Posted on 12/29/2011 8:02:18 AM PST by blam

Gold: This is What an Ex-Momentum Trade Looks Like

Joshua M Brown

December 28th, 2011

Momentum is mystical, no one can truly explain where it comes from, why it manifests itself the way it does, or why it seems to come and go so suddenly - capriciously, the jilted trader who bought at the top would say.

But there is nothing quite so ephemeral or tantalizingly mysterious about the aftermath of momentum. It's brutal-acting and horrid-looking, it's lower highs and lower lows, it feels like give-up and the thwarted snapback rallies on the way get more and more feeble during this hope deflation process.

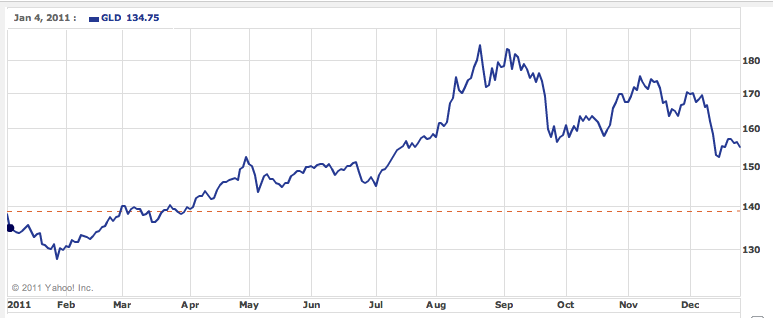

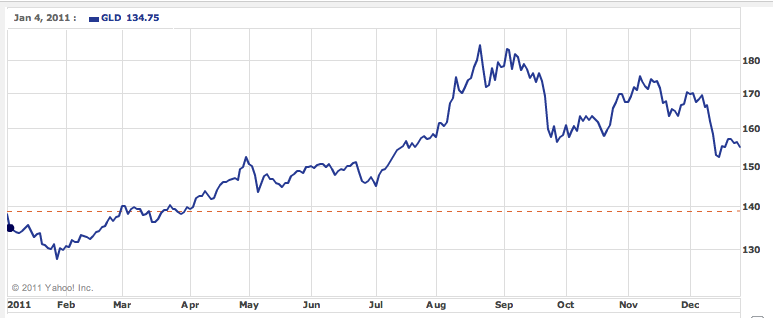

I want you to picture a weightlifter who has stopped working out for three years. Then I want you to transpose both the visual I've given you and the pity I've imparted in your heart onto a fallen momentum stock. Let's take the example of the recent action in $GLD as a big, fat for-instance.

Limping into the homestretch of 2011, giving up it's rapidly fading positive YTD gains. No one will speak positively about it, each bounce succumbs to the Law of Investors Getting the F*ck Out at the Same Time that Benjamin Graham may or may not have written about, I simply cannot recall.

If you loaded up at the peak of the Europe crisis this fall, do yourself a favor and reevaluate if the metal is still acting the way you expected to. Nothing worse than getting the thesis right but screwing up the trade expression. Gold is not a f*cking deflation hedge, no matter how badly you want it to be.

I wrote the below ten days ago, it is a very important reminder about crowded trades and waning momentum. I've reprinted it in its entirety below...

***

Gold and the Too Many Schmucks Problem (12/18/2011)

I was out at dinner last night with a few friends and once the wives the went off into their own lala-land conversation about god knows what, the boys began talking about the usual rundown of topics:

1. How hot is that waitress over there? How old do you think she is? etc.

2. NFL and Fantasy football etc. (yes, one of my favorite things is listening to guys describe their fantasy football teams in detail and where they stand in their leagues and all that - I just love it and can never get enough)

3. Gold

And the thing about the gold thing is that now everyone's suddenly bragging about the fact that "Oh, yeah, I got out already." Of course they did. And by the way, no one at the table works on Wall Street. My friends are doctors or pharmaceutical sales reps or they're in real estate or the jewelry business - I go out of my way to spend as little time as possible outside of work with other Wall Street assholes like myself. And this isn't easy to do where I live.

The only guy at the table who admits to still be long gold is the guy that goes "Yeah, I don't really care where it trades in any given year, I only own it as a hedge for my currency risk long-term." Okay.

I have some gold in my client portfolios. It's an asset class and we have some exposure, mainly through an active manager we work with who's been a gold bull since $300 an ounce, long before owning gold would've occurred to almost anyone else. We'll leave his weighting in gold to his discretion.

I don't profess to have any particular expertise in precious metals but I know deflation when I see it. But more importantly, I also know a crowded trade. Gold had become the quintessential crowded trade and at the height of the Euro crisis this summer it had gotten flat out silly. The way people off The Street were talking about it sounded an awful lot like the one-way run in real estate a few years back. For me, a correction was obviously going to occur but it became a question of when and from what price. I've mentioned 2000 an ounce here and there as where I thought the big selling would come in. Close but no cigar.

And the correction so far has been brutal - not so much in terms of price but in terms of timing (right at year-end!) and in terms of swiftness (what do you mean gold's down a few hundred bucks this fall?). Gold dropped through the 200-day moving average like it didn't even exist this past week and it is now hugging long-term support in the 1500's.

The believers are fully entrenched and will not acknowledge the dynamics of a crowded trade with too many schmucks in it. Here's a take in Barron's this weekend from a piece by Andrew Bary and Jaquelin Doherty, they steal my trademarked phrase in their story's title: "Next: "Face-Ripping" Inflation?"...

"A full deleveraging of the banking system could mean that the dollar and other currencies will lose 70% to 80% of their purchasing power," Quaintance says, arguing that all major banks in developed lands will suffer because markets are so interconnected.

How should investors prepare if they buy into this Grinch-y world view? Buy gold and unlevered assets, says Quaintance. The losers in this scenario: holders of cash and "risk-free" Treasuries. Of course, cash and Treasuries are what risk-adverse investors favor right now. I know, it's always right around the corner.

But the bears are becoming as vocal as I can remember them in the yellow metal. Reuters polled 20 top hedge fund managers and other big shots - they say gold is headed lower in Q1...

Gold prices will fall below $1,500 an ounce over the next three months and are unlikely to retest September's all-time highs until later 2012 at the earliest, according to a Reuters poll of 20 hedge fund managers, economists and traders.

The bleak forecast, coming after gold has lost 11 percent of its value so far this month, is likely to fuel fears that bullion is close to ending its more than decade long bull run and entering a bear market.

Almost half of respondents predicted bullion will fall to 1,450 an ounce in the first quarter next year, with three seeing prices as low as $1,400 an ounce.

The forecasts come after a dismal performance last week when prices hit a 2 1/2 month low of $1,560 and gold lost its safe haven status. So who to listen to? The believers or the now-bitten pragmatists who were happy to be in the trade so long as it was working? That's for everyone to decide for themselves at this point. But one thing's for sure, gold has become a very tough trade and I expect rallies to find stiff resistance from the Too Many Schmucks factor, they will now be selling what they plowed into at the recent high. This is a fact.

Time to trade gold and silver for steel, brass, and lead?

As anyone can see, the gold trade is entirely over, which is why central banks are buying it like crazy just now. Sell your gold now and buy paper, especially sovereign debt paper, which is undervalued and sure to rise in the coming years. Particularly Greek and Italian paper, which are the most undervalued.

< rolls eyes>

Piercing the 200 day is enough for me, were I long.

In all probability the bull run is over.

Crowded trade is a good description. Most who would buy gold, already has. Perhaps saturated market is a better description.

Time to look for another asset class. 2011 was a tough year for whipsaws, but those were in asset classes that do not have the straight up trajectory of gold.

Only “dips” don’t buy on the dips.

Deflation Ping

Scary as h@ll

Sorry guys, this is all my fault, last week I put a tiny bit of money into a commodity mutual fund.

Gold is only valuable to people who want gold. If you can’t sell it, it is a paperweight.

And the value of paper is worth what?

Yep. You would have to go all the way back to mid-July of 2011 to see Gold trading so low.

That chart makes me want to buy more silver.

I understand that feeling, completely.

Of course gold is going down! On a day when a poll comes out showing a financial genius defeats a sitting, socialist president 45 - 39, you would be well advised to be bullish on America. You may hate Romney for many reasons, but the man is a business genius and closer to becoming president than any such person since the founding of this country.

with QE3 coming in Jan/Feb the push is on to drive gold prices down so the big boys can buy more physical gold

as soon as ANYONE shows me ANYTHING that is being implemented that will strengthen the dollar... then maybe I’ll move away from gold. until then, the dollar will continue to weaken... which will make gold and the market look like its increasing, but in reality its staying the same. it’s just the unit of measure getting smaller

gold is the primary instrument to hold your buying power

Paper.

The same could be said about salt or flour

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.