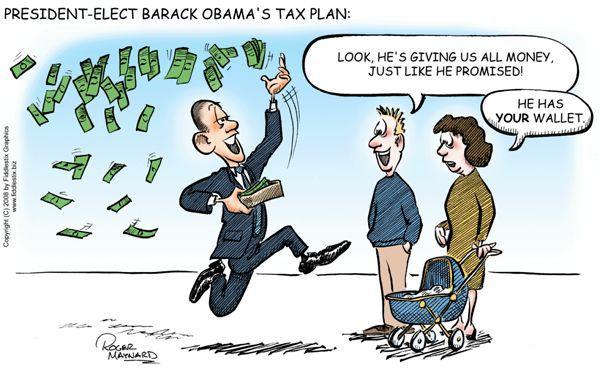

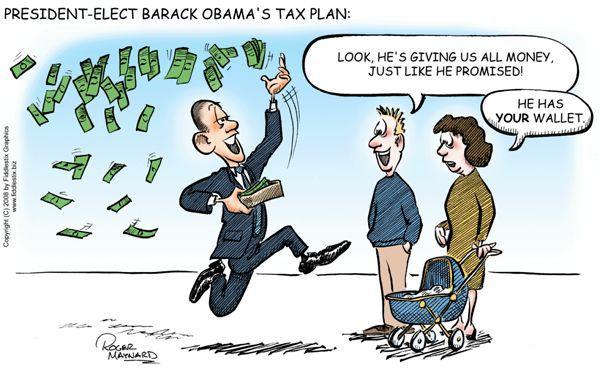

"Using Inflation to Erode the Savings and Retirement Income of Prudent Taxpayers"

There, all fixed.

Posted on 12/07/2009 12:28:10 PM PST by reaganaut1

As a share of GDP, the U.S. Federal debt held by the public exceeds 50 percent in FY2009, the highest debt ratio since 1955. Projections indicate the debt ratio may be in the 70-100 percent range within ten years. In many respects, the temptation to inflate away some of this debt burden is similar to that at the end of World War II. In 1946, the debt ratio was 108.6 percent. Inflation reduced this ratio about 40 percent within a decade. Yet there are some important differences –shorter debt maturities today reduce the temptation to inflate, while the larger share held by foreigners increases it. This paper lays out an analytical framework for determining the impact of a large nominal debt overhang on the temptation to inflate. It suggests that when economic growth is stalled, the U.S. debt overhang may trigger an increase in inflation of about 5 percent for several years. This additional inflation would significantly reduce the debt ratio, even with some shortening of debt maturities.

(Excerpt) Read more at papers.nber.org ...

Ben Bernanke promises us he won't let inflation get out of hand. We'll see.

I believe that real claims (those that would rise with inflation) such as Social Security and Medicare are large compared to the national debt. Even if the debt were partially inflated away, the need to fund those programs would still exist.

So, I can pay off my mortgage 20 years early with inflated $$$?................

That’s a good point. That has led me to believe for some time that the interesting angle of this whole story is going to be the way the Federal government inflates away the country’s debt while at the same time artificially understating the real inflation rate so as to minimize automatic cost-of-living adjustments for these entitlement programs.

Not sure if it is a rheoterical question, but the answer is YES assuming you have a fixed rate mortgage. Unexpected inflation is a big boon to borrowers. One of the reasons the Populist and Democratic parties back in the late 19th century wanted the silver coins minted was to create inflation to help farmers who tended to be in debt.

Government, and leftists in particular love inflation. Inflation reduces savings and investments to zero. So all the people who worked hard and saved money so as not to be dependent have their money reduced to nothing.

This makes them poor and miserable, and dependent on the government. That’s how the left “redistributes” income.

Sure, if your job is one of the few who can pay with inflated dollars as a result of raising prices to keep up with that inflation. Most jobs can’t.

With the current debt and the debt being accumulated, there are only three ways out. First is to reduce spending while holding interest rates at arbitrarily low levels. Second is to inflate our way out. Third is to default.

The first solution is tricky. Interest rates have to stay low so principal can be paid off, but low interest was what created the high levels of debt in the first place. I can’t imagine the government having the guts to default, because they fear the economic chaos, and the loss of their own personal fortunes. So, I think we’ll try to inflate our way out.

Nothing indicates that Washington is willing to control spending.

In fact, using inflation to dump $10 trillion dollars of debt right now will almost certainly cause the increase in the future debt to be many times more than that in present dollars because the inflation will damage the economy reducing productivity and future taxes, along with the loss of the dollar as the world reserve currency which will drive up and destablize our prices for imports especially oil.

in an oft-fogotten speech, Ronald Reagan took pains to point out that in the 1970’s inflation was part of the government’s DELIBERATE ECONOMIC PLANNING. I don’t suppose that the Liberals have changed their views since that time.

"Using Inflation to Erode the Savings and Retirement Income of Prudent Taxpayers"

There, all fixed.

Ironically, the 1970s inflation was a well-orchestrated move by the Federal government to overcome Lyndon Johnson's abject idiocy of waging a major military campaign in Vietnam while at the same time embarking on the enormous "Great Society" programs that still haunt us to this day.

I'm no fan of Jimmy Carter, but on this count I think he gets a bad rap. LBJ and Nixon were culprits more than anyone else when it came to a totally unsustainable economic situation that would ultimately need to be corrected.

As a share of GDP, the U.S. Federal debt held by the public exceeds 50 percent in FY2009, the highest debt ratio since 1955. Projections indicate the debt ratio may be in the 70-100 percent range within ten years. In many respects, the temptation to inflate away some of this debt burden is similar to that at the end of World War II. In 1946, the debt ratio was 108.6 percent. Inflation reduced this ratio about 40 percent within a decade.This is a debate that goes back to Old Hickory's administration (at least). Thanks reaganaut1.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.