Posted on 12/06/2022 7:52:48 AM PST by george76

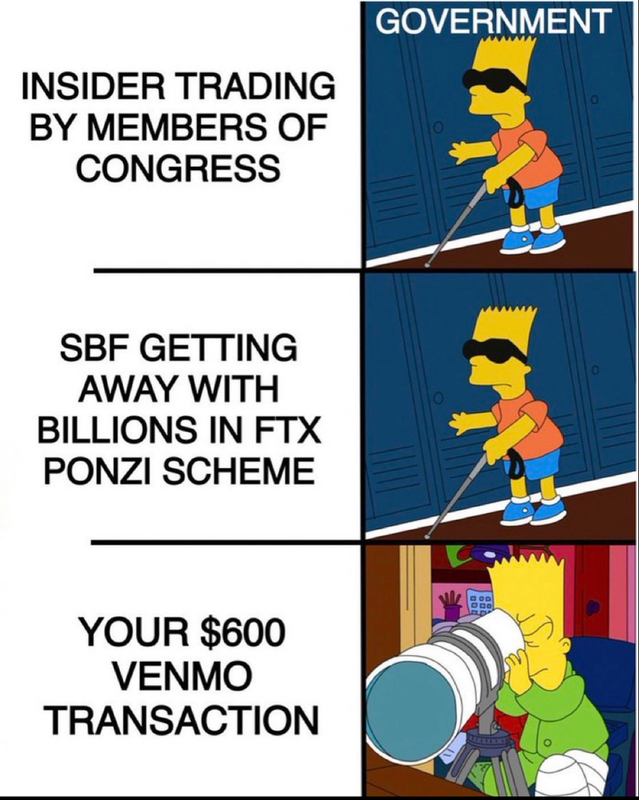

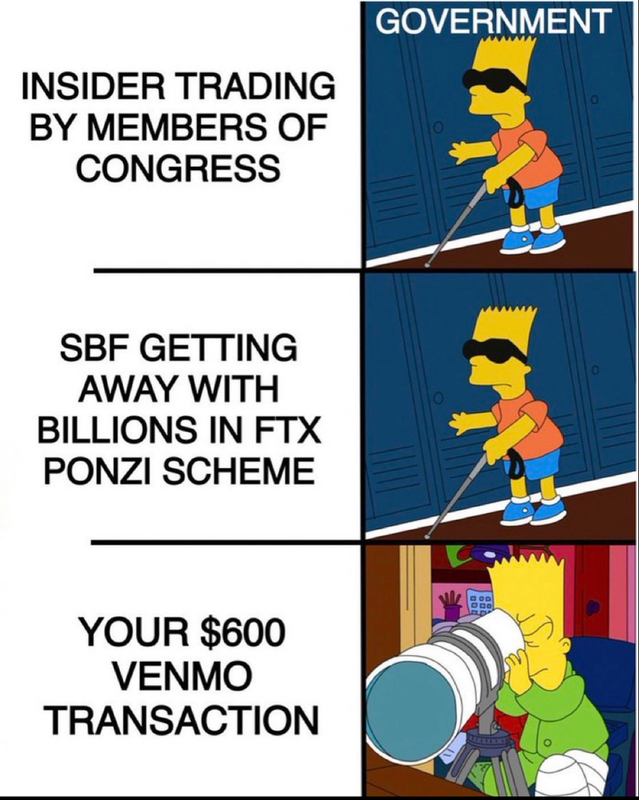

Sam Bankman-Fried: I don’t know where $10 billion went. The Pentagon: We don’t know where $2.2 trillion went. The IRS: You just sent $601.37 don’t forget to report it.”

The Biden administration is recruiting 87,000 IRS agents, allegedly to keep an eye on billionaires. .. aiming at the little fish of the gig economy instead.

Taking payments for a side hustle via PayPal or Venmo? Not only is the IRS reminding you those payments are taxable income, it’s deputizing those payment companies to snitch on you.

...

But wait — it gets worse. People get payments through these companies for all sorts of things, like gifts from family members, expense reimbursements from employers, even money from friends for medical expenses, etc. Venmo and PayPal may — and sometimes undoubtedly will — mischaracterize these tax-free gifts as something taxable.

...

The threshold used to be $20,000 but was lowered to $600 as part of the Democrats’ American Rescue Plan Act ... The legislation tightened the screws on the little guy, and that was no accident.

...

Democrats .. hostile to self-employment and small business.

...

you can’t get people fired from jobs when they work for themselves.

...

independence is anathema to Democrats, who have made pretty clear they want everyone under their thumb. Since the pandemic, in which lockdowns gave preferential treatment to big-box stores while brutally punishing small businesses, it’s been a steady grinding down of small businesses and entrepreneurs. (Well, except for the Bankman-Fried sort of “entrepreneurs” who make six-figure donations to favored politicians.)

This new rule is just another tightening of the screws. If everyone works for the government or a big corporation that’s in cahoots with the government, everyone is controllable. And for Democrats, that’s not a bug but a feature.

(Excerpt) Read more at nypost.com ...

I do so detest these people. Life is a real struggle for many people and the Commie Rats just don’t give a $h!+ . . . they just want to make it harder for those folks. Evil

” the Commie Rats just don’t give a $h!+ . . . they just want to make it harder for those folks. Evil”

Many Republicans don’t care either.

Dimms hate the gig economy for several reasons.

1. Because their union overlords hate it (California tried to kill the gig economy by fiat at least twice, e.g., the infamous AB5 promoted by the despicable union hack Lorena Sanchez).

2. It undermines the concept of minimum wage (the wages are established by the employer and gig employee).

3. It’s harder to enforce tax-wise (unless you have an army of IRS storm troopers).

Wiped out hundreds of thousands of jobs (which the media mysteriously managed to ignore) of 1099 workers, trying to force them to become employees (i.e. union members), pretending not to notice that so many of these jobs, based on their project-based nature, CANNOT be hourly or shift work.

Biden's puppets are going to try to take A.B. 5 national. This is NOT simply Uber and Lyft jobs, as they tried to spin it in California. This is home health care workers, truckers, wedding planners, photographers, transcribers like myself, writers, beauticians, etc. etc.

Predictably, these people were NOT turned magically into employees. Companies did NOT all of a sudden hire them. They simply cut them off because using them was now illegal. ILLEGAL. By the stroke of Lunkhead Governor Newsom's pen.

But yeah, they care about the little people.

If you’re surprised by this, you shouldn’t be allowed to vote.

The dumbing-down and de-moralization of America has consequences.

Brian Griffin Official Employer Inc. would be happy to get $16/hour and pay $15/hour.

Precisely why we're hiring 87,000 new IRS agents.

To go after billionare tax cheats?

LOL! Hell no!

We're going after people making a extra few bucks selling baked goods and handyman services and on Etsy and Facebook Marketplace.

THEY want to destroy the Kulak class.

Yes

Attacking ordinary folk as they go about their daily lives, sometimes buying something, sometimes selling, sometimes doing a little job for someone.

I don’t doubt for one second that this is the first step on the way to total government control of all monetary transactions. It’s a tax on the little people. The ones without power. NOWHERE do I see anything that leads me to believe that they will go after the bill gates, george soros, jeff bezos, Sam Bankman-Fried’s of this world.

Those people will escape government’s greedy clutches. They have nothing to worry about because they are “philanthropists.” But Joe Ordinary Person now has to worry about an audit because he was paid for mowing someone’s lawn.

The IRS also announced that money transactions via financial payment apps (Paypal ect) of $600 or more are now (on the recieving side) going to get IRS scrutiny and must be submmitted in your income tax forms as income. So if you sell that antique dresser of yours in a garage sale and someone pays you through Paypal, the IRS will expect you to include that $600 as “income”. And of course if you want to take it is a “capital loss” you will need documentation for what you originally paid for the dresser as well as that it was an investment only.

At $600 the IRS is directly going after the millions of small businesses, more then you or me or the major corportations.

The prior dollar value of Paypal transactions that got IRS scrutiny was $20,000. Will the GOP in the House try to force a reset to that value???

Yeah! Get those billionaires!

Does this include when you withdraw amounts over $600 from the bank? Like through the ATM?

1. Have your cousin in Naples set up a papyl account.

a. Give him 10%

b. Tell him to reinvest the 10% in your Biz when you need

it.

c. Acccept pappl in his account, funds go to Naples ...

d. Have him send you debit card/or western union cash

pickup etc..from his bank in Naples.

2. Have cousin in Naples set up a corresponding USA bank account with partner bank in Italy.

a. let customer use direct deposit/wire funds to his Italy bank’

d. above.

any holes in this?

d. or credit card

What are the tax laws in Italy? Your cousin may have to pay taxes on the cash going into his account.

Do you trust your cousin?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.