You can't beat Dow Jones stocks for stability and defense in a down market. By the same token, the blue chip average won't always keep up in a rising market.

Case in point: equities are having a strong 2023, with the S&P 500 delivering a price gain of 15% for the year-to-date through November 10. The tech-heavy Nasdaq Composite, which is both riskier and "growthier," soared 32% over the same span.

The Dow Jones Industrial Average, by comparison, is very much lagging the pack. The elite bastion of 30 mostly mature industry leaders delivered a comparatively poky price gain of 3.4% through early November.

Zoom out, however, and Dow Jones stocks have served buy-and-hold investors quite well since the market hit its all-time closing high back on Jan. 3, 2022. The S&P 500 is down 8% since then, while the Nasdaq Composite is still off 13%.

True, the Dow by no means escaped unscathed, but its price decline of 6% since the market peaked has saved plenty of investors from suffering significantly steeper losses.

It's also important to know that the Dow's recent underperformance isn't abnormal. More than half of the average's components are low-beta stocks. That means they tend to lag in up markets, but hold up better when everything is selling off. This low-beta skew can actually be quite advantageous to long-term investors.

After all, as bright a year as it's been for equity investors, plenty of economists and strategists see dark skies ahead. Rising interest rates, pricey stock valuations and gloomy earnings forecasts could very well squelch market participants' appetite for risk as we head towards 2024.

Among the more notable bears is Mike Wilson, chief U.S. equity strategist and chief investment officer at Morgan Stanley. He expects the market's rally to "fizzle out...as it becomes clear the growth picture does not support either Fed cuts or a significant acceleration in earnings per share growth in the near term."

Should such a change in market sentiment come to pass... Well, that's where Dow Jones stocks come in.

This collection of industry-leading companies and dividend growth stalwarts with their battleship-like balance sheets can offer something of a safe harbor in tempestuous market times. From the best Dow dividend stocks to the most widely held blue chip stocks, components of the industrial average occupy top spots in the portfolios of hedge funds and billionaire investors. Warren Buffett's Berkshire Hathaway (BRK.B), in particular, is a huge fan of select Dow stocks.

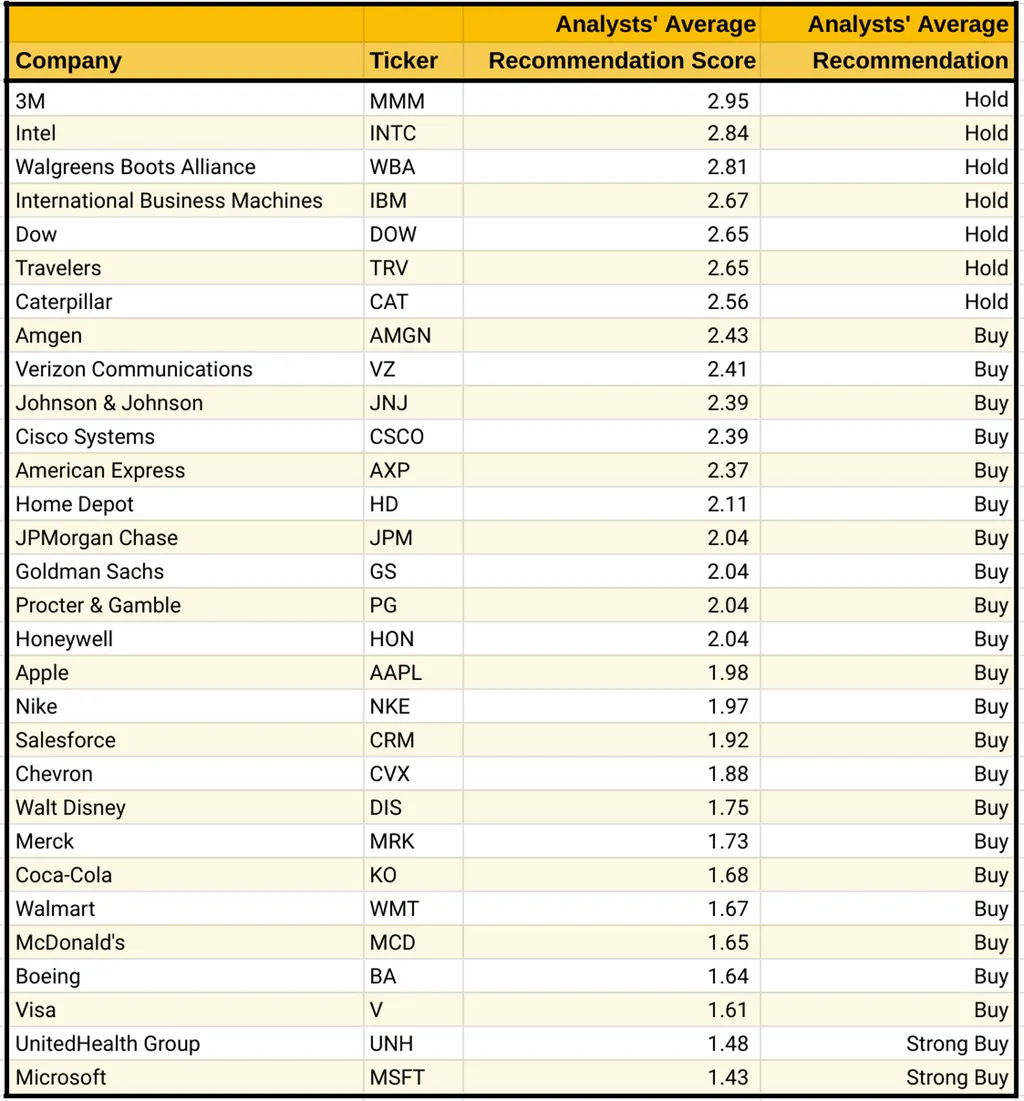

To get a sense of which Dow Jones stocks Wall Street recommends at an increasingly uncertain time for equities, we screened the DJIA by analysts' consensus recommendations, from worst to first, using data from S&P Global Market Intelligence.

Here's how the ratings system works: S&P surveys analysts' stock calls and scores them on a five-point scale, where 1.0 equals a Strong Buy and 5.0 is a Strong Sell. Scores between 3.5 and 2.5 translate into Hold recommendations. Scores higher than 3.5 equate to Sell ratings, while scores equal to or below 2.5 mean that analysts, on average, rate shares at Buy. The closer a score gets to 1.0, the higher conviction the Buy recommendation.

See the table below for analysts' consensus recommendations on all 30 Dow Jones stocks, per S&P Global Market Intelligence, as of November 10, 2023.