Posted on 11/03/2009 6:58:08 AM PST by blam

Property Values Set to Fall 43% From Current Depressed Levels

Michael David White

November 02, 2009

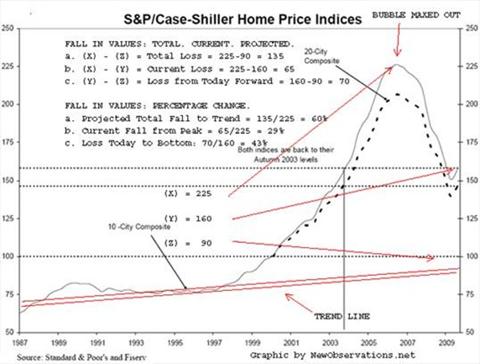

Price Trends / WAR OF THE WORLDS: If you use a 20-year time horizon, and assume prices will return to the trend line, then our residential property bubble will bottom after values fall over 40% from current levels (see above (c) aka “(y) - (z)” aka “Loss Today to Bottom”). I make no predictions. I do watch numbers. The chart shows a catastrophe of falling real estate values loaded up on top of our current catastrophe in real estate values.

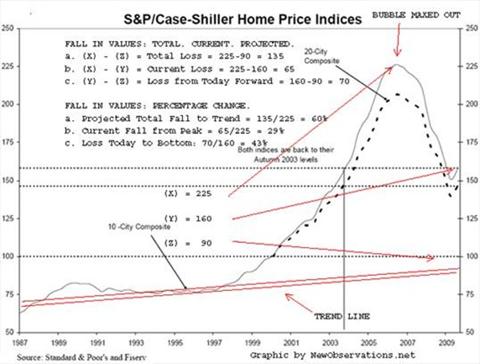

No one would question these numbers absent The War of the Worlds. The War of the Worlds is the United States Government versus aggregate borrower income. Uncle Sam is funding every new mortgage – high, low and in between (see chart below--the blue and red represent government-backed loans and the private market is the yellow and green).

It takes very little imagination to see the world of real estate prices vaporizing without government support. If that support was lost, values would crash down faster than a big rock dropped into a shallow puddle.

[snip]

If this happens we will see the nation divided into people of honor who keep making payments based on loan values far about actual value, versus those who walk away.

Anyone care toredict the ration of walkaways? I would guess 60% of all homeowners or more

Related

http://www.businessinsider.com/chart-of-the-day-house-prices-and-median-household-income-2009-11

I don’t believe this at all - the market is currently at or very near bottom, look for an upswing in the next 6 months.

At that point it really all falls apart, and we have to enter a communist society, where ownership is a stupid, outmoded concept, and we all just use stuff without caring how it got there.

A bloody time. A time without rules or laws.

Well, don’t forget about that third group who stays and pays with their free government monopoly money.

Just because you walk away doesn’t mean you are no longer liable for the home.

If the bank won’t buy it back, you may not be paying a payment, but you will still owe for the taxes and liability on that home. That’s where we are in MI. The banks won’t take them back. So you have this millstone, losing value but at least if you keep up your payments, you remain current on taxes and you don’t take the chance of someone gets hurt in your abandoned property (stealing your copper pipes most times).

and how would this happen as we see that smart investor buy up depressed real estate as good investments.

More crap from the sky is falling crowd.

Marxist or Lenist socialism is such a downer.. woo wee...

Great housing price chart. Looks like we now have 2004 levels in late 2009.

So did CRA cause this steep growth?? The myth is that this growth could go forever and that the CRA crashed this great Bush party we had.

I’m with you....one can now buy most homes for less than land construction cost unless in very hot immune area.

seems flat....not poised for a 40% drop..if so, starter home neighborhoods will be all tumbleweeds

rich dad ping

Even worse, we will live in a society that believes being honorable is stupid. I guess though, if you only consider this lifetime and what you can get out of it, that might be so, its a very Nietschean point of view.

However, Eternity is a long time to regret being “smart.”

When the news seems it can’t get any worse, a stock broker once told me, you know you’re at the bottom. We may stay here for the next 3 years, but I think we are pretty much at the bottom of this thing.

No matter which way real estate goes, you can bet that Carlton Sheets will show you a way to make millions!

IMHO:

Depending on the area, go back to late 2003, compare sold prices in a given area.

Ignore the highest and lowest price, get the average price of the rest.

Again, depending on the area, add 4%-6% appreciation to that average price for each of the following years up until 12/09.

Assuming the property and it’s neighbors have been well maintained, you will have the fair market value of your home.

You never "bottom" on a trend line - you crash right through it (or it would not be a trend line in the first place)...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.