1) GDP as a % of debt. It's going to revert back to the mean which guarantees a depression.

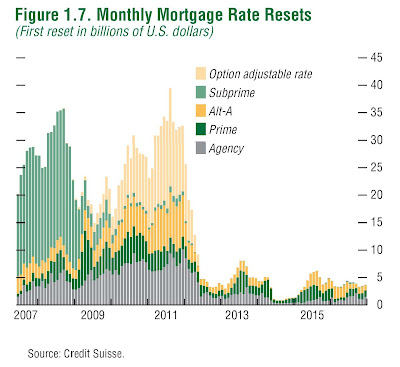

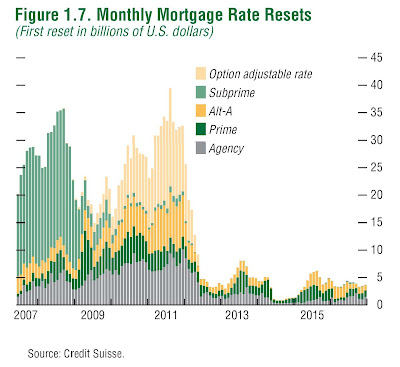

#2) Option ARM / Alt-A reset coming

We're only in the 3rd inning of this financial debt burst.

Posted on 12/20/2008 10:31:53 AM PST by SeekAndFind

I've been complaining for years about how excessively pessimistic everyone has been about the economy and the stock market. But I have to admit, now that the economy is in recession and the stock market has taken a serious hit, all the pessimism is serving some useful purposes.

First, pessimism has driven stock prices down to levels that make them terrific bargains. If you've been a long-suffering value investor, frustrated by decades of high prices, then your day has come. Stocks are cheap -- at last. Second, pessimism has given everybody a healthy respect for the risks that our economy faces now. Sure, it's annoying when people falsely compare today's economy to the Great Depression. But because we're talking about it, that means that we're unlikely to repeat the mistakes that created the Great Depression in the first place.

Now put those two ideas together. Stocks are so cheap they're priced as though the economy was going into a depression. But it's not, because we've learned how to avoid that kind of horrible economic catastrophe. That means stocks really are a buy.

Imagine you were living in 1930. It looked a lot like today. The booming economy suddenly stopped cold. The stock market had just crashed. Everyone was up to his eyeballs in debt and struggling to get out of it. But at that point it was still just a recession. You wouldn't have known then you were headed for a depression and certainly not the Great Depression.

What went wrong? What turned a recession into a depression. And what made that depression great?

For one thing, Herbert Hoover raised taxes. Then Franklin Roosevelt raised them again. The theory was that falling tax revenues were putting the government into debt, and all that debt would hurt the economy. No one seemed to realize that you hurt the economy even more when you raise taxes.

Fortunately, our president-elect seems to realize that. Barack Obama campaigned on the promise to repeal the 2003 tax cuts rather than just let them expire naturally in 2011. Now he's let it be known that he won't be repealing them, so taxes are going to stay low -- on incomes, dividends and capital gains. I never thought I'd be so glad to see a politician break a campaign promise.

In 1930, America enacted the Smoot-Hawley Tariff Act, which raised taxes on international trade. The idea was that protectionism would be good for American jobs and American tax revenues. But other nations retaliated, and the volume of global trade collapsed. It took more than 50 years for the percentage of world GDP contributed by global trade to recover to 1929 levels.

There's been a lot of talk about protectionism over the last several years, thanks to the rise of China and India as manufacturing superpowers, and the trend toward outsourcing low-end U.S. labor to them. But as the recession has set in for real this year, for some reason we're suddenly not hearing very much about it anymore.

In fact, when the G-20 group of nations met in Washington to discuss the global recession last month, the members pledged not to use protectionism as a tool for creating local recovery at the expense of the global economy. That's great news because protectionism is a lose-lose proposition. By destroying the efficiencies of cross-border trading, it hurts everyone everywhere.

Worst of all, in the early 1930s the Federal Reserve just sat there doing nothing while thousands of banks failed. And once that happened, the Fed tightened the money supply. From the peak in 1929, the Fed reduced the money supply by 28% over four years. You really couldn't come up with a more effective way to strangle an economy.

Today's Fed is doing precisely the opposite. After a series of bungled interventions earlier this year in which several banks and brokers not only failed, but in my opinion were forced into failure by speculation and regulatory mismanagement, the Fed and the Treasury are now dedicated to propping up the banking system at any cost.

When Citigroup (C: 7.02, -0.41, -5.51%) got into trouble last month, the Treasury invested $20 billion in new capital on top of the $25 billion they'd invested a month earlier. And the Fed put a guarantee on $262 billion of Citi's "toxic" assets to assure that the bank's balance sheet would stay strong.

And money supply? Don't get me started. The "monetary base" -- the best measure of pure money creation by the Fed -- grew at a 740% annualized rate over the last three months. The Fed's balance sheet has tripled. It's now equal to 20% of the balance sheet of the entire commercial banking system.

The Fed's move to lower interest rates to near-zero this week is part of that, but it's not itself especially relevant. The important thing this week was when the Fed announced that it intended to keep its balance sheet huge and even grow it from here by buying mortgages, Treasurys and who knows what else.

Put it all together, and it means that the four worst mistakes that caused the Great Depression -- tax hikes, protectionism, bank failures and tight money -- are most assuredly not being repeated today.

So I'm quite confident we're not moving from recession to depression. That makes me think that a lot of the massive "stimulus" that Washington is talking about will end up being a big waste of money. By the time we do it, it won't be necessary. And even if it were, I worry that a lot of it is really just an excuse to implement politically popular spending programs using an economic emergency as the excuse.

But let's not pick nits. The point is that we're not headed into a depression. All the rest is details.

If I'm right, and this view starts to gradually seep into public consciousness, then stocks are going to keep working higher, as they have for much of the last month. There will be scares. And there will be big downdrafts as investors who didn't sell on the way down use rallies as an opportunity to get out while the getting's good. But I really think the bottom is in and that stocks are headed for a very nice rally from here.

If nothing else, a rally is due just from sheer exhaustion of selling. Late November was surely a "selling climax," and even if we ultimately have to retest those levels, we can still have a nice rally in the meantime. When stocks have moved somewhat higher a month or two from now, we can stop and reappraise. But for now, the course of least resistance is higher.

Donald Luskin is chief investment officer of Trend Macrolytics, an economics consulting firm serving institutional investors. You may contact him at don@trendmacro.com.

bttt

The multiplier right now is exactly 1, meaning that - just like everyone else - the banks aren’t lending or spending. Why would they? In a deflation the inherent 0% rate of return on cash is actually a pretty good risk/return tradeoff. And Japan has taken 15 years to prove that throwing money at a multiplier of 1 is a waste of time.

Here’s what some of the most prominent economists who have studied deflation, liquidity traps, the Great D and Japan’s lost decade say (Bernanke, Svenssen, Krugman, Anna Schwartz, the Romers, Feldstein), and it’s all pretty depressing:

The nature of a bubble-deflation or debt-deflation is a pattern of mutually reinforcing solvency crises, confidence crises, and output reductions. From one side of the MV=GDP=PY equation, the money multipler and velocity plummet due to the solvency and confidence crises, and from the other side output plummets as over-production is scaled back. Price movements and broad money measures are just a trailing reflection of the underlying problems.

Zero interest rate policy (ZIRP) is an ineffective stimulus, because it is paradoxically both too high and too low. First, any nominal interest rate that is not well into negative territory (right now, estimates range from -2.5% to -5%) is still to too high in deflation-adjusted terms to (theoretically) encourage lending, borrowing and investment. However, 0% is the exact nominal yield of mattress-money (or its banking equivalent, excess reserves) - therefore the risk/return tradeoff for lending is not favorable compared to the risk/return tradeoff of hoading cash. Additionally, due to low confidence, the perceived risk/return tradeoff for borrowing money for either consumption or investment is also unfavorable compared to just waiting until prices drop further or until investment conditions improve.

http://www.federalreserve.gov/pubs/feds/2004/200448/200448pap.pdf

http://web.mit.edu/krugman/www/bpea_jp.pdf

Quantitative easing (QE) may help temporarily dampen a solvency crisis, but it cannot simultaneously solve the three crises in solvency, output and confidence, and the result of Japan’s experiment has been to delay badly needed structural reforms. First, the mechanics of QE tend to artificially prop up the economically and financially weakest institutions, creating unproductive zombie institutions that are only solvent while on government assistance, with little incentive to reduce systemic risk. Additionally, the economy comes to realize that any reinflation of money is short-lived. In QE, the Fed monetizes Treasuries, agency bonds, MBSs, CDSs, and anything else it can buy, thus injecting money into the economy - in essence using its magical powers to convert those instruments into brand new “money.” It does so in the hope of stabilizing the solvency crisis, of reigniting the multipler and velocity, and sometimes even of bypassing them altogether and directly inflating broad money measures. The drawback is that it eventually becomes public knowledge that the Fed eventually must demonetize (that is, re-deflate its own QE re-inflation), and that any inflation is temporary noise in a longer-term trend.

http://www.federalreserve.gov/pubs/feds/2004/200448/200448pap.pdf

http://www.frbsf.org/publications/economics/letter/2006/el2006-28.pdf

Krugman’s proposal that the Fed “credibly promise to be irresponsible” and build a self-fulfilling expectation of inflation is also unconvincing. The essense of Krugman’s proposal is to create a perception that by ZIRP and QE the Fed will somehow dramatically overshoot its inflation target, thus encouraging people to part with their money, and ultimately restoring economically productive lending and spending. The underlying risk is that instead of restoring confidence in the economy or financial system, it further increases pessimism, igniting a flight to the perceived relative safety of foreign currency and gold. Krugman himself recently stated that such a measure requires creativity and luck, not the best foundations for monetary policy.

http://krugman.blogs.nytimes.com/2008/12/17/a-whiff-of-inflationary-grapeshot/

http://krugman.blogs.nytimes.com/2008/11/15/macro-policy-in-a-liquidity-trap-wonkish/

Svensson’s Foolproof Way to Escape From a Liquidity Trap focuses on devaluing the dollar against other currencies (in conjunction with ZIRP and QE to peg that depreciation). However, it has a surprisingly obvious draw-back in a global deflation. Specifically, that policy cannot be simultaneously successful at the five key global central banks - the Fed, Japan, Europe, London and China. In a simultaneous crisis in those five economies, there will either be big winners and big losers, or a combined overall failure (more likely due to growing monetary interdependence), or in the worst case a race to the bottom and eventual flight to gold. Japan and China have already demonstrated their unwillingness to let the West undermine either their export base or the value of their dollar investments. While Svensson prescribed such a measure for Japan in 2003 (when it was in a self-contained trap) or for Europe or the US if it ever found itself in a contained trap, he never explicitly described it as a solution for global deflationary contagion.

http://www.princeton.edu/svensson/papers/js.pdf

http://www.nber.org/papers/w10195

While fiscal policy may provide a fleeting cushion against rapid deterioration, it cannot trigger a recovery. Any combination of increased deficit spending - in lower taxes and/or higher spending - suffers from a prohibitively slow lag to full implementation, and from the effects of low velocity. Additionally, counter-cyclical fiscal policy by definition requires pre-deflation surpluses. The existing pre-deflation deficits further reduces the expectations of effectiveness that are needed to drive money through the economy. Modern infrastructure projects are the most ineffective of fiscal measures, because of the slow lag time to initiate, and because most require trained and ready workers... the days of handshovels are long gone.

http://www.econ.berkeley.edu/~cromer/RomerDraft307.pdf

http://www.econ.berkeley.edu/users/cromer/great_depression.pdf

http://sfb649.wiwi.hu-berlin.de/papers/pdf/SFB649DP2005-039.pdf

Stop the bailouts and stimulus garbage, I vote for depression!

You may want to consult with some real economists before making such a ridiculous claim. May I suggest Bernanke & Greenspan themselves, Anna Schwartz, the Romers, Stiglitz, Krugman, Feldstein, Cowen, Phelps, Makiw, Svenssen, and quite a number of Fed governors and directors. Go ahead and call them idiots and ideologues too, since that seems to be your primary means of communication.

I only asked for your advisor on the chance he saw all this coming, as I can always use new credible sources during this crisis. I am putting great stock in those who predicted the bursting of the housing bubble, the collapse of the stock market an the impact on the economy. My list is growing, but the numbers of these people is still low. I read them exclusively and while I they disagree among themselves, I don’t ignore any of them. People like Mike Shedlock and Peter Schiff and Eric Janzsen and Meredith Whitney and Nouriel Roubini and of course Mr. Adler here. Some others as well, but you get the point.

I have had my investment dollars in my 401(k) invested primarily in aggressive growth, large cap and small cap mutual funds since the early 1990s. It took me a few years after starting my career to start adding to the retirement account.

The housing bubble caught me completely by surprise. I was living in San Francisco where I knew I could never afford property, so I paid no attention to house prices. In 2004, co-workers started chattering about buying houses or being prices out forever. I took a quick look at houses and saw that prices were rising parabolicly while incomes were stagnant. That raised immediate flags and I begged people not to buy as they had already missed the boat.

I started watching house sales volumes and inventories, knowing a plunge here would lead a plunge in prices by about a year. (Conversely, people say you can’t pick a bottom in housing, but the fact is, watch sales and inventories. When inventories plunge and sales take off, about a year later you will see prices rise. So YES, you can pick a bottom.)

Sales cratered throughout 2006. I knew the bubble had burst. By Dec. 2006, I transferred my entire portfolio from mutual funds and index funds, to cash-related funds. I’ve been earning 3-4% per year ever since.

As it turns out, I did the right thing but got it slightly wrong. I anticipated a crash in the stock market, but got the scale and reason wrong.

I saw the collapse in house prices coming and knew this would implode the wealth effect and crush consumer spending as people could no longer suck massive equity from their homes to buy fancy cars, take vacations and party like no tomorrow. I expected this to tank the real economy and I expected the low earnings to tank the stock market, fully realizing we SHOULD retest the 2001 lows from the dot.com collapse.

Little did I know of the subprime/MBS/CDS problem. I did not know that the financials were going to be gutted by losses and writedowns from failed mortgages. So I was right that the stock market would collapse, but wrong that the real economy would lead. As you know, it was the collapse in the financials that lead the stock market crash and only know is it all hitting the real economy. This means we have wave 2 to go through as the deep recession, layoffs, business closures and bankruptcies come full circle to give the stock market a second beating. People are buying this bounce-back bear market rally as a bottom. They are dead wrong. We’ll go to S&P 1000-1050 and then collapse back to 750 or lower. The pessimists are calling S&P 600 and DOW 6500 or so.

Since the most “pessimistic” forecasts have been completely right so far, I think it is unwise to dismiss them now out of hand. I know we are going down to S&P 750. That was the closing low just one month ago and we WILL retest it. I won’t be surprised at all to see S&P 650. Now imagine GM and Chrysler eventually go bankrupt, unemployment goes to 10%, tax revenues plunge and states like California get their credit ratings downgraded and default on some loans. All of a sudden S&P 500 doesn’t sound insane.

Early on, when Obama takes office, he will ramrod his ridiculous “stimulus” package to the tune of nearly a Trillion dollars for “Green” energy. (In the form of Hydrogen, Wind and Solar power which will be a complete waste of time and money.) That will include his plan to build/rebuild schools, roads bridges, etc,. The media will sell this as an amazing recovery and the Messiah will emerge as a new Godlike figure and will get everything he desires.

The unemployment figures will reflect a tolerable level at first. And in the mean time they will pass his Carbon Crap scheme and it will pass the legislative branch like water through a cow. Industry will have to completely turn itself upside down to survive. The cost will be beyond logic. We will be forced to carry the expense through goods and services.

It may take two years before the effects of this kicks in, but business will leave or fail in record proportions. Protectionist trade policies will then become what we have all warned about. The average American worker will make a higher (union) wage but a loaf of bread will cost $5 bucks. Inflation will run off the chart, as will all other vital economic indicators, in a negative sense.

Oil shortages, gas rationing, double digit inflation, unemployment extensions, food stamps and rationing and interest rates will have to rise to keep up with inflation.

It will be the Carter years on Steroids. Depression is to put it mildly.

So, save your staples and keep your powder dry. It will be the wildest of rides.

IMO can’t have hyperinflation without wage growth and that’s just not going to happen anytime in the next year or two—no matter how much the $ supply grows. Right now that money supply is just sitting at the bank so there is no multiplier effect. Agree with the depression thoughts though.

1) GDP as a % of debt. It's going to revert back to the mean which guarantees a depression.

#2) Option ARM / Alt-A reset coming

We're only in the 3rd inning of this financial debt burst.

The hedge funds are simply liquidating positions (mostly bought on credit) and that’s only going to get worse as things like Madoff pop up.

Eh, we know printed money (at least as off start of this year) but not M3.

That doesn’t even make sense. Anyone who has been short the market the last 18 months has made a fortune. I got out of stocks at around 12.5k and riding US treasuries since then (which have skyrocketted). What’s your portfolio done this year?

Houston. I remember the doomers, back then, saying it was “over” for Houston, too. Houston came back.

No kidding. Forbes was on about this in 2004. Excellent coverage and discussion of the matter. Incidentially, the cities and locations are all run by Democrats.

!!!!!!!!!!!

[IMO can’t have hyperinflation without wage growth and that’s just not going to happen anytime in the next year or two—no matter how much the $ supply grows. Right now that money supply is just sitting at the bank so there is no multiplier effect. Agree with the depression thoughts though.]

We are just arguing WHEN the hyperinflation begins, not IF. Like arguing the number of angels on the head of a pin.

[#2) Option ARM / Alt-A reset coming]

That’s the chart I knew I needed but couldn’t find. It’s worse than I thought.

Velocity of money is too low and going lower for hyperinflation to be an issue in the foreseable future. I’m not sure we will see hyperinflation although it’s possible. I can’t imagine it will happen before 2011.

Strawman alert, I said nothing about Bush.

And the Fed did see it coming. It sent M1 flat in 2005, 9 quarters before the real estate top and 13 quarters before the oil top. It began raising rates in the summer of 2004 and proceeded to increase them *17 times* through the summer of 2006, then left them at 5.25 for 3 months until the real estate market rolled over. M1 had already stopped increasing by the time they got the rate to 2.75% in early 2005. This was the right action to preserve the value of the dollar. The worst one can say against it is that it was gradual enough market participants had plenty of time to react, as though that is a drawback if they are at all rational.

Did private banks stop making reckless loans as the Fed increased rates? They did not. Did they try to keep their loan books growing no faster than their reserves? They did not, instead they created $2 trillion more of broad money, without a particle of additional narrow money underneath it. Did they begin to overprovision and build loss reserves? They did not, since they were still at record low portions of assets in the summer of 2007. Did commodity spectulators see what was coming and pull back? Briefly oil took one correction dip, then it double upward on fumes, destroying demand, as the market sold rampant idiocy about peak oil to anyone who would listen.

The false minor of your statement is a belief that the Fed or Fed and president are all-powerful. They are not. They can point out the right course of action to banks and market participants, but the latter are perfectly free to take a flying leap into an abyss instead, if they want to and are stupid enough. They are stupid enough.

In pretending that anything that happens in the economy is the authorities' fault, while simultaneously pretending they ought not do anything, you have simply erected an incoherent ideological fortress of stupidity that is immune from empirical facts of any kind.

The Fed can screw up, but it didn't this time. The markets can be rational and efficient in allocating capital and gauging risks, but they were not this time. Men are falliable, and they do what they freely choose to do. And no, straw man alert again, I am emphatically not saying the Fed is smarter than the market *all the time*, I am saying it is an empirical matter, and this time they were right 2 years early, and the market, banks, and spectulators fought them like manic idiots, and got their heads handed to them.

You don't have to like this for it to be true. Your idiotic ideology doesn't have any room for it, because its first premise is the rationality of all private economic actors, and that premise is simply false. From it your predecessors and the creators of your ideology drew conclusions that are immune to empirical reality, and that renders it unscientific nonsense and a standing recipe for disaster, as a basis for policy.

Conservatism isn't an ideology, and trying to make it one simply makes it evaporate. The first principle of conservatism is the moral freedom of mankind; they will do different things with that freedom; therefore institutions dealing with men need to be practical, flexible, empirical, and moderate. Socialists deduce from the fallibility of free men that they ought not to be free and are rogues. Libertarian ideologues deduce from that chain of reasoning on the part of socialists that said libertarians need to impudently and falsely maintain the infallibility of men. They are both packs of raving lunatics.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.