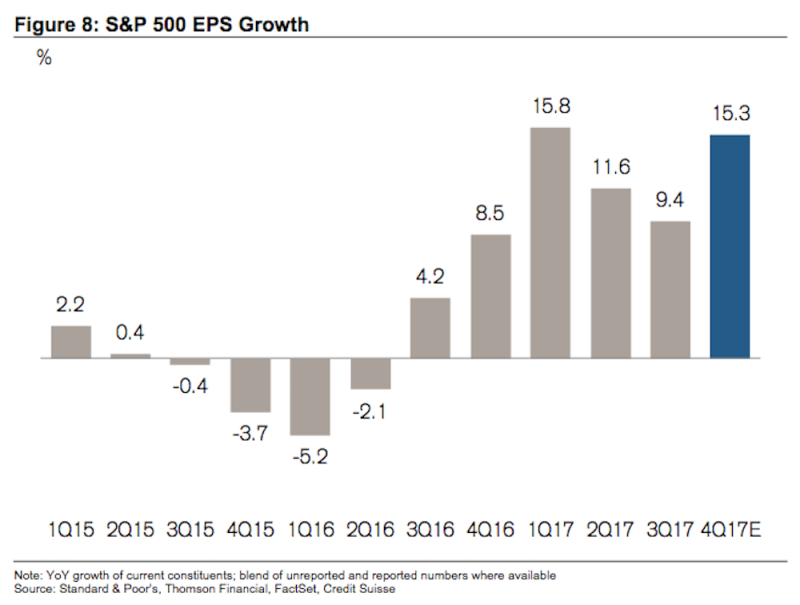

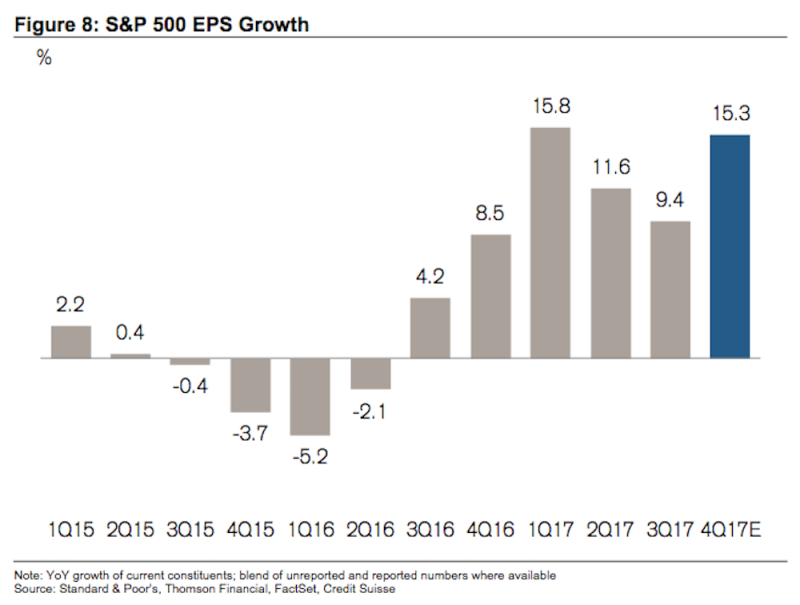

The market went up last year on these earnings.

It went down this year based on next year’s earnings, which will not increase as much, as well as next year’s interest rates.

How does the market know what will happen next year? That is a very interesting question....

For me, all the recent earnings increases do, on a market average basis, is BEGIN to bring earnings UP TO the over valued average P/E ratio condition (based on prior so called “expectations”) the stock market has been in for over a year.

Even should the stock market NOT keep climbing greatly, it is (a) already above this time last year, and (b) last year it was already in near bubble territory as far as the history of the average P/E ration goes.

That is not to say it is time to dump U.S. stocks, just that instead it is a good time to hold. Things will likely see more volatility as the feds stimulus is wound down and interest rates start to approach historic norms.

Worth remembering that those companies that shared w/ employees the tax break windfall in Q1 will register even higher earnings in Q2 precisely because of those expenditures.

Nicely played.