Posted on 04/30/2022 9:52:33 PM PDT by SeekAndFind

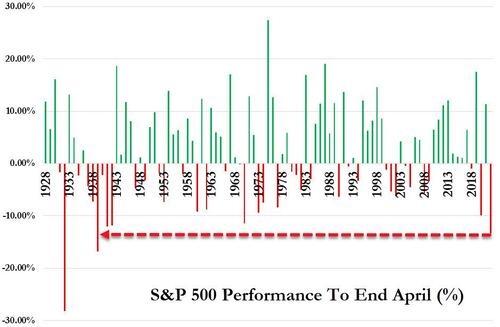

After a tumultuous week of violent lurches higher (but mostly lower), the S&P 500 has ended April with its worst start to a year since the start of World War 2...

Vacation bookings are soaring, car sales are booming and Americans continue to spend with abandon, thanks to higher wages and brisk hiring; and yet, the economy unexpectedly contracted in the first quarter, led by trade deficits and a drop in inventory purchases.

“The market is worried about a very fragile economic outlook, as it should be," said Joe LaVorgna, chief Americas economist at Natixis and former Trump White House economic adviser.

“The economy is fundamentally soft: The Fed is going to hike next week, the situation in Ukraine is not getting better and high inflation is cutting into costs."

All this chaos and divergence appears to have 'triggered' 91-year-old Warren Buffett who lambasted Wall Street for encouraging speculative behavior in the stock market, effectively turning it into a "gambling parlor."

Having announced that Berkshire Hathaway suffered a $1.58 billion loss in the first quarter of 2022 (a huge reversal from the nearly $5 billion gain it saw at the same period of 2021), Buffett spoke at length during his annual shareholder meeting Saturday about one of his favorite targets for criticism: investment banks and brokerages.

“Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism,” Buffett said.

“They don’t make money unless people do things, and they get a piece of them. They make a lot more money when people are gambling than when they are investing.”

Buffett bemoaned that large American companies have “became poker chips” for market speculation. As CNBC reports, he cited soaring use of call options, saying that brokers make more money from these bets than simple investing.

Still, the situation can result in market dislocations that give Berkshire Hathaway an opportunity, he said:

"That's why markets do crazy things, and occasionally Berkshire gets a chance to do something."

98-year-old Charlie Munger also chimed in, warning that “It’s almost a mania of speculation."

“We have people who know nothing about stocks being advised by stock brokers who know even less,” Munger said.

“It’s an incredible, crazy situation. I don’t think any wise country would want this outcome. Why would you want your country’s stock to trade on a casino?”

CNBC noted that an audience member made an inaudible comment while he was talking.

“Was that a banker screaming?” Buffett joked.

and how, exactly, did they do this Warren?

Hey Hiawatha, you have no stock investments? Prove it..

You want to see some idiots lose a lot of money? Go on You Tube and search for “trading loss meltdowns” (or some variation). Shows guys freaking out when a trade goes wrong and they lose all their money.

One guy lost $40,000 that his dad had given him for college. He lost it in just a few minutes.

How do you make a small fortune in the stock market?

Start out with a large fortune.

“I’m shocked; shocked that there is gambling going on inside this stock exchange!”

Criticism of the market he helped create. Mr Short stacks the deck, abs then cleaned out the rubes. So he is right, exactly like a gambling parlor.

Whatever, Buffett, you’re a Rat, and continually voted for the downfall of Country.

He actually got something right. I have been saying this for years. The stock market has been turned into a casino where stock values have very little to do with the actual value and productivity of companies.

The bottom line for these guys is that companies aren’t worth a damn unless they put real money in the pockets of their owners — i.e., by paying dividends. There’s something to be said for that. For the life of me, I can’t imagine why anyone would invest in companies like Facebook or Amazon that have never once paid a dividend to their shareholders.

bmp

Having a zero interest rate environment also pushes all the money into the market

The market is dominated nowadays by emerging technology companies, the market value of which cannot be determined by the good old Buffett/Benjamin Graham model.

Investors who ignore the transformation of our economy away from the industrial era and toward the computer age are investing in the past, not the future.

Bottom line: this new market would look like a crapshoot to an old market guy like Buffett. But investing in the future is a must (however dangerous).

Reports are that he has donated lots and lots to the abortion cause:

“Having a zero interest rate environment also pushes all the money into the market”

combined with the trillions sloshing around the economy that the FedGov had the FedReserve print for them ...

Start out with a large fortune.

Or get yourself elected to Congress.

Berkshire Hathaway doesn’t pay dividends.

How do you make a small fortune in the stock market?

Start out with a large fortune.

create a recession/depression sell high then buy low, a win win. Sounds like a high stake poker game to me

Dividends are not a good indicator of the quality of an investment.

Sometimes the speculators and gamblers can brag about their gains and poke fun of the old fashioned types. These days us cautious, dividend types can have a laugh. I have some paper losses for the year but I have a lot of gains locked in just from buying in gradually and holding.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.