Posted on 12/06/2020 4:05:48 PM PST by SeekAndFind

The biggest debate about 2021 probably isn’t where the market is going. It’s how it gets there.

We, and many others, are optimistic on the next 12 months. But there’s less agreement among investors on how these gains will be achieved. With our economists still in the 'V-shaped recovery' camp, we think returns will be powered by strong economic growth, driving an early-cycle, post-recession pattern of returns. Buy what you’re usually supposed to buy following a recession.

Others disagree. They think our forecasts for economic growth are too optimistic and expect COVID-19 to take longer to dissipate, with a more serious, longer-lasting impact on the global economy. They argue that the drawdown and recovery happened so fast that the economic cycle never truly reset, leaving both the corporate and sovereign sectors overleveraged. For these investors, liquidity and low rates will be the principal drivers of market gains. Secular stagnation lives.

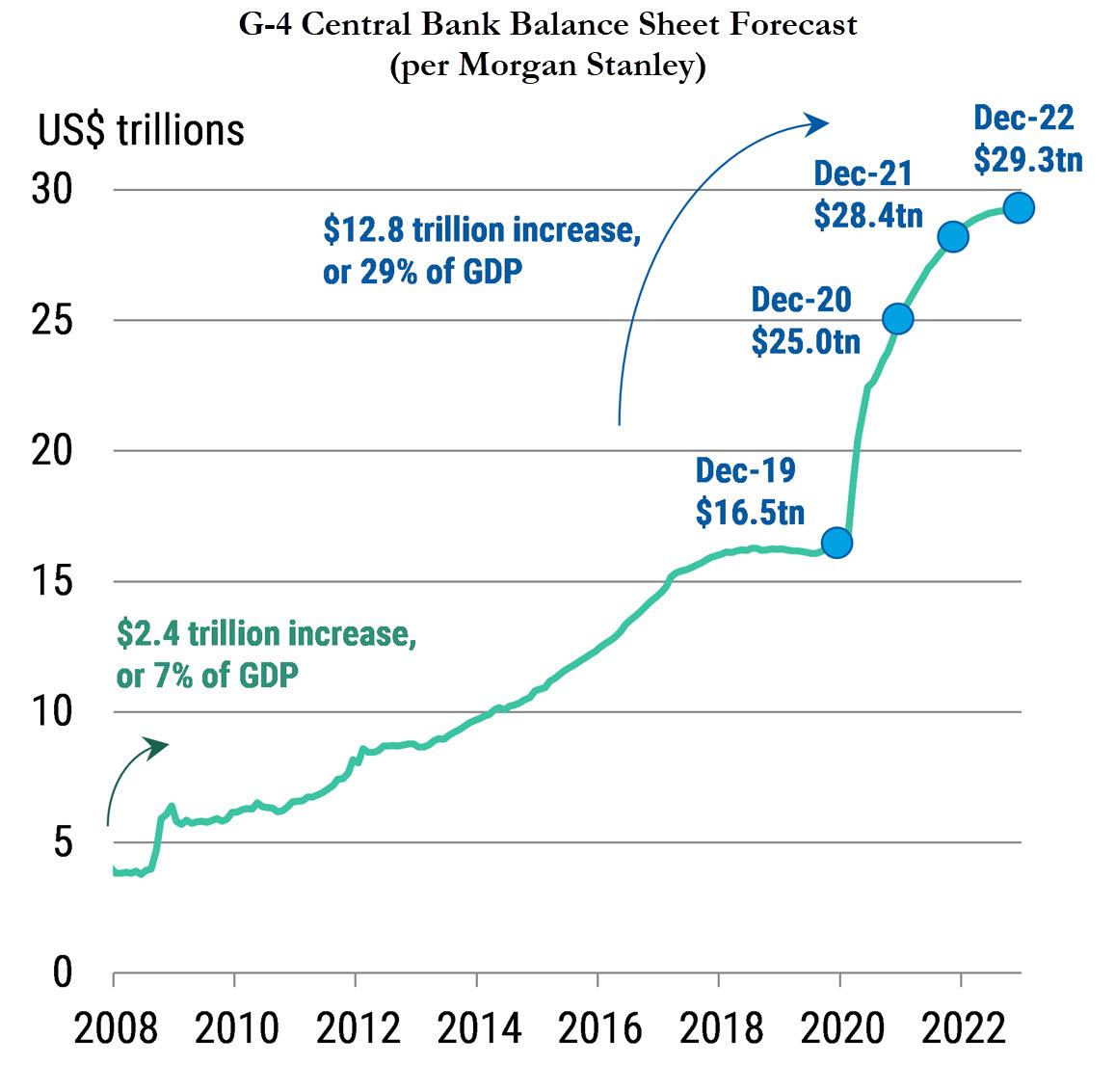

In investing, as in life, more than one thing can be true at the same time. Morgan Stanley’s economists forecast both above-consensus global growth and US$3.4 trillion of G4 balance sheet expansion in 2021. We’re positive on the year ahead in part because we think that growth and monetary policy will be rowing in the same direction.

Our argument is simply that weak-but-improving growth and supportive liquidity are a normal post-recession backdrop. Meanwhile, market pricing often remains sceptical that economic 'normalcy' will return any time soon. Better growth, supportive liquidity and attractive valuations are all reasons to adopt a 'pro-cyclical' stance across key cross-asset pairs: Long US small-caps over large-caps, long AUD/NZD/SEK/NOK versus USD and long high yield over investment grade. We think that US 10-year rates will hit 1.45% by end-2021, and are underweight government bonds.

But what about that missing reset? The economic collapse and recovery were unusually fast, bypassing the large defaults of 2008-10. There hasn’t been a single significant bank failure in the wake of the world's largest economic drawdown on record and, more strikingly, there hasn’t been a single significant capital raising. The US trailing 12-month speculative-grade default rate sits at 8.0%. In 2009, a milder recession, it peaked at 14.2%.

This failure to reset is often cited as a key reason why this can’t be the start of a new economic cycle: Recessions, while painful, help to clear out weaker, less-productive and undercapitalised businesses, making room for stronger, more dynamic ones to prosper in their place. The historic levels of policy intervention in 2020 prevented this 'creative destruction'. Without that clearing out, a dynamic recovery is unlikely. With it, a wider run of corporate defaults is inevitable.

Since we do think this is the start of a new economic cycle, do believe it will be ‘dynamic’ (we’re above consensus on growth) and don’t expect a surprisingly high wave of defaults, this would be a good time to explain why we don’t subscribe to the counter-argument.

Indeed, one of the great ironies of 2020 is that for all the hand-wringing around 'covenant-lite' lending, it was probably a blessing. 'Weak' terms on lending gave borrowers a helpful level of flexibility during the 1H downturn, where strict provisions would have forced more defaults. Neither owner, employee nor lender would have benefited from debt suddenly coming due in the depths of a recession; if you don’t believe me, search 'recovery rates March 2009'.

Finally, it’s also unfair to say that policy prevented any pain from being endured. If we combine the trailing 12-month default rate (8.0%) with our credit strategists' forecast for the next 12 months (6.0%), we get a 24-month default rate of ~14.0%. We can compare that two-year default rate to two-year changes in economic activity (i.e., taking a somewhat broader view of this unusual year). Viewed this way, things look more normal.

If you're constructive on the year ahead, the question of ‘how you get there’ still matters. We remain in the pro-cyclical, early-cycle camp, and don't believe that the 'absence' of a larger corporate default wave nullifies this story. Our corporate and securitized credit strategists are constructive with an early-cycle bias: positive on junior exposure in CLOs and CMBS, and on high yield over investment grade.

And Morgan Stanley would know, because they and all their assets have been bankrupted and bailed out by the taxpayer a bunch of times!

Bkmrk

The real question: Will Trumps tax cuts benefit a President Biden? Reagan’s cuts in 81’ benefitted Clinton 12-20 years later. Clinton gets the credit. Clintonomics-I loved them.

RE: The real question: Will Trumps tax cuts benefit a President Biden?

Depends on what a (God forbid ) Pres. Biden would do. If he leaves it alone and doesn’t listen to Bernie and AOC , the economy will naturally recover. If he doesn’t, expect a turn for the worse.

Morgan Stanley is trying to convince the suckers to stay in the market.

Wall Street is totally disconnected from Main Street. It couldn't give a single crap less about things like massive unemployment and ACTUAL earnings... only government infusion. If we all fkn starve or live under communism or bankrupt our treasury... that's fine. As long as the multi-nationals and banks are good who GAF if every mom and pop in America goes under?

America is exploding/imploding around us and the markets are in record territory. What does that tell us?

Markets will care when Baby Boomers start getting nervous and go from free money to this is insane. I say February 2021. Maybe earlier.

There is no money behind the market right now except the Fed giveaways and greedy investors and no options for any other return. Eventually investors will want 0% over -50%. It’s just a matter of timing now.

They want out first. Trying to milk out another 10-15%. Blood suckers.

I have a pretty good blend of stocks, cash, and dividend earning securities.

For 12 months, including the deep V I am still getting 13% or so. I have not put any additional $ in as I am on the sidelines until after YE (probably cost me $200k or so but sitting on cash helps me sleep).

The U.S. boom from 1994-2000 was driven by two simple things. The combination of Clinton’s tax hikes in 1993 and the GOP tax cuts of 1995-98 left us with a combination of high income tax rates and very low capital gains tax rates. This gave investors a huge incentive to flock to capital assets like real estate and shares in U.S. companies.

It all came crashing down in 2000 because people literally ran out of sound investments to pursue ... and therefore began pouring money into dot-com stocks that had no assets of value and never made any money.

Last month’s IRA gain was around 10%. Unbelievable for just a single month. But then again it could backslide 20% next month, and I expect it to when the election turmoil is factored in.

I pulled two-thirds of my money out of the stock market last month, because I know a crash is coming. I'm sleeping better after pulling back. The other third is making money in select stocks and I may sell those also if the market slides negative; if I lose some there I won't cry. The market is crazy and too many signs of a bad year in 2021.

Cashing out either last trading day of the year or in the first 30 minutes of 1st trading day in 2021. Maybe leave just small amount in some stocks as a marker.

...as the dementia-afflicted President Elect would say, come-on, man.....!!! he has Big Tech, Big Pharma, Big Business, Big Media, Big Academia, Big Religion (see Pope Francis’ swooning appraisals of a Biden administration), and so forth behind him....he’ll do just fine....!!!

(but.....as my late very wise father-in-law used to say, no tree grows to the sky......)...

This reminds me of the bailout scene in “The Big Short”. The last guy holding onto housing shorts is confused by why foreclosures are up and the value of what he’s holding is going up. Then the reports say the hedge funds are going into the White House for a bailout. He cries, “they knew, they knew they’d be bailed out, that’s why ...”

These financial institutions are like cars with powerful engines but don’t have any brakes.

There’s no punishment or responsibility for failure, but all the winnings they get to pocket.

I’d like to go to Vegas on a deal like that.

...and I’ve been in Finance for almost 30 years. This shit surprises me every day, it just gets more corrupt each passing day.

Big business loves the lock downs. No competition from the little people. Is it a wonder that Wall Street donates heavily to democrats?

If God forbid Biden gets in, you might as well put your money in Nigerian currency.

“It’s how it gets there.”

Who the hell cares how it gets there as long as it is up.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.