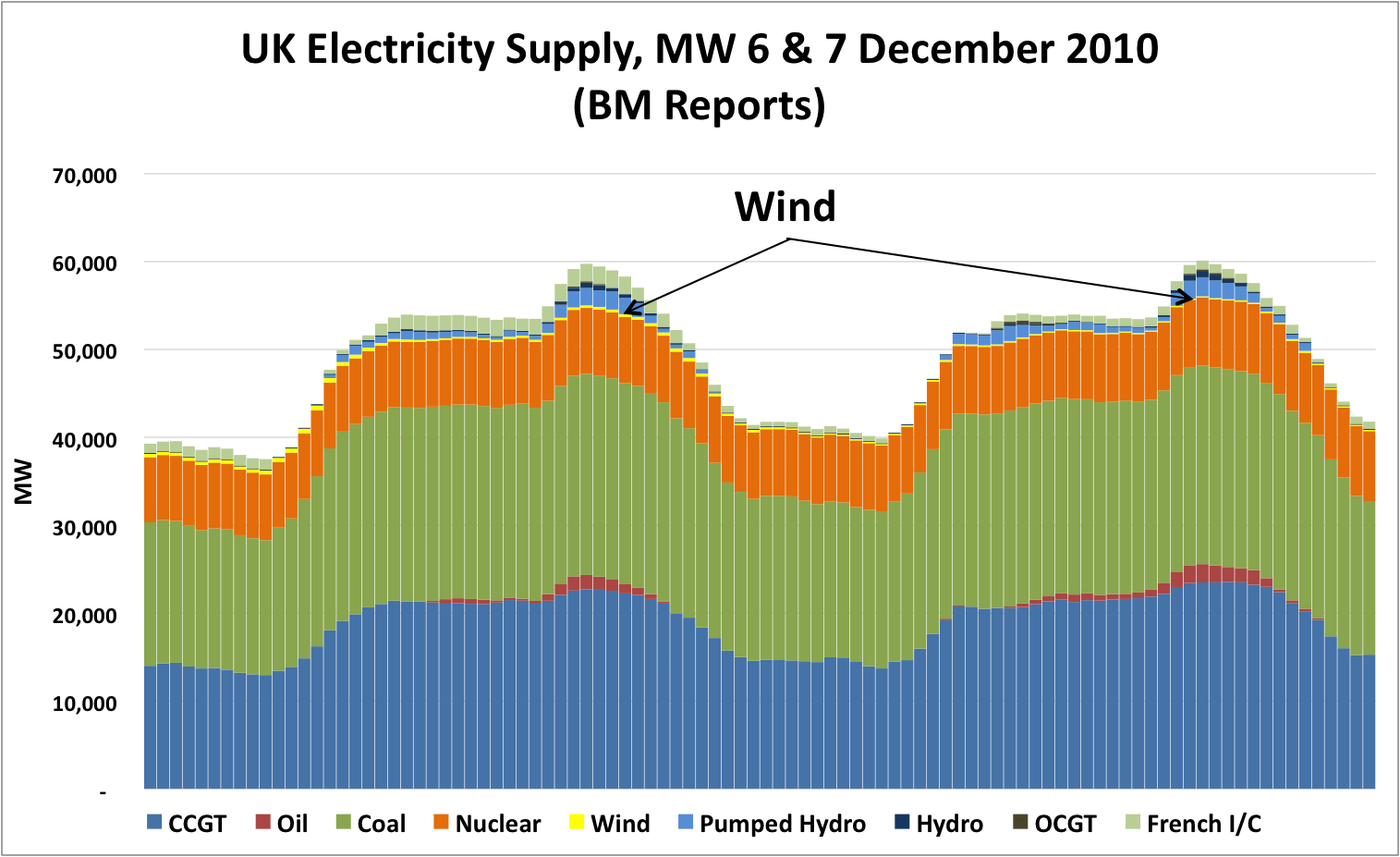

This winter is proving once again that, just when it is needed most, wind power (installed capacity > 5 GW) can provide the nation with no effective, reliable generation capacity at all. And forget about photo-voltaic output (PV)!

Dr Constable’s article is not so much focused on the reliability of renewable energy so much as its hidden cost to consumers who pay the whole cost, including subsidy, for all renewable energy. It is frightening that the expanding fleets of wind turbines and many GW of installed photovoltaic generation still require subsidy at all, given their market maturity and the many £ billions of subsidy they have received already.

As he writes, “…the costs of environmental legislation tend to be moderate in the short run, with the pain of the full impact only likely to be felt in years beyond the political horizon.” So true! The sinister reality is that these rising costs are like a line of still-invisible torpedoes, all on target, all heading for the engine room of the UK economy which is likely to blow up and sink the boat with all its unsuspecting passengers.

If this all sounds like “anti-renewables” hyperbole, UK readers who wish to learn more about the way these costs creep up on consumers, can read all about it at the English language version of Germany’s Der Spiegel at Will High Costs Kill Merkel's Green Revolution?. Unlike the UK, Germany has actually built a huge renewable energy capacity, every kW financed by feed-in tariffs, under-written by all consumers. Germany is looked to as the model for promoting further expansion of renewable generation in UK. In the past year, Germany’s PV capacity has almost doubled from 9.4 GW to something between 17 and 18 GW, representing a sunk investment of something between € 50 and €60 billion, the repayment of which will fall on all consumers during the next twenty years. Yet this vast investment yields the equivalent of just 2% of German generation!

Dr Constable also points to Spain which, to avoid exposing its citizens to the real cost-pain of renewable energy through the tariffs they pay, undertook to repay investors through the tax-base. The result is a deficit that is reported to be growing towards €22 billion by December 2010. (Spanish Tariff Deficit to Grow 30% in 2011, Economista Says and Solar investors outraged by Spain's slashing of subsidies) . This deficit is unlikely ever to be re-financed by the markets and could result in the bankruptcy of many of the original investors, some of which are among Spain’s largest power companies.

Dr Constable’s paper expertly exposes the threat to consumer prices if the UK Government does not soon review its current intentions and embrace the German model. Fortunately for the UK, at this point it is saddled with relatively light liabilities, compared with its European peers. There is still time to step back and reconsider our whole renewables subsidy strategy.

From the text, I am not entirely sure that Dr Constable shares my gloom over the rising price and growing scarcity of oil and coal – and therefore, inevitably, of gas. He writes “Concerns over gas availability and price appear to be alleviated by the unexpected growth of global shale gas production…”.

If this surmise is right, it will certainly be a wonderful thing. The view of most conventional analysts is that shale gas makes gas “forever” abundant and that the price link between oil and gas is broken. This view is likely to be shared by the Department for Energy and Climate Change (DECC) on the somewhat specious grounds that this is the advice they will receive from upstream industry analysts. In a future article, we shall review the record of the upstream industry’s advice to predecessors of the DECC, being the DTI and BERR; on the whole it has been woeful.

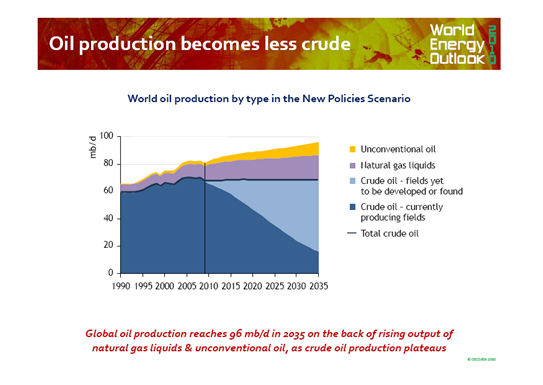

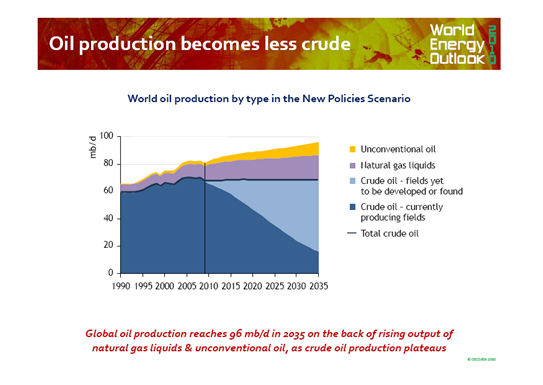

If indeed peak conventional oil flows occurred in 2006, as seems likely from the IEA’s latest “World Energy Outlook”, published on 9th November this year, then it is hard to be anything except gloomy about oil prices (and therefore supply security) from 2011 onwards.

Slide 8/23 of the IEA’s press pack, 9 November 2010.

This slide tells us that in order for conventional crude oil volumes to be maintained at around 74 million barrels per day, the upstream oil industry must find, develop and commission new, conventional oilfields at the rate of a Saudi Arabia equivalent every five years. No serious energy analyst could possibly accept this hypothesis. And nor do they. The analysts are once again, with some honourable exceptions, staying as mute over the fact that we are over “peak oil flows” as they are about the UK’s energy prices.

There is ample evidence on this site and a growing body of fact-based evidence elsewhere, that growing demand from Asia will push up global demand faster than this can be supplied. The IEA understands this very well but still appears to fear the wrath of its OECD paymasters if it dares to be frank about the extreme fragility of energy supplies. Just over two years ago, during the summer of 2008, on the top of the global boom, global oil demand could simply not be met by global supply, despite record prices. There are siren voices claiming that there is “6 million b/d of spare capacity” at OPEC that can be mobilized as demand continues to rise. The truth is that as we enter 2011, with the oil price once again about to break through the $100/b ceiling (~$17/GJ), that only another global financial crisis can prevent run-away oil price inflation during the next decade, with dire consequences for the UK’s balance of payments.

Even mature businessmen who should know better seem to prefer optimistic myth to studying facts. We will shortly publish a scholar’s review of WEO 2010. In the mean time readers are encouraged to read TheOilDrum's review of WEO 2010 “Questionable assumptions and major omissions” and “Don’t worry be happy” which examines the US EIA’s year-end energy review.

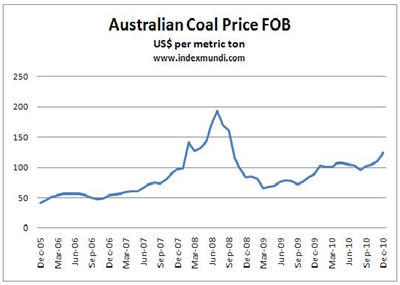

Hitherto, the conventional and comforting view has been that coal can “fill the energy gap” and that the Fischer-Tropsch (coal to liquid) process can keep liquid demand satisfied. This view, often cited by economists, ignores the huge upfront capital costs of Fischer-Tropsch and the long lead times of such capital intensive processes. It also assumes that coal will remain abundant and cheap. And it is the belief of most of the globe’s most influential citizens that CO2 emissions from burning oil, coal and gas threaten the very health of the Globe, so in Europe and probably America, supply will have to get very much worse and liquids prices must rise before any new coal-to-liquids plant gets built.

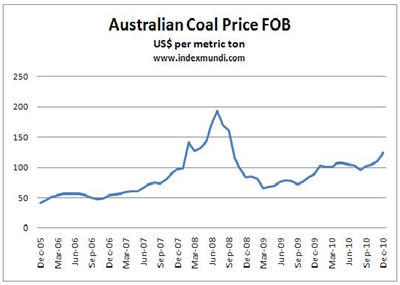

But as the reality of “peak oil” has become clearer, scholars are beginning to question the optimistic assumptions about coal supply. China and India are between them burning about half of all coal mined. China produces and consumes roughly 42% of global coal (3 billion t/y) and until 2008 was a significant coal exporter, despite that its historical annual increase in demand is between 150 and 200 million tons. However, China imported significant amounts of coal for first time in history during 2010. We have to remember how very small the ship-born market for thermal coal actually is – less than 700 million tons per year. (Coal Statistics).

China’s share of ship-born coal this year was 130 million tons; the direct consequence of this has been a doubling of the price of coal since the end of 2009. What will happen during 2011, if China looks for up to 300 million tons from the international market, is still unknown but prices are likely to be increased again. We expect coal supply security to become a major issue during 2011.

It is clear enough that the China understands the parlous state of its energy supply security well. Chinese state and privately owned energy suppliers are scouring the Earth for fossil fuel and other basic industrial commodities and are out-bidding international bidders to secure the resources for the Chinese market, as any reader of the Financial Times knows very well.

Its demand for iron and copper seems insatiable, and its near monopoly of the World’s supply of refined rare earths is driving up the costs of capital equipment in the renewable energy industry enormously.

Coal price rises will, of course, stimulate coal production in the UK, which until 1981 was a major coal-mining centre. And this increased production may give limited protection to the UK’s coal-fired power stations during the coming decade, providing they are allowed to operate.

But in the short to medium term, it would be naïve to believe that there will not be a large substitution of coal for “cheap gas” all over the globe. As this article goes “to press”, well-head natural gas prices in the USA, depressed by high stocks and relatively high national production) are around $4/GJ, or four times cheaper than oil and considerably cheaper than internationally traded coal at $124/t (roughly $5/GJ FOB).

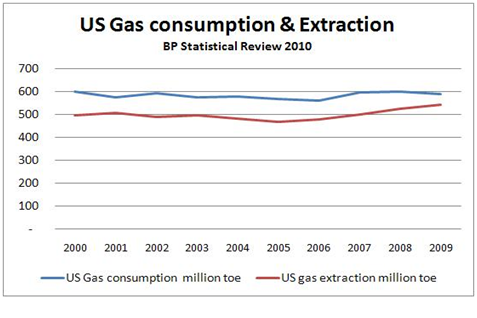

All the same, it might be well to keep in mind some simple facts about the shale gas boom.

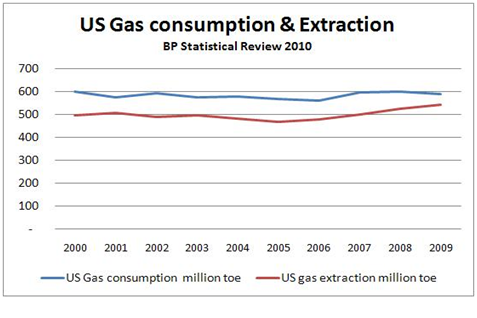

- Conventional (that is to say cheap) gas supply continues to decline.

- The USA remains dependent on Canadian imports and Canada’s own conventional gas supplies are declining

- At current prices, shale gas is unprofitable for many producers, particularly in cases (most) when second year and subsequent year flow rates fall dramatically (Debate over shale gas decline fires up ).

- The motivation of the energy majors in making shale gas acquisitions is not because of the low prices currently causing so much joy to consumers.

- Shale gas production is under fire in many producing areas for the alleged pollution that it is causing, particularly to aquifers that supply America’s drinking water.

The foregoing chart shows that the USA remains dependent on imported gas!

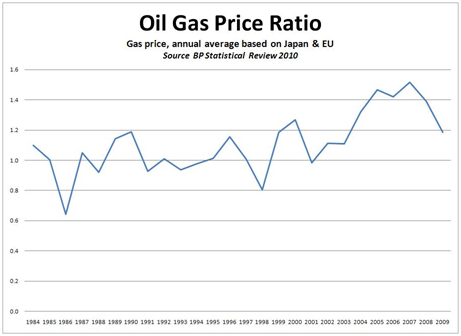

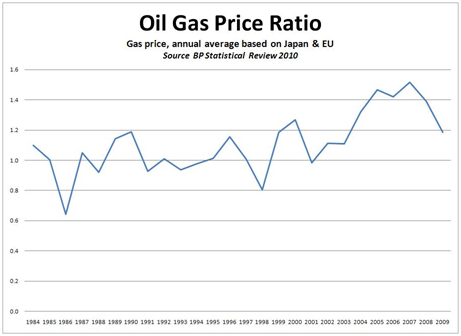

The low price of natural gas in the USA is the cause of huge and loudly expressed joy among a surprising number of fossil energy analysts and market traders. Some even believe that US prices today signal a long term dislocation between oil and gas prices.

All the following is true:

- Natural gas is a cleaner fuel than coal.

- The power generating equipment needed to turn it into electricity is much cheaper than for coal plants.

- Gas-fired CCGTs can be built much faster and deliver electricity much more efficiently (up to 60% thermal efficiency) than high efficiency (up to 48%), super-critical, coal-fired plants. Indeed, the “dash for gas-fired power stations” has been a global phenomenon since the early 1990s.

Since 1990, nearly all new, thermal, generating capacity that has been built in Europe, including the UK, has been gas-fired. This is estimated to amount to 160 GW, or 20% of European capacity and is largely responsible for the increased, roughly 200 million toe per year, gas that is now being burned since CCGTs began to be delivered.

However, as Steve Kopits, managing director of Douglas-Westwood’s NY office, writing in the December 2010 issue of Petroleum Review Magazine, reminds us “...economics works. When a commodity becomes expensive, consumers will switch to the next closest substitute and learn how to use that substitute efficiently”.

Compressed natural gas (CNG) is also being used to substitute for diesel and gasoline as a transport fuel. There are many millions of vehicles that have been cheaply and easily adapted for CNG in operation around the World (Compressed natural gas & Natural Gas in the Transportation Sector) and it is quite certain that the USA’s (and China’s) ingenious and price-savvy citizens will soon be adapting their vehicles in their millions to run on CNG. Oddly, for a continent that prattles so much about transport fuel’s effect on Climate Change, the iron grip of Europe’s tax authorities on the use of fuels for transport is likely to make Europe the last major economic area where vehicles are adapted en-masse for CNG.

To repeat, we can be absolutely sure that the mass purchase by the oil majors of the independents who developed shale gas extraction is not for the derisory returns presently being made by these pioneers!

It will only be a matter of time before the relatively small global surplus of gas extraction will be “used up” and the wide ratio between oil and gas prices will revert to the historical mean, close to one. That is what the US energy majors are banking on.

So by 2015, not only will the UK’s generation fleet be heavily dependent on natural gas but there is a high risk that this will also be very expensive and will certainly be beyond national control.

The rate of decline in the North Sea is staggering. We must draw what cold comfort we can from the supposed fact that gas-fired power emits less CO2. However, one cannot resist reminding the reader that the so-called CO2 footprint of a MWh of power derived from LNG is hardly better than that of a modern, super-critical, coal-fired power plant.

To "keep the lights on" this winter (2010 – 2011), we continue to rely on the UK's ancient, polluting, inefficient but generally reliable coal-fired power stations and its mostly ancient but relatively unreliable nuclear to provide respectively 45% and 17% of UK demand. It is a sobering thought that the UK is legally committed (by the EU’s Large Combustion Plant Directive or LCPD) to closing down more than 8 GW of this capacity, along with 3 GW of serviceable oil-fired capacity by or before 31st December 2015, on the grounds that these emit more than the permitted level of sulphur oxides. With the exception of Torness and Sizewell B, most nuclear capacity will also be phased out by 2018, unless the AGRs can be given a make-over to extend their lives.

It is possible but by no means certain that this loss of capacity will be entirely replaced by new CCGT capacity, but as we write, this could be a close-run thing.

The new Coalition is now wrestling with the near criminal consequences of thirteen years of New Labour talking shops, muddle and inaction over energy reform.

When Labour came to power in 1997, there was ample generating capacity, North Sea gas and oil flows were still rising and during 1999 the international oil price fell to less than $10/b. Some OPEC nations were staring at the possibility of defaulting on their huge debts. The Economist became famous (or infamous) for suggesting that the World was “drowning in oil”; so much for the analysts at our premium and most influential weekly newspaper. (Drowning in oil)

Since coming to power, apparently obsessed by “climate change concerns”, New Labour was in constant dialogue with the public through endless consultations. These were long, drawn-out affairs, ending up with a “white paper” full of bombast and invariably endorsed by then Prime Minister Blair. But only two serious actions were actually taken.

- The introduction of the so-called “New Energy Trading Arrangement” or NETA

- The introduction of a complicated and expensive, customer-subsidy for renewable energy called the “Renewable Energy Obligation” or ROC

Over the last six years, the Renewable Energy Foundation (www.ref.org.uk) of which Dr Constable is the Research Director, has published a number of devastatingly forensic analyses, of which “Renewables won’t keep the lights on” is the latest.

NETA was introduced in England and Wales on 27th March 2001 and replaced the “pool trading system” introduced by the Conservatives, following electricity industry privatization. (NETA-One Year On). The idea was to deliver more efficient and competitive trading arrangements. It certainly soon led to a substantial reduction in wholesale electricity prices.

NETA replaced an energy trading system that had rewarded both production capacity and energy production with a system that only allowed remuneration for pure energy trades. At the time of its introduction, oil was still cheap (roughly $3/GJ), and the upstream industry was unconstrained in its hydrocarbon production, an extraction policy inherited from the previous Tory government. Given the industry’s low specific prices (a consequence of political policy) the industry could only recover its high costs by maximizing extraction rates. This flawed, short sighted policy led directly to the almost complete evacuation of the nation’s North Sea hydrocarbon resources within a generation. Compare this policy with that of the conservation-driven policies of the Netherlands and Norway.

NETA certainly “constrained” energy prices. British Energy and Drax Power Station (to name only two generators) were effectively bankrupted by the low price (gas-based) competition. Large US investors in the UK electricity system, like Mission Energy, AES and AEP lost many $ billions in fire sales of premium coal-fired plants and the effective nationalization of the nuclear industry.

What NETA was specifically designed for - to cut short term prices – was achieved. What it could not do was to send any sort of appropriate pricing signal for the times to come when the UK would once more have to compete in the global market place for primary energy supplies. That is, the times in which we are now living. Bear in mind that during the winter of 2007 – 2008, Japan was willing to pay over $20/GJ for LNG on which Britain is now heavily reliant. By 2015, Britain will be even more reliant on gas imported from Russia, along with increasing LNG imports.

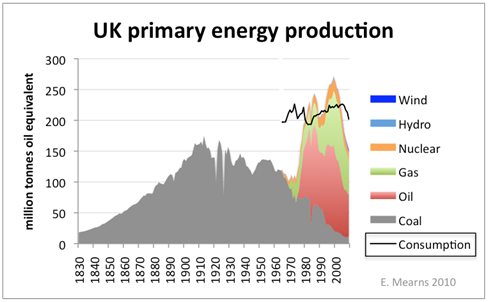

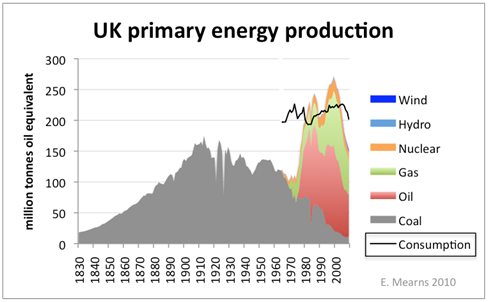

In the dramatic, foregoing chart, Euan Mearns, an editor at www.theoildrum.com, illustrates the vital importance of understanding the UK’s energy dependence in its historical context!

As a direct consequence of an unreformed NETA it is a fact that since Sizewell B was commissioned in 1992, not one single new coal-fired or one single new nuclear plant was built - nor could have been!

In 2009, OFGEM realized, much too late, that the policy of cheap-to-build infrastructure, based on cheap fuel, had indeed shrunk capacity and to a certain extent had kept a lid on prices but only at the expense of future generations. Its recent Discovery Report “discovered” that NETA is no longer fit for purpose and that a complete reform of energy trading will be necessary to enable the financing of the more costly infrastructure that can keep the UK competitive among its OECD peers in the harder times to come.

The paradoxical effect of the publication of Discovery and the announcement that the Coalition is embarking on yet another consultation, this time on energy trading reform (16 December 2010), has been a further reduction in the rate of construction of all new power stations that are not being financed by consumer subsidy, including gas-fired power stations!

As this paper goes to press, the outcome of the consultation remains unknown. It is already a matter of Coalition policy that any new coal-fired power stations must incorporate carbon capture and storage (CCS). There are even calls for new gas-fired power stations to employ CCS. Inexplicably, no one at DECC appears to be “joining the dots” and advocating the use of captured CO2, an excellent fluid for enhancing oil recovery whereby super-critical CO2, effectively an efficient dry-cleaning solvent, “washes out” the oil that other tertiary methods cannot reach. The use of CO2 for stimulating oil production in the fast-fading North Sea would enable the recovery of many billions of otherwise unproduced-able oil from the UK, Norwegian and Danish sectors, while safely burying roughly a ton of CO2 for each 3 barrels of CO2 incremental oil.

CCS will sharply increase the specific fuel consumption (by 20 – 30%) of either conventionally configured gas or coal-fired power stations and add considerably to their capital costs. Without a commercial application for the expensively captured CO2, its implementation will be ruinous for UK power producers and UK consumers. The sheer fatuity of the Coalition’s fixation with CCS, without EOR, will certainly be demonstrated during the forthcoming energy trading consultation.

Oddly, Dr Constable’s article does not mention the Coalition’s policy on CCS at all and disappointingly makes few recommendations about what should be done to “keep the lights on” - and as importantly, keeping UK energy competitive during the coming decade.

He writes “…Instead, government could announce a combination of a carbon tax and a realistic set of emissions regulations. The emerging Emissions Performance Standard might be a basis, but will need revision if it is not to discourage any and all conventional generation.”

Dr Constable is above all, clearly pragmatic insofar as he seems to have accepted the notion that we cannot steer the Coalition away from its “climate-change cart before the energy-security horse” policy. But given the already high costs of carbon ($17/GJ oil, and $5+/GJ coal and the certainty that these costs will rise further, drawing in gas), the last thing we need in is a carbon tax that will make energy prices even more expensive. There is clearly no chance that the US administration will introduce either a carbon tax nor “cap and trade”. Outside Europe, least of all India and China have the slightest intention of further taxing energy use, so a carbon tax in UK and Europe is pointlessly masochistic.

Of course, Dr Constable is right to require our carbon-obsessed politicians to evaluate all “low carbon” energy production from an equal economic base. If the purpose of subsidizing renewable energy is mostly to save CO2 emissions, then these subsidies, especially for PV, are about the most masochistically expensive way that can be imagined and a carbon tax would reveal this.

However, he is absolutely right to conclude that“ …the present policies can only offer emissions reductions through further deindustrialisation and significant economic contraction, effects that are unlikely to be popular with the electorate whatever the weather.”

We are also convinced that unless this Coalition wakes up from its complacent dream of achieving a prosperous “low carbon economy”, reached, almost effortlessly, through massive subsidisation of renewables capacity and energy efficiency, Britain is indeed facing imminent deindustrialisation, economic ruin and massive social unrest.

Paradoxically, OFGEM’s publication of “Discovery” and the launch of the “Power Market Reform consultation” (with the correct but toxic anticipation that base energy rates must rise substantially above a “willingness to pay” threshold) have only increased the already high risk that the lights will start going out by or before 2015. If this is allowed to happen, ruin will certainly follow.

It is time for all those “analysts”, of whom Dr Constable writes, who are carefully protecting themselves from the potential wrath of the “environmentalists” and their captive political establishment, to voice their views stridently and publicly so that a proper consultation can take place this year, not the shams of the Blair years.

We have until only until March 2011 (www.decc.gov.uk) to turn this consultation into a proper and serious public debate.

We are fully aware that the UK must wean itself away from reliance on carbon-based fuels - because fossil energy supplies are no longer secure and imported fuels are likely to be beyond the UK’s ability to afford. If we are going to side-step deindustrialisation, with all that this will entail, we clearly need to develop a strategy that radically transforms the way in which we generate and use energy.

Dr Constable is right. Renewables “cannot keep the lights on”, even if their judicious use, together with the development of large-scale, distributed energy storage, may save increasingly expensive fossil fuel. We should continue to spend a significant fraction of our research and development funding on finding more rational and less costly ways of using renewables. But in the mean time, we really cannot and should not close down the non-sulphur compliant coal-fired power stations (by 2016) and absolutely must accelerate the roll-out of affordable nuclear power on a scale and at a rate that, extraordinarily, has not yet occurred to the Coalition and its senior civil servants.

Just before Christmas, 2009, a correspondent, unusually well informed and sympathetic to our views, wrote as follows “My info from Olkiluoto 3 and at Flammanville is that the EPR is well nigh impossible to build because it is too complex. Essentially, the design of the nuclear island is not conceived for construction so the amount of site welding of pipework is ludicrous. The typical pipe spool length is 1.5m. Apparently, the French do not acknowledge the frailty of welding, culturally, so were not alive to this. However clearly any serious regulator, as distinct from a historic France plc regulator [but they too now are influenced by stronger safety cultures], will insist on weld testing which is painfully slow. Olkiluoto3 is now 5 years late and is bankrolled by France. The Siemens steam island is finished and waiting.”

Yet the UK is depending uncritically on Electricité de France and AREVA for virtually all new nuclear capacity, on a time-scale that cannot even start until after the consultation is satisfactorily concluded, and which looks already as if it will condemn the UK to unaffordable new nuclear capacity that cannot possibly be commissioned until the middle of the next decade.

In China, new Westinghouse-designed, AP1000 reactors are being delivered in three years at a cost that is reliably reported of $1500 per kW; this is even less than a new coal-fired plant without CCS. (This is the same UK state owned Westinghouse that was sold by Gordon Brown’s government for a paltry £5 billion just two years ago to Japan’s Toshiba - an act of economic vandalism comparable to his sale of a third of Britain’s gold reserves at the bottom of the market in 2003 in favour of Euro-denominated assets.)

DimWatt wishes to be as constructive as possible and intends to participate fully in the up-coming energy trading reform consultation. This is a one-off and perhaps a “last chance” to head off the growing risk of the failure of the United Kingdom’s energy infrastructure before the Coalition’s first term is up. Extremely uncomfortable changes in the present policy will be necessary, including the life extension of all environmentally non-compliant coal and nuclear generating plant, the reversal of demonstrably impossible plans to build 33 GW of wind power by 2020 and the large-scale roll-out of new nuclear, relying on Chinese or South Korean, not French, know how.

Has the Coalition the mettle to face these difficult choices? We hope so. It has already shown that it can be both radical and pragmatic and dares to be unpopular. As regards energy policy, it will need to be both. Above all, it will need unusual courage to reverse the disastrous course, set by Labour, and unfortunately signed up to by almost the whole of Parliament during better times.

Short bio: Hugh Sharman

Hugh Sharman is the owner of the Denmark-based energy consultancy and project developer Incoteco.

Hugh is a civil engineering graduate of Imperial College (1962). He worked mostly on oil and gas projects in the Persian Gulf, France and the UK until the early-1970s. His UK-based renewable energy company, Conservation Tools and Technology, pioneered the use of renewable energy during the 1970s. This business failed because its product line was immature and its consumer-facing sales strategy was flawed for this difficult decade in the UK.

Between 1977 and 1986, he was Area Representative for power generation, Swedish Shipyards and BWSC, in the Caribbean and South America, where he was responsible for power stations sales and marketing. He was responsible for power stations that were delivered in Venezuela, Barbados, Puerto Rico, Bahamas and Bermuda. He founded Incoteco (Denmark) in 1986 and performed power station related work, focusing on technically innovative processes. His clients have included TRW Inc., Rolls Royce, Scottish Hydro, Renewable Energy Foundation, Ormat, VRB Power, Danish Energy Agency, Mission Energy, Qatar Petroleum, ECA international, Elsam, Kinder Morgan CO2, among many others.

At present, he is also an editor for DimWatt and EU sales and marketing director for the China-based, globally operating, electricity storage company, Prudent Energy Inc.