Posted on 12/06/2012 7:20:30 PM PST by blam

Investors Ditching Before the Fiscal Cliff

Commodities / Gold and Silver 2012

Dec 06, 2012 - 01:18 PM

By: Peter Schiff

Turn on the TV and this is what you'll hear: The US budget is heading for a fiscal cliff. If a deal isn't reaching in Congress by the end of this year, a combination of automatic tax hikes and budget cuts will sink America into economic depression. There is no escape.

Of course, my readers know that the fiscal cliff is merely an example of the piper having to be paid. The problem isn't the bill, but that we ran it up so high in the first place. Any deal to avoid the cliff by borrowing even more money may allow the piper to keep playing a while longer, but when the music finally stops, the next fiscal cliff will be that much larger.

My readers also know that there are several ways for investors to avoid the cliff altogether. Perhaps the most secure is buying precious metals. However, given what we know, it may seem confusing that the spot prices of gold and silver have been moving sideways.

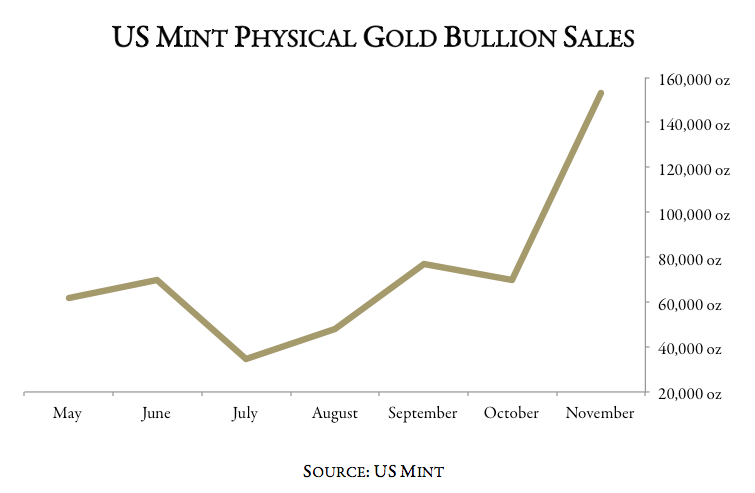

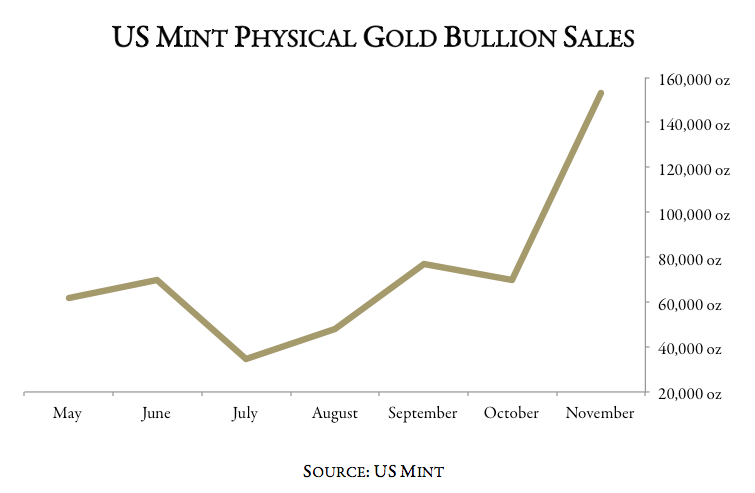

However, these headline prices have largely concealed a more important indicator: physical bullion sales are booming.

An Under-the-Radar Rally

The figures are astounding. For US Gold Eagle coins, mint sales are up some 150% from the QE3 announcement on September 13th. Despite what the spot prices show, there has been a tremendous surge in people buying physical gold.

But why hasn't this translated into higher spot prices?

It seems clear that the spot prices of both gold and silver are being driven right now by a large pool of institutional capital moving into and out of instruments like commodity ETFs. The movements have been predictable: When there is a sign of a deal coming out of Washington, the spot prices move up. If negotiations are faltering, there is instead a major selloff.

Physical bullion investors are a different breed. We are in this market for the long haul. When I increase my physical gold and silver holdings, I do it because I see the long-term fundamental picture for the US getting worse.

Getting a Read on the Bullion Bull

While the ETF speculators are trying to anticipate the market's - and each other's - immediate reaction to whatever 11th hour deal is struck, I believe physical bullion investors are sending a clear signal: this whole debate is out of order.

A J.P. Morgan study concluded that 82% of the hit to GDP if we go over the fiscal cliff would be related to tax increases, not spending cuts. And if the legislators reach a deal? It will only result in more tax increases and much fewer spending cuts. These guys just don't get it.

Looking back to the debt ceiling debate of August 2011, we saw big movements into physical gold there as well. What investors are concluding as they hear these grand debates is that whatever the result, the budget, the dollar, and the taxpayer will lose.

They are deciding to get off this runaway train. Because the real fiscal cliff isn't coming on December 31st - it is coming when there is a global flight from the US dollar.

The Real Fiscal Cliff

The Democrats are complaining that the fiscal cliff imposes too steep demands on those who receive entitlements. Republicans are trying to protect the military budget. What no one seems to want to address is what happens as foreign creditors increasingly decide to stop financing this bonanza.

To a large extent, this is already happening. China has already become a net-seller of Treasuries and is diverting more of its reserves into gold. The Chinese government recently approved banks holding gold as a reserve asset and made it easier for banks to trade gold amongst themselves.

While Japan and other Keynes-drunk governments have filled some of the gap with increased purchases, a supermajority of new issues are being bought directly by the Fed. That was the idea behind QE3 Plus, as described in last month's commentary.

Because of the acute trauma in Europe and certain institutional mandates to hold Treasuries, much of this new inflation is being absorbed. This has caused what may be the most dangerous of situations. It has allowed the inflationists to paint people like me as the boy who cried wolf. It seems to them that no matter how irresponsible Congress and the Fed are, we are immune from economic consequences.

In reality, all this money printing is like pulling back a spring. Pent up inflationary forces are building, and when they are unleashed, the debate will be over faster than they can say "oops."

The Only Way to Win Is Not to Play

Those buying into physical gold and silver see this inevitability and are getting prepared. We believe there is no sense playing Russian roulette with our savings. Every time Washington raises that debt ceiling or announces another stimulus, it's like one more click of the trigger.

When the global markets finally wrap their heads around the scale of US insolvency, the response will be as fierce as it is rapid. In such a once-in-a-century scenario, physical gold and silver are among the few assets without counterparty risk. From the looks of the physical bullion sales charts, I'm not the only investor who has figured this out.

Good article but I’m thinking that those with ammo are far better off.

Yes, it’s like that kid’s game. Rock, scissors, paper. The lead will be the gold and silver everytime though.

The U.S. is on track to become the world’s largest oil producer in eight years and the biggest producer of gas in five, according to the International Energy Agency, which projects energy self sufficiency in 25 years. That remarkable turnaround not only shifts the U.S. relationship with the Middle East but, as economists at RBC Capital Markets predicted in recent research note, will reduce energy imports so far that it will shrink the U.S. trade deficit and eventually convert the current account deficit into a surplus. Inevitably, RBC argues, this will provide long-term support for the dollar.

I agree. Just bought a 30-06 today (my reach out and touch someone weapon) to round out may arsenal. Now will be stocking up on ammo for it to match the stock for my other weapons.

Oil could go as low as 25.00. Inflation adjusted when it was 10.00. It could super charge the economy and payoff the deficit.

Only way out of this mess is for some countries to band together and force oil off the dollar. Then the dollar would plummet and the US government would not be able to sell as much debt. Yeah, it’ll be hell here, but we deserve what’s coming.

What's happening is a mutual game of "let's pretend." Both sides of the Atlantic are playing it. They give each other credit lines and pretend it's real money.

The house of cards will come tumbling down; a long wave contraction like this requires it.

It's the "when" that has everyone guessing (except the clowns in DC, who think they can print to "infinity").

He is on the hyperinflation, gold 5K bus. But, we already have high amounts of inflation! The Dow is inflated, housing, and we exported 'inflation' to China.

Those with ammo = Department of Social Security and Department of Education.

But blam, you have to understand that one of Obama’s goals this term is to end fracking and all other domestic energy production, except for solar and wind power.

That’s why I’ve shifted all my funds from aggressive to conservative.

In addition to that, I’m investing in big bags of large breed dog food to take care of my other security measures.

..and U.S. Weather Service, Forestry Service and DHS. They all purchased millions of rounds at about the same time as SS and DE.

Solar and wind are like unions = money laundering operations for the Fat Cat Socialists. If only Solyndra had been investigated.

Until these past two years gold was not above $800 and for most of its history was never above $100 an ounce. It skyrocketed these past two years. I will not pay $1800 for gold because when the bubble bursts (because people are afraid now) the price will tumble back down to under $800. I see no advantage there. It happened in real estate and it will happen in gold.

If land prices dropped - remember they can’t make more of it - what chance does anything else have?

I’m going to stock up on plenty of firearms, ammo, food and water. Bury whatever money I have left and just sit tight.

I think the regime’s agencies loaded up on ammo so that if Romney (by some miracle, given 0bama’s massive voter fraud machine) won the election, 0bama’s agencies were prepared NOT to leave office.

I love large working breeds. Have owned 2 and am on the 3rd, which is still just a puppy. I likely will not be able to handle another one when this guy goes to the Rainbow Bridge, though, as I will be around 82, then. They live 12 years +/- and usually become mellow wussies by age 10 or so.

My dogs have been Akitas and they are what is known as frugal eaters, so the costs aren’t all that bad. But you do have to factor in 18-24 months of training in order to have a reliable security guard that can also be trusted to discriminate between visitor and enemy and still be a loving family member.

Right now, the 14-week-old puppy loves everyone and everything, even the old cat who hates his guts.

With some breeds, you also have to be aware that there are people who will consider them *vicious* and your home-owners’ insurance company may decline to cover because of them.

Then, there is the fact that they can easily be shot from a distance.

I really believe one should own these guys because you love them, want to give them a wonderful life and intend to share your home with them for over a decade. I’d rather train one to be a pack dog or weight-puller than a major source of security besides a simple announcement of someone’s arrival on the property.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.