Skip to comments.

Will "Private" Oil Sink the NYMEX? (End of fungible oil)

www.investmentu.com/ ^

| 08-2008

| Stewart Miller and the Investment U Research Team

Posted on 08/16/2008 2:18:24 PM PDT by dennisw

Will "Private" Oil Sink the NYMEX?

Oil-Rich And Oil-Hungry Governments Are Ditching Conventional Markets And Locking Up Reserves… Here's How They Could Permanently Destabilize the Price of Crude

An Investment U White Paper Report

by Stewart Miller and the Investment U Research Team

The world's largest governments are drastically changing the way they buy and sell oil. And it could affect every family, small business and multibillion-dollar corporation across the globe…

So far, this historic shift has been scarcely reported. But the transformation is undoubtedly underway, and quietly altering the future of energy.

Rapid economic expansion in Russia, India and, most importantly, China, has led the governments in these countries to review their traditional sources of oil, and to make substantial changes in the way they get it.

And they've opted to circumvent the traditional distribution networks of the New York Mercantile Exchange (NYMEX), and other bourses, entirely.

In fact, they're undermining them, "locking up" supplies by purchasing crude from oil-producing countries directly - behind closed doors:

- Angola committed to supply China with 200,000 barrels per day of crude at $60/barrel for the next 10 years, in return for Chinese investment in infrastructure projects such as railroads, roads and bridges.

- India already imports about 24 million tons of crude from Saudi Arabia every year, which is 26% of its total crude imports. It has stated a desire to secure long-term contracts to assure delivery in the future. Indian public sector firms have participating interests in oil and gas projects in Vietnam, Sudan, Russia, Iraq, Iran, Myanmar, Libya, Syria, Australia, Ivory Coast, Qatar and Egypt.

- Russia, India and China are involved in efforts to build and control petroleum pipelines throughout the central-Asian and Middle Eastern regions. The Shanghai Cooperation Council, for instance, was formed to ensure that oil from the giant Baku-Tbilisi-Ceyhan pipeline flows to the East, not West.

This strategy is coming to be known as "Energy Mercantilism." Producers - and consumers - are bypassing the marketplace altogether. And it's taking massive quantities of oil off the open market.

Now, the crude oil market's forecast is wide open. The free markets that have historically determined the pricing and allocation of oil are in sudden danger of extinction. And with them, competitive prices for U.S. consumers…

State-Run Oil Will Dominate the World Energy Market

In the past, the world has relied on an open marketplace to set the price of energy. For decades, the NYMEX has been the epicenter of energy trade.

But China and India, in cooperation with a key supplier, Russia, have turned the tables by making bi-lateral agreements to lock in long-term supplies at set prices, or by forming consortiums to guarantee supply.

China has become the world's second-largest importer of oil. And the U.S. Energy Department estimates that the country's demand will more than double, to 14.2 million barrels a day, by 2025. More than two-thirds of that will be imported.

Currently, China builds cities the size of New York twice a year.

Every time a new barrel of oil is discovered, the world uses four existing barrels. But China and India's demand for oil is still in its infancy - around 1.3 barrels per person per year, compared to 4.4 barrels per person per year in the developed world.

When their economies begin using 2.4 barrels per annum per person, they'll need 24 billion barrels of oil a year - double the current amount consumed worldwide.

What's important to emphasize is that in this new Energy Mercantilism, oil prices are locked-in, no matter how the market fluctuates in the future. That means not everyone will pay the same price for oil, fundamentally altering the dynamics of the energy marketplace. It directly counters market pricing, and destabilizes the supply/distribution channels that currently determine who can afford oil.

And These "Private" Oil Deals Are Beginning To Roll in…

- In Russia, Vladimir Putin has been squeezing Europe by withholding supplies of natural gas while negotiating for exclusive pipeline deals. In 2003, he dismantled the Yukos oil group who had expanded dealings with the West. He has explicitly stated that Russia will demand bilateral long-term supply contracts with consuming nations, so Russia could guarantee stable demand for its exports.

- China National Petroleum Corp. has entered joint development agreements with Sudan, which is forecasted to produce as much as 300,000 barrels per day by the end of 2006. Another Chinese firm, Sinopec Corp., is erecting a pipeline from that complex to Port Sudan on the Red Sea, where the Chinese are building a tanker terminal for shipping raw crude to the Chinese mainland. Altogether, Sudan, despite conducting what is widely regarded as genocidal warfare not far from the oilfields, provides 10% of Chinese petroleum imports.

- In November 2005, Chinese President Hu Jintao toured Latin America and completed a number of economic deals, including an oil deal with Argentina. Hugo Chavez, the President of Venezuela, has said Chinese firms would be allowed to operate 15 mature oil fields in eastern Venezuela, which could produce more than one billion barrels. Chavez has also invited Chinese firms to bid for natural gas exploration contracts.

- Sinopec, China's state-owned oil giant, signed a $70 billion deal with the Iranians in November 2004 to develop the Yadavaran oil field. Sinopec will also buy 250 million tons of liquefied natural gas over 30 years. Iran is committed to export 150,000 barrels per day of crude oil to China for 25 years.

- Recent testimony before the Congressional Committee on National Security, Emerging Threats and International Relations, outlined how China's three state-owned oil companies "have managed to establish control over about 3 mb/d [million barrels a day] of crude production, which could reach up to 6 mb/d by 2008."

The fact is, 90% of world reserves are controlled by national oil companies, as opposed to market-driven public companies.

Exxon Mobil (NYSE: XOM), for example, is the largest publicly traded oil company. And it ranks only 14th in proven reserves, directly below 13 national oil companies, including those of Iran, Venezuela, and other governments overtly unfriendly to the U.S.

Forecasting Crude Oil… The Bottom Line

A task force for the Council on Foreign Relations (CFR), a highly respected Washington think tank, recently released a report that contains dire predictions for our economy and global oil markets.

Led by ex-CIA chiefs John Schlesinger and John Deutsch, the group reports that the United States will be unable to achieve energy independence any time in the foreseeable future, even with massive injections of ethanol, wind power and other alternative fuels.

Noting the potential ramifications of Energy Mercantilism, it recommends radical conservation initiatives, possibly including higher gasoline taxes and gasoline rationing.

It also calls for the implementation of "an active public policy… to correct these market failures that harm U.S. economic and national security."

"Most oil and gas resources," the report states, "are controlled by state-run companies, some of which enter into supply contracts with consumer countries that are accompanied by political arrangements that distort the proper functioning of the market."

Conclusion on Crude Oil and the NYMEX

The fact is, more and more oil buyers and sellers are hooking up directly, outside of the marketplace. And in many cases, they're including other "payments" into the transactions - direct investment, infrastructure development, political favors, trade agreements, etc.

And therein lies the uncertainty. How does one know if he's paying the going rate for oil when a going rate doesn't exist?

Don Miller, Investment U Researcher

TOPICS: Business/Economy; Foreign Affairs; News/Current Events

KEYWORDS: energy; energyfacts; energyprices; geopolitics; oil

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-47 next last

To: dennisw

How did I ever get the idea that OPEC set oil prices?

To: dennisw

In a sense this whole argument is—or should be—an academic one for the USA, because, counting North American proven reserves plus tar sands, oil shale, and coal, we have enough oil/oil subsitutes for hundreds of years. Taking that into account, we have no need to compete with China or India for oil.

But at the moment, America just lacks the will, including the political will to throw Democrats out of office when necessary.

22

posted on

08/16/2008 3:10:22 PM PDT

by

denydenydeny

("[Obama acts] as if the very idea of permanent truth is passe, a form of bad taste"-Shelby Steele)

To: dennisw

Please tell me you don't go along with Limbaugh on this There's no need to. It won't happen. The new offshore production (and ANWR) will be restricted to the U.S. market.

And that will work out fine us -- so long as Nancy and the Dems don't decide to punish us further for using fossil fuels.

23

posted on

08/16/2008 3:16:36 PM PDT

by

okie01

(THE MAINSTREAM MEDIA: Ignorance on Parade)

To: fightinJAG

"These prices are 'locked-in' by contracts. But what is the enforcement mechanism should a party renege?"

Military force, the same thing that has always run the world.

24

posted on

08/16/2008 4:01:48 PM PDT

by

penowa

To: dennisw

Basically, the author doesn’t understand markets. If 200K barrels is provided off market, then 200K is also demanded off market. It cancels out, the world price is intact.

25

posted on

08/16/2008 4:07:04 PM PDT

by

Ron Jeremy

(sonic)

To: Chgogal

The Globalists ain’t gunna like this,,,

Mite be a good thing...;0)

26

posted on

08/16/2008 4:09:45 PM PDT

by

1COUNTER-MORTER-68

(THROWING ANOTHER BULLET-RIDDLED TV IN THE PILE OUT BACK~~~~~)

To: dennisw

Some good reasons why all new oil from US Government lands such as Alaska and new offshore drilling should be by law reserved for US refineries and use within the United States. None is sold abroadThat would be excellent. How realistic is it for individual oil producers to reserve their oil for the US? Do they currently sell to refineries and the refineries make the decision as to where the product is sold?

27

posted on

08/16/2008 4:14:33 PM PDT

by

ovrtaxt

(This election is like running in the Special Olympics. Even if McCain wins, we're still retarded.)

To: 1COUNTER-MORTER-68

As long as we don’t sell our “natural resources” to the highest bidder who may not be us.

28

posted on

08/16/2008 4:14:52 PM PDT

by

Chgogal

(Voting "Present" 130 times might be a sign of a smart politician. It is not a sign of a good leader.)

To: Ron Jeremy

It really is dependent how short certain entities are. I'm thinking Japan prior to WW2. The commodity market was dysfunctional then. If it gets dysfunctional again, well someone may be willing to go to war for let's say, a pipeline.

29

posted on

08/16/2008 4:20:03 PM PDT

by

Chgogal

(Voting "Present" 130 times might be a sign of a smart politician. It is not a sign of a good leader.)

To: dennisw

30

posted on

08/16/2008 4:20:16 PM PDT

by

berdie

To: okie01

>But it’s a helluva lot more efficient to ship the crude oil to the nearest refineries and markets.

Japan is a closer market for Alaska oil than most US refineries.

To: dennisw

32

posted on

08/16/2008 4:35:57 PM PDT

by

Free Vulcan

(No prisoners. No mercy. Fight back or STFU!!!)

To: chipengineer

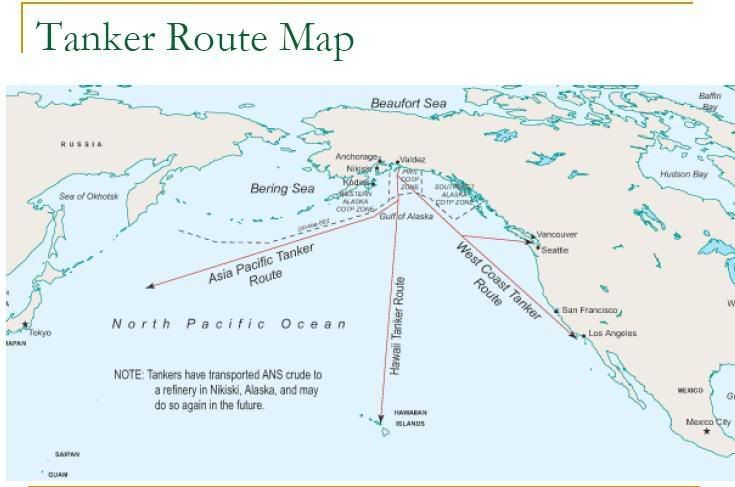

Japan is a closer market for Alaska oil than most US refineries. Literally, you are correct...BUT North Slope oil isn't shipped to Gulf Coast refineries. Instead, it is shipped solely to West Coast refineries -- where it is then refined and marketed on the West Coast.

There are refineries in the Puget Sound area, on San Francisco Bay and in Long Beach/LA.

The furthest of these from the TAPline terminus at Valdez would be Long Beach, some 2362 statute miles. The distance from Valdez to Tokyo is 3458 statute miles, over a thousand miles further.

33

posted on

08/16/2008 4:46:11 PM PDT

by

okie01

(THE MAINSTREAM MEDIA: Ignorance on Parade)

To: dennisw

Death of your fungible oil. LOL!!!

Putin also dealt a blow to free and fungible oil when he invaded Georgia. Oil ain’t fungible without a pipeline!

So are those customer without oil or are they going to get oil from other suppliers?

I believe this will demonstrate yet again the fungibility of oil.

34

posted on

08/16/2008 4:47:35 PM PDT

by

thackney

(life is fragile, handle with prayer)

To: dennisw

The laws allowing North Slope oil mandated it all be kept in the USA.

This law was slightly modified during an oil glut First time I ever heard a law that was completely eliminated without qualifications or limitations as:

"slightly modified".

35

posted on

08/16/2008 4:50:50 PM PDT

by

thackney

(life is fragile, handle with prayer)

To: Chgogal

Some things are worth more than $$$ to some people...

36

posted on

08/16/2008 4:58:18 PM PDT

by

1COUNTER-MORTER-68

(THROWING ANOTHER BULLET-RIDDLED TV IN THE PILE OUT BACK~~~~~)

To: dennisw

Noting the potential ramifications of Energy Mercantilism, it recommends radical conservation initiatives, possibly including higher gasoline taxes and gasoline rationing. That will certainly spur development and economic growth.

37

posted on

08/16/2008 5:06:55 PM PDT

by

VeniVidiVici

(A kid at McDonalds has more real-world work experience than Barack Hussein.)

To: fightinJAG

It will be entertaining watching those thieves cheating each other.

38

posted on

08/16/2008 5:20:39 PM PDT

by

darth

To: chipengineer

39

posted on

08/16/2008 5:24:43 PM PDT

by

thackney

(life is fragile, handle with prayer)

To: businessprofessor

These state run energy companies are notoriously inefficient. Some are, some are not. The state companies that let their oil business focus on oil business, like Saudi Aramco and Petrobras do rather well. Pemex, PDSVA and similar companies that don't invest enough for future production and instead over-milk their cash cow don't have such a bright future.

40

posted on

08/16/2008 5:34:00 PM PDT

by

thackney

(life is fragile, handle with prayer)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-47 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson