The trend is likely to continue until this China mess is taken care of, then more problems that have building up will come to the forefront.

Posted on 12/11/2019 4:24:33 AM PST by Freeport

The Federal Reserve Bank of New York added $70.2 billion in temporary liquidity to financial markets.

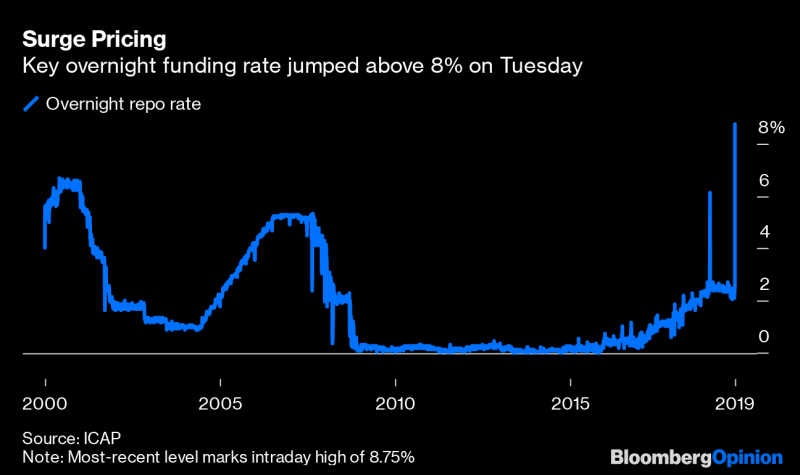

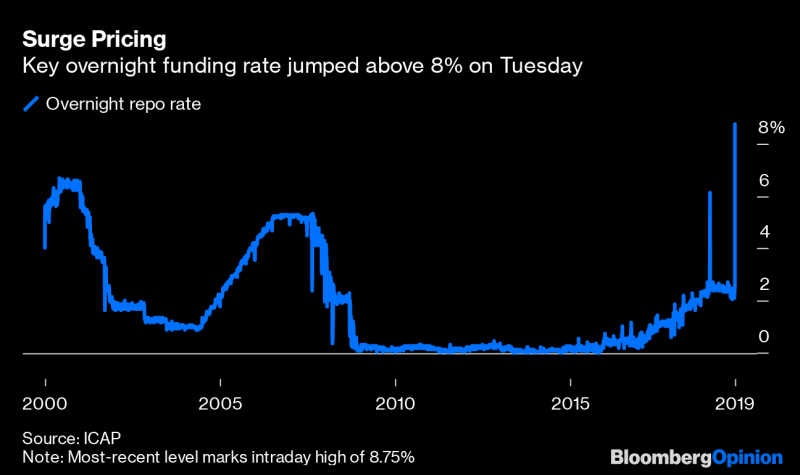

Tuesday’s intervention came in two parts. One was via overnight repurchase agreements, or repos, that totaled $41.7 billion. The other came in a $28.5 billion 13-day repo.

The Fed took all securities offered in both operations. Central-bank repo interventions take in Treasury and mortgage securities from eligible banks in what is effectively a short-term loan of central-bank cash, collateralized by the securities.

The Fed’s money-market operations are aimed at ensuring that the financial system has enough liquidity and that short-term borrowing rates are stable and consistent with Fed goals, with the central bank’s federal-funds rate staying within the 1.5%-to-1.75% target range. The effective fed-funds rate stood at 1.54% Monday. The broad general collateral rate for repo trading stood at 1.53%, also for Monday.

...

On Thursday, the Fed reported that its balance sheet had risen to $4.07 trillion as of Wednesday from $3.8 trillion in September. Some $208 billion in repo interventions were also outstanding as of Wednesday.

(Excerpt) Read more at wsj.com ...

So is it other banks are not willing to loan since the Fed will step in or is the banking system, in general, seeing a run and people are yanking cash?

If it's the former, then the Fed should just stop or take a much lower interest in keeping the repo rate low. Let the rate float higher. The banks will find it advantageous to loan at some point at some higher rate.

If it's the latter, capital leaving the U.S. banking system, what's happening is bad... very bad for this economy.

I need an explanation. I’m not an economist. Is this the government “creating” money and thus diluting the value of the dollar? Is the government creating inflation to inflate the numbers and give the illusion that the economy is expanding?

The text book definition is that the Fed repo program is a tool to influence short term interest rates. The Red buys securities to put more cash into banks keeping money loose and rates artificially low. Perhaps this event is to prevent the dreaded inverted yield curve.

Can’t help thinking the Fed is pumping up the stock market now with the intention of pulling the rug out sometime around September — creating a stock market crash just before the election.

I don’t put anything past them.

That’s crap. The commercial banks are refusing to trade with the Investment bankers because the collateral crap mortgage loans they are trying to pass are just that crap and the Feds are jumping in to keep the wheels churning while be get stuck yet again with feces.

For a straight up repo, a bank gives another bank or the Federal Reserve U.S. or other country’s treasury notes that have not matured as collateral on a “short term loan”. Then the bank repays that loan with the interest and they get the notes back. The length of a repo loan is typically 24 hours, but as the article states, there are other lengths such as a 13-day loan period.

As to what’s going on, that’s my question as well. Is this truly banks not willing to lend to each other and the Fed forced to be the lender of last resort, or is there a long-term flight of capital out of the U.S. system underway.

The first explanation was that the September action was banks covering for corporate customers pulling cash to pay taxes, but that was three months ago. So something else is driving the repo spike now... and what that “something” else is has not been explained.

No chance it is the second, ie money leaving the banking system as in a “run” on the banks. Were this the case it would be blaring front page news and have HYSTERICAL wall to wall coverage on all the other media outlets.

Perhaps some banks are not willing to loan at current (low) rates although the prime rate really only applies to mostly gilt edged customers both individual and corporate It is just a guide anyway with some borrowers enjoying rates of prime minus a quarter to half a point.

Hmmmmmm - that’s about 23% of what illegals are costing us this year.....

The WSJ is reporting this as if it is news. THIS IS NOT NEWS...it’s been SOP for some time now and is simply to increase the liquidity of our banking system and keep it working smoothly. THIS IS NOT A BAD THING despite the attempt by the WSJ to mislead people into alarmist thinking.

If the big banks are having liquidity issues, jobs may be opening up at the FDIC sooner rather than later.

On the net, it matters less than you think because the global demand for and supply of dollars are so vast and the US engages in routine dollar creation to meet that demand. My guess is that the US repo market is stressed because of imbalances in the international financial markets arising out of the US trade conflict with China and China’s economic problems and political uncertainty leading to capital flight and risk avoidance.

” Is this the government “creating” money ...”

The FED is NOT a GOV’t operation - it’s the Rothschilds, Rockefellers etc

‘am I missing something?

Which also means, the stock market is this.

How about banks need cash to loan against rising seasonal credit card purchases representing the excellent economy and general good feeling inducing people to buy lots of Christmas presents with their credit cards?

The Fed is taking securities to ensure that the banks have sufficient liquidity to keep short term interest rates in the 1.5% to 1.75% range. If you will recall, President Trump has been after the Fed to keep interest rates low, even lower than they are currently. If short term rates skyrocket then that goes against what the President wants.

Federal Reserve is insider trading to benefit the connected elite.

Will they be going to prison for their crime?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.