Posted on 12/02/2023 5:37:17 PM PST by SeekAndFind

If, and when, a recession ever occurs again in any of our lifetimes - certainly not in the golden age of Bidonomics, pain will be felt disproportionately as usual.

Sectors which fare better will typically exhibit;

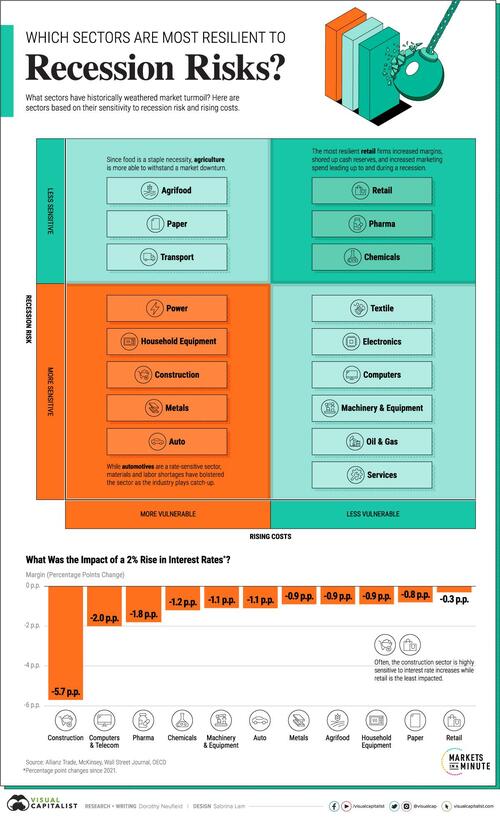

As such, Visual Capitalist's Dorothy Neufeld takes a look at the sectors most resilient to recession risk and rising costs, using data from Allianz Trade.

As slower growth and rising rates put pressure on corporate margins and the cost of capital, we can see in the table below that this has impacted some sectors more than others in the last year:

Generally speaking, the retail sector has been shielded from recession risk and higher prices. In 2023, accelerated consumer spending and a strong labor market has supported retail sales, which have trended higher since 2021. Consumer spending makes up roughly two-thirds of the U.S. economy.

Sectors including chemicals and pharmaceuticals have traditionally been more resistant to market turbulence, but have fared worse than others more recently.

In theory, sectors including construction, metals, and automotives are often rate-sensitive and have high capital expenditures. Yet, what we have seen in the last year is that many of these sectors have been able to withstand margin pressures fairly well in spite of tightening credit conditions as seen in the table above.

One salient feature of the current market environment is that corporate profit margins have approached historic highs.

As the above chart shows, after-tax profit margins for non-financial corporations hovered over 14% in 2022, the highest post-WWII. In fact, this trend has been increasing over the past two decades.

According to a recent paper, firms have used their market power to increase prices. As a result, this offset margin pressures, even as sales volume declined.

Overall, we can see that corporate profit margins are higher than pre-pandemic levels. Sectors focused on essential goods to the consumer were able to make price hikes as consumers purchased familiar brands and products.

Adding to stronger margins were demand shocks that stemmed from supply chain disruptions. The auto sector, for example, saw companies raise prices without the fear of diminishing market share. All of these factors have likely built up a buffer to help reduce future recession risk.

How are corporate metrics looking in 2023?

In the first quarter of 2023, S&P 500 earnings fell almost 4%. It was the second consecutive quarter of declining earnings for the index. Despite slower growth, the S&P 500 is up roughly 15% from lows seen in October.

Yet according to an April survey from the Bank of America, global fund managers are overwhelmingly bearish, highlighting contradictions in the market.

For health care and utilities sectors, the vast majority of companies in the index are beating revenue estimates in 2023. Over the last 30 years, these defensive sectors have also tended to outperform other sectors during a downturn, along with consumer staples. Investors seek them out due to their strong balance sheets and profitability during market stress.

Cyclical sectors, such as financials and industrials tend to perform worse. We can see this today with turmoil in the banking system, as bank stocks remain sensitive to interest rate hikes. Making matters worse, the spillover from rising rates may still take time to materialize.

Defensive sectors like health care, staples, and utilities could be less vulnerable to recession risk. Lower correlation to economic cycles, lower rate-sensitivity, higher cash buffers, and lower capital expenditures are all key factors that support their resilience.

I may have to escape in a balloon just like during the Jimmy Carter years.

I was one of the lucky ones.

Fascist Gov’t?

[What do I win for guessing correctly?]

The DOW has almost equaled its all time high from almost 2 years ago.

That is a positive.

Not that the Biden Administration has any positive impact on that fact, but it is a positive.

“The DOW has almost equaled its all time high from almost 2 years ago. That is a positive.”

But the dollars invested in the DOW are worth 20% less so it isn’t actually as high.

Hookers and Blow.

Community Association Management is recession proof.

Unlike the real estate market and various other forms of property management, HOA managers cannot be outsourced or consolidated under regional directors.

If you have kids in college that aren’t really sure what they want to do after school, tell them to look into this field. If they are smart, sharp, hardworking and good communicators, they can earn $100K within 5 years. Some of my friends in this industry are pulling in $200K a year.

On the other end of the spectrum, many types of home improvement are already in recession. Combination of inflation cutting spending money and the fact that during lock downs many people redirected the money they had budgeted for vacations, is causing retrenchment. I work as an arborist, we had all the work we could do for about two years, reality has set in.

Start cultivating relationships with HOA managers. Landscaping and tree care is, on average, 25% of every association’s budget.

Yea. You’re probably right. It should only go up😂

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.