Posted on 09/21/2012 2:50:26 PM PDT by blam

QE-3 Hyperventilating Hyperbole on Hyperinflation Stock-Markets / Quantitative Easing

Sep 21, 2012 - 12:07 PM

By: Ned W Schmidt

Wow! The hyperventilating hyperbole on hyperinflation to be brought about by QE-3 was near overwhelming. From some of what we read, QE-3 is to cure all the economic woes of the U.S., cause hyperinflation, crash the U.S. dollar, prevent male patten baldness, push $Gold to $2,400, and cause the death of our favorite pet. Oh, and the perennial favorite fantasy trotted out on a regular basis is Silver going back to $50. Could QE-3 really be all those things, or is it really Damp Squib One?

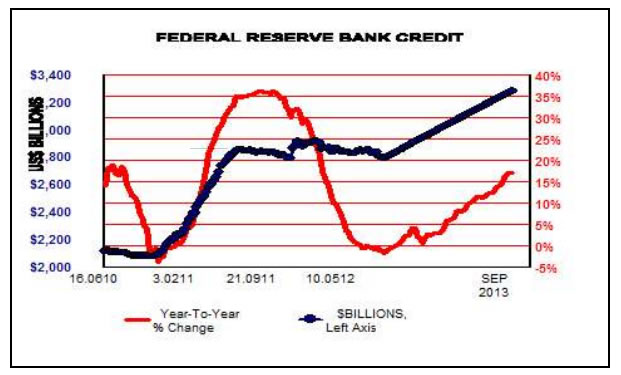

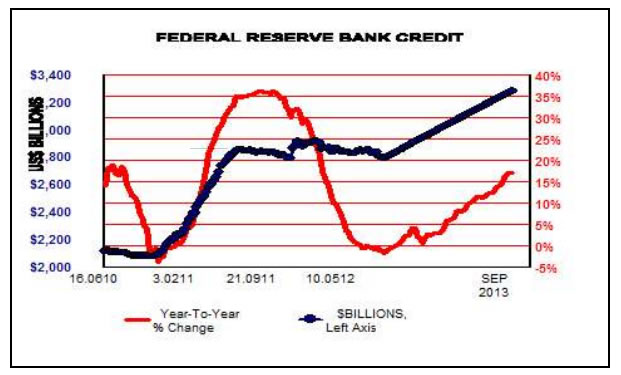

In order to appease the Street, FOMC announced the purchase of $40 billion of mortgage backed securities each month. To help understand the meaning this policy let us consider the chart above. The blue line, using the left axis, is Federal Reserve Credit, or the size of the Federal Reserve's assets. We have extended it out a year at a rate of $40 billion per month. Before going on let us note that the rationale for this policy is totally frivolous, and it was adopted purely to appease the paper asset pushers on the Street.

First observation is that adding $480 billion, while admittedly too much, does not compare to QE-2, early part of graph. QE-2 added nearly twice that much in less than six months. Relative to QE-1 and QE-2, QE-3 is not much to talk about. Second, the red line, using right axis, is the year-to-year change in Federal Reserve credit projected out for the next year.

The absolute size of Federal Reserve Credit, blue line, influences the size of the money supply. Red line is a major determinant of money supply growth and the inflation rate. A year from now that growth rate might be as high as 15-20%. While that rate of growth is too high, it falls far short of that necessary to create hyperinflation. Given the structural problems in the U.S. economy being created by the Obama regime, the level of economic slack in the U.S. economy, and the unwillingness of bankers to make loans that create money, QE-3 is unlikely to live up to most expectations.

Two other portions of the FOMC announcement have also received more comments than they are worth. This policy is to be open ended and more could be added to these purchases. What is new in that? That has been the Federal Reserve's policy for decades.

In anticipation of QE-3, or as we prefer DS-1, the teenage traders on the Street pushed $Gold up by more than $200 and sent the U.S. stock market to an unjustified level. What should investors do given that set of market action and the likely ineffectiveness of QE-3?

Gold has firmly established itself as a portfolio asset. Investors are not likely to abandon it. $Gold's price does have short-term risk as most of the action has been in the derivative's market. Investors should by now be accustomed to volatility in the price of $Gold, and must simply learn to live with it. Further, Gold is the only insurance available to protect one from the Obama fiscal cliff set to cause the U.S. economy to fall into recession in January. Obama fiscal cliff is a greater worry than QE-3.

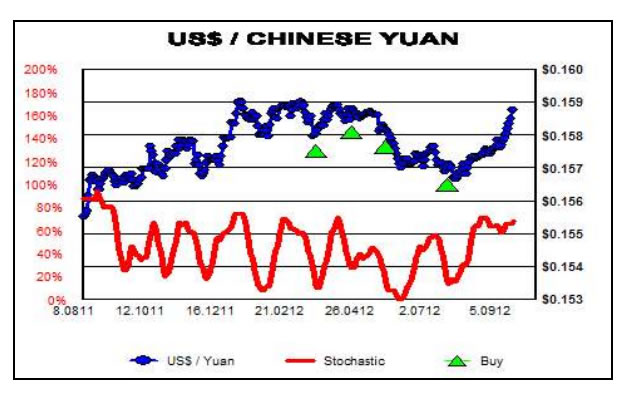

As Silver does not have the positive long-term outlook as is the case with Gold, investors should be looking at alternatives. An excellent one would be the Chinese Renminbi, shown in the above chart. Note it is approaching a new high. Investors owning Gold should be adding Renminbi to their portfolio. Those holding Silver, hoping to recover, would be betters served by switching their investment in Silver into the Renminbi.

An investment in Renminbi can be done with either bank deposit accounts, the preferred alternative, or ETFs. Latter uses non deliverable forwards, which might make them undesirable for many. Do not use exchange traded notes, ETNs.

Chinese Renminbi, along with Gold, is preferable to holding either U.S. dollars or Euros. Likely appreciation over time versus those two currencies is largely due to growing importance of the Renminbi as a currency in Asia, and the positive long-term prospects for the Chinese economy. Think of it as switching from the British pound to the U.S. dollar in 1913. While the negative outlook for the dollar does help the case for the Renminbi, the positive influence from China's growing economic importance is more important.

Yep. The yuan started trading on a Chicago exchange many months ago, IIRC. We have lots of money all over the world. China has stuff and produces stuff. Other countries have also increased production.

Prices of stuff from China, BTW, will go up quite a bit more sooner or later. The country that produces more will inflate, which means we also have to pay more yuan, by way of more dollars in exchange, for stuff from China.

Stuff’s higher there, then higher for us, too (plus several kinds of freight, freight fuel costs going up with increasing manufacturing and millions and millions of new drivers around the world every year, merchants/importers and their anti-domestic-competition, anti-family, regulatory government employees keeping up with the Joneses, etc.).

If you can only read the headlines, remember the axiom: alliteration is always an accurate approximation of authenticity and actuality.

OTOH, rhyming headlines can save you the trouble of reading further. When you don’t have the time/ trust the rhyme.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.