Skip to comments.

US Citizens Now One Step Closer To Becoming Permanent Tax Slaves (Take a look at the Ex-PATRIOT Act)

The Sovereign Man ^

| 05/22/2012

| Simon Black

Posted on 05/22/2012 11:30:21 AM PDT by SeekAndFind

This week, the universally stupid brainchild of US Senators Chuck Schumer and Bob Casey known as the Ex-PATRIOT Act inched a bit closer towards becoming law.

‘Ex-PATRIOT’ is an absurd acronym that stands for “Expatriation Prevention by Abolishing Tax-Related Incentives for Offshore Tenancy”. I call it the Tax Slave Act… and it proposes three key provisions:

1) Individuals who are deemed, in the sole discretion of the US government, to have renounced US citizenship in order to avoid US taxes, will be permanently barred from re-entering the United States.

2) Such individuals will also be required to pay a 30% capital gains tax to the United States government on ALL future investment gains derived from the US. Currently, non-citizens who do not reside in the US pay no US capital gains tax.

3) These proposals are RETROACTIVE, and, if passed, would apply to anyone who renounced his/her citizenship within the last 10-years.

During a Sunday interview with ABC News, House Speaker John Boehner threw his support behind the bill… certainly a big step towards its eventual passage.

Let’s pause briefly for a little history lesson–

Dart Container Corporation was founded in 1960 by William F. Dart, the man who first perfected the design of styrofoam. Dart Container is today a multi-billion dollar family-owned company with thousands of employees and operations around the world.

In the early 1990s, brothers Kenneth and Robert Dart, heirs to the family fortune, renounced their US citizenship and became citizens of Belize and Ireland, and set up residency in the Cayman Islands.

Around the same time, several other wealthy Americans renounced citizenship, including Carnival Cruise Lines founder Ted Arison (who obtained Israeli citizenship), Campbell Soup heir John Dorrance (Irish citizenship), and fund manager Mark Mobius (German citizenship).

President Clinton was furious, and in 1996, he pushed Congress to pass a series of financial penalties for people who renounce citizenship. At the time, a ‘renunciant’ had to continue filing US tax returns for 10-years after renouncing.

Effectively, though, this penalty was a tax on worldwide income, not an exit tax on assets.

Fast forward to the mid-2000s, a time when the asset bubble was at its peak; the stock market was at its all-time high and real estate prices kept going up.

The Bush regime passed a series of changes to expatriation rules, dropping the income tax filing requirements in lieu of charging a one-time exit tax on assets.

In this way, the government was able to derive a much larger payment up front based on total assets rather than chasing around a former citizen for a piece of annual income.

In the years since the exit tax on assets was established, two things have happened:

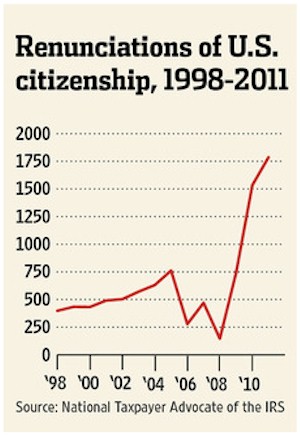

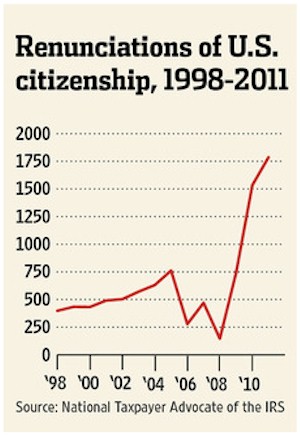

1) The number of Americans renouncing US citizenship has risen steadily, from 235 people in 2008 to 1,780 last year (according to Schumer’s office).

2) The asset bubble has burst, and assets are worth much less than just a few years ago. As such, the government isn’t collecting as much revenue from the exit tax.

My sense is that the government has been watching the number of expatriates rise over the years, and simultaneously watching the value of the exit tax fall… and they’ve been looking for an excuse to make sweeping (i.e. retroactive) changes.

Eduardo Saverin is the perfect excuse. The Facebook co-founder’s recent renunciation of US citizenship has become a rallying cry for politicians to go back in time and steal money from former citizens retroactively…plus establish a larger base for future tax revenues.

This is a truly despicable thing to do considering that these former citizens followed the appropriate rules at the time, paid the tax, and moved on with their lives. Now Uncle Sam wants to go back in time to unilaterally change the deal, and expect everyone to abide even though they’re not even citizens anymore. The arrogance is overwhelming.

More importantly, this bill is also a major deterrent for people who are thinking about renouncing US citizenship today.

The passage of this law will undoubtedly cause many people who were considering expatriation to abandon the idea altogether as the thought of being permanently barred from entry is too much to bear.

It’s truly extraordinary that the Land of the Free has deteriorated to the point that the government must now resort to threats, coercion, and intimidation in order to keep its most productive citizens inside.

TOPICS: Constitution/Conservatism; Culture/Society; Government; News/Current Events

KEYWORDS: citizenship; confiscation; expatriotact; marxism; privateproperty; propertyrights; tax; taxes

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 121-128 next last

To: SeekAndFind

All money rightly belongs to the feral government.

2

posted on

05/22/2012 11:31:18 AM PDT

by

E. Pluribus Unum

(Government is the religion of the sociopath.)

To: SeekAndFind

America, Home of the Slave, Land of the Unfree.

To: Oztrich Boy

4

posted on

05/22/2012 11:35:12 AM PDT

by

massgopguy

(I owe everything to George Bailey)

To: SeekAndFind

are citizens no longer protected from ex post facto punitive legislation?

Looks like tax refugees who want to come back just need to change their names to Jose Gomez and be smuggled back across the mexican border.

5

posted on

05/22/2012 11:39:12 AM PDT

by

silverleaf

(Funny how all the people who are for abortion are already born)

To: massgopguy

These proposals are RETROACTIVE... Nope. No can do. That is if we are to follow our laws.

To: SeekAndFind

The Soviets used to charge their citizens(or is that subjects?) for all the “Free” stuff that the benevolent government had given them throughout their lifetimes before allowing them to immigrate too.

7

posted on

05/22/2012 11:40:17 AM PDT

by

fella

("As it was before Noah, so shall it be again.")

To: SeekAndFind

Just another reason to put money in foreign trusts or other tax dodges.

To: SeekAndFind

How do they plan on enforcing this?

9

posted on

05/22/2012 11:44:19 AM PDT

by

Jess79

To: Principled

Didn’t you get the memo? The Constitution is irrelevant now.

10

posted on

05/22/2012 11:44:26 AM PDT

by

iceskater

(I am a Carnivore Conservative - No peas for me. (h/t N.Theknow))

To: SeekAndFind

Republicans approach situations from an analytical perspective. Liberals approach situations from an emotionally vengeful perspective.

11

posted on

05/22/2012 11:50:26 AM PDT

by

liberalh8ter

(If Barack has a memory like a steel trap, why can't he remember what the Constitution says?)

To: SeekAndFind

While he’s on a roll, good little fascist Chuckie Schumer ought to author a law that any New Yorker who moves to FL or any other state for lower taxes is permanently barred from re-entering New York

12

posted on

05/22/2012 11:50:50 AM PDT

by

silverleaf

(Funny how all the people who are for abortion are already born)

To: SeekAndFind

Republicans like to build walls to keep people out. Democrats like to build walls to keep people in.

To: SeekAndFind

This is right out of the Communist Manifesto:

“4. Confiscation of the property of all emigrants”.

Plank #4 of 10.

To: SeekAndFind

As Norquist has pointed out, this is just an updated version of the Nazi Reichsfluchtsteuer tax on Jewish emigrants.

15

posted on

05/22/2012 12:05:37 PM PDT

by

Vide

To: Jess79

RE: How do they plan on enforcing this?

_________________________________

Expand the reach of the IRS.

The US government ( with the aid of the IRS ) has already BULLIED Switzerland’s biggest banks (e.g. UBS ) into disclosing the names and accounts of US citizens with deposits in that country.

How do they do that? Simple, punish the American business of UBS.

Even as we speak many American ex-pats are starting to find it difficult opening bank accounts in many places. Too much paperwork for US citizens for foreign banks to comply.

It is happening folks. The only thing is most of you are not aware of it because most of you are not expats and don’t have or plan to live and work in other countries.

As they once said in Nazi Germany,

First they came for the Jews and I did not speak out because I was not a Jew.

Then they came for the trade unionists and I did not speak out because I was not a trade unionist.

Then they came for me and there was no one left to speak out for me.

To: SeekAndFind

There are some interesting numbers below....at some point its gonna start looking like a “bank run” ...which is essentially what it is...

The Feds are desperately worried some of the 50% of the population they uses as cash cows to help them fund their delusions are catching on...and leaving....

“Last year, almost 1,800 people followed Superman’s lead, renouncing their U.S. citizenship or handing in their Green Cards. That’s a record number since the Internal Revenue Service began publishing a list of those who renounced in 1998. It’s also almost eight times more than the number of citizens who renounced in 2008, and more than the total for 2007, 2008 and 2009 combined.”

http://www.reuters.com/article/2012/04/16/us-usa-citizen-renounce-idUSBRE83F0UF20120416

Even more alarming....in 1997 the list was ONLY 90 people renouncing...so that year, 2011, it was TWENTY times greater that in 1997...

http://www.gpo.gov/fdsys/pkg/FR-1997-01-30/html/97-2283.htm

17

posted on

05/22/2012 12:12:44 PM PDT

by

mo

(If you understand, no explanation is needed. If you don't understand, no explanation is possible.)

To: SeekAndFind

Nazis did the same thing, but don’t you DARE call Schumckie a Nazi.

18

posted on

05/22/2012 12:14:38 PM PDT

by

E. Pluribus Unum

(Government is the religion of the sociopath.)

To: SeekAndFind

We sure have come a long way since 1970, when conservatives had nothing but disgust and revulsion for anyone who would renounce America and their citizenship.

19

posted on

05/22/2012 12:15:57 PM PDT

by

ansel12

( The first American vote for a man who believes that he will become literally God, an actual deity.)

To: mo

In the international section of its most recent annual report to Congress, the agency’s National Taxpayer Advocate notes that whether it’s Americans working abroad or foreigners residing here, “taxpayers who are trying their best to comply simply cannot.” The result is that some are “paying more tax than is legally required, while others may be subject to steep civil and criminal penalties.”

Here’s the real issue: When it comes to attracting highly successful people, America is just not as competitive as we like to think we are.

What we need is a complete rethink. That rethink begins with a hard look at what these 1,800 citizenship renunciations are telling us. True, 1,800 is a drop in the bucket compared with either the number of Americans working abroad or the number of foreigners who are seeking U.S. citizenship. Still, when it comes to the global inefficiencies of our tax code, these 1,800 ex-Americans are canaries in the coal mine.

Our tax code—and especially the onerous reporting requirements that come with it—is turning U.S. citizens into economic lepers. Many foreign banks refuse us as customers; some investment ventures no longer want us as partners; and some business opportunities that would have benefited Americans now benefit others.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 121-128 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson