Posted on 01/31/2008 8:07:03 PM PST by bruinbirdman

"The monoline bond insurance industry provides services to one industry - the capital markets."

The beams are creaking. Plaster is falling from the ceiling. The cracks in the walls are widening. The entire edifice of wholesale financial markets is under the greatest strain in years. No one any more believes the soothing noises from the builders (aka investment bankers), who say the worst will soon be over. The Federal Reserve’s drastic cuts in interest rates amount to little more than a bit of cosmetic repointing.

Yesterday there was a fresh buckling noise coming from the foundations, where the monoline insurers reside. These are the institutions that insure trillions of dollars of bond issues against default. Having strayed from their original safe but dull role of insuring municipal bonds to underwriting racy sub-prime-backed securities, they are paying the price. One of the biggest, MBIA, announced a $2.3 billion loss yesterday, while another, FGIC, was downgraded by Fitch. All have seen their shares thumped and face further downgrades.

No one quite knows how bad the impact would be if one failed. Together they insure bonds with a face value of $2,400 billion. Most are rock solid, but there is still a residual $231 billion of more questionable securities, a large chunk of them backed by US sub-prime mortgages. Defaults by struggling American homeowners are going to work their way back along the food chain, ultimately to the monoline insurers.

Monolines played a key role in the gigantic game of financial pass-the-parcel that has characterised the credit markets in the past few years. The basic rule was to make a quick turn and pass the risk on to the next mug as quickly as possible. Monolines were where the buck was supposed to stop. If one of these insurers were to fail, the liability would be passed back to the banks.

Toby Nangle, a fund manager with Baring Asset Management, reckons a failure would create panic “on the same scale as Long Term Capital Management”. LTCM, the hedge fund that failed in 1998, was of itself tiny, but was at the centre of a cat’s cradle of trillions of dollars of bets with counterparties comprising most of the world’s biggest banks.

It was the number of zeros on the face value of those bets, plus the uncertainty of who the counterparties actually were, that created the jitters ten years ago. This time around, markets are again unnerved by the size, complexity and opacity of both the underlying assets and the insurance policies supposedly underpinning them.

Private sector attempts to shore them up have not been happy thus far. Warburg Pincus appears to be sitting on a nasty loss from its rescue investment in MBIA, although its shares perked up last night after some encouraging words from its chief executive.

An industry-wide lifeboat orchestrated by the New York State Insurance Superintendent could work, but has dispiriting echoes of Treasury Secretary Hank Paulson’s doomed super-SIV plan.

Researchers at Oppenheimer say there is no systemic risk and insurers could fail and not spark a cataclysm. But it would certainly sort the sheep from the goats: the limping trio of Citigroup, Merrill Lynch and UBS would bear the brunt of an additional $40 billion in writedowns this year. It isn’t yet time to doff the hard hats.

~~Alan Greenspan, May 2003

"American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage."

~~Alan Greenspan, February 22, 2004

“The use of a growing array of derivatives and the related application of more-sophisticated approaches to measuring and managing risk are key factors underpinning the greater resilience of our largest financial institutions.”

~~Alan Greenspan, May 2005

"We're not about to go into a situation where (real estate) prices will go down. There is no evidence home prices are going to collapse."

~~Alan Greenspan, May 21, 2006

“The damage from the subprime market has been largely contained. Fortunately, the financial system and the economy are strong enough to weather this storm.”

Richard Fisher, Federal Reserve Bank of Dallas President, Apr 4, 2007

"All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system."

~~Fed Chairman Ben Bernanke, May 17, 2007

"I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future."

~~E. H. H. Simmons, President, New York Stock Exchange, January 12, 1928

"Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months."

~~Irving Fisher PhD, leading U.S. economist , New York Times, October 17, 1929

"If recession should threaten serious consequences for business (as is not indicated at present) there is little doubt that the Federal Reserve System would take steps to ease the money market and so check the movement."

~~Harvard Economic Society, October 19, 1929

"This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan... that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years."

~~R. W. McNeel, market analyst, as quoted in the New York Herald Tribune, October 30, 1929

“Several brokerage houses tumbled; blue-sky investment companies formed during the happy bull market days went to smash, disclosing miserable tales of rascality; over a thousand banks caved in during 1930, as a result of marking down both of real estate and of securities; and in December occurred the largest bank failure in American financial history, the fall of the ill-named Bank of the United States in New York.”

~~"Only Yesterday: An Informal History of the 1920’s" by Fredrick Lewis Allen

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."

~~Ludwig von Mises

Hey, I have a solution to the whole mess (while some companies will die, the whole market will be stronger for it):

#1 - Banks and other institutions QUIT loaning people money they cannot afford to pay back. This includes marketing insane ARM loans as a way of getting more house than the customer really can afford.

#2 - Consumers - quite gorging yourself on all the cheap/easy credit. Don’t buy more house than you can afford. Spend more time with the kids instead of trying to work a 3rd job to pay the mortgage you cannot afford. you will be glad you did in the end, and society will be less likely to have to support your child...

#3 - Politicians need to just stay out of it. The market will right itself if you just keep your hands off. Sure, some corporations might die - if it was due to stupid business decisions - then that is their fault.

#4 - Cut taxes and government spending. Let consumers do with their money as they see fit (and maybe they can afford that house after all if the government isn’t taking so much). Or maybe mom can actually be mom instead of a wage earner.

MBIA was up 11% today. Ambac was up 7%. Pulte Homes was up 20%. Fannie and Freddie were up 8%.

Very bullish!

"Gridley, re-hang the lifeboats, we aren't all going to die after all."

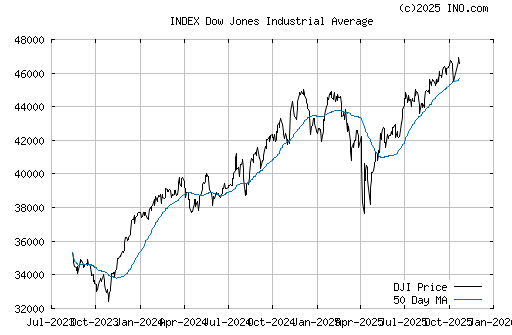

Just flip the chart - a rebound on the downslope is the opposite of a retraction on the upslope of the curve. If you are positive we are at bottom, by all means buy the idea we are going back up...

Me I am sitting it out till the trend becomes clear

I always liked what Louis Rukeyser said, nobody rings a bell at the bottom. I have no way of knowing if we’re at a bottom, but I believe the market is signaling more aggressive rate cutting from the Fed.

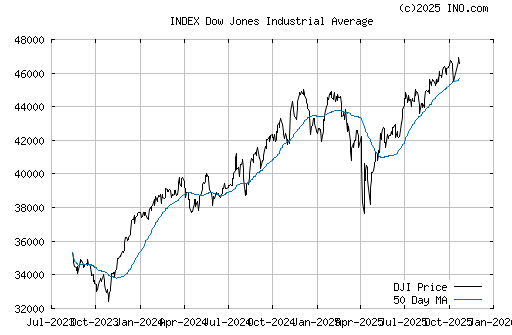

According to the chart (sheep entrails), if the rally fails, we’ll see 11,500 next.

Yep.

bump

Bear market rallies are a beeyaotch.

Yep a bear trap - Elliot Wave is 3-5 wave retractions up and 5-7 down along with a very negative head and shoulders....At least the chartist in me says we have a way to go....

I am all cash and sitting on my hands at this point waiting for a clear trend

This is just the result of speculation. Nothing in these companies outlook improved that much from yesterday. Bond insurance will continue into the future, but the new business will come from new insurance companies, with AAA ratings, and without the baggage of the mortgage backed instruments.

Employment numbers out tomorrow.

Yup.

That’s an ugly lookin’ chart pattern right there.

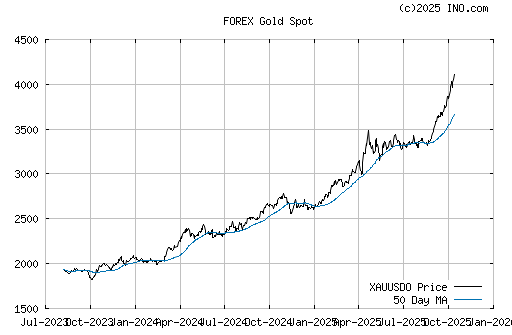

I started going into precious metals at gold $400 and silver $5, and I think they'll go over 1,000 and $20 in a few months.

And on a friday. I’m no expert, but I do follow these things and read a bit. When the markets sank yesterday after the fed dropped another 50, I thought that was a sign of very little underlying confidence. Today a lot of shorts were cleared out. Tomorrow might be interesting.

Way ugly. Lots of folks believe in “don’t fight the fed,” but I think the fed might be out of horses now. I dunno.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.