Skip to comments.

The Fed's Altimeter may be Broken

American Thinker.com ^

| June 22, 2019

| Jim Kudlinski

Posted on 06/22/2019 7:43:32 AM PDT by Kaslin

The Federal Reserve has conducted our nation's monetary policy for 99 years without a formal inflation target. During those years, inflation was among the variables considered by the Federal Open Market Committee when conducting monetary policy, but the committee did not target a specific rate, according to a paper published by the San Francisco Fed. Inflation targeting crept into the FOMC's modus operandi in 2000 with their informal adoption of 1.5%, elevated to 2% in 2007, and formalized and officially published at 2% as measured by the core personal consumption expenditures index (PCE) in 2012. Inflation has hovered below that level since onset of the subprime crisis in 2007 and the lingering question is, why? Despite the Trump tax cut, increases in employment not seen in years, and substantial wage growth -- any one of which in the past has been sufficient to trigger inflationary pressures -- it has remained stubbornly dormant. Let's review how we got here.

In the 1970s under former Fed Chairs Arthur Burns and G. William Miller, inflation moved steadily upward, reaching a high of 11.3% in 1979 when, shortly thereafter, President Jimmy Carter selected Paul Volcker as his inflation assassin. Volcker's punishing monetary policy, accompanied by nationwide protests against his sky-high interest rates, painfully brought inflation down to 1.9% by 1986. Upon Volcker's resignation in 1987, former President Ronald Reagan appointed Alan Greenspan to replace him and for most of his 18-year tenure under four different presidents, inflation remained in a range conducive to economic growth, that is, more than 2% and less than 4%. When Greenspan resigned in 2006, he was about to be coronated the greatest Fed chair ever when the subprime crisis materialized in 2007 and he reported, "we didn't see it coming."

(Excerpt) Read more at americanthinker.com ...

TOPICS: Culture/Society; Editorial

KEYWORDS:

1

posted on

06/22/2019 7:43:32 AM PDT

by

Kaslin

To: Kaslin

In before the Fed Reserv wing of FR brings out their pom-poms.

Restore our Republic by eliminating the non-needed, non-approved FR & eliminating the fiat $$.

The Socialist push in the U.S. would grind to a HALT w/o the ability to add magic 0/1 to any ledger. And, the push to a One World Govt, aka ‘cashless society’, dies as well.

2

posted on

06/22/2019 7:53:09 AM PDT

by

i_robot73

(One could not count the number of *solutions*, if only govt followed\enforced the Constitution.)

To: Kaslin

The Fed would not be a factor if the Congress and the President would live up to their oath of office and return us to fiscal sanity.

And jawboning the Fed, who is not even part of the Federal Government, is foolish.

Time to point the finger where it belongs - at Washington DC.

3

posted on

06/22/2019 7:54:36 AM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: Kaslin

the Federal Reserve has conducted our nation’s monetary policy for 99 years without a formal inflation target..

Huh?? The FED is Mandated BY LAW to maintain “Stable Prices” and they Have done everything in their power to Violate This Law every year since the abortion that created the Fed.

A Formal Policy of 2% inflation, is NOT maintaining “Stable Prices” it is THEFT OF VALUE and they Should be PROSECUTED for it.

4

posted on

06/22/2019 7:55:36 AM PDT

by

eyeamok

To: Kaslin

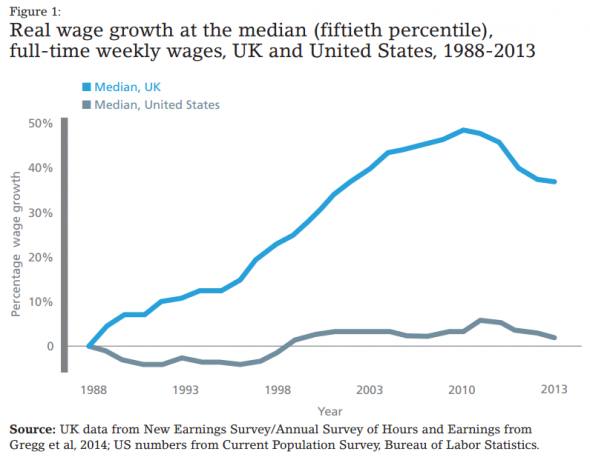

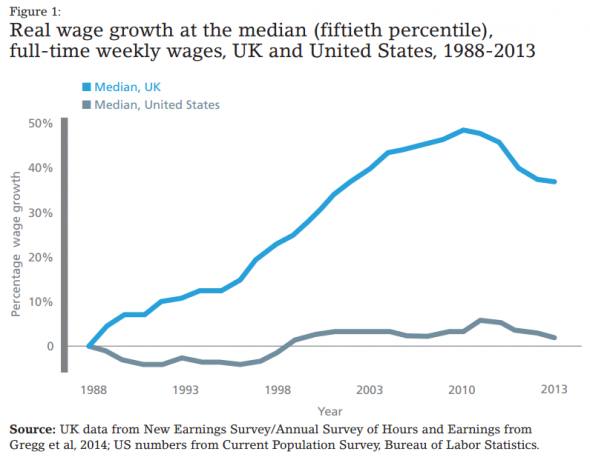

and substantial wage growthSubstantial only in proper historical context. Wages have bee so beaten down and stagnant for decades due to global labor arbitrage that current wage growth has almost no effect on inflation. We would need decades of 5%+ annual wage growth, even that is not really "substantial" wage growth IMO, to even move the inflation needle.

The chart below shows how productivity increases and wage increases have diverged sharply since the "globalization" of the labor force.

What is really pathetic is that socialist countries have higher real wage growth than the the USA.

5

posted on

06/22/2019 7:56:10 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: eyeamok

The theft and the invasion of privacy was replacing import tariffs with the income tax. Biggest mistake in American history.

6

posted on

06/22/2019 7:59:09 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Kaslin

Volcker's punishing monetary policy, accompanied by nationwide protests against his sky-high interest rates, painfully brought inflation down to 1.9% by 1986. Reagan's deregulation and pro growth economic policies brought down inflation, not Volcker. Volcker did cause a nasty recession, though.

The Fed's claim that economic growth causes inflation is false.

7

posted on

06/22/2019 8:00:34 AM PDT

by

Moonman62

(Facts are racist.)

To: Moonman62

The Fed's claim that economic growth causes inflation is

false dangerous.

Fixed it.

8

posted on

06/22/2019 8:06:39 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Kaslin

Andrew Jackson time! Farm out the Fed.. to only the Banks that support the President. Jackson broke these same kind of bozos... who only recovered the ‘game’ in 1913 with the “congress charter” idea and the “Federal” in name only private banking thugocracy that still caused the Great Depression, and all else since.

9

posted on

06/22/2019 8:48:23 AM PDT

by

John S Mosby

(Sic Semper Tyrannis)

To: eyeamok

A Formal Policy of 2% inflation, is NOT maintaining ....

The Fed is mandated by congress for 0.0% inflation which they have always violated. One fed charmian even admitted that the fed was the cause of the great depression.

10

posted on

06/22/2019 8:53:01 AM PDT

by

mountainlion

(Live well for those that did not make it back.)

To: mountainlion

11

posted on

06/22/2019 8:59:46 AM PDT

by

mountainlion

(Live well for those that did not make it back.)

To: Kaslin

I have two words on monetary policy, Gold and Silver.

12

posted on

06/22/2019 9:03:19 AM PDT

by

Don Corleone

(Nothing makes the delusional more furious than truth.)

To: Kaslin

Higher inflation corresponds to higher yields but for what if inflation consumes their buying power? I’d like to see higher returns on investments but higher inflation can negate a lot of it.

I do long for the days of 6% mortgages, 4% funds rates, 3.5% inflation and 11% GICs. That was some pretty good safe times. I don’t think they are coming back anytime soon and this sadly makes equities about the only game left if you hope to not just cycle money. I wonder daily when that house of cards is going to come crashing down. Of course the 11% GICs had to be invested in something and that was, guess what?

13

posted on

06/22/2019 9:43:44 AM PDT

by

Sequoyah101

(It feels like we have exchanged our dreams for survival. We just hava few days that don't suck.)

To: central_va

I thank God that I am in a good, fair, union, and have a minimum annual raise built into our contract.

We don’t try to rape the company we work for, and we are still below cost of living increases.

It is quite sad.

14

posted on

06/22/2019 10:09:31 AM PDT

by

vpintheak

(Stop making stupid people famous!)

To: mountainlion

A Formal Policy of 2% inflation, is NOT maintaining .... The Fed is mandated by congress for 0.0% inflation which they have always violated. Their mandate was never 0.0% inflation.

Our two goals of price stability and maximum sustainable employment are known collectively as the "dual mandate." The Federal Reserve's Federal Open Market Committee (FOMC), which sets U.S. monetary policy, has translated these broad concepts into specific longer run goals and strategies.

Price Stability

The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for Personal Consumption Expenditures (PCE), is most consistent over the longer run with the Federal Reserve's statutory mandate. The Committee has also explicitly noted that the inflation target is symmetric and stated that it "would be concerned if inflation were running persistently above or below this objective."

https://www.chicagofed.org/research/dual-mandate/dual-mandate

To: Kaslin

People may be interested to know that the original federal reserve act of 1913 gave rise to the need for a ‘printing concession’ as in money printing.

The US Mint which had always minted gold and silver coins was allowed to contract out the task of printing paper bills that represented gold and silver reserves.

Think of your local private copy shop. That’s how the ‘Federal Reserve’ got started.

When you hear it said the Federal Reserve is a private entity, you are hearing it right.

Now consider human nature. If the Federal Reserve concession shop had the task of removing old worn paper bills from banks and replacing them with fresh new paper bills, how long do you think it would take before eyes met with crooked smiles to come up with a plan to print more bills than were to be replaced?

Enter dark money.

And how do you keep it secret?

You cause anyone who snoops around about it, to disappear, suicide themselves, meet an unfortunate accident, retire suddenly, etc.

And how do you know who is a member, a ‘wise guy’, a mark? You adapt what others have developed, you learn the special codes, handshakes, eye expressions. Voila! You got yourself a secret society with membership protocols.

Of course, if you are someone of some sort of substance or importance, and you are seen and heard discussing the above secret squirrel stuff, then by whatever means necessary you will be branded, derided, mocked, ridiculed, as a lunatic conspiracy nut.

16

posted on

06/22/2019 12:23:21 PM PDT

by

Hostage

(Article V)

To: Hostage

Or…

The BEP had its foundations in 1862 with workers signing, separating, and trimming sheets of United States Notes in the Treasury building. Gradually, more and more work, including engraving and printing, was entrusted to the organization. Within a few years, the BEP was producing Fractional Currency, revenue stamps, government obligations, and other security documents for many federal agencies. In 1877, the BEP became the sole producer of all United States currency.

https://www.moneyfactory.gov/uscurrency/history.html

To: Don Corleone

Doesn’t matter. All forms of currency are fiat. There is no intrinsic value in precious metals; value of anything is always extrinsic.

To: kosciusko51

> There is no intrinsic value in precious metals; value of anything is always extrinsic.

Spoken like a true fanatic.

19

posted on

06/22/2019 8:26:59 PM PDT

by

old-ager

(anti-new-ager)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson