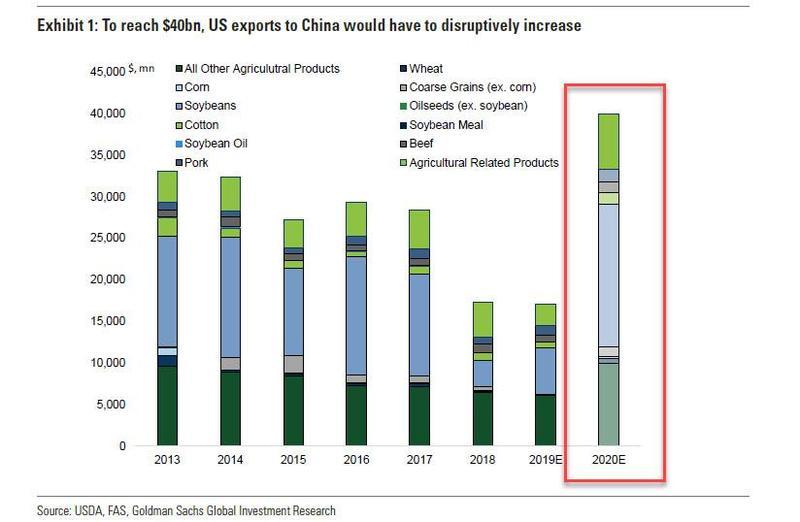

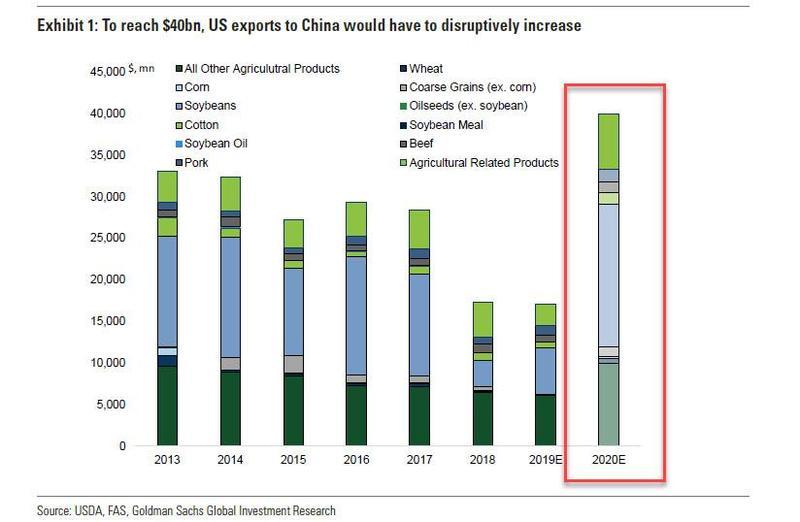

To get a sense of just how improbable such a surge in Chinese imports from the U.S. is, here is a visual representation of what this "disruptive increase" in U.S. agriculture exports to China would look like...

SOURCE: ZERO HEDGE

Posted on 01/07/2020 10:03:04 AM PST by SeekAndFind

BEIJING (Reuters) - China will not increase its annual low-tariff import quotas for corn, wheat and rice to accommodate stepped-up purchases of farm goods from the United States, local media group Caixin quoted senior agriculture official Han Jun as saying on Tuesday.

The report underlines China’s desire to protect its farmers at a time when it is under pressure to buy billions of dollars more of U.S. agricultural goods to calm a prolonged trade war, although its grain imports have been well below quota levels in recent years.

Traders and analysts said the announcement appeared to be aimed at local concerns as Beijing gears up to buy more U.S. agricultural goods.

“This is soothing market nerves here,” said Meng Jinhui, a corn analyst with Shengda Futures. “I think the market is worried about a blow from the possible increase of grain imports, and that (message) has gone to the high leadership.”

U.S. President Donald Trump said in December that China will likely double its $24 billion in pre-trade war purchases of U.S. agricultural products as part of a Phase 1 trade deal to be signed this month.

Han, a vice agriculture minister and part of the negotiating team, said last month China would buy more U.S. wheat, rice and corn, leading to speculation that Beijing could increase annual quotas on the amount of wheat, corn and rice that can be imported at a tariff rate of 1%.

Han was quoted by Caixin on Tuesday as saying the quota is offered to global markets and “we won’t adjust it for one country.”

In 2017, before the trade war started, purchases of the three grains from the United States amounted to only around $534 million, leaving room for a significant rise in imports within the existing quotas.

(Excerpt) Read more at reuters.com ...

SOURCE: ZERO HEDGE

So, either Trump was wrong, or the Chinese are already negating a deal?

The US farmers would be happy to take Chinese issued market disruption compensation checks and keep their grain.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.