Posted on 01/12/2024 10:26:11 AM PST by SeekAndFind

In the most recent BLS employment report, the percentage of full-time jobs relative to the population dropped sharply. The robust headline number of 216,000 led most media commentators to suggest a “soft landing” is at hand. However, the decline in full-time employment suggests recession risks are higher than thought.

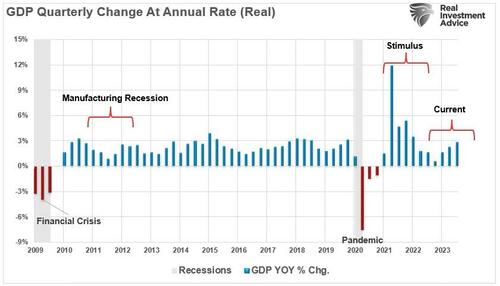

To understand why such is the case, we must first review why the current economic environment remains stronger than anticipated. In mid-2023, we discussed how the massive monetary infusions supported economic activity, and we were experiencing a “manufacturing” recession but not an economic one.

“In 2011, the world faced a manufacturing shutdown as Japan was shuttered by an undersea earthquake creating a tsunami. The flooding of Japan also sparked a nuclear meltdown. Simultaneously, the U.S. was entrenched in a debt ceiling debate, a debt downgrade, and threats of default. Given the combination of events, the economy’s manufacturing sector contracted, convincing many of an impending recession. However, as shown, that recession never happened.“

Much like in 2011-2012, the manufacturing side of the economy has been in contraction for over a year, as shown by the ISM Manufacturing Index.

The reason such was possible is that the service sector of the U.S. economy kept the economy afloat. Unlike in the past, where manufacturing was a significant component of economic activity, today, services comprise nearly 80% of each dollar spent.

This isn’t the first time we have seen the manufacturing side of the economy contract, but services remained robust enough to keep the overall economy out of recession. The economy similarly avoided a “recession” in 1998, 2011, and 2015.

Let’s build a composite index and economically weigh services and manufacturing to the current environment. We can more clearly see why the economy has avoided a recession.

So, what does that have to do with full-time jobs?

With high inflation and interest rates, how has the services side of the economy held up so well? That was a function of a tremendous amount of fiscal liquidity poured into the economy. However, as shown above, service growth has slowed as those “excess savings” ran out. In the future, wage growth and employment will be the supporting factors for economic activity, which is critical to understand.

The U.S. is a consumption-based economy. However, consumers can not consume without producing something first. Production must come first to generate the income needed for that consumption. The cycle is displayed below.

Of course, if you bypass the production phase of the cycle by sending checks directly to households, you will get a strong surge in economic growth. As shown in the GDP chart above, the massive spike in economic growth in the second quarter of 2021 directly resulted from those fiscal policies.

However, once individuals spent that stimulus, the economic activity subsided as the production side of the equation was still lagging. Here is the crucial point about full-time jobs.

“For a household to consume at an economically sustainable rate, such requires full-time employment. These jobs provide higher wages, benefits, and health insurance to support a family. Part-time jobs do not.”

While the media touts the ‘strong employment reports,’ such is mostly the recovery of jobs lost during the economic shutdown. As shown, full-time employment as a percentage of the working-age population failed to recover to pre-pandemic levels.

There are two crucial points in this data. First, the economy has NOT created millions of “new” jobs, as touted by the current administration. Secondly, relative to the working-age population, full-time jobs dropped dramatically, generally seen at the onset of recessions. Combine that with the decline in wage growth, and the potential stress on the service sector becomes more apparent.

As the economy slows down, it should not be surprising that full-time jobs are declining.

To protect earnings and profitability, cutting full-time jobs, the most significant expense to any business, is the most efficient. While employers tend to hang on to employees as long as possible, employees eventually get sacrificed when protecting profits. As such, a reasonably predictable cycle continues until exhaustion is reached.

With CEO confidence currently at levels usually associated with recession, it should be unsurprising that full-time jobs are declining.

Such is particularly the case with the surge of foreign-born workers pouring into the U.S.

That large pool of workers, who tend to work longer hours for less pay than native-born workers, gives companies an alternative hiring source to replace full-time with part-time workers.

The alternatives for higher-skilled workers include swapping full-time employees for technological improvements, artificial intelligence, and robotics to reduce costs.

As we discussed in why “Minimum Wage Increases Hurt,” when faced with threats to profitability, companies will opt to reduce head counts. This was a point made in a previous report by the Congressional Budget Office:

By increasing the cost of employing low-wage workers, a higher minimum wage generally leads employers to reduce the size of their workforce.

The effects on employment would also cause price changes and the use of different types of labor and capital.

By boosting the income of low-wage workers who keep their jobs, a higher minimum wage raises their families’ real income, lifting some of those families out of poverty. However, real income falls for some families because other workers lose jobs, business owners lose income, and consumer prices increase. For those reasons, the net effect of a minimum wage increase is to reduce average real family income.

You should read that last sentence again.

While the recent downturn in full-time jobs is very early, it is a data point worth paying close attention to. Regardless of whatever else is happening in the world, a recession will ensue if full-time jobs continue to decline. Such is something the CEO confidence survey already suggests is happening.

Sure, this “time could be different.” The problem is that, historically, such has not been the case. Therefore, while we must weigh the possibility that analysts are correct in their more optimistic predictions of a “soft landing,” the probabilities still lie with the indicators.

Full-time jobs are an indicator that is worth paying very close attention to.

High Tech is repeating 2002 firing Americans and hiring from India.

This time they are “protected” by DEI.

The ghost of Carly Fiorina is back destroying American companies.

The contraction in manufacturing was just a matter of time.

There was a huge short term decline during the covid shutdown, quickly followed by a huge up tick in demand for two years.(2020-2022)

As a manufacturer, it doesn’t make me happy, but that’s the reality. My preference is a less boom & bust market, a slower more consistent market makes planning easier than having all these wild swings in supply & demand.

I don’t/won’t look seriously at any graph or pictorial from BLS UNLESS they publish what they predict and report - and LATER REVISED the following month when their BS has to be reported.

I don’t/won’t look seriously at any graph or pictorial from BLS UNLESS they publish what they predict and report - and LATER REVISED the following month when their BS has to be reported.

*************

Good point, they’ve been caught cooking the numbers more than once over the years.

You are right on beam as usual. What else are you seeing “going forward”?

Bidencession.

Plenty of jobs working for the government doling out free stuff for illegal immigrantgs.

You are right on beam as usual. What else are you seeing “going forward”?

****************

Saxxon,(Good to hear from you, it’s been awhile.)

Hard to tell on the overall economy, my expectations on manufacturing is a “slow hard slog” until summer.

It’s only anecdotal, but I cut my shop rate substantially a couple of months ago.(We’ll be fine.)

You should see some lower pricing in the fall of 2024.

Enough of boring economics, lets look at important stuff.

How is the music gig going?😀👍

Thanks for the biz take. Music, I’ve been playing but just went on sabbatical from that act to study as the rolling gig/prep/rehearse/gig routine was feeling stale. Going to the Bahamas in May to flyfish for Bonefish and Permit and shoot an American Sportsman episode with a 45-year friend who hosts episodes of the show. He’s a Nashville singer/songwriter and I’ve been asked to play on a special recording being done for a musician everyone knows who is very ill. A group of Nashville writers are going to record a cover of his biggest hit. He has agreed to sing just the first iconic line. About 6 writers involved, they play and write together all the time. I’m cutting the bass track if it comes together. Song will be a hit again if they do it, will be a big feather in the cap. So, things are pretty exciting, thanks for asking. I assume you are rolling with the waves?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.