Skip to comments.

PayPal Founding COO: Don’t Blame Depositors For Bank Failure, Blame Biden And SVB Management; If you want to understand the context for the crisis, look at the Federal Deposit Insurance Corporation chair’s March 6 testimony

The Federalist ^

| 03/15/2023

| David Sacks

Posted on 03/15/2023 8:59:57 PM PDT by SeekAndFind

It’s important to understand that SVB’s failure didn’t arise from risky startups doing risky startup things.

It’s painful for me to watch so many smart pundits and politicians on both the right and the left buy into a media narrative that seeks to blame “wealthy speculators” or “tech bros” or venture capitalists for a banking crisis that ultimately started in Washington. Let me explain.

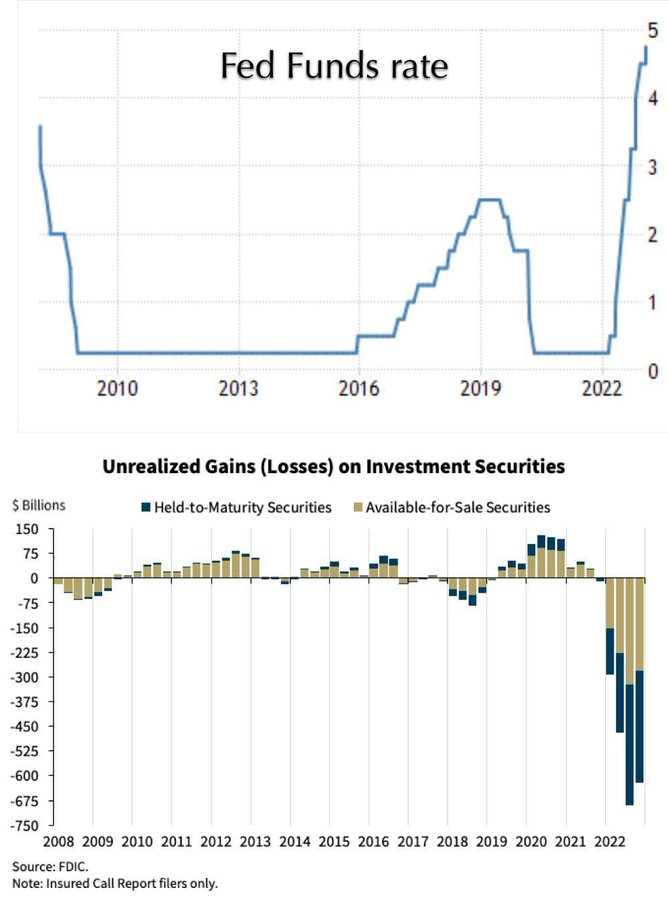

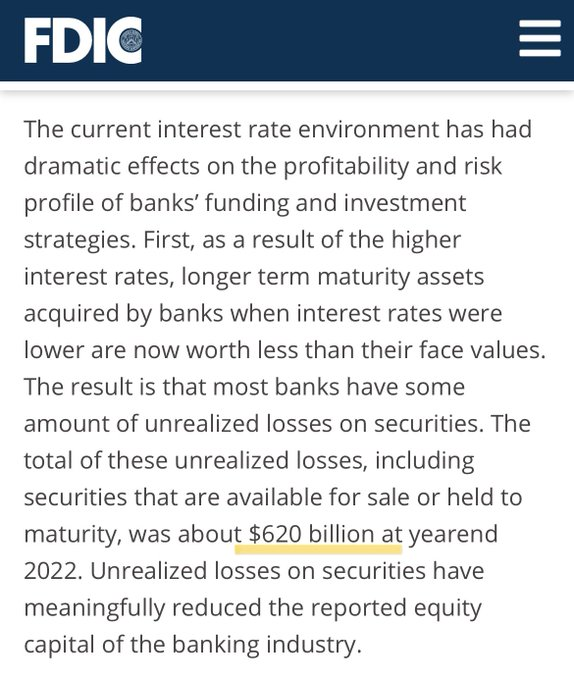

If you want to understand the context for the crisis, look at the Federal Deposit Insurance Corporation chair’s March 6 testimony — a week before Silicon Valley Bank’s collapse — where he explains that banks were sitting on $620 billion of unrealized losses from long-dated bonds. This provided the tinder for the crisis.

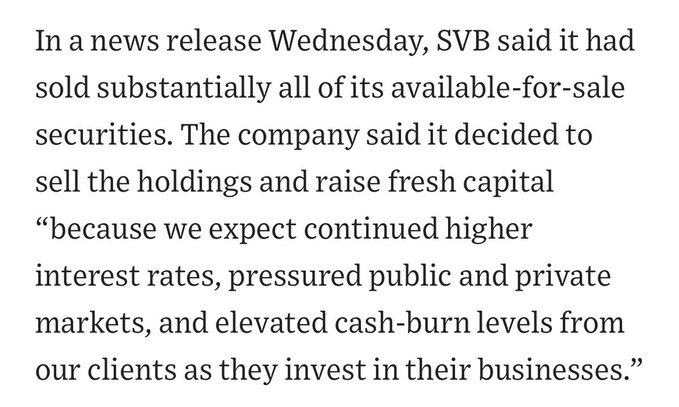

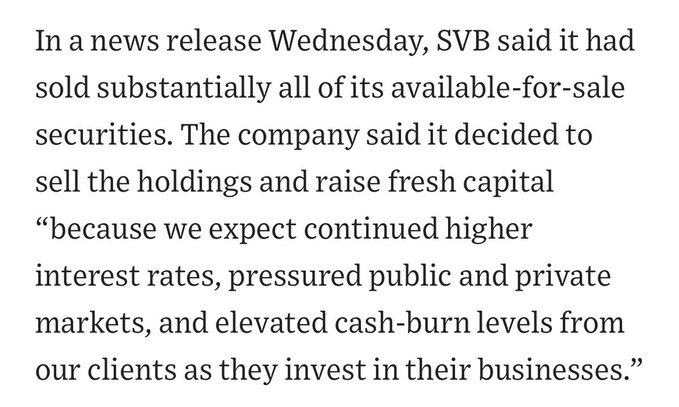

The match was lit when SVB announced on Wednesday, March 9, that it had effectively sold all of its available-for-sale securities and needed to raise fresh capital because of large unrealized losses from its mortgage bond portfolio.

Screenshot: Wall Street Journal

On Thursday morning, the financial press widely reported SVB’s need for new capital, and short sellers were all over the stock. The CEO’s disastrous “don’t panic” call later that morning only heightened fears and undermined confidence in the bank.

The idea that one needed “non-public information” to understand that SVB was at risk is drivel being peddled by populist demagogues. Any depositor who could read The Wall Street Journal or watch the stock ticker could understand there was no upside in waiting to see what would happen next.

By Friday, the run on other banks had begun. This became abundantly clear when regulators placed Signature Bank in receivership, announced a backstop facility for First Republic, and temporarily halted trading of regional bank stocks on Monday. Even trading of Schwab was halted.

Some unscrupulous reporters and political types have even claimed that I somehow caused this through my tweeting. Dang, they must think I’m Superman! Or maybe E.F. Hutton. But the timing doesn’t line up at all, as I already explained.

Once the run on the bank started, decisive action by the Fed was imperative. This meant protecting deposits (uninsured are 50 percent) and backstopping regional banks. No matter how distasteful you may find those things to be, preventing a greater economic calamity was necessary.

But back to SVB: Its collapse was first and foremost a result of its own poor risk management and communications. It should have hedged its interest rate risk. And it should have raised the necessary capital months ago through an offering that didn’t spook the street.

SVB doesn’t deserve a bailout and isn’t getting one. SVB’s stockholders, bondholders, and stock options are getting wiped out. The executives will spend years in litigation and may have stock sales clawed back. Anyone who thinks there’s a “moral hazard” isn’t paying attention.

But it’s important to understand that SVB’s failure didn’t arise from risky startups doing risky startup things. It arose from SVB’s over-exposure to boring old mortgage bonds, which were considered safe at the time SVB bought them. Perhaps this is why SVB had an “A” rating from Moody’s and had passed all of its regulatory exams.

What turned the mortgage bonds toxic? The most rapid rate-tightening cycle we’ve seen in decades. You can see the connection here between rapid rate hikes and unrealized losses in the banking system.

So what caused the rapid rate hikes? The worst inflation in 40 years. And what caused that? Profligate spending and money printing coming out of Washington — all while Joe Biden, Janet Yellen, and Jerome Powell assured us inflation was “transitory.”

I warned two years ago that pumping trillions of dollars of stimulus into an already hot economy was an unprecedented and likely dangerous experiment. But this was Bidenomics.

So when Joe Biden says he’s going to hold those responsible for this mess fully accountable, he ought to start by looking in the mirror. But I’m sure that’s not going to happen, just as I’m sure the hunt for scapegoats is just beginning.

David Sacks is an entrepreneur and author who specializes in digital technology firms. He is a co-founder and general partner of the venture capital fund Craft Ventures and was the founding COO of PayPal.

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: bankfailure; bloggers; bloghatingnutjob; bondrates; bonds; davidsacks; fdic; keywordkarenabuse; newsforumabuse; riskmanagement; svb

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

To: SeekAndFind

🤣🤣 yep got screwed on their own failed risk management.

2

posted on

03/15/2023 9:18:47 PM PDT

by

markman46

(engage brain before using keyboard!!!)

To: SeekAndFind

Don’t Blame Depositors For Bank Failure

Banks have faced this dilemma for centuries. If you try to ban a bank run, you create a bank run.

To: markman46

4

posted on

03/15/2023 10:18:53 PM PDT

by

TheConservator

(Beware the tyranny of the woke mob. There has never been a greater threat to liberty.)

To: TheConservator

If someone chooses to deposit their money in an unconventional bank because they offer better interest rates and VIP treatment:

It should not be my problem when that unconventional bank goes under. Not one of the uninsured SVB or Signature Bank depositors were naive, they thought themselves better or smarter than the rest of the rubes.

Turns out they may have been right given how fast they were bailed out.

5

posted on

03/15/2023 10:42:00 PM PDT

by

13foxtrot

To: TheConservator

Wonder who will be next in the got screwed in securities game

6

posted on

03/15/2023 11:23:08 PM PDT

by

markman46

(engage brain before using keyboard!!!)

Wasn’t Elon Musk also a founding member?

7

posted on

03/16/2023 12:24:35 AM PDT

by

Gene Eric

(Don't be a statist!)

To: markman46

8

posted on

03/16/2023 1:25:53 AM PDT

by

JubJub

( )

To: SeekAndFind

There is only the question of when will a

America wake up and realize that the dollar is not worth the paper it is printed on?

That and the fact that all of the conspiracy theories you have heard are probably true.

9

posted on

03/16/2023 1:45:41 AM PDT

by

.44 Special

(Taimid Buacharch)

To: SeekAndFind

To: SeekAndFind

“ No matter how distasteful you may find those things to be, preventing a greater economic calamity was necessary.”

The ever recurring theme.

To: GeneralisimoFranciscoFranco

“... preventing a greater economic calamity was necessary ...

The ever recurring theme.”

Applies to both ends. It was first the reason for throwing money at the Covid situation. Now it’s the reason for raising interest rates.

To: SeekAndFind

When the rates started creeping up, some institutions thought they could lock in the higher rates by buying the long term bonds. It assumed rates would go down or wouldn’t go higher.

Depositors, looking to get out of their .01% CD accounts have been steered by the banks to 3 plus year CDs paying three and four percent, telling them they can “lock in the rates”. Meanwhile money market funds are paying 4 plus percent and are perfectly liquid.

Banks are trying to lay off the mid term risk to their customers by trying to get them to lock in their cash with CDs.

13

posted on

03/16/2023 4:48:10 AM PDT

by

Fido969

(45 is Superman! Assumed that rates would go down, or wouldn't go higher.)

To: SeekAndFind

Depositors and not responsible for SVB’s failure, but they are responsible for protecting their cash assets of over $250k. There are multiple methods of protecting and insuring those assets. It smells to me that there is a case of cutting corners to avoid costs (actually very low costs) to effectively manage their money. Read that as greed, or in nicer terms, squeezing out every last penny of profit. It may be sheer incompetence and a lack of focus.

14

posted on

03/16/2023 6:13:46 AM PDT

by

ConservativeInPA

("How did you go bankrupt?" Bill asked. "Two ways," Mike said. "Gradually and then suddenly." )

To: Right_Wing_Madman

15

posted on

03/16/2023 6:40:32 AM PDT

by

GailA

(Constitution vs evil Treasonous political Apparatchiks, Constitutional Conservative.)

To: Gene Eric

Not that I can find anywhere. He says he has considered buying it this past few days though.

16

posted on

03/16/2023 7:18:58 AM PDT

by

JoJo354

(We need to get to work, Conservatives!)

To: Gene Eric

Musk is a co-founder of PayPal. According to Business Insider, Musk founded the searchable business directory Zip2 with his brother when Musk was 24. The brothers sold Zip2 for $307 million four years later. Musk used his $22 million profit from the sale to help start the online bank X.com.

Max Levchin and Peter Thiel had created the startup Confinity, which developed an online payment system called PayPal, according to Fast Company. In March 2000, Confinity merged with Musk’s X.com and the execs later renamed the company PayPal.

17

posted on

03/16/2023 8:20:32 AM PDT

by

StayoutdaBushesWay

(Trust in the Lord with all your heart, and lean not on your own understanding)

To: SeekAndFind

In fairness, Trump was totally on-board with all the pandemic spending authorizations in 2020. I would vote for Trump over almost anyone else (Republican, Democrat, or Independent).

But all the 2020 pandemic spending was a huge gamble.

Two weeks to flatten the curve was the BIG LIE.

To: Honest Nigerian

Ok, let’s accept that Trump had to spend because of the pandemic.

What is the excuse to CONTINUE that amount of spending AFTER the Pandemic?

To: SeekAndFind

Ok, let’s accept that Trump had to spend because of the pandemic.

*************************************

That is one nutty stipulation you are making (or requesting).

I don’t know what the excuse was to continue the spending.

But there always seems to be an excuse.

************************************

AND ... I reject your excuse that we need to accept that the pandemic spending was “necessary”.

BTW - when all the Covid bailouts were being made I predicted to numerous people that we would be re-paying all the largesse (which most people received to some degree) back at a rate of maybe 9 to 1.

Maybe it will be 14 to 1?

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Screenshot: Wall Street Journal

Screenshot: Wall Street Journal