Posted on 12/10/2021 9:41:52 AM PST by blam

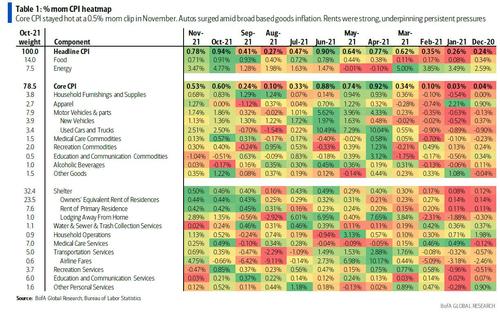

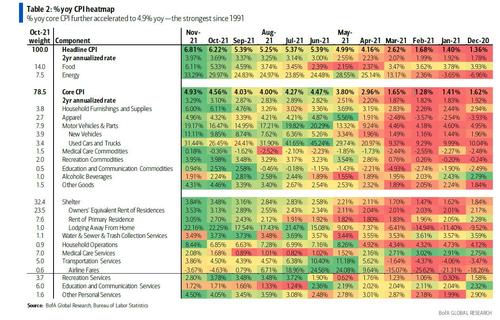

As noted earlier, consumer inflation stayed red hot in November as core CPI rose a robust 0.53% mom, which boosted the yoy rate to 4.93% from 4.56% yoy—the highest since 1991. Headline CPI jumped 0.78% mom as energy prices spiked 3.5% mom and food rose 0.7% mom. Headline % yoy similarly soared to 6.81% yoy from 6.22%—the highest since 1982.

In its post-mortem breakdown of today’s CPI print, BofA’s Alexander Lin notes that in core goods, new cars picked up 1.1% mom and used cars surged 2.5% mom – just as the Manheim Used Vehicle Index had predicted – as the auto sector remains constrained. The move in used cars was actually lower than expected given that wholesale prices moved up 5.3% mom in September, but this move may have been spread out given that CPI used cars surprised to the upside in the last report, also rising 2.5% mom like in this report.

Wholesale prices suggest further significant upside in used cars in the months ahead as the gauge is up 14.5% through November relative to the prior high in May.

Outside of autos, core goods components broadly gained as apparel popped 1.3%, household furnishings/supplies rose 0.7% mom, and both recreation and other goods rose 0.3% mom. One exception was education/communication commodities which slipped 1% mom. The breadth of gains in goods likely reflects ongoing constraints in the supply chain as well as the pull forward in the holiday shopping season, which meant earlier discounting in October.

In core services, OER and rent of primary residence stayed hot, growing 0.4%+ mom for the third consecutive month, however as we will discuss in a subsequent post, US rents may have finally peaked. Travel components also surged as lodging popped 2.9% mom and airline fares soared 4.7% mom. Broader transportation services rose 0.7% mom as car/truck rental also jumped 1.1%, though MV insurance fell -0.8% mom. Outside of that, services components were mixed. Recreation fell -0.5% mom, education/communication and water/sewer/trash were both flat, other personal services inched up 0.1% mom, and household operations popped 1.1% mom. Medical care services grew 0.3% mom but this was below expectations as hospitals fell -0.3% mom.

Overall, the continued strength in OER/rents indicates that persistent inflation pressures continue to heat up, although as BofA puts it “the mixed services components suggests we may not need to hit the panic button just yet.” Indeed, the breadth of gains across core goods supports ongoing pandemic-related pressures and the pull forward in the holiday shopping season. Travel components also rebounded as people went home for Thanksgiving, but this will likely see some softening in the near term given the rise of Omicron.

Here it’s also worth noting that as the following chart from Janney shows, even if sequential inflation slows (to say 0.2%), annual inflation will remain very hot until at least March 2022 due to base effects.

Looking at the market response to this morning’s print, CPI notes that it reflects some disappointment on a headline level but affirmed expectations for the Fed to lean more hawkish. Inflation breakevens declined across the curve, but were concentrated in the front-end, suggesting that market may have been expecting a higher print than what was reflected in surveys. Expectations going in were probably bolstered after Biden’s comments yesterday that today’s print won’t reflect recent energy price declines. Real rates rose by 8 and 6 bps at the 3y and 5y point respectively. Strong persistent inflation pressures reflected in the reading support a continued Fed hawkish pivot and should continue to put flattening pressure on the nominal curve.

Finally, here is the CPI heatmap on a MoM basis…

… and here it is for prices compared to year ago levels:

“Headline % yoy similarly soared to 6.81% yoy from 6.22%—the highest since 1982.”

How can that possibly be true when gas and oil and meat are 100% higher in price this year over last year?

That 6.8% year-over-year inflation number seems incredibly low, compared to my real-world experience.

I agree something is fishy about the numbers.

The Consumer Price Index, which is the measure of inflation, is based upon a “market basket” of goods which can be changed at any time to suit the narrative. Actually inflation may be currently running closer to 18% by my estimation.

Yes and you must take into account horizontal substitution. Steak may go from $7 / lb to $15 / lb. But if you the consumer give up your $7/lb steak and start buying $3 /lb hot dogs that is deflationary not inflationary even if you did it because you had not choice after your daughters dental price for braces went up.

US used to use a cost of goods index which was based on the cost of a set basket of goods. Of course that makes the politicians look bad so it was changed.

Government inflation figures have been rigged for years. To put it in a nutshell, the Department of Labor’s market-basket-of-goods approach treats technological advances and improvements in manufacturing methods and worker productivity as deflationary — offsetting the monetary inflation taking place.

In 1981 the fed funds rates were 20% in the attempt to stem inflation. By 1982 they dropped to 9%.

Good post. To be fair, I would point out that the Dept. of Labor CPI estimate isn’t intended to be an accurate measure of overall inflation. It’s really aimed at measuring consumer prices in the context of their inflationary impact on wages in the U.S.

No. Hit the panic button. Waiting to fix the problem will only make the solution more painful. It won’t happen, but the solution is rather straightforward. Massively cut government spending. Massively cut taxes. Drastically increase tariffs on imports, particularly from China. Increase interest rates and cut the money supply. Open up state and federal lands for petroleum exploration. Eliminate about 90% of regulations affecting businesses. Drop all this climate change bullshit and burn baby burn. Burn coal. Burn natural gas. Burn the least expensive stuff out there. Jeez, burn Democrat cities to keep warm.

Correct. It was temporary. There are other levers to adjust to stamp out inflation, but tighten monetary policy has rather fast results. Interest rates should be increased now and by a decent amount, so they do not have to be increased to 20% in a couple years. That piece of schiff Carter allowed things to get out of control. We had to wait for Reagan and Volcker fix things. The wait was too long. Volcker wasn't around until late '79, if I recall. We can't wait for Powell to be replaced and for Trump in 2024 to start fixing these problems. We also need to rid the Treasury of that commie Yellen. She's eff'n clueless.

i know, don’t remember when they took the fuel/food out of the inflation equation.

These people making up these statistics don’t shop.

Indeed. For my normal daily shopping things are easily 50%-100% higher. I saw the new weight of some oats I was buying. The shrinkflation is now down to 13 ounce from the 14oz from the 16oz. A 6 pack of good beer is $12. Way to go Brandon!!!

If you didn’t buy steaks for July 4th and got a bag of generic hotdogs instead, you saved 16 cents... YAY BRANDON!!!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.