43 Administration for once put a stop to it. To get flood insurance in this 100 year flood town, you should have had to put jacks on new houses, to hike them up when the rain started.

Posted on 12/10/2017 5:34:53 AM PST by Elderberry

The National Flood Insurance Program, designed to protect Americans from catastrophic floods, has failed in almost every way, encouraging people to buy and build in flood-prone areas while increasing the cost and magnitude of disasters.

Congress' efforts to reform the program have failed just as thoroughly.

Attempts to fix flood insurance have been derailed repeatedly by special interests, political expediency and powerful lobbies that have poured hundreds of millions of dollars into congressional campaigns, a three-month examination by the Houston Chronicle reveals. Banks, builders, insurers and real estate agents — supported by property owners and allies in Congress —have combined to thwart even the most practical changes.

Earlier this year, for example, a proposal to stop the federal government from insuring homes built in flood plains beginning in 2021 was scuttled by coastal lawmakers and the National Association of Home Builders, which spent $39 million lobbying Congress since 2005.

The impact of Congress' failure is undisputed. The National Flood Insurance Program was supposed to discourage development in flood-prone areas, but new development has spread across flood plains, including thousands of homes in the Houston area that flooded during Hurricane Harvey.

(Excerpt) Read more at houstonchronicle.com ...

End it.

Let companies offer flood insurance on their own. It will be expensive. It will no longer be cost-effective to build so much so close to the shore. There will be more sanity and less cost because people will understand and manage the risk better.

"Help" from Congress just muddies the water.

Albert Einstein said the definition of insanity is doing something over and over again and expecting a different result.

And liberals expect the government to pay each time.

The Bush 43 Administration for once put a stop to it. To get flood insurance in this 100 year flood town, you should have had to put jacks on new houses, to hike them up when the rain started.

Ain’t it grand that we get 100 year floods every decade or so, 100 year earthquakes every 50 years, and trailer park tornado magnets.

Reinsurance is complicated, but it’s made so that everybody pays. Not just a risk pool. Everybody.

The government should give one rebuild and after that you’re on your own.

Basically anywhere you build is hazardous. The Earth can be very unforgiving. It’s simply a matter of time when your house gets hit by something. Then there’s disrepair,accidents and just plain age. People gotta live somewhere.

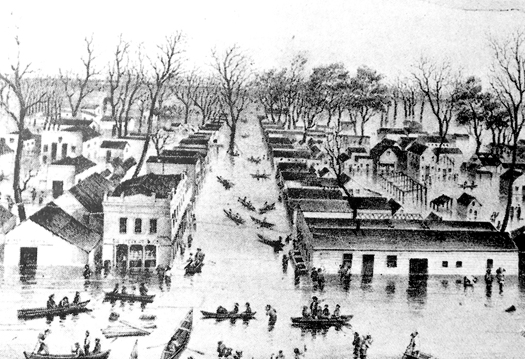

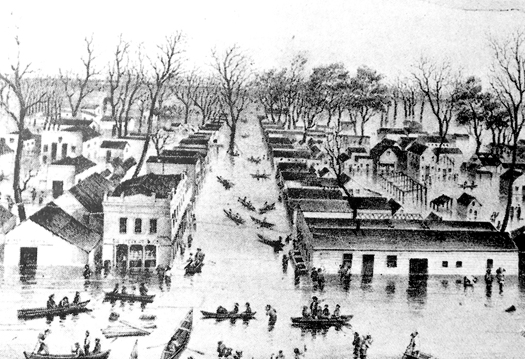

Back in the 70's, I had a neighbor, an elderly gentleman, who grew up on the Mississippi. He said his, and his sister's house, would float, along with several of their farm structures. They would utilize cork oak logs for flotation. They would guy wire their structures so they stayed in place during the seasonal floods. He said on one flood his sister called him on the radio, saying she was afraid her house was going to roll off the logs. Her house was upstream of his, so he had no way to get to her, so he told her to Pray.

It’s not just sea coastal areas that require flood insurance.

Most homes built around lakes and rivers...especially interior reservoirs that are created by utility company dams...require flood insurance. FEMA construction rules apply to any new-built homes...ultra-raised foundations, no ground level living spaces (garage ok), breakaway walls if the foundation is walled in, special internal strapping/bracing to keep the living areas from washing away.

One simple (simple, as opposed to easy) solution is you can rebuild with the insurance money, but you cannot rebuild on any site that flooded.

End the government program of flood insurance. HOWEVER, the government should require that all property be eligible for flood insurance, even the parts that are almost guaranteed to flood again. Let the free market set the rates for those properties, with NO subsidy from the federal government. (after all, this is like pre-existing conditions for health insurance. Let everybody enter into the next transaction with a clear idea of real costs.)

If any government agency is required to subsidize the cost of rebuilding flooded areas, it should be the parent agency that allows the zoning in the first place. (Like a city has a zoning board; it's time for local governments to take responsibility for their bad decisions and not expect the national debt to fund those bad decisions.)

100 year floods take place more often because there are more structures in the flood plain. It just makes the problem worse.

There are some places not meant for habitation. Most of Houston is one of those places.

This is just another festering problem of the nation aggravated and encouraged by bribes to politicians called “campaign donations”.

I lived in Houston for 30 years and was never flooded. I never bought a house near a flood plain.

For the taxpayers, it is better to buy people out and return more of the land to the flood plain.

If it’s totally private insurance and you can afford it without a taxpayers backstop, fine. But don’t complain after the umpteenth flood and they won’t insure you anymore.

You could have just not moved to a location that your lender required flood insurance for to begin with.

The quick simple answer would seem to be to get the gov’t. out of it & let insurance companies do it their way. I don’t understand exactly how this program works,but it seems to me that some of us,who maybe can’t afford our homeowner’s insurance(in a non-flood plain)are having to subsidize others who are building where they shouldn’t be building.

no problem

no problem

Generally true, but there's always ways to make some of it habitable. For example build every road and highway as a river to channel water to floodable areas. There will always be losses in a Harvey-type event but they will be manageable.

Flood losses are dropping steadily here in the US over many decades. That's due to better planning, better forecasts so people can prepare, and most of all more economic strength so that a disaster like a flood doesn't matter to most people. They just rebuild and keep going.

There's also a good reason there are many "100 year" floods. It is because there are thousands of areas that can get flooded that people have now built in as you alluded to. With 1000's of target areas, we should see at least 10 such "100 year" events every year.

Harvey flooded 113,843 homes worth $29 billion, 6.7 percent of the local market.

You must mean "not meant for habitation" due to the heat, humidity and mosquitos. Not because of flooding, that only affects some of the housing.

I have, and still live, in Houston for over 60 years and have never flooded. My current home was in the 100 yr flood plain when I purchased it. After drainage improvements and remapping, my home was no longer in the flood zone, so I dropped my flood insurance. The home I grew up in was 1 block away from Sims bayou and it never flooded as well.

Flood insurance is already very expensive. I lived next to a river and had a $40,000 mortgage. 2 years ago my flood insurance premiums were $200 a month. That’s ridiculous. I lived in a 100 year flood plain. Sold the place because of it.

Every time there’s an event like Katrina or Irma, premiums are adjusted for all policies nation wide.

The cost of insurance will eventually drive everyone out of flood plains IMHO?

So.... WHAT HAPPENED?!?

“The National Flood Insurance Program, designed to protect Americans from catastrophic floods, has failed in almost every way, encouraging people to buy and build in flood-prone areas while increasing the cost and magnitude of disasters.”

Okay guys and gals, we will cover you to build and live in flood prone areas and as the continual rebuilding caused by disasters that are prone to that areas use more money that overshoots your premiums just like too many accidents with a car, we’ll change your policy costs. You’ll become an assigned risk and pay top dollar. And if it continues, we can’t afforded you so we cancel you.

This is not new. But just like having too many accidents, if you build in an area that is going to break you, that’s your fault, not the insurance company’s. And you knew what you were getting into when you signed the contract. They are a business, not UNICEF. And you’re a bad risk, dummy, cause it is your responsibility to take care of yourself.

rwood

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.