Posted on 09/12/2011 12:27:46 AM PDT by blam

Deflation Is Here

Graham Summers

September 12, 2011

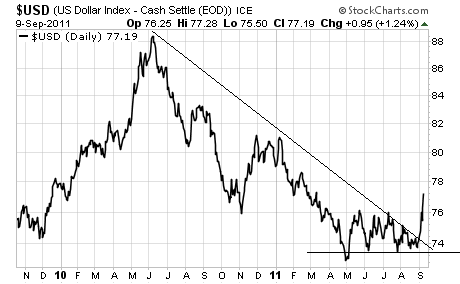

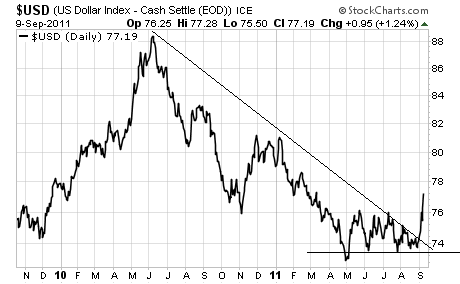

I’ve been warning that the markets were on the verge of another round of Deflation. By the looks of things, it’s here with the US Dollar breaking out of its massive wedge pattern.

The ultimate target for this pattern is the mid-80s. So consider this latest breakout the first leg up of a much larger move that will affect all other asset classes in a big way.

In order for a move of that caliber to occur in the US Dollar, we’ll need to see a full-scale crisis hit the markets (the last two US Dollar rallies occurred during the 2008 collapse and the 2010 Euro Crisis). So expect greater downside risk in stocks in the near future.

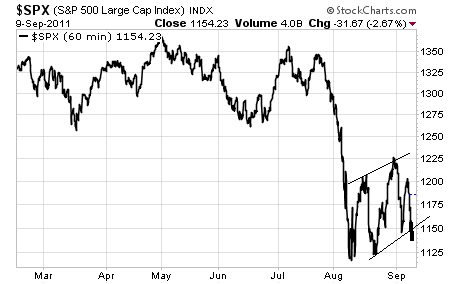

On that note, the S&P 500 has broken out of its bearish flag formation to the downside. The ultimate target for this pattern is at 1,000: 13% DOWN from here. Considering that we’ve already wiped out a year’s worth of gains in one month, this should be a MAJOR warning that we’re not done yet.

(Excerpt) Read more at seekingalpha.com ...

If deflation is coming you WANT to maintain cash, not “appreciating” assets like real property that could just as easily “depreciate”.

In deflationary times cash is king.

“Better start stockpiling more food also.”

Yes, that will never go to waste.

“there won’t be any stuff to buy.”

Why do you say that?

The trick occurs with your supplier ~ he will have to sell off his existing stock for less than he paid for it. He will suffer losses. He will be unable to pay his creditors. He will go bankrupt.

There's usually so much bankruptcy up and down the supply chain (from raw materials producers to final sandwich makers) that nothing gets done.

Sometimes deflation will be kept localized to a single country ~ then they can use those extra chunks of money leftover and IMPORT what they need (See: Spain 1500s). Othertimes deflation will be more widespread. In that case if impediments to import/export are put in place ~ e.g. with protective tariffs to encourage domestic producers to not go bankrupt, you'll get a general collapse of trade ~ (See: Great Depression 1930s)

Most individuals will perceive that their existing debt loads are too high to sustain with their reduced incomes ~ even though interest rates may go to ZERO.

Sometimes your first indication that you have serious deflation is the drop in your interest rates. The United States and Switzerland (as usual) are already accepting deposits for which no interest is being or will ever be paid.

The 2 year T-bill rate may go to 0.3% today ~ and tomorrow it may bo to 0.0%. We can envision selling T-bills with as much as a 2% carrying charge where the buyers pay the government for the privilege.

Much more of this and banks will go "bankrupt" ~ check out the status of BOA today.

Thanks for the information, and your insight.

It’s getting scarry out there.

Scary? This is scary: http://finance.yahoo.com/bonds

Very scarry.

Do you think my old EE U.S. savings bonds are secure?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.