Posted on 02/06/2013 7:42:32 AM PST by blam

How To Profit From A Potential Doubling In Copper Prices

Commodities / Copper

February 06, 2013 - 08:30 AM GMT

By: Daily Wealth

"I think copper has at least 50% upside from today's price..." legendary analyst Adrian Day told me recently.

"I wouldn't be surprised to see the price double by the end of the decade."

When Adrian talks commodities, I listen... He's written his Global Analyst newsletter for over 25 years. At one time, it was one of the most popular investment letters in America, with over 60,000 subscribers. And for a decade now, he has focused on commodities for customers of Adrian Day Asset Management.

Today, Adrian has his sights set on copper... Over coffee last week, he explained why copper prices could soar. He also shared his favorite way to profit from it. Here's the story...

Adrian believes there's a big opportunity in copper. It's a simple story of supply and demand...

"In recent years, we've seen a record copper price and record demand. Yet production has actually declined," Adrian told me. "Output from Escondida, the world's largest producer, is down 25% over the last five years."

Adrian explained there are currently 82 new mines set to come online by 2020. "About 80% of them had their start dates delayed in the past 12 months. The future supply of copper is anything but certain."

With uncertain supply, a "pop" in demand could easily send copper prices soaring. And Adrian sees China as an obvious source of continued demand growth...

China's copper demand has tripled in the last 15 years. Based on where the country is in its development cycle, I believe demand will triple again over the next 15 years. By 2020, world copper production won't even meet China's demand.

Adrian's story here is simple. It's Economics 101.

With demand exploding and supply decreasing, the copper price has only one way to go... higher. Again, Adrian says prices could double by 2020.

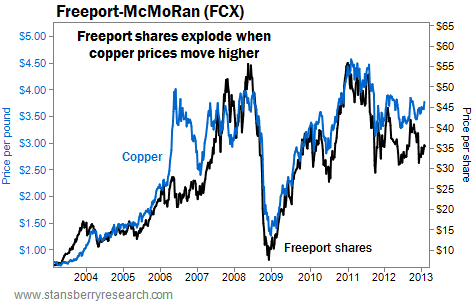

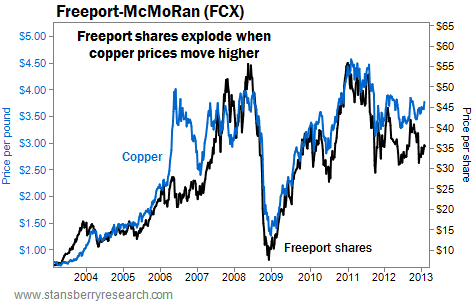

As investors, we have one simple way to profit from a rising copper price. Longtime readers are familiar with this opportunity... When copper prices increase, shares of Freeport-McMoRan (NYSE: FCX) explode. Take a look......

For example, shares of Freeport soared from below $10 to near $60 in about two years (roughly 2009 through 2010). When copper takes off, shares of Freeport can go nuts.

Freeport is currently a "buy" in our True Wealth newsletter. And Adrian says the stock is one of his top ideas right now. It's easy to see why...

The stock is dirt-cheap. As I write, it trades for just 7.5 times next year's earnings. The company also pays a 3.5% dividend.

The company is cheap today because of a recently announced acquisition of Plains Exploration & Production (NYSE: PXP) and McMoRan Exploration (NYSE: MMR). Freeport shares fell 16% on the news. But Adrian believes this offers a fantastic buying opportunity...

Freeport acquired fantastic oil and gas assets in this deal. The potential is enormous, and they didn't overpay for it. We've been buying at the depressed prices, and we'll continue to do so.

Even with Freeport's diversification into oil and gas, I expect the company to continue trading in-step with copper. If Adrian's forecast is correct, that could mean enormous gains like we have seen in the past with Freeport.

Today, we have an opportunity to get in cheap. It will surely be a bumpy ride. But long-term, both Adrian and I expect big gains in shares of Freeport.

Why Silver Is Headed Back $50.00-An-Ounce

" We have already begun to see demand for silver increase significantly. I call it the “Silver Rush.” It wasn’t too long ago when I reported the U.S. Mint had halted sales of Silver Eagle coins because it ran out of stock. It’s no surprise that the U.S. Mint now reports that American Silver Eagle coin sales in January rose to an all-time monthly high with 7.1 million ounces of silver purchased, compared to 6.1 million ounces purchased in January of 2012."

A 50% increase in copper would be quite notable. I believe the highest prices copper has seen in recent times have been closely tied to the “China to the moon” story. That story having chilled a tad, I frankly don’t see a 50% bump in copper, although over a decade, sure, anything is possible. It will take strong patience to ride that trend out.

I *do* however like FCX very much as a stock, one of my faves, but it is a very volatile bucking bronco. IMO it is a tad expensive here, not that it is so expensive, but I would wait for a better entry. I wouldn’t diss anyone for buying a little bit here, but usually once or twice a year, FCX will have a mine collapse or something like that because its’ main mines are in New Guinea and the ground is soft and mushy. That will produce a 7% or so hit to the stock, and that’s when you pounce. It JUST went ex-div. Wait, but watch. Additionally, FCX just bought something or other which brought it into the petroleum biz, and market did not like that....altho it is warming up to it.

Incidentally, the story of how FCX acquired Phelps Dodge is one of the most fascinating stock market stories I know of.

A little more dramatic copper (only) play is SCCO. Primarily a South American co, it has regime and strike risk, but is a neat stock.

Steal the coils from A/C’s?

A new law here...you have to be a licensed AC contractor to sell them as scrap.

Copper is only one of many metals that will be in demand if the world goes to war.

I think war is coming.

Goldbug Ping.

bookmark

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.