Posted on 04/12/2022 2:23:36 PM PDT by blam

The timeline for the looming stagflationary recession continues to creep forward, with the Peterson Institute for International Economics warning that global growth is set to slow dramatically, and warning that “an even more abrupt tightening of monetary policy that causes asset prices to fall sharply and consumers to pull back, combined with a greater slowdown in China than currently expected, could push the economy into recession by the end of this year.“

Last week, Deutsche Bank spooked trading desks when it became the first major bank to predict a US recession would strike before the end of 2023, echoing a little seen call from BofA’s CIO who predicted a recession as soon as the second half. But now, one of Washington’s most closely watched think tanks believes that amid a sharp stagflationary slowdown in 2022, a global recession could arrive as soon as later this year.

Of course, the PIIE assessment was written prior to Tuesday’s CPI print, which came in at the hottest rate in more than 40 years. The print was seen as cementing the odds of a 50bps Fed rate hike next month.

But that doesn’t change much. Now that the Fed’s rate-hike liftoff is in the rear-view mirror, it’s worth bringing up this old chart, which shows that the countdown to every recession is triggered by a rate hike from the Fed.

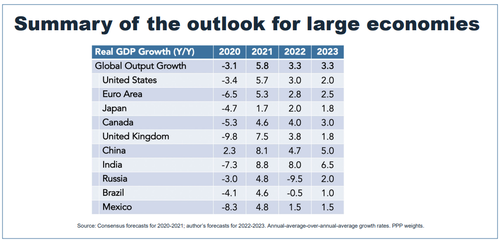

To be sure, the PIIE’s base case is not that dire, and the think tank expects global growth to slow to 3.3% this year, down from 5.8%, while US growth is forecast to slow from 3% this year to 2% in 2023. “After a year of recovery from pandemic-related weakness, nearly all countries are seeing a significant slowing of economic growth,” Karen Dynan, PIIE senior fellow and former U.S. Treasury Department chief economist, said in the report.

But it’s the inflation outlook that’s probably of greater interest to consumers, who are struggling with higher prices at the pump and at the grocery check-out. PIIE’s outlook for price growth suggests that core inflation in the US will ease to 4.1% this year and ease further to 3% in 2023, which is still above the Federal Reserve’s 2% target. Consumer prices excluding energy and food skyrocketed 6.6% in March from a year earlier.

In the US, data released Tuesday showed headline CPI rose 1.2% in March (vs +1.2% MoM) which sent the headline CPI up a shocking 8.5% YoY (vs +8.4% YoY exp and +7.9% prior). The 1.2% MoM rise is the biggest since Sept 2005 and CPI has risen for 22 straight months. And with wages growing at a far slower pace, the real average weekly earnings collapsed at a 3.6% rate, the biggest drop on record! And no, Putin didn’t do this.

,/A>

,/A>

All of this adds up to one thing: stagflation.

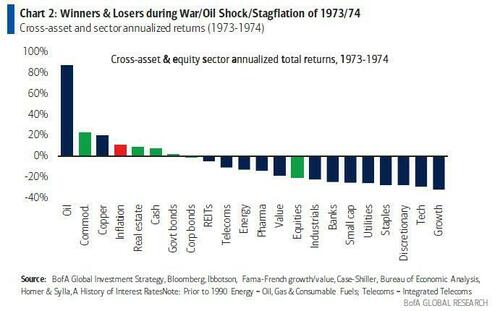

So, how will the Fed react once this inevitable reality has set in? Well, Bank of America noted last month, war is inherently stagflationary.

And as the reaction in equity markets has already suggested, investors are already looking through the Fed’s series of 50 bp rate hikes, all the way to QE5 just as we noted last month.

All part of the plan

That is probably the best remedy for the overheated rhetoric and generally chilly relations among the nation, a widespread recession/depression that affects just about every country in the world to some degree or other.

There is still going to be a lot of blood on the floor. And nobody to mop it up for a while.

Just think the last time we had a worldwide depression that devasted the USA and Europe, it didn’t turn out so well.

From 1919 to approximately 1939 look who came to power, Hitler, Stalin, Tojo, Mussolini, Mao, etc...

Good. If it means the Biden criminal cartel and the Democrat Congress will be thrown out, I’m all for it.

Stolen elections have consequences.

It has to show up in December so the Democrats can blame the Republican legislature

How’d they figure that out?

Since they’re gazing into their crystal ball I looked into mine.

No US depression until 2024.

Recessions usually kick in a year or two after FED tightening starts.

The FED is politicized and won’t do more than 25 basis points at a time, and nothing right before the 2022 election.

Even with inflation there is strong pent up demand coming out of Covid madness.

If a Republican is elected POTUS in 2024 a nice strong recession/depression will elect scads of Democrats for a long while after (think FDR) as they and their media lapdogs will blame it all on them.

If a Democrat is elected it’s simply a springboard to the Great Reset.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.