Skip to comments.

Comparing 2011 with 1937. One more time -- We are NOT in a depression.

Economic One ^

| 06/10/2011

| John B. Taylor

Posted on 06/10/2011 5:19:18 AM PDT by SeekAndFind

In today’s

article in Bloomberg View I explore reasons for the current weak recovery, and in particular whether there is an analogy with what happened in the recession of 1937-38 which interrupted the recovery from the Great Depression. Several charts elaborate on numbers provided there which argue against such an analogy.

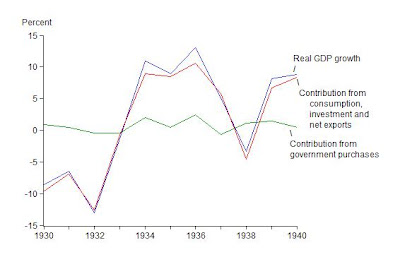

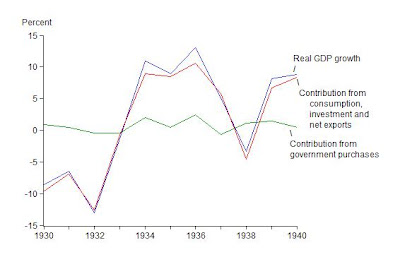

The first one relates to fiscal policy. It shows the ups and downs of real GDP growth in the 1930s and the contributions to that growth coming directly from government purchases and other components of GDP. (The data come from this interactive

table at the Bureau of Economic Analysis ). Clearly the change in government purchases contributed little to the downturn in 1937 and 1938. Even with generous multiplier effects on consumption, the changes in government purchases are too small to make much difference. Given that any decline in government purchases now due to the end of the 2009 stimulus is even smaller than the declines in 1937, the fading out of the stimulus is unlikely to have much to do wht the current slowdown.

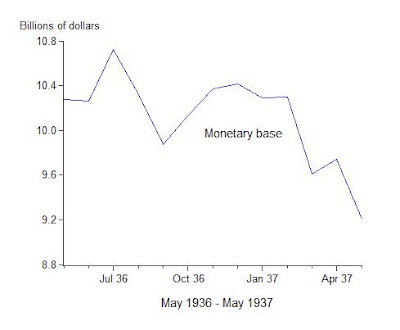

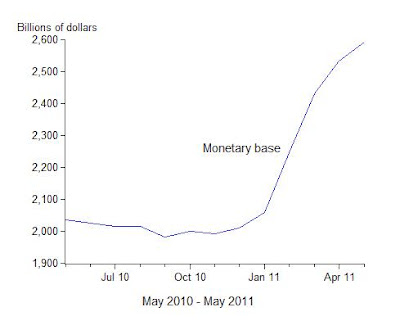

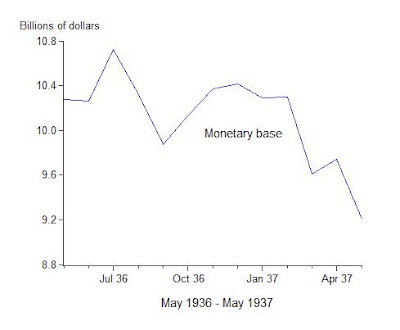

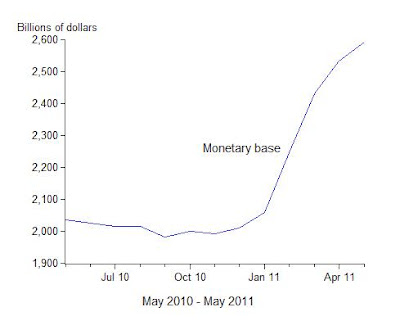

The other two charts relate to monetary policy. One shows the large decline in the monetary base (currency plus reserves) from May 1936 to May 1937 and the other shows the large increase in the monetary base from May 2010 to May 2011. While the decline in the monetary base is likely to have been a reason for the slowdown in the 1930s, there is no such decline now to explain the current slowdown. The recent ups and downs in the monetary base are due to the quantitative easings and at some point the monetary base will have to decline again. The challenge for the Fed will be to carry out this exit strategy in a clear and transparent manner in order to minimize disruption and uncertainty.

John B. Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University George P. Shultz Senior Fellow in Economics at the Hoover Institution

TOPICS: Business/Economy; History; Society

KEYWORDS: 1937; 2011; depression; recesion

Navigation: use the links below to view more comments.

first 1-20, 21-30 next last

To: SeekAndFind

Horse pucky. We are in a depression. Every number published by the Government is massaged to appear as favorable as possible. Real unemployment is about 21% and climbing. The GDP numbers are crap and not real. Every statistic is “revised” later to make it appear to follow the predicted trend. The stock market is propped up by billions of taxpayer dollars every day and 0 is talking about another porkulus.

2

posted on

06/10/2011 5:26:39 AM PDT

by

mad_as_he$$

("If I ever kill you, you'll be awake. You'll be facing me, and you'll be armed. " Mal Reynolds)

To: SeekAndFind

This is the same kind of ivory-tower reasoning that “proves” bumblebees can’t fly.

Tell it to the 35 million people who don’t have jobs.

3

posted on

06/10/2011 5:30:24 AM PDT

by

IronJack

(=)

To: SeekAndFind

Pure government bullshit!

Statistics: How to lie with figures and how yo make figures lie and to really lie use a graph!

4

posted on

06/10/2011 5:35:50 AM PDT

by

dalereed

To: SeekAndFind

If anyone reads the article instead of posting against the headline, they would see that the author is challenging Paul Krugman’s assertion that it was gov’t spending that created some recovery, just like it did during the 1930s.

The author tears apart any comparison and even shows how gov’t spending in the 1930s was ineffective while increased unionization and higher taxes choked off the recover in 1937.

FReepers, please read the article before posting. The title has nothing to do with the substance.

5

posted on

06/10/2011 5:36:02 AM PDT

by

Erik Latranyi

(Too many conservatives urge retreat when the war of politics doesn't go their way.)

To: SeekAndFind

We are in a depression and we have been and all of the lies and lying charts prove nothing but those that rule with an iron fist are scared of the truth... they are destroyed... they just do not know it yet.

LLS

6

posted on

06/10/2011 5:41:29 AM PDT

by

LibLieSlayer

(WOLVERINES... a Conservative subsidiary of Reagan's party)

To: SeekAndFind

Title of posting doesn’t match title of article at the link.

The real title is simply

“Comparing 2011 with 1937”

7

posted on

06/10/2011 5:46:35 AM PDT

by

kidd

To: mad_as_he$$

Horse pucky. We are in a depression. It depends on the definition used. Can you give any data...real data...that proves we are in a real depression based on the traditional definition?

8

posted on

06/10/2011 5:47:37 AM PDT

by

NELSON111

To: SeekAndFind

Statistics today mean nothing. It is “GIGO”.

Any child with a pencil can draw lines.

We have listened to the government, aided my the Marxist media

proclaim that the recession ended some time ago, and happy days are just around the corner.

The Communist are going to string the American morons along as long as they can, until it is too late.

9

posted on

06/10/2011 5:47:55 AM PDT

by

AlexW

(Proud eligibility skeptic)

To: SeekAndFind

Was that monetary base curve a result of quantitative easing(s)?

10

posted on

06/10/2011 5:56:12 AM PDT

by

Flightdeck

(If you hear me yell "Eject, Eject, Eject!" the last two will be echos...)

To: NELSON111

That is the problem. The “traditional” definition does not fit the economy today. In addition the spending of untold trillons by the Government skews the real situation (deliberatly). If everything was counted the same was as in 1932 and adjusted for inflation we would see numbers that are worse than any before. I will give you one. The real UE is 21% and rising; using the definitions from the 30’s. BTW classic econ says you do not know until it is over. So only time will tell - except that the Government will lie about it then.

11

posted on

06/10/2011 6:01:11 AM PDT

by

mad_as_he$$

("If I ever kill you, you'll be awake. You'll be facing me, and you'll be armed. " Mal Reynolds)

To: SeekAndFind

My money's hidden in tin cans, and stuffed in my mattress.

Which way to the nearest Democrat soup kitchen?

To: LibLieSlayer

We are in a depression and we have been and all of the lies and lying charts prove nothing but those that rule with an iron fist are scared of the truth... they are destroyed... they just do not know it yet. I see Freepers say this a lot...and while a agree with the sentiment...does it really match the facts of the situation?

Now I know there are different definitions...but the most common definition of a recession is two down quarters of GDP. Others have different definition.

Now...I know we are headed for a double dip...but I don't think we are technically there yet. Do you have any real data to suggest the governments figures of 1.5% GDP growth is false and actually much lower?

I ask this because while it may "feel" like a depression...and it certainly is depressed for those out of work...we are not libtards and deal with FACTS...not feelings. If we are not prepared to say NO...it's NOT 1.5% growth...it's -1.5% and for the second straight quarter...AND HERE ARE THE FACTS THAT PROVE IT...then we are no different than a liberal who argues from their heart...not their brain.

Now...if there are data to actually prove a recession...are there data to prove a depression? If so...where and by who's definition? Generally its a GDP of -10% or 2 years -GDP growth (I think...? Correct me if wrong). So...are data available to prove we have had absolutely NO positive quarters in GDP over the last 2 years? If so...please provide it. Otherwise...we are not in a depression. We may be HEADED that way (and are probably headed for a cliff...not a depression...which is why we are preppers)...but I don't think we are technically there yet.

To: mad_as_he$$

Now that I can agree with. Has anyone done any work on data removing the input of government stimulant from private sector GDP? Since government debt must be repayed...it does seem foolish to include it into GDP...its kinda like including my home equity loan into my annual earnings.

That would be a very good study and a good campaign theme for a Cain or Palin type figure (someone with guts enough to use it is what I am actually saying).

To: SeekAndFind

the decline in the monetary base is likely to have been a reason for the slowdown in the 1930s Is this guy saying that a decrease in the monetary base caused a recession?

15

posted on

06/10/2011 6:21:06 AM PDT

by

SwankyC

(*sniff* I lost my bigot today. Syncro - where are you?)

To: mad_as_he$$

One more thing: It's funny you mention that as well. I had the same thought on the way into work this morning but didn't connect the dots.

I was driving on a highway into Houston...which they are repaving. Here is what they did: They resurfaced it...and I thought that was it...and it was a nice surface. THEN they came back and added a couple of inches of ashphalt...resurfacing that.

So...they took a highway that really wasn't in bad shape...had no potholes...was pretty smooth...and made it nice and black with a thin layer of road...and then it was really nice. THEN came back and layed a layer of asphalt on THAT...compressed it...and now its super nice.

So...my thought was: This created a lot of jobs. There is a business making a lot of money because the state did this. There are workers employed because the state did this. However...it is my tax $ they are using and its not real because without my tax dollars...these jobs don't exist and this company doesn't exist.

Now I am all for using my tax $ to maintain the roads I drive on...but this was "stimulus." The road didn't need to be repaired. It was a waste of my tax $ to keep people employed. There's a problem here.

To: mad_as_he$$

I wonder what this guy will say when the dollar collapses and there is a run on the banks followed by banks closing and complete chaos especially in the cities?

17

posted on

06/10/2011 6:37:18 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped.)

To: NELSON111

Now I know there are different definitions...but the most common definition of a recession is two down quarters of GDP. The media stopped using that standard when Bush was in office. Then it was the worst economy in (______)you fill in the blank, years with a positive growth rate.

Secondly, GDP includes government outlays, which this administration has massively increased, yet don't really measure economic strength.

Without the massive government outlays, the GDP doesn't look so good.,GDP is meaningless unless it is adjusted for inflation. Taking inflation into account, the GDP looks even worse.

Taking alone, that one figure (GDP) tells little about economic activity. It is but one factor in the whole picture and can easily be manipulated by government outlays to make the economy appear healthier than it is.

There are some real indicators that point to a very poor economy (joblessness, foreclosures, defaults, disposable income, under employment). All of these point to a severe continuing recession.

18

posted on

06/10/2011 6:43:24 AM PDT

by

CharacterCounts

(November 4, 2008 - the day America drank the Kool-Aid)

To: Georgia Girl 2

This won't happen because the govt. has enough printing presses to handle the demand for cash, just like the Weimar Republic. We are ready. It wouldn't surprise me if their are huge stock piles of green backs stowed away for just such a circumstance.

The reason there were bank runs in the 30's was because the dollar was still worth something.

19

posted on

06/10/2011 6:45:48 AM PDT

by

central_va

( I won't be reconstructed and I do not give a damn.)

To: SwankyC

“. . . the decline in the monetary base is likely to have been a reason for the slowdown in the 1930s . . .

Is this guy saying that a decrease in the monetary base caused a recession?”

There is some evidence that it contributed. Money is a measure of value of the goods and services in the economy. As more goods are produced the total aggregate wealth increases (assuming the goods are needed and useful), so the aggregate supply of money needs to increase to reflect the increased wealth. If the two get out of whack, bad things happen.

If you increase the money supply faster than you increase total wealth, you get inflation. More and more money is chasing the same unit amount of goods, so money becomes worth less relative to the goods. Anyone old enough to remember the 1970s and early 1980s remembers that situation. And other may have read about the German hyperinflation of the 1920s and 1930s.

What people have less experience or knowledge of is what happens when the opposite happens — more wealth is produced, but the money suppy remains constant (or shrinks). In that case, all goods become worth less, and the value of money increases.

In the 1880s and early 1990s, when the United States was on the gold standard, something like this happened. The industrial revolution drastically increased productivity. A laborer could produce hundreds of widgets where twenty, thirty years earlier he could have only produced a dozen. Farmers, using McCormick reapers and other new farm equipment increased production by factors of ten to twenty times the yields they were getting earlier. So everyone was producing a LOT more.

But, there was still the same amount of gold. So when you produced a dozen bushels of wheat where previously you had produced one, that dozen bushels was worth the same amount of gold. So each bushel was worth a lot less. Not only that, but your farm was worth a lot less — because it represented a smaller percentage of the total gold available (due to all that extra wheat) than when you purchased it. And you could not produce your way out of the problem because the more you produced, the less everything you owned was worth.

This is what caused the Panic of the 1890s. And the call to go to a bi-metal (gold and silver) currency. Making silver a monetary metal increased the money supply. We did not do that because of major gold strikes in Australia and the Yukon. Because more gold was found, the money supply increased enough that the wheat (and farm, and widgets) were worth more because they represented more gold.

Same type of thing happened in the 1930s. Roosevelt's brain trust got in their heads the idea that the money supply was too large because the economy had shrunk. So they reduced it. Drastically. So much so that manufacturers could not afford to produce. Purchasing labor and material to produce goods cost more than what those goods could be sold for (especially since manufacturers could not reduce wages due to government pressure and the goods had to be sold for less money than previously due to the small supply of available money). So they shuttered their factories.

One of the major reasons that WWII ended the Great Depression was that in 1942 the government could not borrow money to pay for the war (no one had any) and could not pay for the war through taxes (it took a year to raise and collect taxes), so they simply printed money. Under more normal circumstances this would have caused severe inflation. But since the money supply had been so much smaller than appropriate for the size of the American economy, all this did was restore the money supply to the appropriate size. Businesses could now recover their manufacturing costs, they started hiring, and the economy boomed — without inflation.

Had the government continued wildly printing in 1943, we would have gone into hyperinflation, but by then new war taxes were being collected, and the delta between revenues and spending was being covered by borrowing (anyone remember War Bonds?) from newly-employed citizens who were saving a good chunk of their new income to provided a safety cushion for the recession they knew was coming when the war ended.

But basically, yes. Reduce the money supply enough and you will cause a recession. Increase it too much and you will cause a recession. Think of it as fuel going into a carburetor — too rich a mixer and the engine chokes. Too lean and it stalls.

Navigation: use the links below to view more comments.

first 1-20, 21-30 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson