Posted on 12/30/2014 11:33:06 AM PST by blam

December30, 2014

John_Rubino

Twelve short months ago, the immediate future looked like a lock. Overvalued equities had to fall, ridiculously-low interest rates had to rise, and beaten-down precious metals had to resume their bull market.

The evidence was overwhelming. Debt in the developed world had risen to $157 trillion, or 376% of GDP, by far the highest level on record and clearly unsustainable. Long-term US Treasury rates had been falling for literally three decades and despite a recent uptick were so low that the only way forward seemed to be up.

Europe and Japan were drifting into recessions that could easily morph into capital-D Depressions. The eurozone would fragment, Japanese bonds and probably stocks would crater, one or more major currencies would implode. No way to know which event would come first and in what order the other dominoes would fall, but without doubt something had to give.

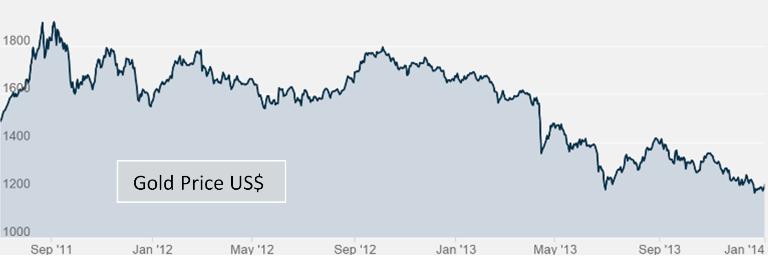

And gold, of course, had had its correction and was, at the beginning of 2014, perilously close to the mining industry’s cost of production. The last time that happened, in 2008, an epic bull market ensued — and gold-bugs were anxious for a replay.

Yet 2014 turned out to be a pretty good year for the powers that be and the economic theories that animate their behavior. Equities boomed, interest rates fell, the dollar soared, and gold ended the year below where it started. Gold miners, after a year of operating at an aggregate loss, have seen their market values crater.

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

It worked in Germany. If the dollar crashes the tractors will still start, the ovens will still light, the cattle will still graze. It will just be a matter of deciding who gets the sustenance that will still be produced. People with valuable skills will exchange their skills for sustenance. Also people with gold and silver will exchange their real money for sustenance. The government will step in and distribute what is left over for the masses that choose to depend on them. They will get the minimum.

lol Every pro-Fedder likes to assume every gold owner on earth bought their gold at the 1980 high. No, some bought when it was under $250 around 1999 and at other low price periods.

That’s no more disingenuous than claiming that gold always tracks inflation (it doesn’t), or bragging about buying in at the lowest possible price.

The truth, as always, is somewhere in between the two extremes.

It’s true that gold is a shiny metal, but it’s also true that it doesn’t decompose over time (think rust, corrosion, etc). This means that if you have an ounce of gold today, it will be an ounce of gold in 50 years. It is stable.

There is also a limit on the amount of gold available, and a significant cost associated with increasing that amount (on the order of $1400-1500/oz, all in). Paper money has a small production cost and electronic money has almost no production cost.

Gold price has gotten lower over the last year because it is in the best interest if the powers that be to keep the price low. Agents of the PTB can sell an unlimited quantity of gold on the Comex because they have no expectation of having to deliver it to the buyer. If push came to shove, the sellers would (and have) settled the contracts in cash.

Gold has long been a barometer for inflation. If gold remains low, the PTB can point to it and say, “Look, gold is low so there can’t be inflation.”

Printing (creating) money will eventually result in inflation for goods the money is used to buy. 40 years ago those goods were real (remember Carter), so prices of goods went up dramatically.

Today printed money is being used to prop up the stock and bond markets. The PTB can point to the markets and say, “Hey, look. The markets are strong so the economy must be good.” Actually, inflation from newly created money is showing up in stock and bond prices, not in the prices of goods.

That’s what happens when printed money goes to Wall Street and not to Main Street.

No see it didn't because you are equating the German currency with the dollar.

The Dollar is the reserve currency of the world. When it collapses the entire World financial system collapses. Further when the weimar collapsed they weren't as dependent on oil as we were their food was still mostly produced by men and livestock.

We import far more oil than we produce we can't produce enough oil for a month of our needs let alone a year. and if we don't have oil we don't have crops because our food system is totally dependent on oil.

When the dollar collapses the oil stops and the Entire Western world grinds to a halt. Do you think the world will want to use a NEW American Dollar as the reserve currency?

Do you think China will still buy our Treasuries? Sorry but you magic Gold bars won't fix the situation that the world will descend into. There will be a system wild upheaval that will make the dark ages look like a walk in the park.

I've never said it follows inflation precisely. I have said it's never went to zero. At any point in history, there's been people within a reasonable distance willing to pay a good price for it. That is not true of all the failed fiat currencies.

You typed a lot of words but you didn't say much. Bottom line is, no matter what happens, anyone with gold and silver will be able to trade for sustenance.

The inflation adjusted price of gold fell from over $2400 in 1980 to $364 in 2001. Over those 21 years, gold lost over 80% of its value. Simultaneously, the Consumer Price Index went from 82.4 to 177.07. Prices for consumer staples more than doubled.

So, over a good span of both our lives, gold has been a horrible investment. Gold is a safe haven in times of economic turmoil, period. Don’t fall in love with it and don’t even begin to think buy and hold because you will lose your proverbial backside.

The time to sell with the most recent run up of gold was last year. The price has fallen from over $1,800.00/oz to bumping around in the vicinity of $1,200.00/oz. in that time.

What sort of loss, in a year, does this represent? And, how does that loss compare to other investments in the same timeframe?

Only when there is excess food. You fail basic economics.

Few people bought in 1980 and few people sold in 2001. You're cherry-picking again.

Over those 21 years, gold lost over 80% of its value. Simultaneously, the Consumer Price Index went from 82.4 to 177.07. Prices for consumer staples more than doubled. So, over a good span of both our lives, gold has been a horrible investment.

And over a good span gold was a wonderful investment, from 2001 to around 2010. See how easy it is to cherry-pick. But regardless, when I buy physical, it won't be as an investment, it will be to keep back in case of a dollar crash.

Gold is a safe haven in times of economic turmoil, period. Don’t fall in love with it and don’t even begin to think buy and hold because you will lose your proverbial backside.

One should never put all one's eggs in one basket. Investing 101, No Shiite!

The time to sell with the most recent run up of gold was last year. The price has fallen from over $1,800.00/oz to bumping around in the vicinity of $1,200.00/oz. in that time.

Wow, isn't hindsight wonderful. lol

What sort of loss, in a year, does this represent? And, how does that loss compare to other investments in the same timeframe?

You're preaching to the wrong choir. When I buy it will be physical to hold.

I'll remember you said that if and when the fiat dollar crashes.

I'll add you to my contrary indicator pile.

Gold is only useful if there is something to buy. You claim your gold will save you because farmers will drop everything and sell their food to you for your gold.

The problem with your plan is if the dollar collapses there will be no dollars to buy oil.

No oil means no gasoline and fertilizer.

No gasoline and no fertilizers means the US food production will plummet. And thus a farm that used to feed hundreds will now barely feed the people who live on it because they will need to work it by hand.

That is of course unless the government swoops in and gets oil by force (whether it be political force or military force does not matter) then the whole capitalistic system is gone. The government will control the oil and thus the food production. Show your gold to the government then to buy food and they will take it from you. And if you don't believe me just check your history. Executive Order 6102

Ardent goldbugs have every psychological defense lined up to support their goldbuggery. I don’t disparage gold as a store of value in times of economic turmoil but it’s not a panacea. There has to be a willing buyer, and for that to be the case there has to be some semblance of a functioning economy, but envisioned total economic breakdown is the scenario that has them buying gold despite it now being a major losing proposition, the glory days ended last year. There’s no point in debating, they cherry-pick, you point that out and show a much worse decline over a period twice as long, and they accuse you of cherry-picking. They’re in love with their investment come hell or high water and there’s no persuading that perhaps that fiat money would be better spent elsewhere while it still spends, lol.

Yeah, I know all about FDR and his illegal activities. There will still be trade if the dollar collapses. The question is who will be doing the trading. Those with gold and silver.

Grey Men and you sir are not one. You have not a clue.

“Holding physical gold and silver is an insurance policy.”

It’s even better when you buy insurance in 1999. (Yes - I was a Y2Ker. My generator still runs too. When I need it.)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.