RUN MICKY RUN!

Posted on 03/22/2011 10:33:23 AM PDT by RWB Patriot

This weekend, a North Carolina man was convicted of minting and circulating “Liberty Dollars” and “Ron Paul Dollars” that were valued based on the gold and silver they contained. The man, Bernard von NotHaus, now faces up to 25 years in prison and the forfeiture of $7 million worth of gold and silver that was taken by police in a raid.

The U.S. Attorney who prosecuted the case explains:

“It is a violation of federal law … to create private coin or currency systems to compete with the official coinage and currency of the United States.”

But what’s wrong with competition? As long as there’s no fraud or counterfeiting – which NotHaus has not been convicted of – I would think that individuals should be allowed to use whatever currency they want.

(Excerpt) Read more at stossel.blogs.foxbusiness.com ...

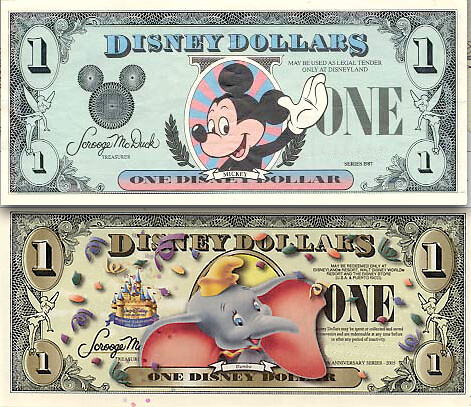

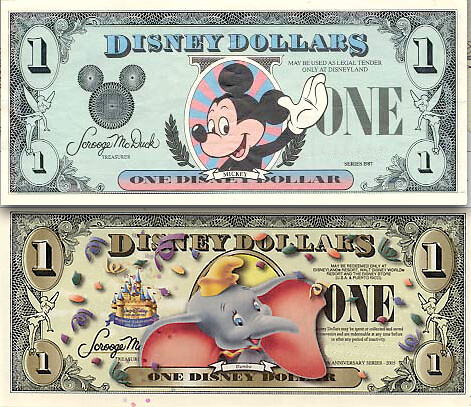

RUN MICKY RUN!

3 Cheers for Detroit's Local Currency

i guess the only difference is that the detroit 'money' is really just worthless coupons whereas this guy was issuing coins with intrinsic value (ie: real money)

“Who verifies the gold or silver content of a coin?”

Who verifies the the value of a dollar bill? Certainly not the Fed.

Every transaction verifies the value of “government money”.

Now a bill or coin could be a counterfeit but that is a different issue.

That market correction took a long time and only occurred after years of fraud and large losses by those defrauded by these “banks”. And New England was not the center of the problem with the wildcats. They were most prevalent where there was an undeveloped banking system such as the frontier areas. I believed that is why they were called “wildcats” as in being located where wildcats were common.

The whole episode was another example of an insufficient money supply which always accompanies the so-called gold standard. People had to use their ingenuity to devise other currencies to keep the economy moving. And not all of it was good.

But the same would be true for privately minted coins, right? The poster I was replying to was asserting that there was no one to verify the quality of privately minted coins.

I will be happy to receive all that “worthless paper” that comes into your hands. You can send it to me C.O.D. I will set back and await your deliveries. thanks in advance.

LoL

Bingo

I get ads for gold coins very frequently from long established businesses.

BTW how did this guy propose to give up his coins could I buy them with US dolla?

Unfortunately for your desire this nation’s economy has more important usages for metals than coinage. The world supply just does not grow at a sufficient rate to keep the economy out of recession. The growth rate of the supply of gold has been less than 1% per yr for the last 500 years (including adding the gold hoard of the Mezo-Americans). This forced the development of credit institutions to provide the means of growth for capitalists.

Gold and silver coins are subject to clipping and washing both of which reduce their weight. Accepting one as being the correct weight means accepting it on faith in any case.

Then when the value of the metal content in a coin becomes higher than its face value another set of problems arise.

The real problem with money is that there is little chance that a democratic society will elect authorities with the wisdom or knowledge sufficient to appoint the appropriate monetary controllers. There were steps taken to insure the independence of the Federal Reserve officials from political pressures. You can decide how effective that is.

Perhaps it is nit-picking but no private person could call his production “money” since it would not have to be universally accepted as anything other than an object of value. Nor is foreign exchange true “money” for exchange.

The Dixie story is an interesting one isn’t it?

New England was indeed the epicenter of the wildcat banking phenomenon. The wildcat banks were founded in Minnesota in order to make it nearly impossible for New England bankers and merchants to redeem their notes for specie - despite the notes being nominally redeemable. But they were founded by unscrupulous New England bankers and the notes were intended to circulate in New England.

The reason they are called wildcat banks is good story. New Yorkers had resorted to paying their taxes with wildcat notes - getting rid of their least reliable notes which is smart. The New York city treasurer decided to personally go to Minnesota and redeem a wagon load of of notes, but he never returned. Some months later his body was found along with all of the money. It had been predated on and rumors circulated that he had been killed by a wildcat. So the Minnesota banks became known as wildcat banks.

Suffolk published a discount list for every known type of banknote stating what they would pay for the notes. To get a favorable rate a bank had to have gold on deposit at Suffolk bank. A low discount rate meant a bank's customers had to pay higher prices all over town. It worked. The wildcat banks, and many local banks as well, were revealed to be weak or insolvent and went under.

A similar phenomenon to Suffolk Bank happened in New Orleans with Citizens Bank. Citizen's was not founded by merchants though. It was a pre-existing bank that emulated Suffolk's methodology.

BTW the notion that their could ever even be such a thing as an "insufficient money supply" ranks right up there with the Labor Theory of Value on the list of government rationalizations no longer taken seriously.

The “Liberty” is very close to a real coin. The rear view is extremely confusing as to what it is communicating. Is it twenty dollars or just something with a bunch of strange letters?

People are awfully dumb though and don’t pay attention to things so it would be easy to confuse them. Some old lady would tip her delivery boy with a $500 coin and all hell would break loose.

Several other posters and I have pointed out that every transaction verifies our money’s value. Even the value of gold and silver is defined in dollars.

I don't follow. Private individuals have issued money and have had it universally accepted. Usually private money contained gold or silver but not always. Token money issued by button makers fueled the early industrial revolution - see Good Money by George Selgin. There is a great story in Selgin's book about how the Chancellor of England was outraged at being asked to pay double by a Manchester merchant when he tried to pay with English money. Nine out of ten English coins were counterfeit at the time. The local merchants in places like Manchester and Birmingham preferred the local factory tokens because they knew they could exchange them in bulk for gold.

Since PxQ = MxV the only way the economy can grow is to increase either M (money supply) or V. Prices (P) can also fall which was likely under the gold standard but that produces its own problems. We certainly can create growth by changing the Velocity of Circulation but that is not necessarily continuous. Increases in Q (Quantity) can occur but generally mean more investment or higher productivity.

Friedman believed the proper monetary policy would be to set a consistent growth rate in the money supply and leave it alone. The money supply is like a straight jacket for the economy and without expandability it stifles economic activity.

Credit crunches created by the recall of specie from the frontier banks led to the creation of wildcat banks without sufficient reserves to handle their issue. Suffolk acted as a Reserve Bank a role once played by the Second Bank of the United States.

Demands by westerners and populists to better insulate the state economies from the actions of the Money Center banks were the source of calls to establish Reserve banks which led to the creation of the Federal Reserve system. Eastern bankers fought the idea kicking and screaming for decades since it would reduce their power.

Wildcat banking did not end quickly. Mark Twain mentions being paid in wildcat notes in the 1850s and the practice was not finally stopped until the passage of the National Banking Act in 1863. There are alternative stories as to the origin of the term as well. One is that a bank in Michigan printed notes with a wildcat on it.

What I was trying to say was that money is only true money when it is defined by political authority as legal tender which must be accepted. And only official money meets that requirement.

Of course, if the private money is of more value because of the market than the official money one would have to be a fool not to take it but it would be within his rights to refuse it.

I will check out the book you reference it does sound fascinating.

If you're interested, Selgin also gave a talk about his book at the Mises Institute a couple of years ago.

Thanks.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.